Irs Form 8832 Vs 2553

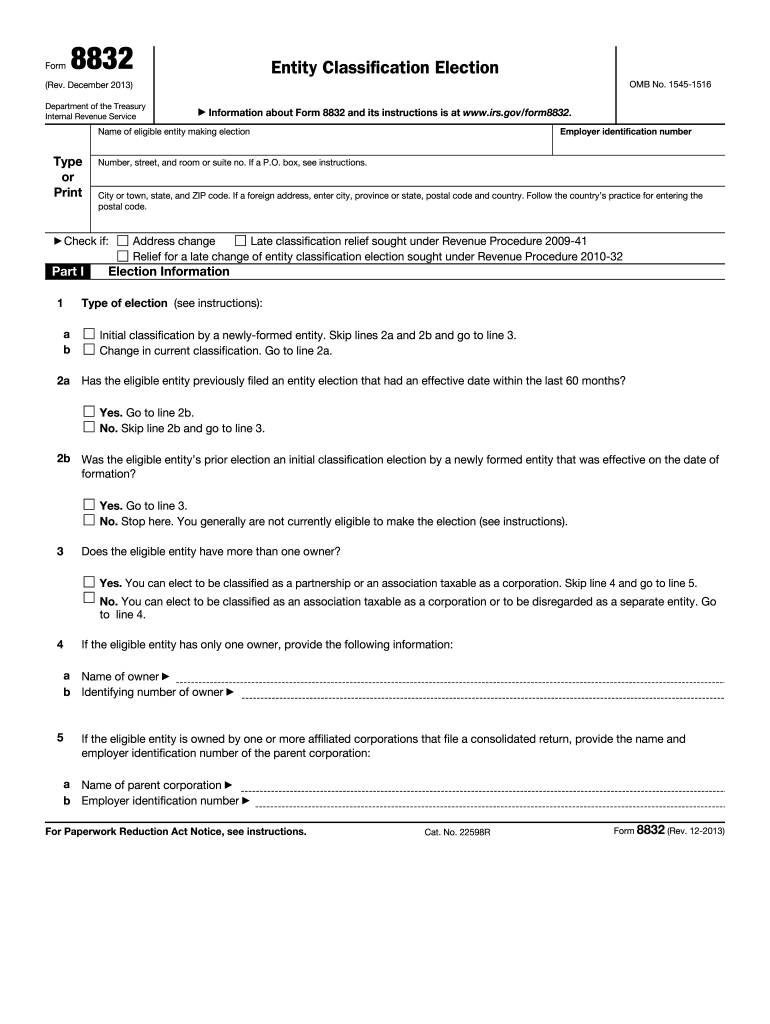

Irs Form 8832 Vs 2553 - Form 8832 is used by a business that wants to change its default tax classification. But how do you want that new company to be taxed? Web in addition, filling out form 8832 allows a business to change its tax status so that the business reports its income and expenses on its own tax return, rather than the owners reporting. Web form 8832 vs. This is where the honest debate comes into play. Web selected as best answer. The biggest difference between form 8832 and form 2553 is the tax classification that you’re requesting. Web use form 8832, entity classification election to make an election to be an association taxable as a corporation. If you are an llc with a single member, you are by default classified as a sole proprietorship for federal tax purposes—there is no need to file the 8832 under these circumstances. You may have recently set up a limited liability company or a corporation.

If you have more than one member, you are by default classified as a partnership for federal tax purposes, and you do not have to file the. The biggest difference between form 8832 and form 2553 is the tax classification that you’re requesting. If a taxpayer doesn't file form 2553, the default classification will apply. If you are an llc with a single member, you are by default classified as a sole proprietorship for federal tax purposes—there is no need to file the 8832 under these circumstances. Web file a irs form 8832 to elect tax classification. Web selected as best answer. But how do you want that new company to be taxed? This is where the honest debate comes into play. Web use form 8832, entity classification election to make an election to be an association taxable as a corporation. You may have recently set up a limited liability company or a corporation.

A sole member can opt to either disregard llc status for tax purposes thus claiming income on their personal return or opt to file taxes as a corporation. Web selected as best answer. Web what about irs form 8832 vs 2553? Web an entity eligible to elect to be treated as a corporation that meets certain tests discussed below will be treated as a corporation as of the effective date of the s corporation election and doesn’t need to file form 8832, entity classification election. Form 8832 is used by a business that wants to change its default tax classification. Web in addition, filling out form 8832 allows a business to change its tax status so that the business reports its income and expenses on its own tax return, rather than the owners reporting. This is where the honest debate comes into play. Web use form 8832, entity classification election to make an election to be an association taxable as a corporation. Form 8832 notifies the irs which business entity or tax status you plan to employ for filing tax returns for the llc. If form 8832 is not filed, the effective date of the s election could be entered.

