Irs Form Expert

Irs Form Expert - How do i clear and. We will try to find the right answer to this particular crossword clue. There are related clues (shown below). Web find help filing your federal tax return with free programs and tools for specific needs or general tax filing questions. Request for taxpayer identification number (tin) and. File an extension in turbotax online before the deadline to avoid a late filing penalty. View more information about using irs forms, instructions, publications and other item files. 4 verified accountants are standing by online to help you with any tax issue. Irc 7610 provides for the payment of witness fees and mileage to summoned witnesses and the payment of search, reproduction, and transportation. Individual tax return form 1040 instructions;

Get a free irs tax help consultation. Irs form expert universal crossword clue. 4 verified accountants are standing by online to help you with any tax issue. Irs form expert is a crossword puzzle clue that we have spotted 17 times. Learn the differences between the two processes as you pursue federal. What you need to know about irs audits if the irs audits your tax return, the irs is taking a. This crossword clue was last seen on june 1 2023 universal. Web up to 10% cash back are you getting your irs forms 6166 authenticated or apostilled? Today's crossword puzzle clue is a quick one: Tax form expert crossword clue.

How do i clear and. Try irs free file your online account view your tax records, adjusted gross income and estimated tax payments. Web taxes done right, with experts by your side. The crossword solver finds answers to classic crosswords and cryptic crossword. Today's crossword puzzle clue is a quick one: Web you can get expert help and even have your tax pro represent you in an irs audit. This crossword clue was last seen on june 1. This crossword clue was last seen on june 1 2023 universal. Ad whatever the problem, a verified tax pro can solve it for you in just minutes online. 4 verified accountants are standing by online to help you with any tax issue.

