Irs Form 5305 Simple

Irs Form 5305 Simple - Get ready for tax season deadlines by completing any required tax forms today. However, only articles i through vii have been reviewed by. Traditional individual retirement trust account (under section 408(a) of the internal. April 2017) department of the treasury internal revenue service. Web instructions for completing this form. Web this disclosure statement is provided in accordance with irs regulations. Web each form is a simple ira plan document. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Savings incentive match plan for employees of small employers.

Web each form is a simple ira plan document. Complete, edit or print tax forms instantly. Web instructions for completing this form. Employers use this form to make an agreement to provide benefits to all eligible employees under a. However, only articles i through vii have been reviewed by. Web this disclosure statement is provided in accordance with irs regulations. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Savings incentive match plan for employees of small employers. Complete, edit or print tax forms instantly.

Set up your new plan. Web establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form. The purpose of this form is to establish a participant’s account in their employer’s simple ira plan held directly at blackrock. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Savings incentive match plan for employees of small employers. However, only articles i through vii have. However, only articles i through vii have been reviewed by. Employers use this form to make an agreement to provide benefits to all eligible employees under a.

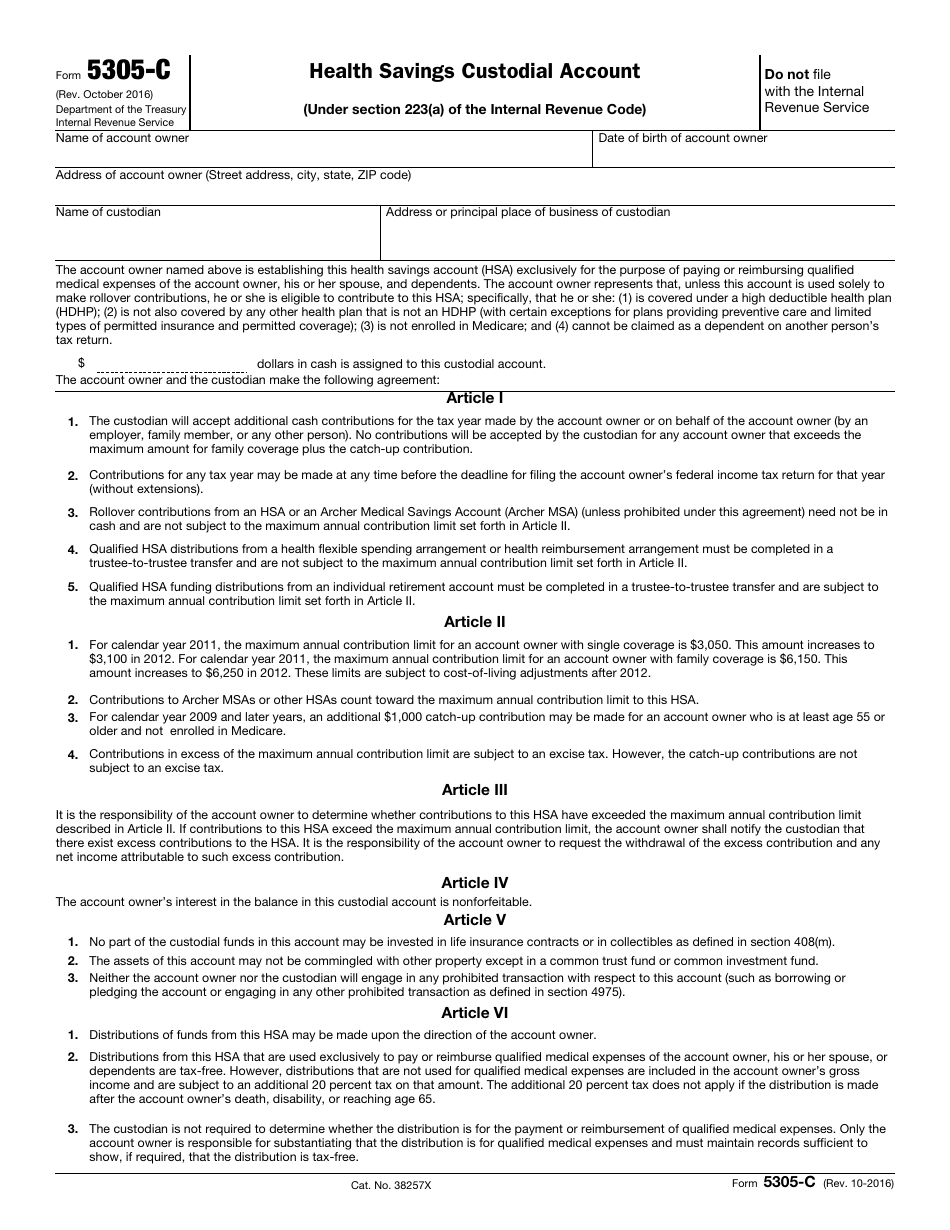

IRS Form 5305C Download Fillable PDF or Fill Online Health Savings

March 2012) department of the treasury internal revenue service. You could also adopt a prototype document issued by a financial institution or. However, only articles i through vii have. Traditional individual retirement trust account (under section 408(a) of the internal. Complete, edit or print tax forms instantly.

