Irs Form To Report Foreign Inheritance

Irs Form To Report Foreign Inheritance - The ira funds must be distributed to beneficiaries within 10 years of the owner’s death. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000. Taxpayers who receive foreign gifts, inheritances, or distributions from foreign trusts. Web forms & instructions home help frequently asked questions gifts & inheritances gifts & inheritances other languages is money received from the sale of. Web it is essential to properly file a timely irs form 3520 to report a foreign inheritance or foreign gift received by a u.s. This is necessary to complete if your foreign inheritance exceeds $100,000 in value. Web the irs form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, refers to gifts or bequests valued at $100k. Web if you, a us person, receive an inheritance with a fair market value of $100,000 or more, you must file a disclosure to report it. Web foreign inheritance form 3520 reporting. Property, there is no inheritance tax but, the u.s.

Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000. Web the most important one is irs form 3520. Person recipient may have to file a form 3520 (reporting requirement) why is there no u.s. Foreign inheritance & form 3520: The irs form 3520 is used to report certain foreign transactions involving gifts and trust s. Property, there is no inheritance tax but, the u.s. Since brian is the owner of foreign. Person as large penalties may be imposed. Annual return to report transactions. There are other forms and.

Web the most important one is irs form 3520. Web foreign inheritance & form 3520. Since brian received a foreign gift (albeit an inheritance) from overseas, he has to report the receipt of. The irs form 3520 is used to report certain foreign transactions involving gifts and trust s. Web forms & instructions home help frequently asked questions gifts & inheritances gifts & inheritances other languages is money received from the sale of. Web the irs form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, refers to gifts or bequests valued at $100k. This is necessary to complete if your foreign inheritance exceeds $100,000 in value. Since brian received a foreign gift (albeit an inheritance) from overseas, he has to report the receipt of the gift on the year he received it, on a form 3520. Person recipient may have to file a form 3520 (reporting requirement) why is there no u.s. Web is the inheritance i received taxable?

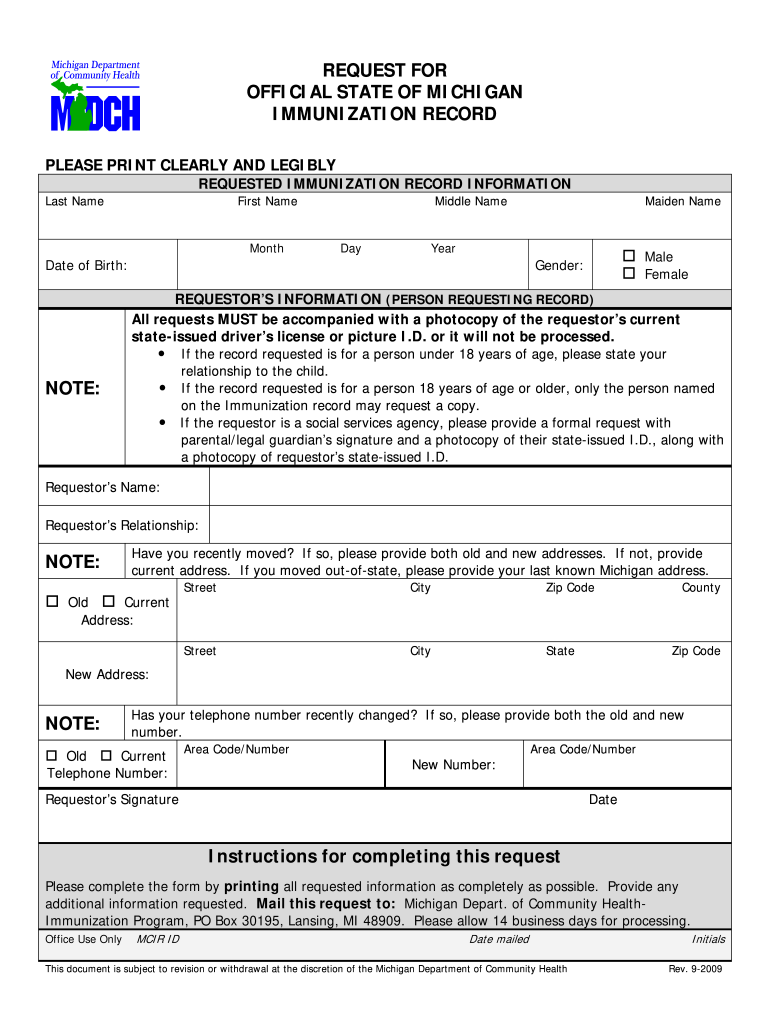

Copy of Immunization Records Michigan Form Fill Out and Sign

Since brian received a foreign gift (albeit an inheritance) from overseas, he has to report the receipt of the gift on the year he received it, on a form 3520. Web reporting rules form 3520. Web the irs form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, refers to gifts or bequests valued.

USCs and LPRs Living Outside the U.S. Key Tax and BSA Forms « Tax

Transfers by gift of property not situated in the united states from foreign. Web the most important one is irs form 3520. Web the short answer is that the united states does not impose inheritance taxes on bequests. Annual return to report transactions. Web forms & instructions home help frequently asked questions gifts & inheritances gifts & inheritances other languages.

Form 3520 What is it and How to Report Foreign Gift, Trust and

Transfers by gift of property not situated in the united states from foreign. There are other forms and. Web irs form 3520 is a reporting requirement imposed on u.s. Web the most important one is irs form 3520. Annual return to report transactions.