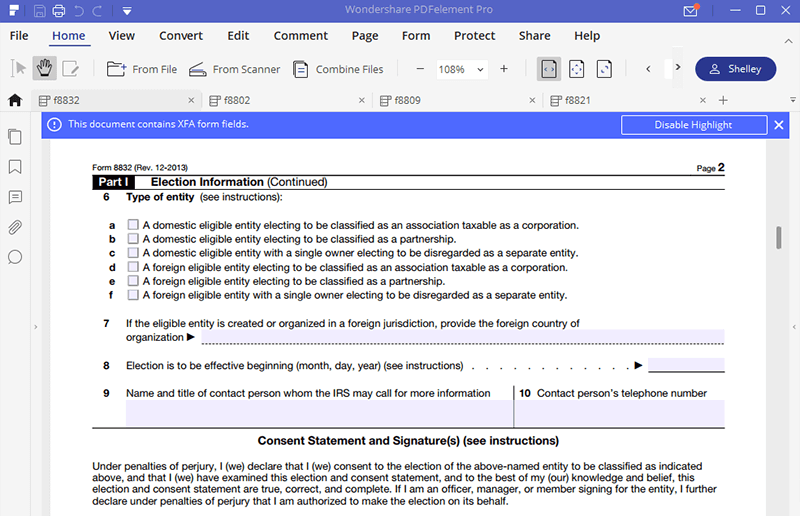

Irs Form 8832 Fillable Pdf Printable Forms Free Online

Web in addition, filling out form 8832 allows a business to change its tax status so that the business reports its income and expenses on its own tax return, rather than the owners reporting. You may have recently set up a limited liability company or a corporation. If you’re an llc or partnership, use form 8832 if you want to.

What Is IRS Form 8832? Definition, Deadline, & More

Web file a irs form 8832 to elect tax classification. A sole member can opt to either disregard llc status for tax purposes thus claiming income on their personal return or opt to file taxes as a corporation. If a taxpayer doesn't file form 2553, the default classification will apply. Form 8832 notifies the irs which business entity or tax.

20132023 Form IRS 8832 Fill Online, Printable, Fillable, Blank pdfFiller

If form 8832 is not filed, the effective date of the s election could be entered. Web selected as best answer. If a taxpayer doesn't file form 2553, the default classification will apply. Web form 8832 vs. This is where the honest debate comes into play.

