Kentucky Form 720 Extension

Kentucky Form 720 Extension - Web for kentucky purposes, do not file federal form 7004 if filing kentucky form 41a720sl. Edit your kentucky form 720 es 2019 online. Do not send a copy of the electronically filed return with the payment of tax. 53 and 16 are added to form 720, part i. Sign it in a few clicks. Web tax period beginning and ending dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date (weekends and holidays. Web kentucky state general business corporation tax extension form 720ext is due within 4 months and 15 days following the end of the corporation reporting period. Web the new irs nos. Web taxpayers who request a federal extension are not required to file a separate kentucky extension, unless an amount is due with the extension. See the instructions for form 6627, environmental taxes.

Web use this form if you are requesting a kentucky extension of time to file. Type text, add images, blackout confidential details, add comments, highlights and more. 53 and 16 are added to form 720, part i. Web taxpayers who request a federal extension are not required to file a separate kentucky extension, unless an amount is due with the extension. Edit your kentucky form 720 es 2019 online. Do not send a copy of the electronically filed return with the payment of tax. Web the new irs nos. Web tax period beginning and ending dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date (weekends and holidays. This form is for income earned in tax year 2022, with. Any extension granted is for time to file.

Web kentucky state general business corporation tax extension form 720ext is due within 4 months and 15 days following the end of the corporation reporting period. Form 720ext is produced from entries on the other extensions > state extension information section. This form is for income earned in tax year 2022, with. Web the new irs nos. Taxpayers who request a federal extension are not required to file a separate kentucky extension,. Web tax period beginning and ending dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date (weekends and holidays. Renewable diesel and kerosene changes. Edit your kentucky form 720 es 2019 online. Do not send a copy of the electronically filed return with the payment of tax. Sign it in a few clicks.