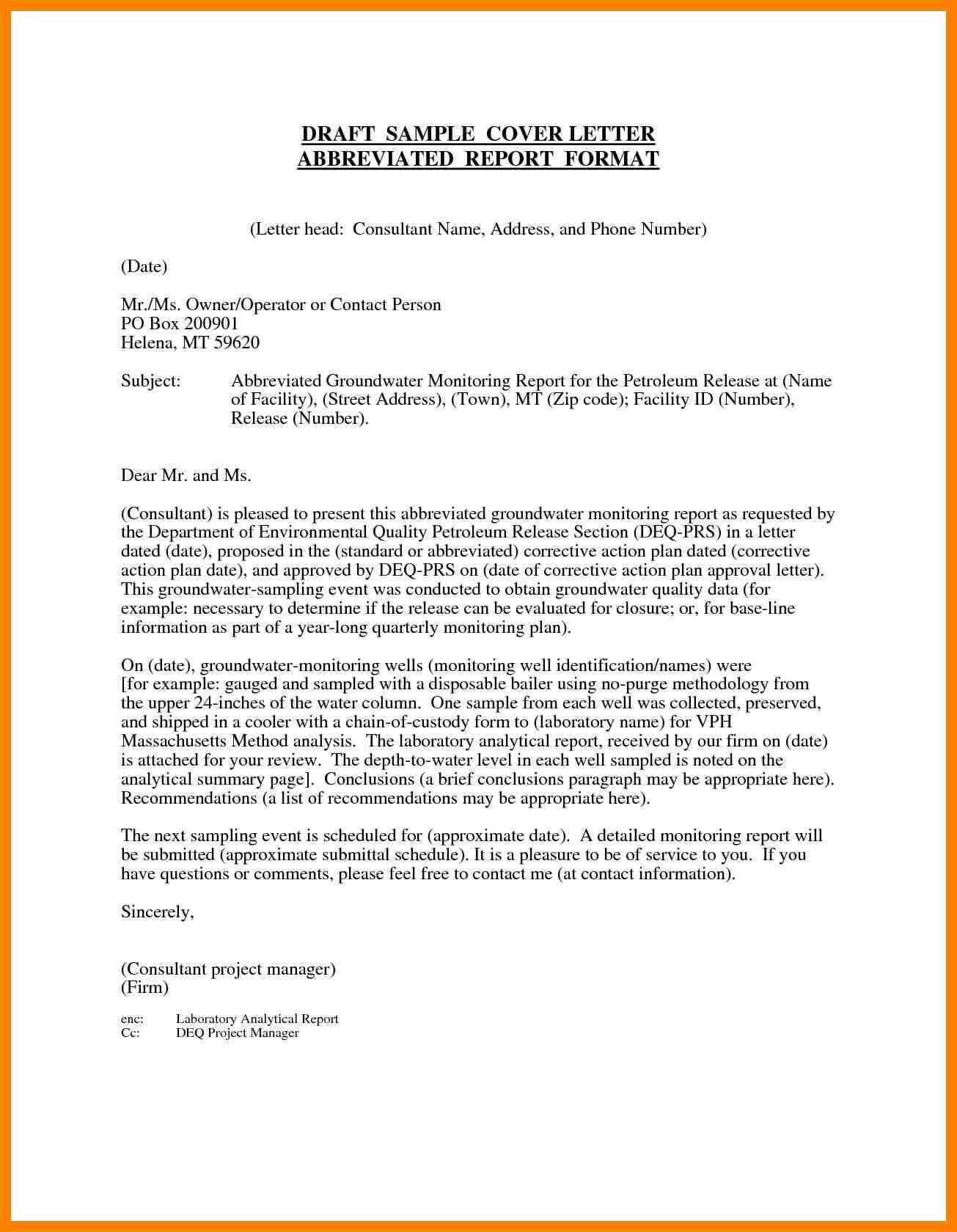

Expert Witness Report Template

There are related clues (shown. Irc 7610 provides for the payment of witness fees and mileage to summoned witnesses and the payment of search, reproduction, and transportation. Ad don't face the irs alone. Tax form expert crossword clue. How do i clear and.

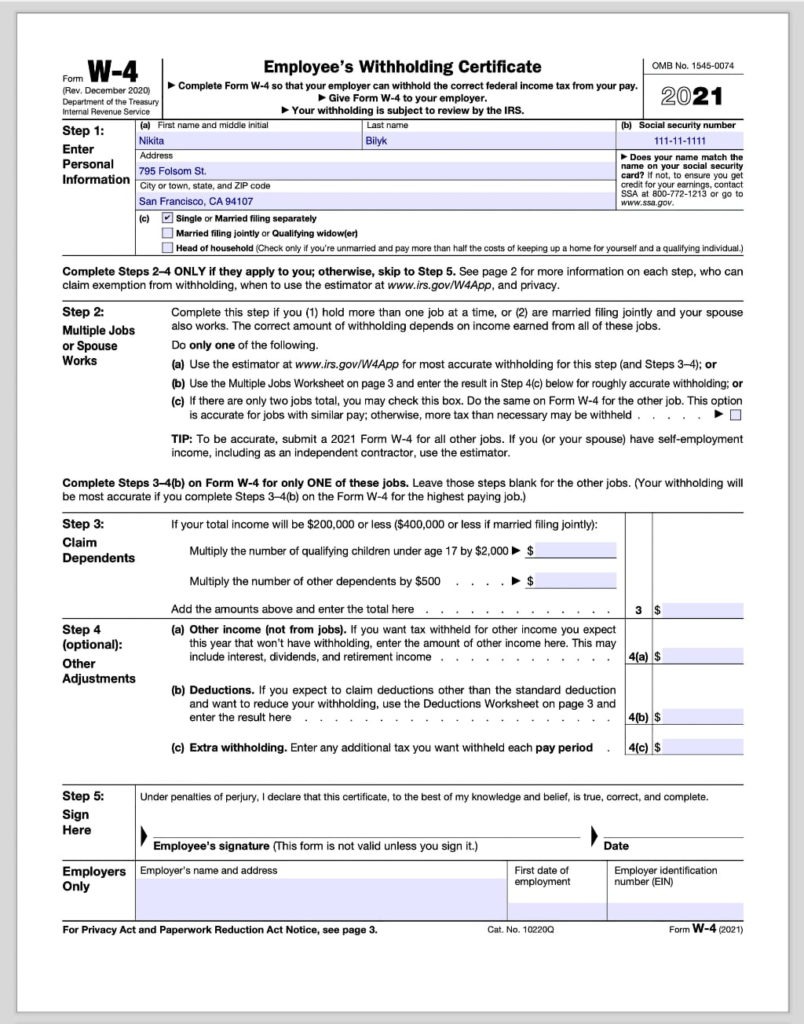

How To Fill Out Irs Form W9 20192020 Pdf Expert for Free W 9 Form

Irc 7610 provides for the payment of witness fees and mileage to summoned witnesses and the payment of search, reproduction, and transportation. How to file your federal income tax return learn the steps to. Web taxes done right, with experts by your side. Irs form expert is a crossword puzzle clue that we have spotted 17 times. This crossword clue.