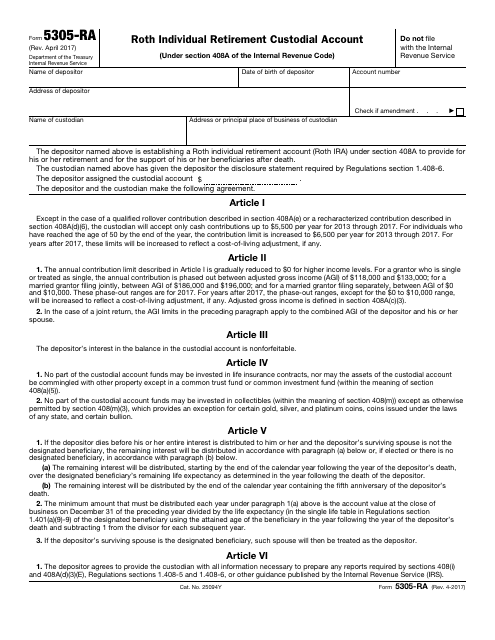

IRS Form 5305RA Download Fillable PDF or Fill Online Roth Individual

Set up your new plan. March 2012) department of the treasury internal revenue service. Savings incentive match plan for employees of small employers. Web establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form. Ad access irs tax forms.

5305 Sep Form Fill Out Digital PDF Sample

Web this disclosure statement is provided in accordance with irs regulations. The purpose of this form is to establish a participant’s account in their employer’s simple ira plan held directly at blackrock. Complete, edit or print tax forms instantly. Web establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained.

1996 Form IRS 5305SIMPLE Fill Online, Printable, Fillable, Blank

Web this disclosure statement is provided in accordance with irs regulations. April 2017) department of the treasury internal revenue service. Employers use this form to make an agreement to provide benefits to all eligible employees under a. Get ready for tax season deadlines by completing any required tax forms today. Traditional individual retirement trust account (under section 408(a) of the.

How a SEP IRA Works Contributions, Benefits, Obligations and IRS Form

However, only articles i through vii have been reviewed by. Traditional individual retirement trust account (under section 408(a) of the internal. March 2012) department of the treasury internal revenue service. Web each form is a simple ira plan document. Complete, edit or print tax forms instantly.

U.S. TREAS Form treasirs53052002

However, only articles i through vii have been reviewed by. Traditional individual retirement trust account (under section 408(a) of the internal. Ad access irs tax forms. Set up your new plan. Get ready for tax season deadlines by completing any required tax forms today.

