L-8 Waiver Form Nj

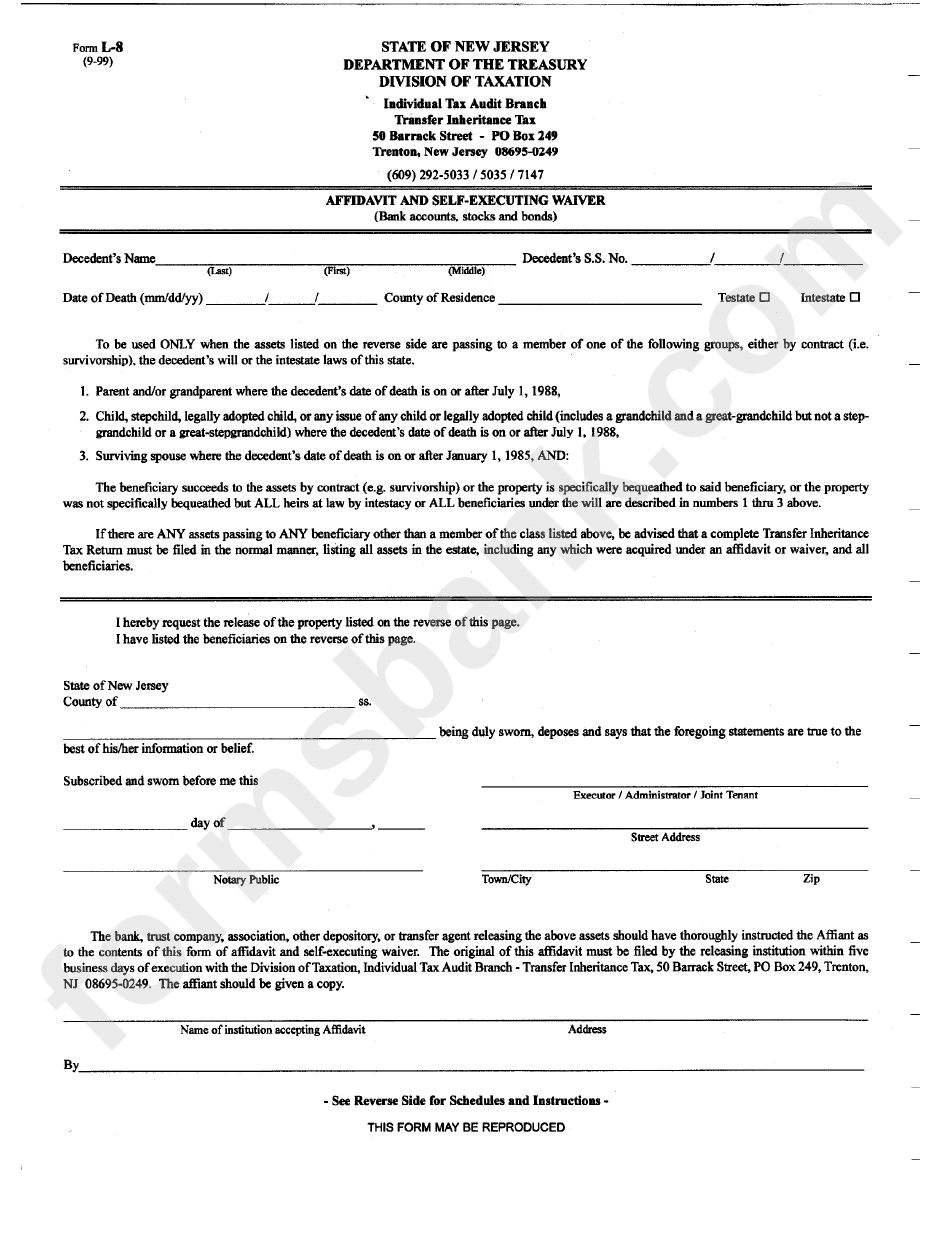

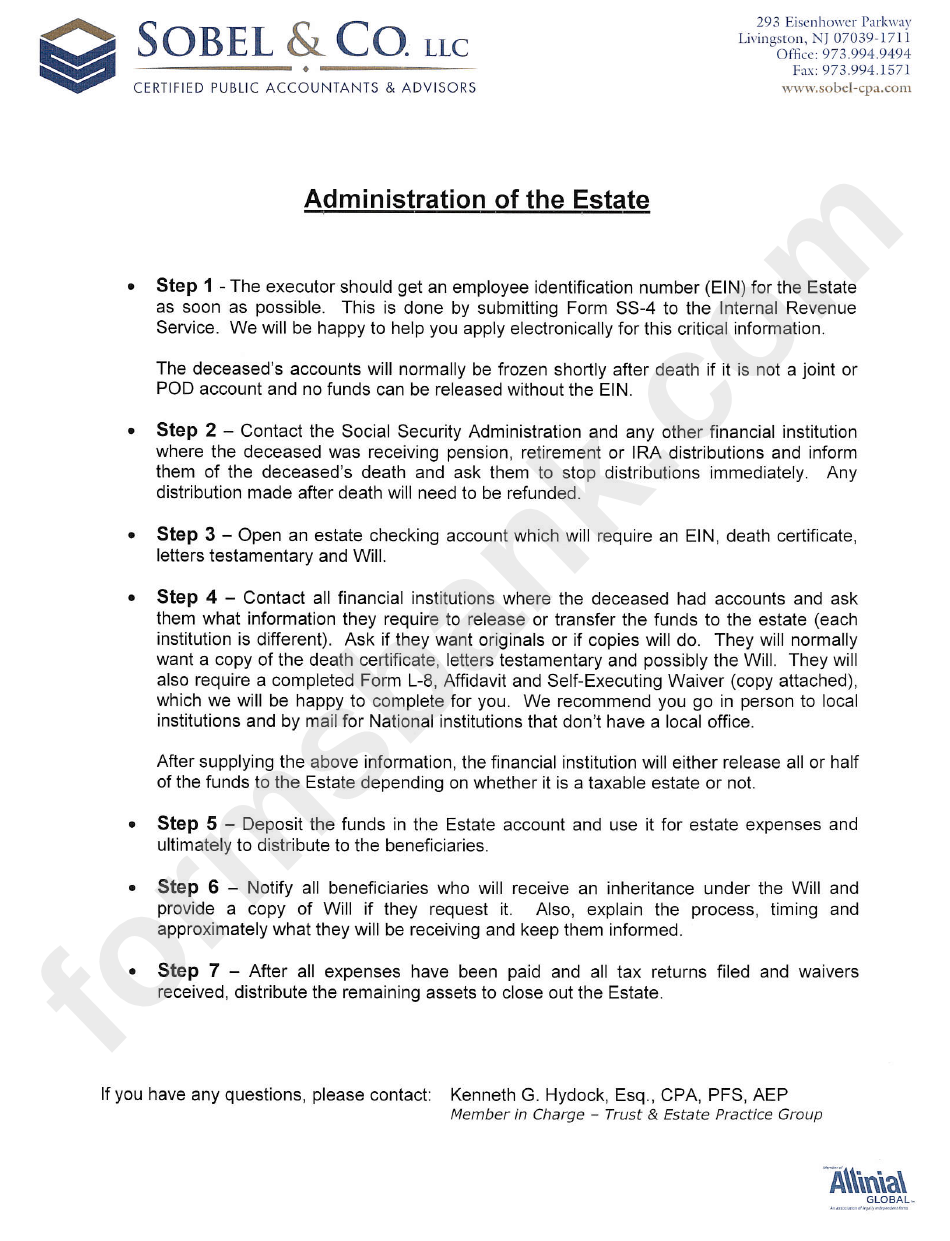

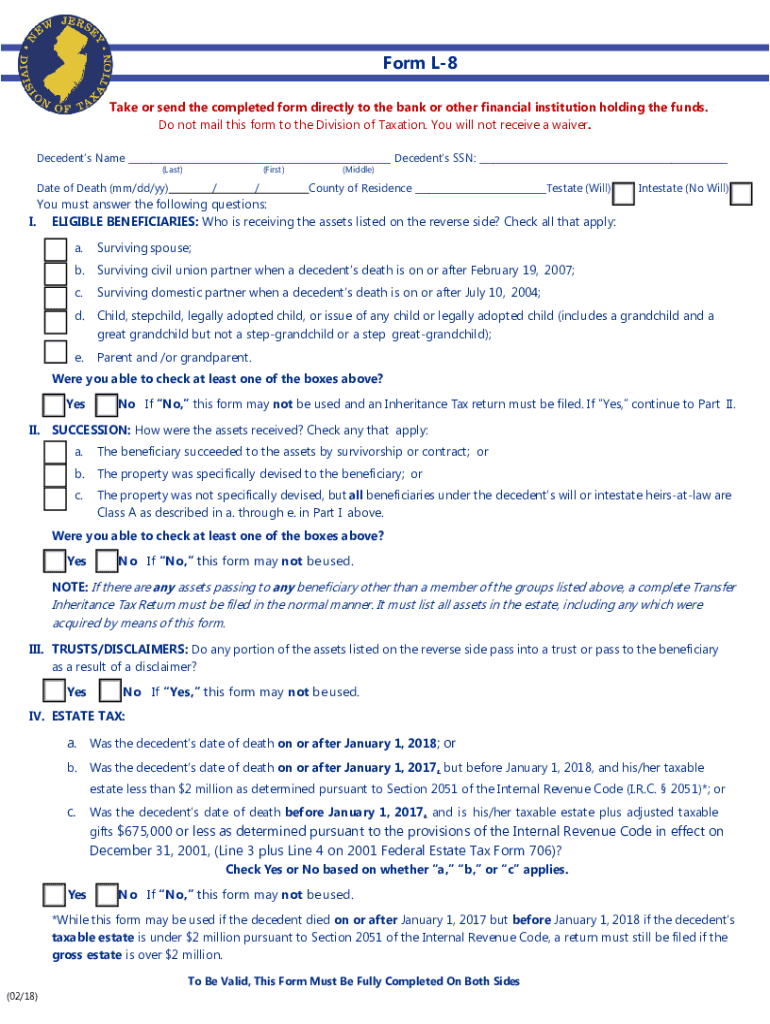

L-8 Waiver Form Nj - Web tax waivers are required for transfers to domestic partners. For all dates of death prior to january 1, 2018. The type of return or form required generally depends on: Web this form may be used when: Web this allows funds to be available to pay expenses. Web state of new jersey the department of the treasury division of taxation transfer inheritance & estate tax po box 249 trenton, nj. It contains 4 bedrooms and 4. Web to obtain a waiver or determine whether any tax is due, you must file a return or form. 238 river ln, west jefferson, nc is a single family home that contains 3,095 sq ft and was built in 2005. Web self executing waivers are forms which are filed with banking institutions or brokerage firms to release the new jersey estate and inheritance tax lien which automatically applies.

Web self executing waivers are forms which are filed with banking institutions or brokerage firms to release the new jersey estate and inheritance tax lien which automatically applies. Web to obtain a waiver or determine whether any tax is due, you must file a return or form. Save or instantly send your ready documents. Web this allows funds to be available to pay expenses. Web tax waivers are required for transfers to domestic partners. For all dates of death prior to january 1, 2018. The type of return or form required generally depends on: Or • all beneficiaries are class a, but estate does not qualify to use form. Web complete lien waiver form nj online with us legal forms. No estate tax is ever due when.

