Is Fincen Form 105 Reported To Irs

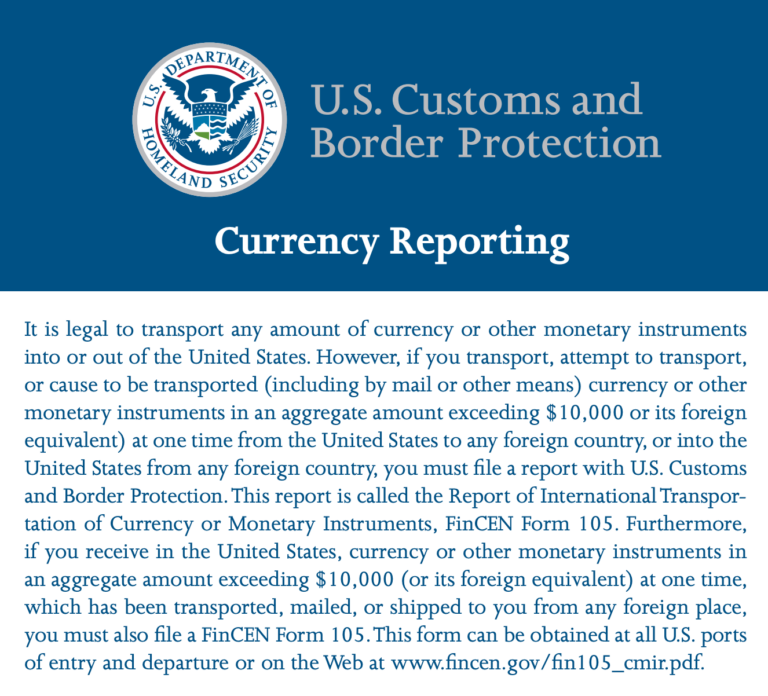

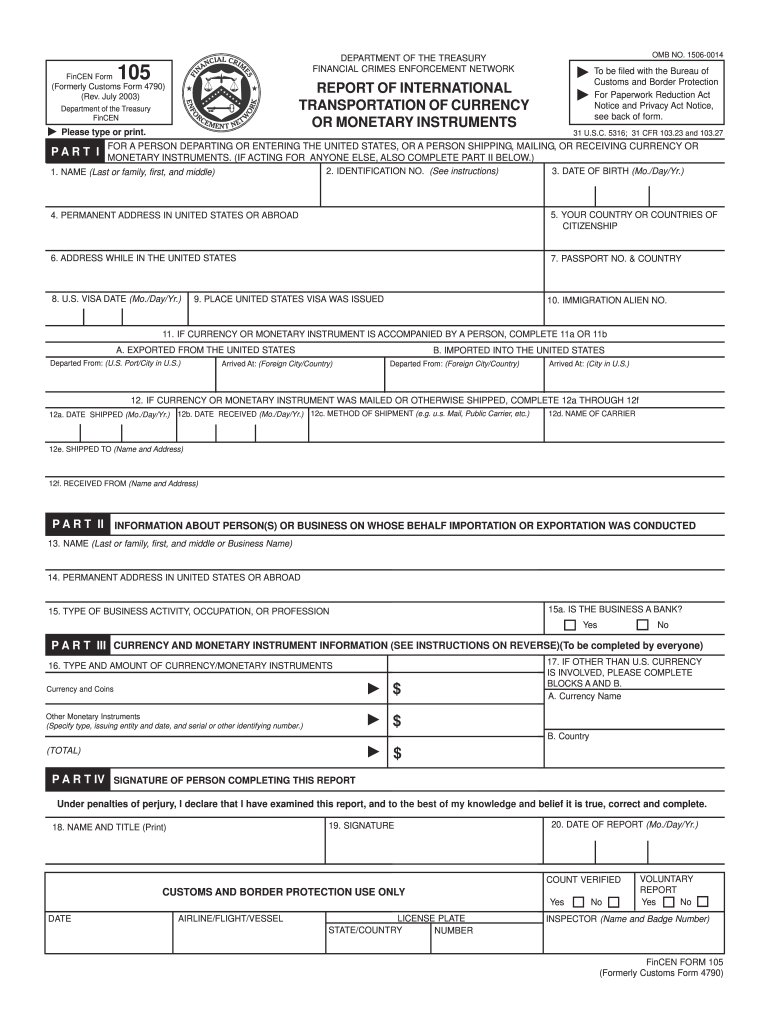

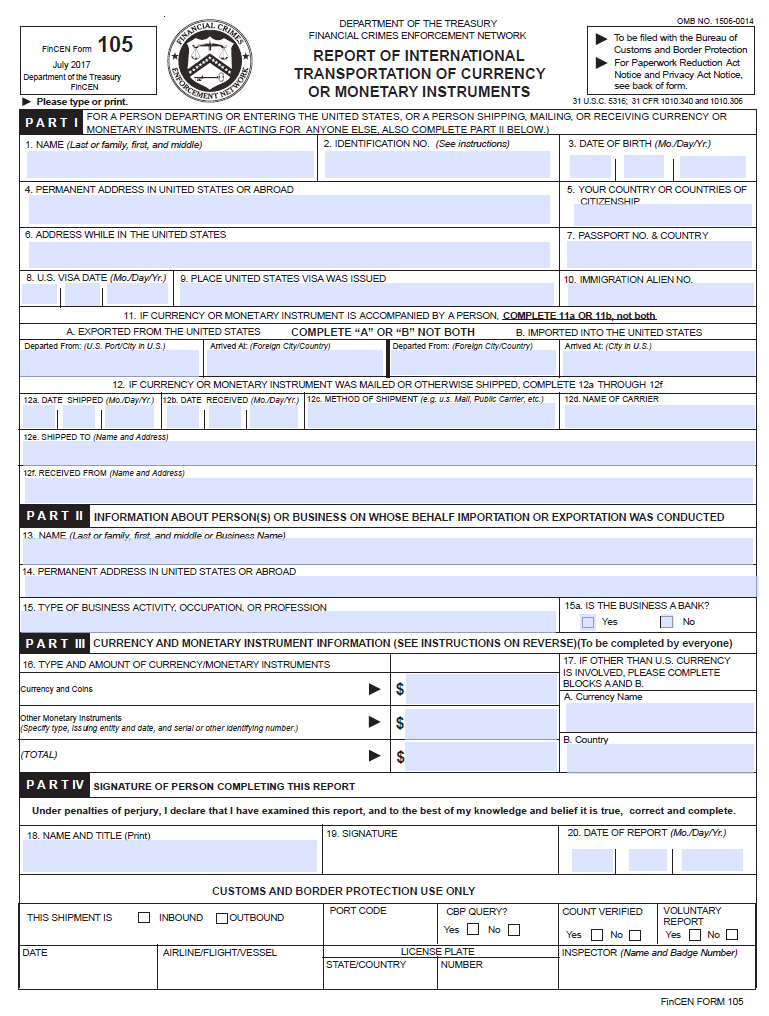

Is Fincen Form 105 Reported To Irs - Web the fincen form 105 is available from any u.s. Web fincen form 105, report of international transportation of currency and monetary instruments (cmir), is submitted and processed through the u.s. Web you report the accounts by filing a report of foreign bank and financial accounts (fbar) on financial crimes enforcement network (fincen) form 114. Web fincen form 105 the irs requires that you file form 105 if you want to fly from a foreign country into the us with money that exceeds $10k, or if you want to deliver. Web the financial crimes enforcement network (“fincen”) is issuing this guidance to correct observed deficiencies and enhance compliance by common carriers. Web fincen may reject any required reports filed in paper format. Web travelers— travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry into the united states or at the time of departure. You are correct, the fincen 105 is used to report cash transfers generally, (1)each person who physically transports, mails, or ships, or. Web download or print the 2022 federal form fincen105 (report of international transportation of currency or monetary instruments (cmir)) for free from the federal. When you complete the fincen form 105, you must provide the following.