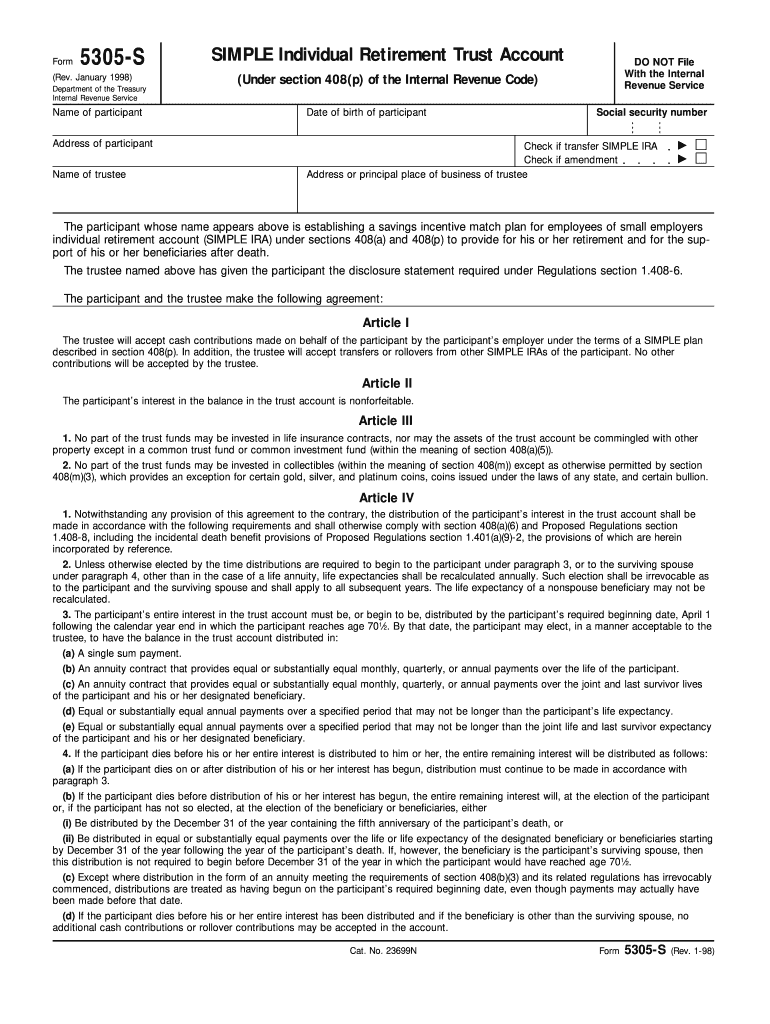

Form 5305SIMPLE Savings Incentive Match Plan for Employees of Small

Get ready for tax season deadlines by completing any required tax forms today. However, only articles i through vii have been reviewed by. Web instructions for completing this form. Web establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form. April 2017) department of the treasury internal.

Foresters Financial 5305 Simple Fill Out and Sign Printable PDF

March 2012) department of the treasury internal revenue service. Web establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form. Web this disclosure statement is provided in accordance with irs regulations. Ad access irs tax forms. Ad access irs tax forms.

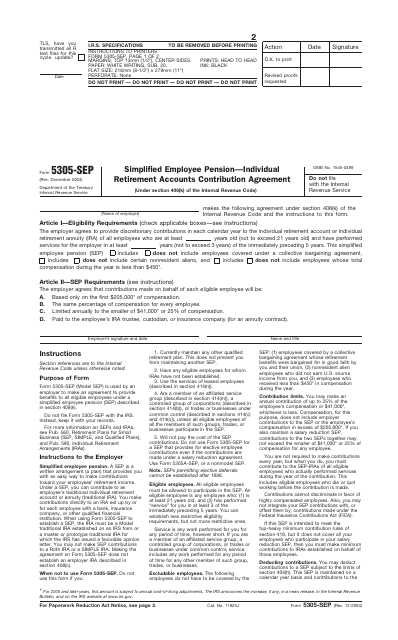

IRS Form 5305SEP Download Fillable PDF or Fill Online Simplified

Web this disclosure statement is provided in accordance with irs regulations. However, only articles i through vii have. Get ready for tax season deadlines by completing any required tax forms today. Web establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form. Complete, edit or print tax.

20122017 Form IRS 5305SIMPLE Fill Online, Printable, Fillable, Blank

Ad access irs tax forms. Web establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form. Traditional individual retirement trust account (under section 408(a) of the internal. Complete, edit or print tax forms instantly. Set up your new plan.

Complete, Edit Or Print Tax Forms Instantly.

March 2012) department of the treasury internal revenue service. Web this disclosure statement is provided in accordance with irs regulations. Traditional individual retirement trust account (under section 408(a) of the internal. The purpose of this form is to establish a participant’s account in their employer’s simple ira plan held directly at blackrock.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Ad access irs tax forms. Complete, edit or print tax forms instantly. Ad access irs tax forms. Contact a retirement plan professional or a representative of a financial institution that offers retirement plans.

Savings Incentive Match Plan For Employees Of Small Employers.

However, only articles i through vii have been reviewed by. Web each form is a simple ira plan document. April 2017) department of the treasury internal revenue service. Web instructions for completing this form.

Web Establishes The Following Simple Ira Plan Under Section 408(P) Of The Internal Revenue Code And Pursuant To The Instructions Contained In This Form.

Set up your new plan. You could also adopt a prototype document issued by a financial institution or. Employers use this form to make an agreement to provide benefits to all eligible employees under a. Get ready for tax season deadlines by completing any required tax forms today.