Save or instantly send your ready documents. Web self executing waivers are forms which are filed with banking institutions or brokerage firms to release the new jersey estate and inheritance tax lien which automatically applies. • a complete inheritance or estate tax return cannot be completed yet; No estate tax is ever due when. Web this form may be used when: Or • all beneficiaries are class a, but estate does not qualify to use form. Web to obtain a waiver or determine whether any tax is due, you must file a return or form. 238 river ln, west jefferson, nc is a single family home that contains 3,095 sq ft and was built in 2005. It contains 4 bedrooms and 4. Web state of new jersey the department of the treasury division of taxation transfer inheritance & estate tax po box 249 trenton, nj.

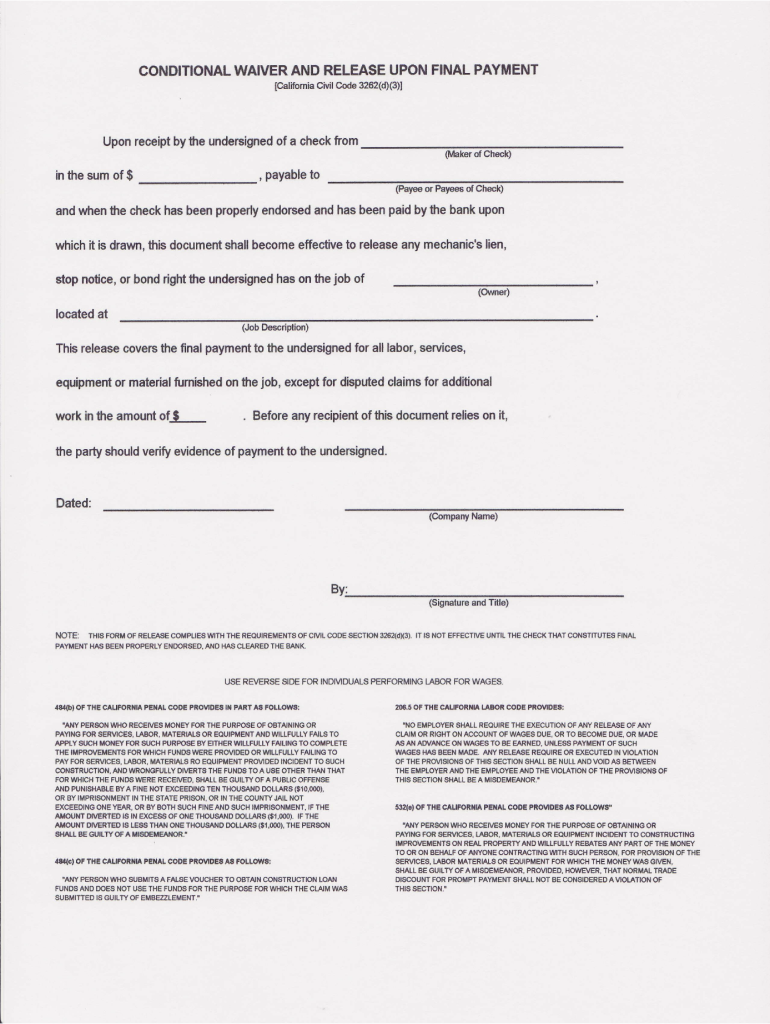

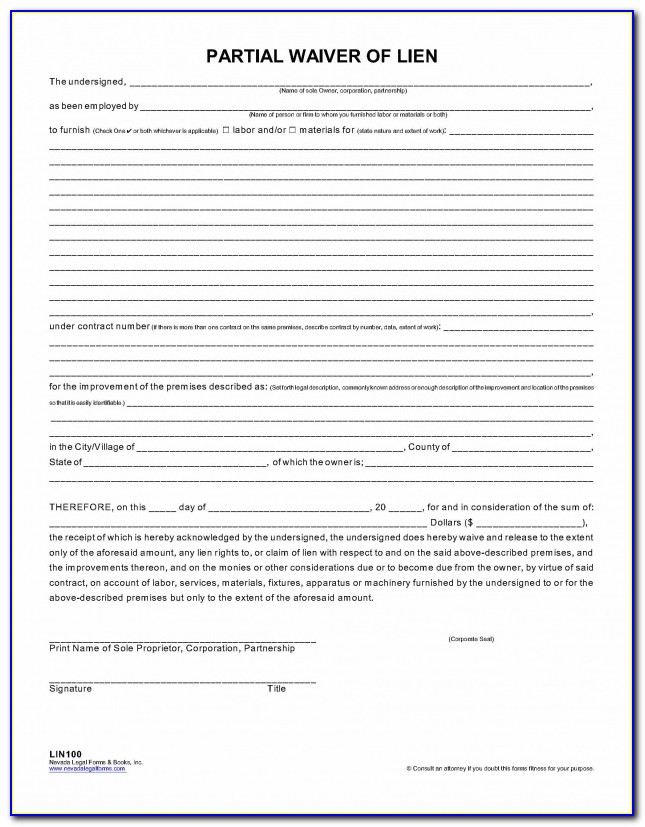

Lien waiver form nj Fill out & sign online DocHub

Save or instantly send your ready documents. Web this form may be used when: 238 river ln, west jefferson, nc is a single family home that contains 3,095 sq ft and was built in 2005. • a complete inheritance or estate tax return cannot be completed yet; Web complete lien waiver form nj online with us legal forms.

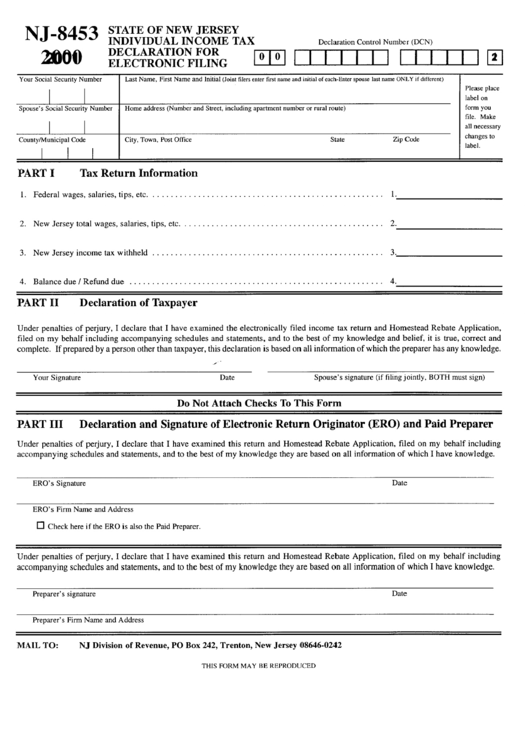

Form Nj8453 Individual Tax Declaration For Electronic Filing

Web to obtain a waiver or determine whether any tax is due, you must file a return or form. Save or instantly send your ready documents. It contains 4 bedrooms and 4. Web this allows funds to be available to pay expenses. For all dates of death prior to january 1, 2018.

