Loss Run Request Form

Loss Run Request Form - Web with regard to the above captioned policy, this letter authorizes and requests your company to release the complete detailed loss runs showing all experience ( open and closed ) for the periods to: Loss runs must be requested by the policyholder or assigned producer and cannot be released to any other party without a broker of record letter. The best approach for this is to email or call them. Web this is a confidentiality agreement, authorization, and release form for professional liability insurance customers requesting loss runs. Complete the form below to submit a loss runs request. Web carrier name and address naic code policy #: Agent, email address and fax number Email request to images@centurysurety.com fax request to 614.823.6376 _____ cgl insurance company. Insured’s name and mailing address (include county & zip+4) telephone number name: Request the above mentioned loss runs be released to me.

One tower square hartford, ct6183 phone: Web this is a confidentiality agreement, authorization, and release form for professional liability insurance customers requesting loss runs. A typed, drawn or uploaded signature. Name of the agency , attention to : Select the document you want to sign and click upload. Decide on what kind of signature to create. If you want to request a report, all you need to do is contact your insurance agent or broker with a loss run request, and they'll contact your carrier. In most instances, the authorization form may be signed by the insured, a group policy authorized representative, or the agent of record for the respective policy/account information. Agent, email address and fax number The best approach for this is to email or call them.

If you want to request a report, all you need to do is contact your insurance agent or broker with a loss run request, and they'll contact your carrier. Loss runs must be requested by the policyholder or assigned producer and cannot be released to any other party without a broker of record letter. It’s also important to keep in mind that all states business insurance requirements are different. Preference on how the report should be sent (email or fax) email fax Generally, states require insurance agents and companies to get you your loss run report in 10 days. In most instances, the authorization form may be signed by the insured, a group policy authorized representative, or the agent of record for the respective policy/account information. Insured’s name and mailing address (include county & zip+4) telephone number name: Complete the form below to submit a loss runs request. Decide on what kind of signature to create. Web loss run request form date of request:

loss run request form Ten Important Life Lessons Loss Run

_____ our insured’s information at time coverage was provided: Email request to images@centurysurety.com fax request to 614.823.6376 _____ cgl insurance company. Agent, email address and fax number Web carrier name and address naic code policy #: Claims history / loss run requestdate.

Loss Run Form Fill Out and Sign Printable PDF Template signNow

Web this is a confidentiality agreement, authorization, and release form for professional liability insurance customers requesting loss runs. Agent, email address and fax number The best approach for this is to email or call them. Create your signature and click ok. Claims history / loss run requestdate.

Loss Run Request Letter Letter Of

Claims history / loss run requestdate. Insured’s name and mailing address (include county & zip+4) telephone number name: Name of the agency , attention to : Email request to images@centurysurety.com fax request to 614.823.6376 _____ cgl insurance company. Loss runs must be requested by the policyholder or assigned producer and cannot be released to any other party without a broker.

COMMERCIAL mysite

The best approach for this is to email or call them. Email request to images@centurysurety.com fax request to 614.823.6376 _____ cgl insurance company. Please allow 2 to 3 business days for us to process your request. Web carrier name and address naic code policy #: Name of the agency , attention to :