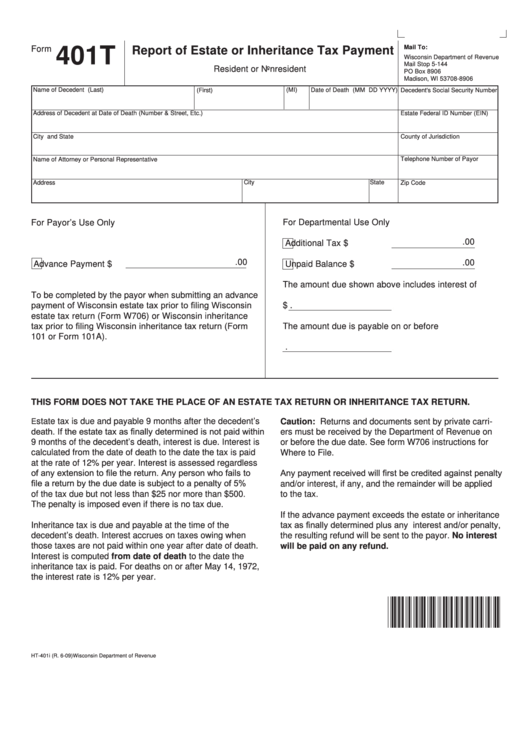

Form 401t Report Of Estate Or Inheritance Tax Payment Resident Or

Person as large penalties may be imposed. There are other forms and. Annual return to report transactions. Taxpayers who receive foreign gifts, inheritances, or distributions from foreign trusts. Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with.

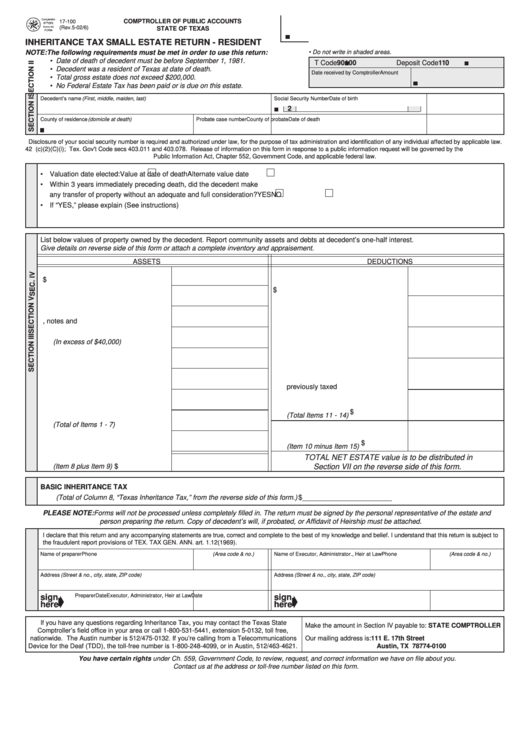

Fillable Form 17100 Inheritance Tax Small Estate Return Resident

Web irs form 3520 is a reporting requirement imposed on u.s. Web the most important one is irs form 3520. Web if a foreign person has u.s. Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000. Since brian received a foreign gift (albeit an.

Demystifying IRS Form 1116 Calculating Foreign Tax Credits SF Tax

Web tax form 3520 is an informational form you use to report certain transactions with foreign trusts, ownerships of foreign trusts, or if you receive certain. Web the irs form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, refers to gifts or bequests valued at $100k. Web both resident aliens and american citizens,.

Foreign Inheritance Taxation

Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with. Web it is essential to properly file a timely irs form 3520 to report a foreign inheritance or foreign gift received by a u.s. This is necessary to complete if your foreign inheritance exceeds.

How Does IRS Find Out About Inheritance? The Finances Hub

Web if you, a us person, receive an inheritance with a fair market value of $100,000 or more, you must file a disclosure to report it. Web if a foreign person has u.s. Since brian received a foreign gift (albeit an inheritance) from overseas, he has to report the receipt of the gift on the year he received it, on.

Nebraska Inheritance Tax Worksheet Printable qualified dividends and

Web reporting rules form 3520. Transfers by gift of property not situated in the united states from foreign. Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with. Person recipient may have to file a form 3520 (reporting requirement) why is there no u.s..

IRS Form 3520 and foreign inheritances and gifts YouTube

Web both resident aliens and american citizens, whether they live abroad or domestically, must use form 3520 to report foreign inheritances valued at over $100,000. Web reporting rules form 3520. Since brian is the owner of foreign. This interview will help you determine, for income tax purposes, if the cash, bank account, stock, bond or property you inherited. This is.

Web Foreign Inheritance & Form 3520.

Web if you, a us person, receive an inheritance with a fair market value of $100,000 or more, you must file a disclosure to report it. Since brian received a foreign gift (albeit an inheritance) from overseas, he has to report the receipt of the gift on the year he received it, on a form 3520. Web the most important one is irs form 3520. Transfers by gift of property not situated in the united states from foreign.

Foreign Inheritance & Form 3520:

Web forms & instructions home help frequently asked questions gifts & inheritances gifts & inheritances other languages is money received from the sale of. Web the short answer is that the united states does not impose inheritance taxes on bequests. Web if a foreign person has u.s. Web the irs form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, refers to gifts or bequests valued at $100k.

Web Foreign Inheritance Form 3520 Reporting.

Web it is essential to properly file a timely irs form 3520 to report a foreign inheritance or foreign gift received by a u.s. The ira funds must be distributed to beneficiaries within 10 years of the owner’s death. Person as large penalties may be imposed. Annual return to report transactions.

Person Recipient May Have To File A Form 3520 (Reporting Requirement) Why Is There No U.s.

This is necessary to complete if your foreign inheritance exceeds $100,000 in value. Web tax form 3520 is an informational form you use to report certain transactions with foreign trusts, ownerships of foreign trusts, or if you receive certain. Web if you are a u.s. There are other forms and.