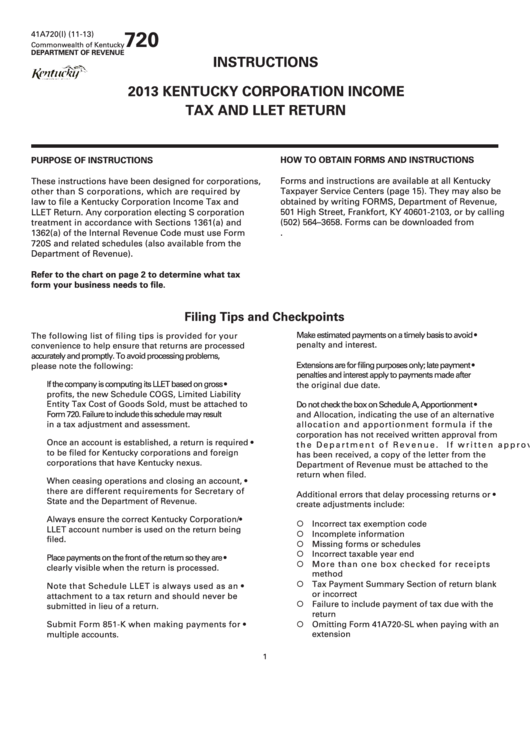

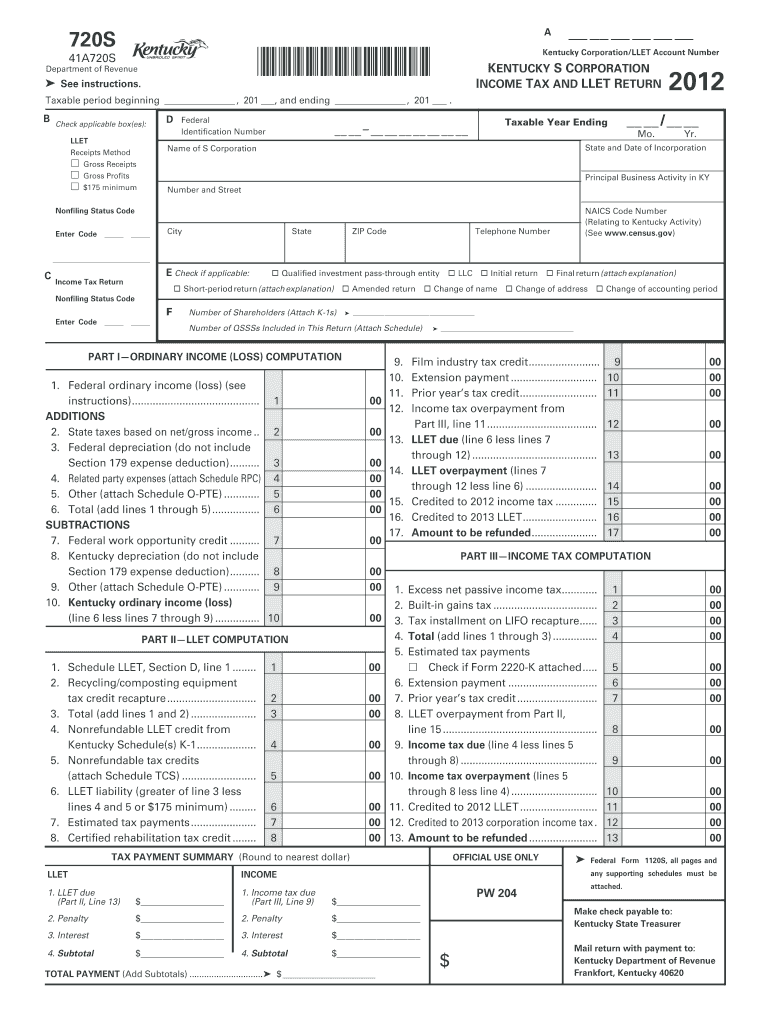

Instructions For Form 720 Kentucky Corporation Tax And Llet

Web use this form if you are requesting a kentucky extension of time to file. Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st. Web tax period beginning and ending dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date (weekends and holidays. Web file now with turbotax.

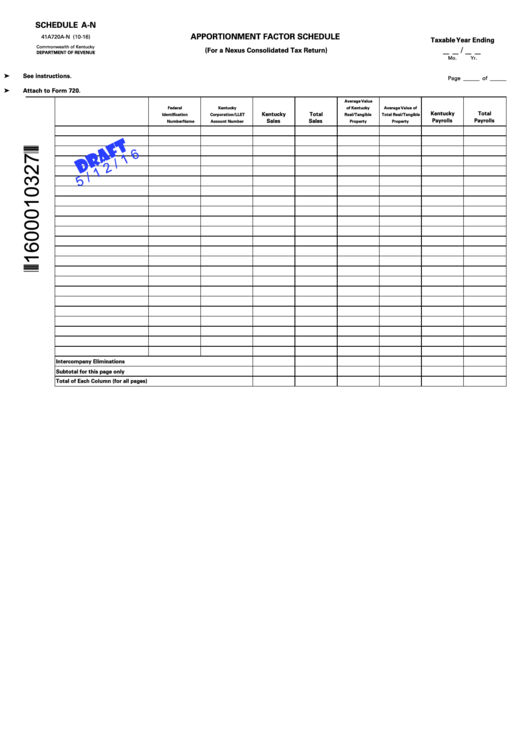

Schedule AN Draft Attach To Form 720 Apportionment Factor Schedule

Web the new irs nos. The requirement may be met by. Edit your kentucky form 720 es 2019 online. Any extension granted is for time to file. Web kentucky state general business corporation tax extension form 720ext is due within 4 months and 15 days following the end of the corporation reporting period.

Form 720 Es Ky Fillable Fill Online, Printable, Fillable, Blank

Web file now with turbotax we last updated kentucky form 720 in february 2023 from the kentucky department of revenue. Web use this form if you are requesting a kentucky extension of time to file. Any extension granted is for time to file. See the instructions for form 6627, environmental taxes. Type text, add images, blackout confidential details, add comments,.

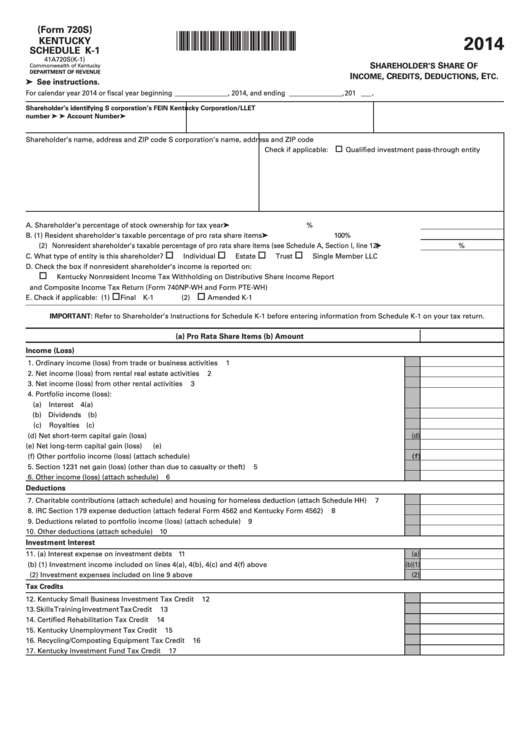

Fillable Kentucky Schedule K1 (Form 720s) Shareholder'S Share Of

Any extension granted is for time to file. Do not send a copy of the electronically filed return with the payment of tax. Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest version of form 720, fully updated for tax year 2022. Web file now with turbotax we last.