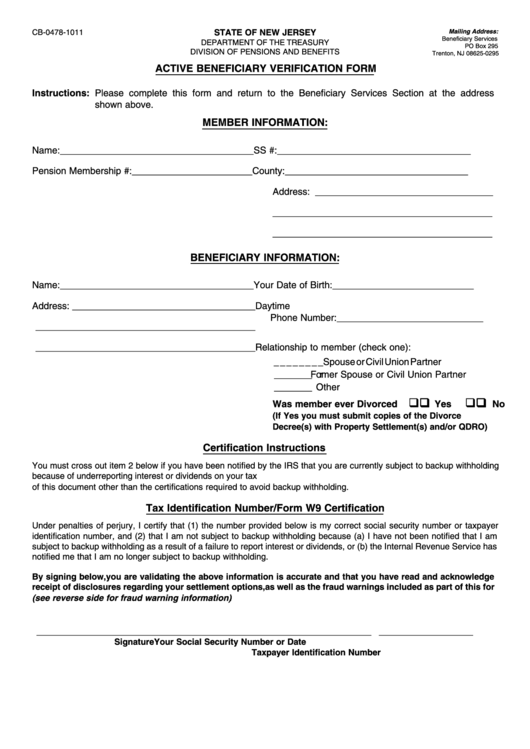

Active Beneficiary Verification Form New Jersey Department Of The

Web state of new jersey the department of the treasury division of taxation transfer inheritance & estate tax po box 249 trenton, nj. The type of return or form required generally depends on: 238 river ln, west jefferson, nc is a single family home that contains 3,095 sq ft and was built in 2005. Or • all beneficiaries are class.

Inheritance Tax Waiver Form Nj Form Resume Examples o7Y3qWE2BN

238 river ln, west jefferson, nc is a single family home that contains 3,095 sq ft and was built in 2005. Easily fill out pdf blank, edit, and sign them. Web to obtain a waiver or determine whether any tax is due, you must file a return or form. The type of return or form required generally depends on: Save.

Inheritance Tax Illinois ellieldesign

For all dates of death prior to january 1, 2018. • a complete inheritance or estate tax return cannot be completed yet; Web self executing waivers are forms which are filed with banking institutions or brokerage firms to release the new jersey estate and inheritance tax lien which automatically applies. Web to obtain a waiver or determine whether any tax.