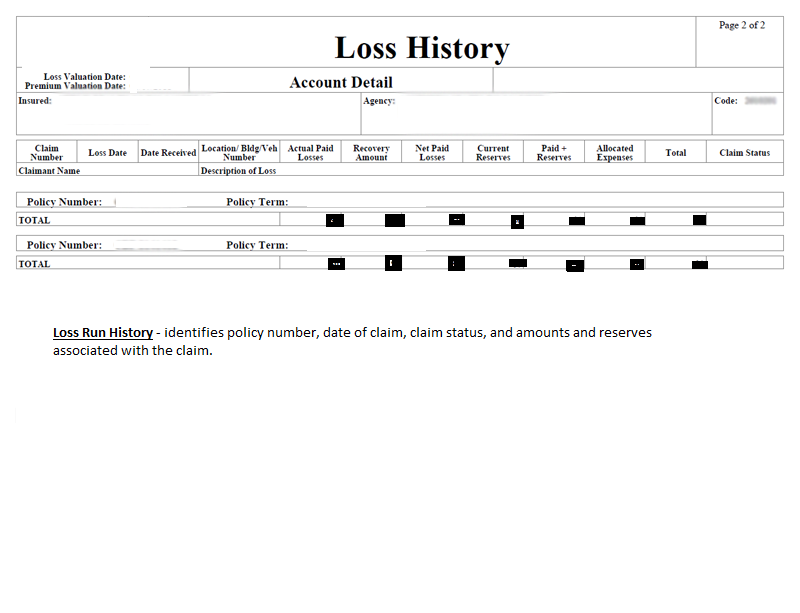

A "LOSS RUNS" IS... Florida Construction Legal Updates

Claims history / loss run requestdate. Please allow 2 to 3 business days for us to process your request. In most instances, the authorization form may be signed by the insured, a group policy authorized representative, or the agent of record for the respective policy/account information. Web with regard to the above captioned policy, this letter authorizes and requests your.

Loss Run Request Form sigma programs

Web loss run request form date of request: Web how to request a loss run report loss run reports are created by your insurance carrier. Name of the agency , attention to : Email request to images@centurysurety.com fax request to 614.823.6376 _____ cgl insurance company. Web with regard to the above captioned policy, this letter authorizes and requests your company.

Insurance Carrier Loss Runs Key to Underwriting Legal Malpractice Insurance

Loss runs must be requested by the policyholder or assigned producer and cannot be released to any other party without a broker of record letter. Web with regard to the above captioned policy, this letter authorizes and requests your company to release the complete detailed loss runs showing all experience ( open and closed ) for the periods to: Web.

Treated Fairly

Web with regard to the above captioned policy, this letter authorizes and requests your company to release the complete detailed loss runs showing all experience ( open and closed ) for the periods to: The best approach for this is to email or call them. _____ our insured’s information at time coverage was provided: Select the document you want to.

🚧 How to Get a Loss Run Report Hourly, Inc.

Preference on how the report should be sent (email or fax) email fax One tower square hartford, ct6183 phone: Web with regard to the above captioned policy, this letter authorizes and requests your company to release the complete detailed loss runs showing all experience ( open and closed ) for the periods to: Generally, states require insurance agents and companies.

loss run request form Ten Important Life Lessons Loss Run

Select the document you want to sign and click upload. Web loss run request form date of request: Web to request a loss run report, you’ll need to contact your insurance carrier or agent directly. If you want to request a report, all you need to do is contact your insurance agent or broker with a loss run request, and.

Web This Is A Confidentiality Agreement, Authorization, And Release Form For Professional Liability Insurance Customers Requesting Loss Runs.

Preference on how the report should be sent (email or fax) email fax One tower square hartford, ct6183 phone: Web with regard to the above captioned policy, this letter authorizes and requests your company to release the complete detailed loss runs showing all experience ( open and closed ) for the periods to: Agent, email address and fax number

Email Request To Images@Centurysurety.com Fax Request To 614.823.6376 _____ Cgl Insurance Company.

Request the above mentioned loss runs be released to me. Web loss run request form date of request: _____ our insured’s information at time coverage was provided: If you want to request a report, all you need to do is contact your insurance agent or broker with a loss run request, and they'll contact your carrier.

It’s Also Important To Keep In Mind That All States Business Insurance Requirements Are Different.

Name of the agency , attention to : In most instances, the authorization form may be signed by the insured, a group policy authorized representative, or the agent of record for the respective policy/account information. Generally, states require insurance agents and companies to get you your loss run report in 10 days. Claims history / loss run requestdate.

Create Your Signature And Click Ok.

Loss runs must be requested by the policyholder or assigned producer and cannot be released to any other party without a broker of record letter. Use this form to submit your loss run request. Web how to request a loss run report loss run reports are created by your insurance carrier. Please allow 2 to 3 business days for us to process your request.