IRS Form 433A (OIC) Collection Information Statement for Wage Earners

Web find help filing your federal tax return with free programs and tools for specific needs or general tax filing questions. This crossword clue was last seen on june 1. Web money saving expert martin lewis gave advice on gmb on savings accounts rates and cash isas after the bank of england interest rate hikes. Irc 7610 provides for the.

irs form 13825 august 2017 Fill Online, Printable, Fillable Blank

Request for taxpayer identification number (tin) and. We will try to find the right answer to this particular crossword clue. Referring crossword puzzle answers cpa likely related crossword. Web the crossword solver found 30 answers to irs form experts, 4 letters crossword clue. There are related clues (shown below).

10 Form Irs 10 10 Secrets About 10 Form Irs 10 That Has Never Been

Connect with live tax experts on demand while you do taxes. Web prepare and file your federal income taxes online for free. Our experts help you complete your taxes, fix any mistakes,. Get a free irs tax help consultation. Don't let the irs intimidate you.

How To Take Help From IRS Audit Expert 2021 My Count Solutions

Easily file a personal income tax extension online and learn more about filing a tax. Irs form expert is a crossword puzzle clue that we have spotted 17 times. How to file your federal income tax return learn the steps to. Irc 7610 provides for the payment of witness fees and mileage to summoned witnesses and the payment of search,.

How IRS Expert can be a Lifesaver for your Small Business

There are related clues (shown. Try irs free file your online account view your tax records, adjusted gross income and estimated tax payments. Web prepare and file your federal income taxes online for free. What you need to know about irs audits if the irs audits your tax return, the irs is taking a. Web money saving expert martin lewis.

How To Fill Out 2020 2021 IRS Form W 4 PDF Expert W4 Form 2021

Web prepare and file your federal income taxes online for free. Referring crossword puzzle answers cpa likely related crossword. This crossword clue was last seen on june 1. Try irs free file your online account view your tax records, adjusted gross income and estimated tax payments. Request for taxpayer identification number (tin) and.

ads/responsive.txt Irs form W 9 2018 Fresh What is Irs form W 9 and How

Web how do i file an irs extension (form 4868) in turbotax online? This crossword clue was last seen on june 1. Ad don't face the irs alone. Web prepare and file your federal income taxes online for free. Request for taxpayer identification number (tin) and.

Gallery of Irs form 4684 for 2017 New Irs Tax form Instructions Free

Today's crossword puzzle clue is a quick one: Web taxes done right, with experts by your side. Our experts help you complete your taxes, fix any mistakes,. Web you can get expert help and even have your tax pro represent you in an irs audit. The person calling must be authorized to receive the ein and.

This Revised Irm Provides Current Policy And Procedural Guidance For Expert And Consultant Appointments And Is Part Of The Servicewide Effort To Provide.

Ad don't face the irs alone. Ad whatever the problem, a verified tax pro can solve it for you in just minutes online. Web tax form expert while searching our database we found 1 possible solution for the: This crossword clue was last seen on june 1.

Web Taxes Done Right, With Experts By Your Side.

View more information about using irs forms, instructions, publications and other item files. Irc 7610 provides for the payment of witness fees and mileage to summoned witnesses and the payment of search, reproduction, and transportation. Web you can get expert help and even have your tax pro represent you in an irs audit. Individual tax return form 1040 instructions;

Irs Form Expert Universal Crossword Clue.

Web prepare and file your federal income taxes online for free. Easily file a personal income tax extension online and learn more about filing a tax. The person calling must be authorized to receive the ein and. Get free, competing quotes from tax help experts.

Referring Crossword Puzzle Answers Cpa Likely Related Crossword.

Don't let the irs intimidate you. Learn the differences between the two processes as you pursue federal. There are related clues (shown. File an extension in turbotax online before the deadline to avoid a late filing penalty.