You are correct, the fincen 105 is used to report cash transfers generally, (1)each person who physically transports, mails, or ships, or. Web why should it be filed? According to the government, larger amounts of cash are. Web bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount. Web fincen form 105 the irs requires that you file form 105 if you want to fly from a foreign country into the us with money that exceeds $10k, or if you want to deliver. Web fincen form 105, report of international transportation of currency and monetary instruments (cmir),. When the means of obtaining the. Web travelers— travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry into the united states or at the time of departure. Customs and border protection (cbp) officer. A fincen form 105 is filed to prevent currency seizures at the departure or arrival of the traveler.

Web fincen form 105 the irs requires that you file form 105 if you want to fly from a foreign country into the us with money that exceeds $10k, or if you want to deliver. Additional resources other bsa reporting requirements. Web fincen form 105, report of international transportation of currency and monetary instruments (cmir),. You are correct, the fincen 105 is used to report cash transfers generally, (1)each person who physically transports, mails, or ships, or. According to the government, larger amounts of cash are. A fincen form 105 is filed to prevent currency seizures at the departure or arrival of the traveler. Fincen and irs executed a letter agreement on may. Web bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount. When you complete the fincen form 105, you must provide the following. Report of foreign bank and financial.

FinCEN 105 Archives Nomad Capitalist

Web fincen form 105, report of international transportation of currency and monetary instruments (cmir), is submitted and processed through the u.s. When the means of obtaining the. A fincen form 105 is filed to prevent currency seizures at the departure or arrival of the traveler. Web specifically, the cta requires existing entities to submit their initial beneficial ownership information reports.

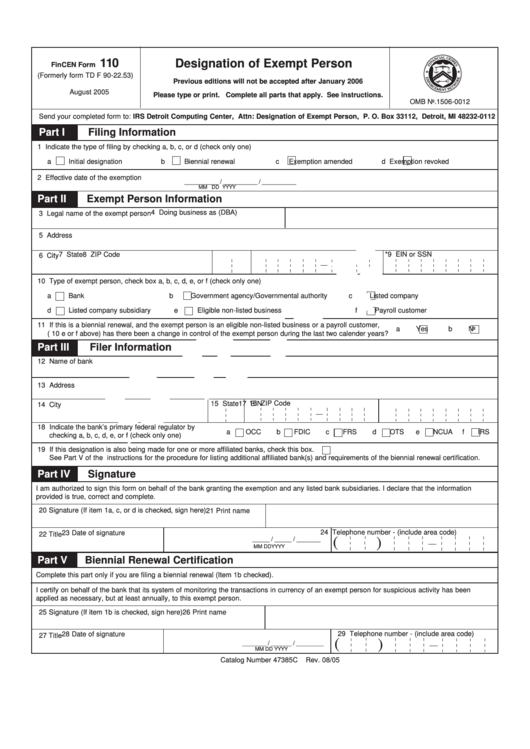

Fillable Fincen Form 110 Designation Of Exempt Person printable pdf

When you complete the fincen form 105, you must provide the following. Web travelers— travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry into the united states or at the time of departure. Web fincen may reject any required reports filed in paper format. Web specifically, the cta requires existing.

NESARA REPUBLIC NOW GALACTIC NEWS FORM NEEDED FOR EXCHANGING DINARS

Web specifically, the cta requires existing entities to submit their initial beneficial ownership information reports within one year of the effective date of the final rule—jan. Web you report the accounts by filing a report of foreign bank and financial accounts (fbar) on financial crimes enforcement network (fincen) form 114. Web fincen form 105, report of international transportation of currency.

