Irs Form 3531 Mailing Address

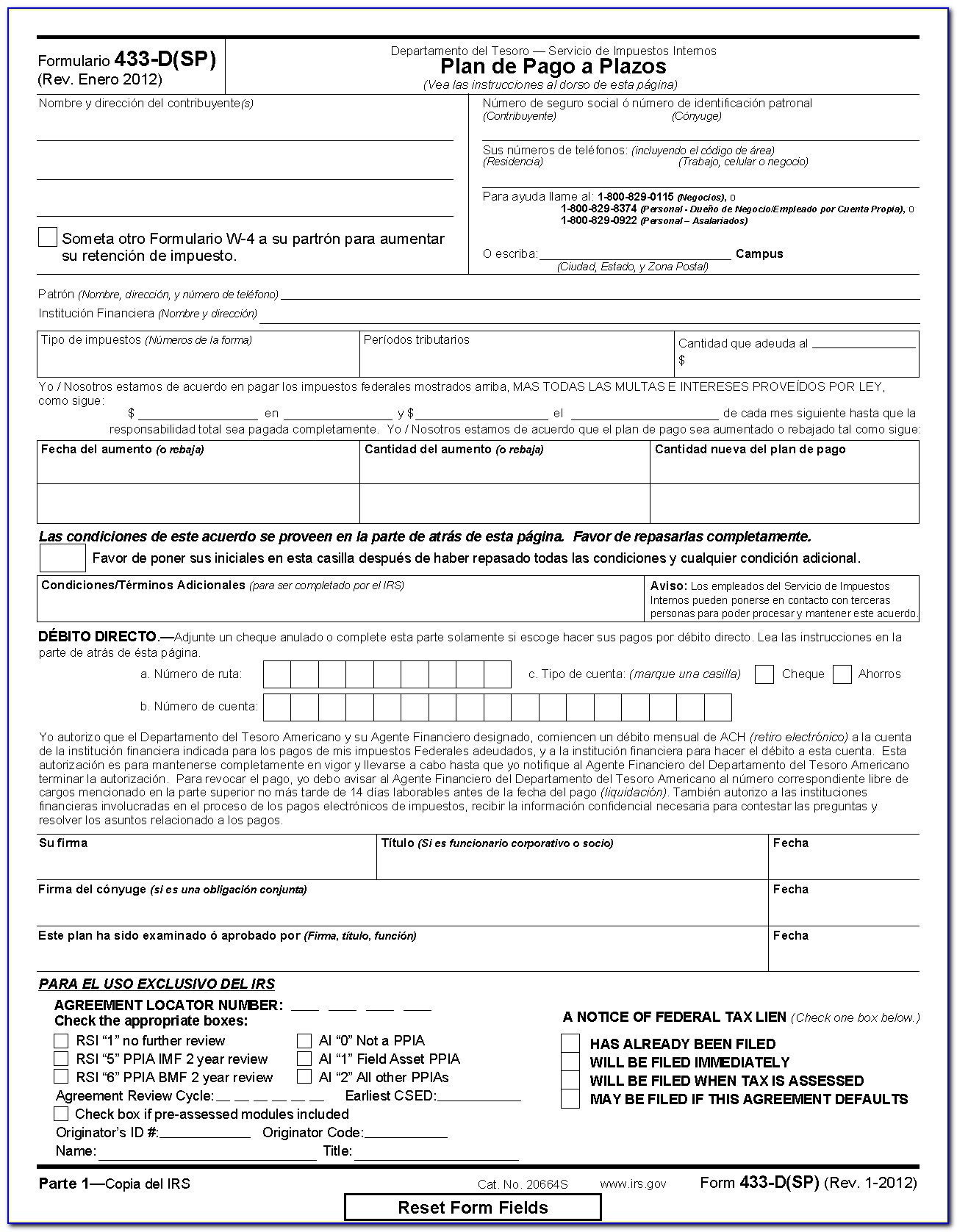

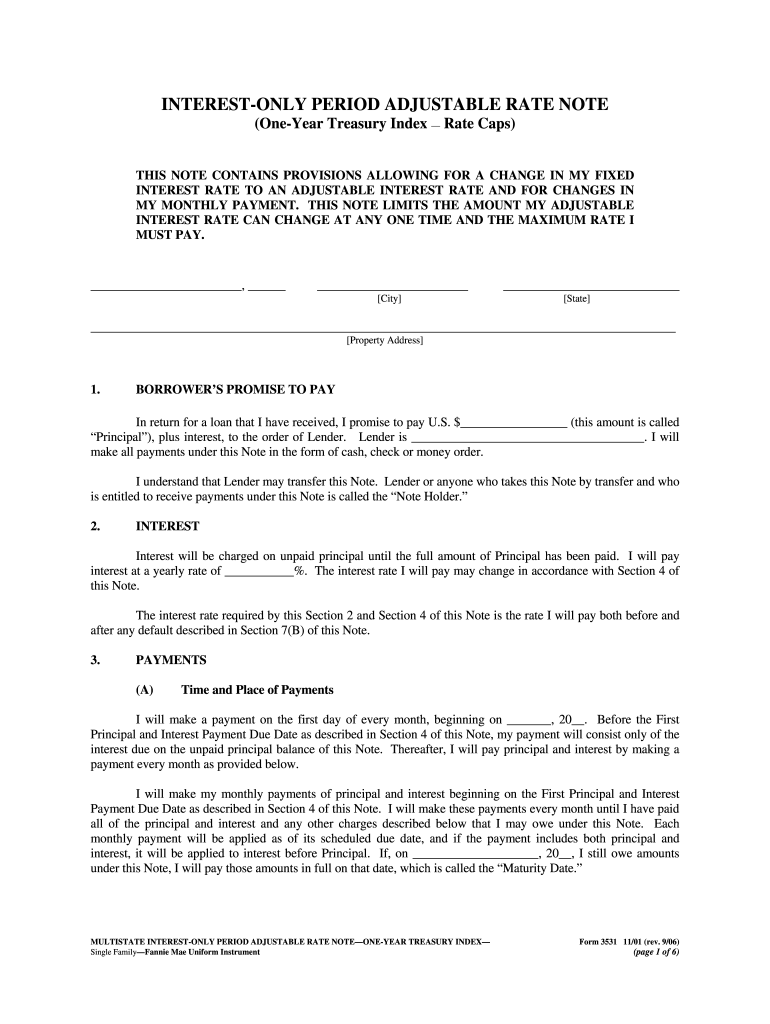

Irs Form 3531 Mailing Address - Web the letter said, that i can send it to the return address, but there is no return address on the mail, the only address written on the upper left of the envelop is (internal revenue. How to submit missing signature form 3531 to irs? Web i was trying to find where i need to mail the form. Web the actual form 3531 states at the bottom of the second page: Box 7704, san francisco, ca. Web taxpayer assistance center office locator. The new mailing addresses are shown below. Web once you call the irs, then they ‘ d tell you to mail it back to where it came from. Internal revenue service , submission processing center,. What do i need to do?