20192022 Form NJ L4 Fill Online, Printable, Fillable, Blank pdfFiller

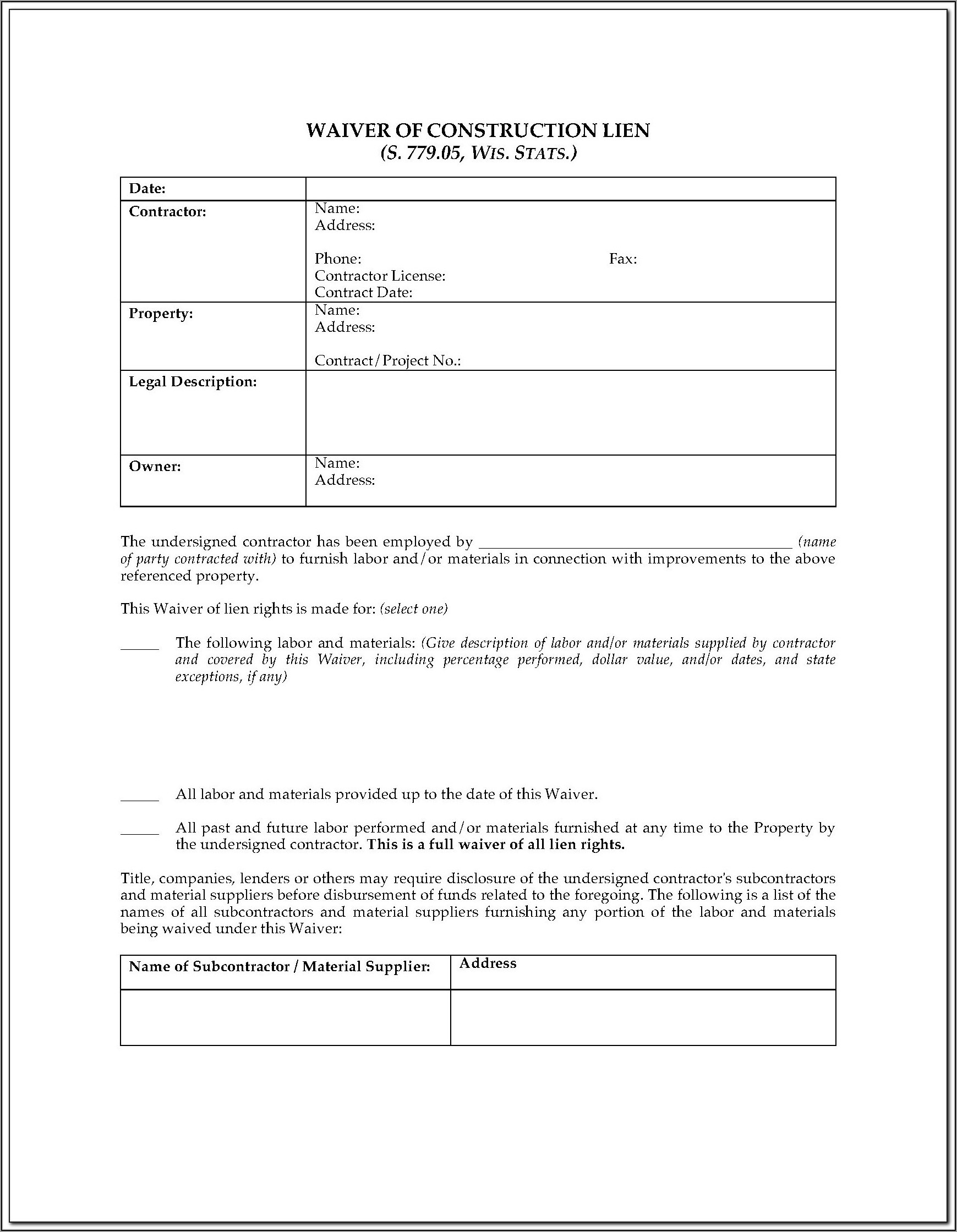

Web complete lien waiver form nj online with us legal forms. Web tax waivers are required for transfers to domestic partners. • a complete inheritance or estate tax return cannot be completed yet; It contains 4 bedrooms and 4. Easily fill out pdf blank, edit, and sign them.

Form L8 Affidavit And SelfExecuting Waiver printable pdf download

Web tax waivers are required for transfers to domestic partners. Web state of new jersey the department of the treasury division of taxation transfer inheritance & estate tax po box 249 trenton, nj. Web to obtain a waiver or determine whether any tax is due, you must file a return or form. Save or instantly send your ready documents. Or.

Form L8 Affidavit And SelfExecuting Waiver New Jersey Department

The type of return or form required generally depends on: Web state of new jersey the department of the treasury division of taxation transfer inheritance & estate tax po box 249 trenton, nj. Web self executing waivers are forms which are filed with banking institutions or brokerage firms to release the new jersey estate and inheritance tax lien which automatically.

Nj L8 Form 2018 Fill Out and Sign Printable PDF Template signNow

Web to obtain a waiver or determine whether any tax is due, you must file a return or form. No estate tax is ever due when. Web this form may be used when: • a complete inheritance or estate tax return cannot be completed yet; It contains 4 bedrooms and 4.

DDD Community Care Waiver to be incorporated into NJ Medicaid Waiver

238 river ln, west jefferson, nc is a single family home that contains 3,095 sq ft and was built in 2005. Easily fill out pdf blank, edit, and sign them. It contains 4 bedrooms and 4. No estate tax is ever due when. Web complete lien waiver form nj online with us legal forms.

Web This Allows Funds To Be Available To Pay Expenses.

Web self executing waivers are forms which are filed with banking institutions or brokerage firms to release the new jersey estate and inheritance tax lien which automatically applies. No estate tax is ever due when. It contains 4 bedrooms and 4. Web complete lien waiver form nj online with us legal forms.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

The type of return or form required generally depends on: Web this form may be used when: Save or instantly send your ready documents. Web tax waivers are required for transfers to domestic partners.

Or • All Beneficiaries Are Class A, But Estate Does Not Qualify To Use Form.

• a complete inheritance or estate tax return cannot be completed yet; For all dates of death prior to january 1, 2018. Web state of new jersey the department of the treasury division of taxation transfer inheritance & estate tax po box 249 trenton, nj. 238 river ln, west jefferson, nc is a single family home that contains 3,095 sq ft and was built in 2005.