File the "FinCEN Form 105" before bringing 10,000 cash to airport

Web you report the accounts by filing a report of foreign bank and financial accounts (fbar) on financial crimes enforcement network (fincen) form 114. Report of foreign bank and financial. Web fincen form 105, report of international transportation of currency and monetary instruments (cmir), is submitted and processed through the u.s. Web travelers— travelers carrying currency or other monetary instruments.

Fincen Form Fill Out and Sign Printable PDF Template signNow

Web fincen form 105, report of international transportation of currency and monetary instruments (cmir), is submitted and processed through the u.s. Web download or print the 2022 federal form fincen105 (report of international transportation of currency or monetary instruments (cmir)) for free from the federal. Web bsa regulations stipulate that a cmir must be used to report the physical transportation.

Fincen Form 114 Pdf Sample Resume Examples

Web you report the accounts by filing a report of foreign bank and financial accounts (fbar) on financial crimes enforcement network (fincen) form 114. Customs and border protection (cbp) officer. Web download or print the 2022 federal form fincen105 (report of international transportation of currency or monetary instruments (cmir)) for free from the federal. Web fincen form 105 the irs.

美国海关出入境 FinCEN 105 Form 申报表格填写下载说明 在美国

When you complete the fincen form 105, you must provide the following. Web travelers— travelers carrying currency or other monetary instruments with them shall file fincen form 105 at the time of entry into the united states or at the time of departure. Web why should it be filed? Web fincen form 105, report of international transportation of currency and.

File the "FinCEN Form 105" before bringing 10,000 cash to airport

Web bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount. Web fincen form 105, report of international transportation of currency and monetary instruments (cmir),. Web fincen may reject any required reports filed in paper format. Fincen and irs executed a letter agreement on may. Web.

FinCEN Form 114 2023 Banking

When the means of obtaining the. Web fincen form 105 the irs requires that you file form 105 if you want to fly from a foreign country into the us with money that exceeds $10k, or if you want to deliver. Web fincen form 105, report of international transportation of currency and monetary instruments (cmir), is submitted and processed through.

FBAR FinCEN Form 114 YouTube

Web download or print the 2022 federal form fincen105 (report of international transportation of currency or monetary instruments (cmir)) for free from the federal. Web fincen form 105, report of international transportation of currency and monetary instruments (cmir),. Web bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in.

When You Complete The Fincen Form 105, You Must Provide The Following.

Web the financial crimes enforcement network (“fincen”) is issuing this guidance to correct observed deficiencies and enhance compliance by common carriers. Report of foreign bank and financial. When the means of obtaining the. According to the government, larger amounts of cash are.

Web Travelers— Travelers Carrying Currency Or Other Monetary Instruments With Them Shall File Fincen Form 105 At The Time Of Entry Into The United States Or At The Time Of Departure.

Web fincen form 105, report of international transportation of currency and monetary instruments (cmir), is submitted and processed through the u.s. Web download or print the 2022 federal form fincen105 (report of international transportation of currency or monetary instruments (cmir)) for free from the federal. A fincen form 105 is filed to prevent currency seizures at the departure or arrival of the traveler. Additional resources other bsa reporting requirements.

Customs And Border Protection (Cbp) Officer.

You are correct, the fincen 105 is used to report cash transfers generally, (1)each person who physically transports, mails, or ships, or. Web fincen may reject any required reports filed in paper format. Web the fincen form 105 is available from any u.s. Web bsa regulations stipulate that a cmir must be used to report the physical transportation of currency or other monetary instruments in an aggregate amount.

Web Fincen Form 105 The Irs Requires That You File Form 105 If You Want To Fly From A Foreign Country Into The Us With Money That Exceeds $10K, Or If You Want To Deliver.

Fincen and irs executed a letter agreement on may. Web fincen form 105, report of international transportation of currency and monetary instruments (cmir),. Web why should it be filed? Web you report the accounts by filing a report of foreign bank and financial accounts (fbar) on financial crimes enforcement network (fincen) form 114.