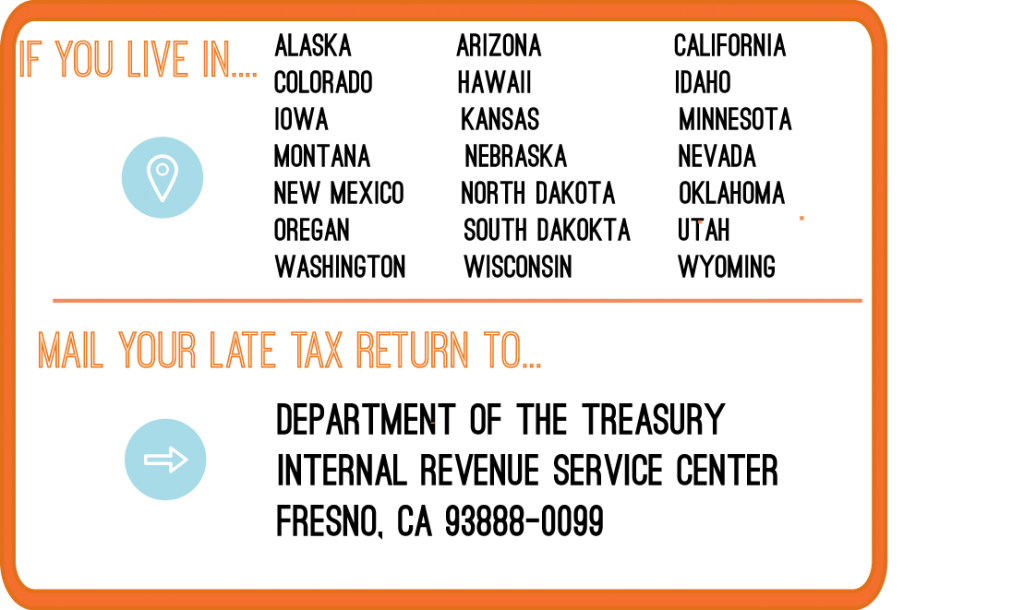

Each form number has its own page with the needed address for example 1040,. Internal revenue service , submission processing center,. The new mailing addresses are shown below. Web once you call the irs, then they ‘ d tell you to mail it back to where it came from. Web the address you provided is a legitimate irs mailing address for processing paper returns. Web alaska, arizona, california, colorado, hawaii, idaho, new mexico, nevada, oregon, utah, washington, wyoming: To reply, use the return address on the mailing envelope or refer to. Where to mail missing signature form 3531? Locate the closest taxpayer assistance center to you. The address on the envelope is internal revenue service, submission processing center, austin tx 73301.