Filling out IRS Form 8832 An EasytoFollow Guide YouTube

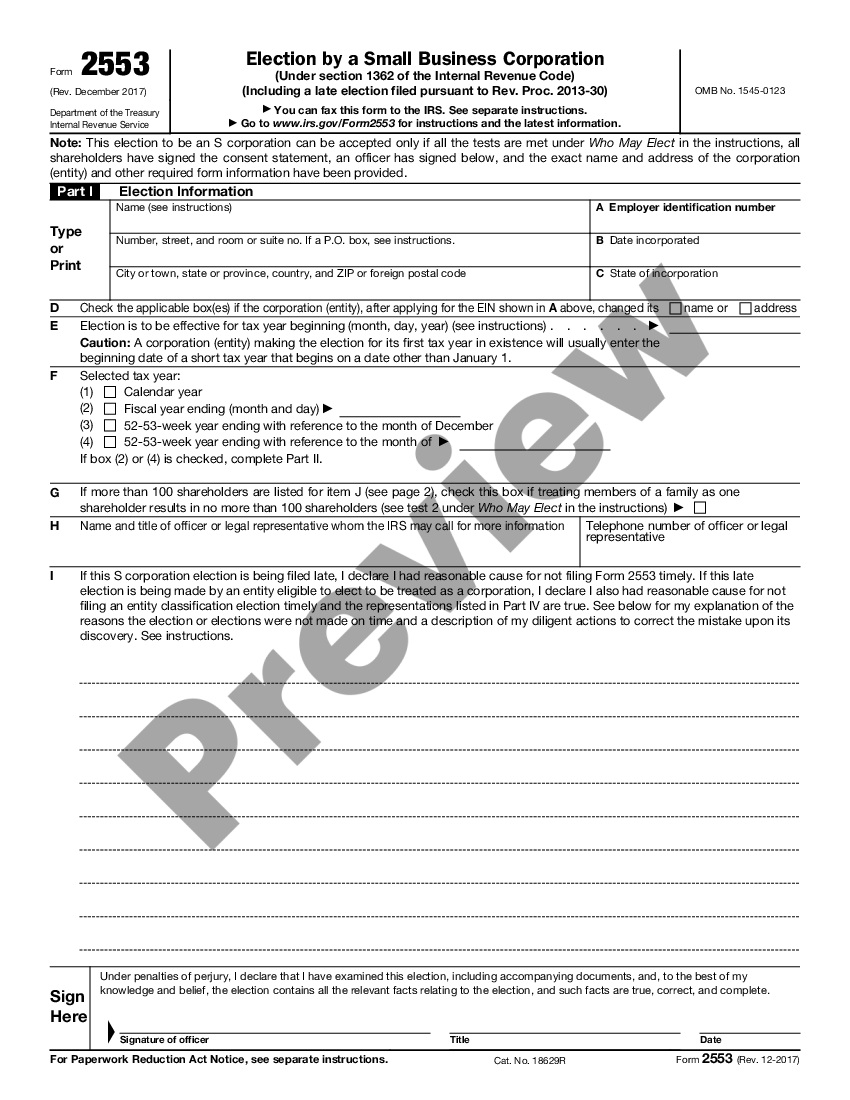

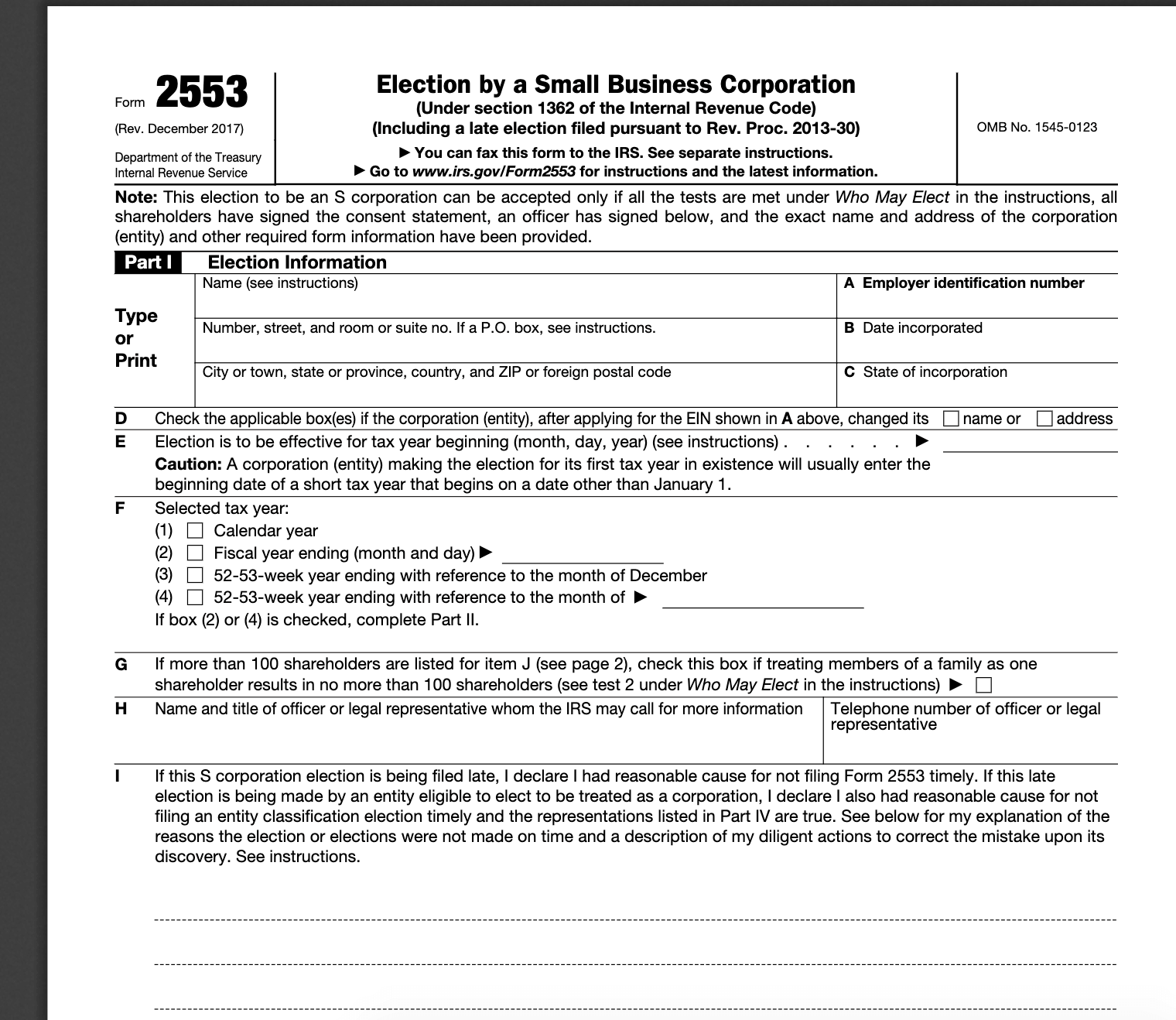

Use form 2553, election by small business corporation to make an election to be an s corporation. A sole member can opt to either disregard llc status for tax purposes thus claiming income on their personal return or opt to file taxes as a corporation. Form 8832 is used by a business that wants to change its default tax classification..

What Is Irs Form 8832?

Use form 2553, election by small business corporation to make an election to be an s corporation. Form 8832 is used by a business that wants to change its default tax classification. But how do you want that new company to be taxed? Web use form 8832, entity classification election to make an election to be an association taxable as.

Election of 'S' Corporation Status and Instructions Form 2553 S Corp

If you’re an llc or partnership, use form 8832 if you want to be taxed as a. Web an entity eligible to elect to be treated as a corporation that meets certain tests discussed below will be treated as a corporation as of the effective date of the s corporation election and doesn’t need to file form 8832, entity classification.

IRS Form 8832 How to Fill it Right

Form 8832 is used by a business that wants to change its default tax classification. Web form 8832 vs. Web selected as best answer. The biggest difference between form 8832 and form 2553 is the tax classification that you’re requesting. Form 8832 notifies the irs which business entity or tax status you plan to employ for filing tax returns for.

Irs Form 8832 Fillable Pdf Printable Forms Free Online

This is where the honest debate comes into play. If you have more than one member, you are by default classified as a partnership for federal tax purposes, and you do not have to file the. Use form 2553, election by small business corporation to make an election to be an s corporation. Web form 8832 vs. Form 8832 is.

Irs 2553 Form PDF S Corporation Irs Tax Forms

If form 8832 is not filed, the effective date of the s election could be entered. Web form 8832 vs. This is where the honest debate comes into play. The biggest difference between form 8832 and form 2553 is the tax classification that you’re requesting. But how do you want that new company to be taxed?

Como usar el Formulario 8832 para cambiar la clasificación fiscal de su