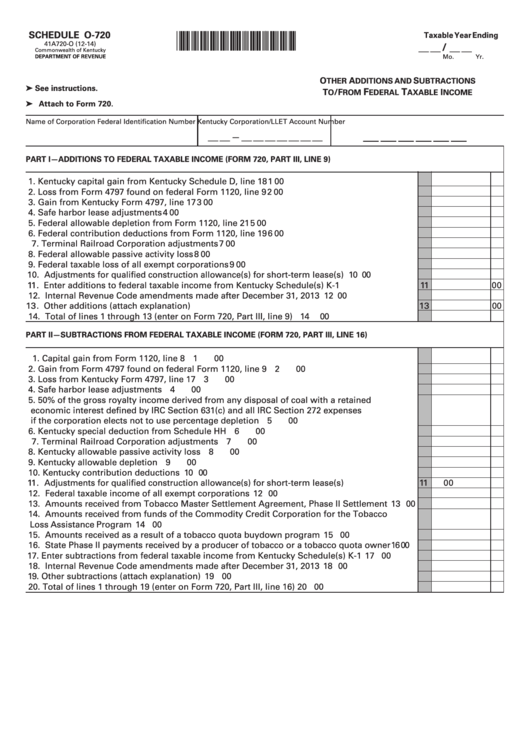

Fillable Schedule O720 (Form 41a720O) Other Additions And

Sign it in a few clicks. Any extension granted is for time to file. Web file now with turbotax we last updated kentucky form 720 in february 2023 from the kentucky department of revenue. Edit your kentucky form 720 es 2019 online. Type text, add images, blackout confidential details, add comments, highlights and more.

2012 Form KY DoR 720S Fill Online, Printable, Fillable, Blank PDFfiller

Taxpayers who request a federal extension are not required to file a separate kentucky extension,. Deferral until october 31, 2020, for filing and paying certain excise taxes for 1st. Web use this form if you are requesting a kentucky extension of time to file. Do not send a copy of the electronically filed return with the payment of tax. Edit.

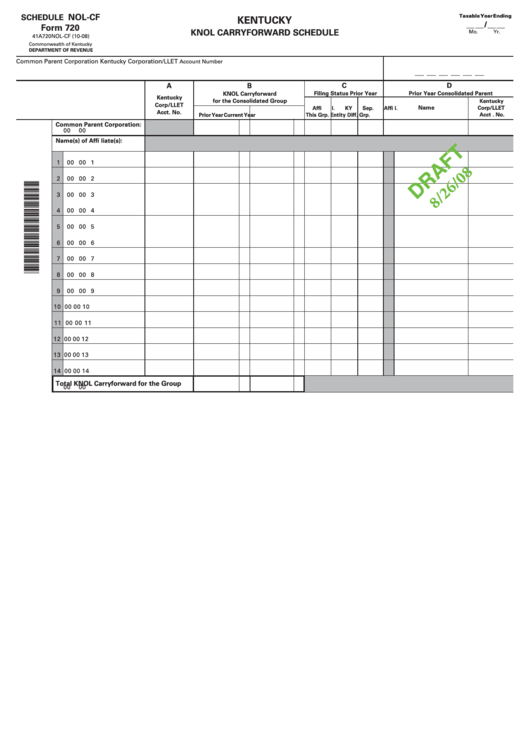

Form 720 Schedule NolCf Kentucky Knol Carryforward Schedule (Draft

Form 720ext is produced from entries on the other extensions > state extension information section. 53 and 16 are added to form 720, part i. Sign it in a few clicks. The requirement may be met by. Renewable diesel and kerosene changes.

Form 720 Kentucky Corporation Tax YouTube

Sign it in a few clicks. Web for kentucky purposes, do not file federal form 7004 if filing kentucky form 41a720sl. Web taxpayers who request a federal extension are not required to file a separate kentucky extension, unless an amount is due with the extension. Web tax period beginning and ending dates form 720 tax period due date (weekends and.

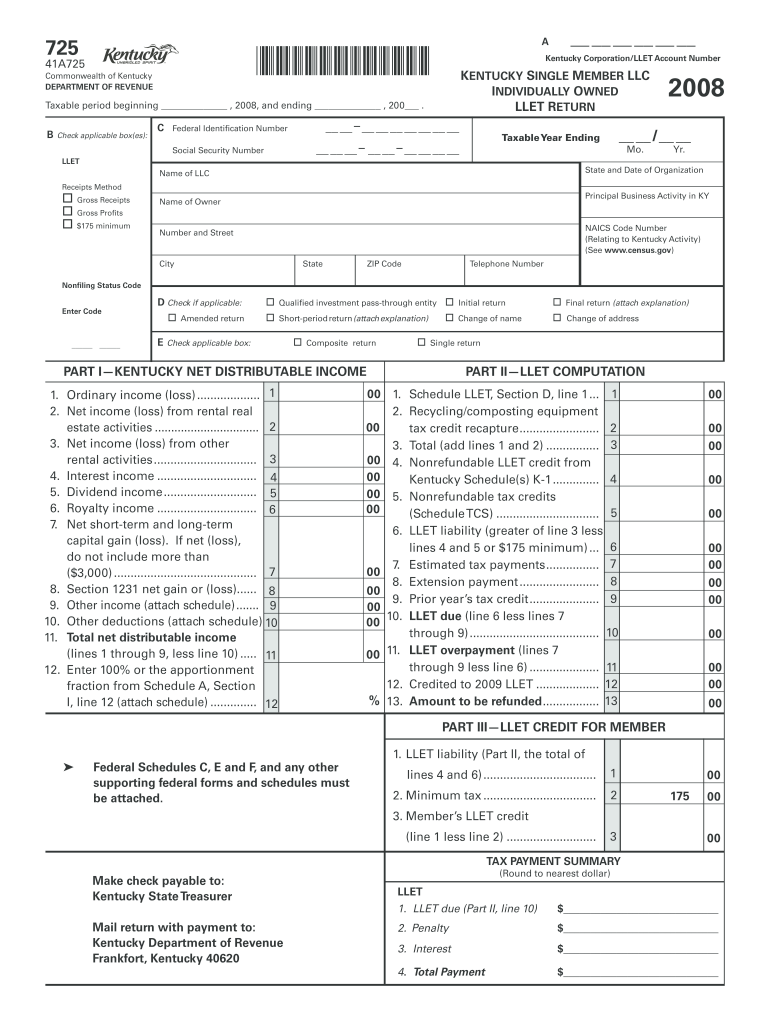

2008 Form KY DoR 725 (41A725) Fill Online, Printable, Fillable, Blank

53 and 16 are added to form 720, part i. Do not send a copy of the electronically filed return with the payment of tax. Renewable diesel and kerosene changes. Any extension granted is for time to file. Web use this form if you are requesting a kentucky extension of time to file.

Form 720 Kentucky Corporation Tax And Llet Return 2013

Sign it in a few clicks. Taxpayers who request a federal extension are not required to file a separate kentucky extension,. Web file now with turbotax we last updated kentucky form 720 in february 2023 from the kentucky department of revenue. Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the.

Web For Kentucky Purposes, Do Not File Federal Form 7004 If Filing Kentucky Form 41A720Sl.

This form is for income earned in tax year 2022, with. Web use this form if you are requesting a kentucky extension of time to file. Type text, add images, blackout confidential details, add comments, highlights and more. Web file now with turbotax we last updated kentucky form 720 in february 2023 from the kentucky department of revenue.

Deferral Until October 31, 2020, For Filing And Paying Certain Excise Taxes For 1St.

Web tax period beginning and ending dates form 720 tax period due date (weekends and holidays considered) six (6) months extension due date (weekends and holidays. Web we last updated the kentucky corporation income tax and llet return in february 2023, so this is the latest version of form 720, fully updated for tax year 2022. Web the new irs nos. Renewable diesel and kerosene changes.

Do Not Send A Copy Of The Electronically Filed Return With The Payment Of Tax.

Web taxpayers who request a federal extension are not required to file a separate kentucky extension, unless an amount is due with the extension. Form 720ext is produced from entries on the other extensions > state extension information section. Web kentucky state general business corporation tax extension form 720ext is due within 4 months and 15 days following the end of the corporation reporting period. Any extension granted is for time to file.

Sign It In A Few Clicks.

Taxpayers who request a federal extension are not required to file a separate kentucky extension,. 53 and 16 are added to form 720, part i. See the instructions for form 6627, environmental taxes. The requirement may be met by.