Web an entity eligible to elect to be treated as a corporation that meets certain tests discussed below will be treated as a corporation as of the effective date of the s corporation election and doesn’t need to file form 8832, entity classification election. Web file a irs form 8832 to elect tax classification. If you’re an llc or partnership,.

Web Selected As Best Answer.

If you have more than one member, you are by default classified as a partnership for federal tax purposes, and you do not have to file the. Form 8832 is used by a business that wants to change its default tax classification. Form 8832 notifies the irs which business entity or tax status you plan to employ for filing tax returns for the llc. Web form 8832 vs.

But How Do You Want That New Company To Be Taxed?

Web use form 8832, entity classification election to make an election to be an association taxable as a corporation. A sole member can opt to either disregard llc status for tax purposes thus claiming income on their personal return or opt to file taxes as a corporation. The biggest difference between form 8832 and form 2553 is the tax classification that you’re requesting. Web what about irs form 8832 vs 2553?

Web In Addition, Filling Out Form 8832 Allows A Business To Change Its Tax Status So That The Business Reports Its Income And Expenses On Its Own Tax Return, Rather Than The Owners Reporting.

If a taxpayer doesn't file form 2553, the default classification will apply. Use form 2553, election by small business corporation to make an election to be an s corporation. If you are an llc with a single member, you are by default classified as a sole proprietorship for federal tax purposes—there is no need to file the 8832 under these circumstances. You may have recently set up a limited liability company or a corporation.

This Is Where The Honest Debate Comes Into Play.

Web file a irs form 8832 to elect tax classification. Web an entity eligible to elect to be treated as a corporation that meets certain tests discussed below will be treated as a corporation as of the effective date of the s corporation election and doesn’t need to file form 8832, entity classification election. If you’re an llc or partnership, use form 8832 if you want to be taxed as a. If form 8832 is not filed, the effective date of the s election could be entered.