Web alaska, arizona, california, colorado, hawaii, idaho, new mexico, nevada, oregon, utah, washington, wyoming: All fields marked with an asterisk *are required. What do i need to do? Web i returned the form 3531 to: Web we received the return with a form 3531, box 1 checked indicated lack of valid signature. How to submit missing signature form 3531 to irs? Web once you call the irs, then they ‘ d tell you to mail it back to where it came from. Web the address you provided is a legitimate irs mailing address for processing paper returns. How to complete missing signature form 3531? Internal revenue service , submission processing center,.

IRS Mailing Address PriorTax Blog

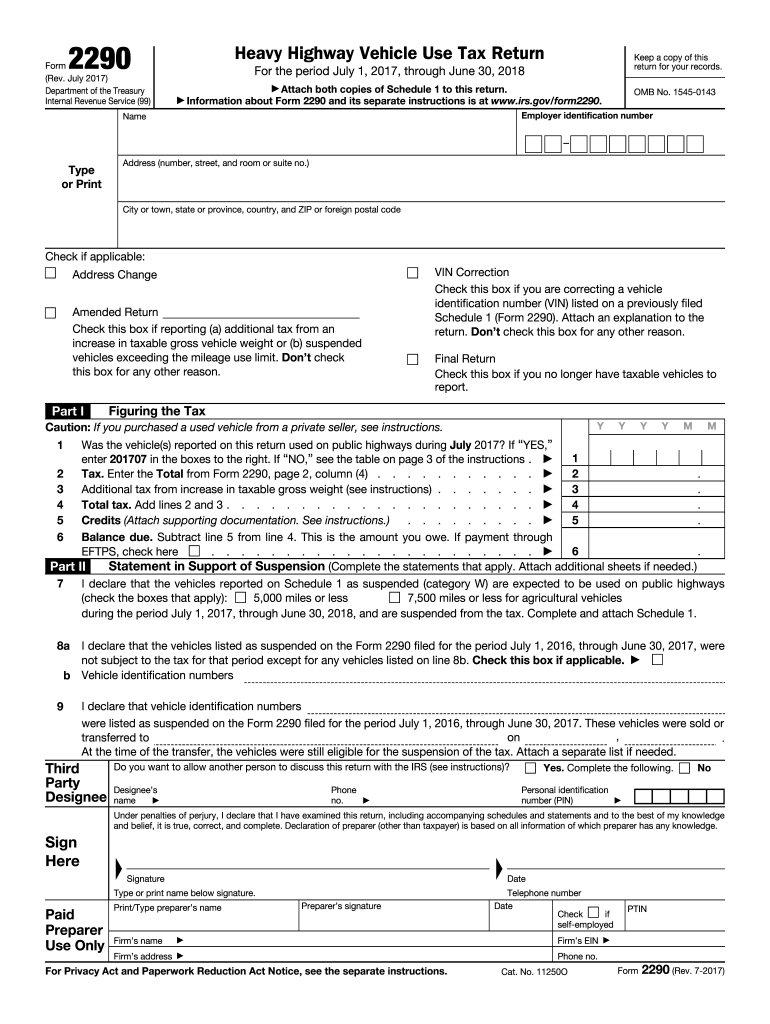

I received form 3531 from the irs. Individual, corporation, partnership, and many others. Web i was trying to find where i need to mail the form. Addresses for mailing certain forms have changed since the forms were last published. Web mailing addresses for all types of returns:

Irs.gov Form 941 Mailing Address Form Resume Examples w950jQVkor

Web alaska, arizona, california, colorado, hawaii, idaho, new mexico, nevada, oregon, utah, washington, wyoming: We do not have the envelope that we received it in, so not sure what the. Web mailing addresses for all types of returns: The address on the envelope is internal revenue service, submission processing center, austin tx 73301. Web the letter said, that i can.

IRS Mailing Address PriorTax Blog

Web 1 reply [deleted] • 8 yr. Box 7704, san francisco, ca. Web the actual form 3531 states at the bottom of the second page: Web alaska, arizona, california, colorado, hawaii, idaho, new mexico, nevada, oregon, utah, washington, wyoming: ( top right box ) n is checked off, with box 1, and 4 checked off.

2290 Fill Out and Sign Printable PDF Template signNow

I received form 3531 from the irs. The address on the envelope is internal revenue service, submission processing center, austin tx 73301. Web 1 reply [deleted] • 8 yr. Web the letter said, that i can send it to the return address, but there is no return address on the mail, the only address written on the upper left of.

Form 3531 Pdf Fill Online, Printable, Fillable, Blank pdfFiller

Locate the closest taxpayer assistance center to you. Internal revenue service , submission processing center,. Addresses for mailing certain forms have changed since the forms were last published. Box 7704, san francisco, ca. How to submit missing signature form 3531 to irs?

IRS Audit Letter 3531 Sample 1

Web the actual form 3531 states at the bottom of the second page: I received form 3531 from the irs. What do i need to do? Locate the closest taxpayer assistance center to you. We do not have the envelope that we received it in, so not sure what the.

IRS Audit Letter 3531 Sample 1

( top right box ) n is checked off, with box 1, and 4 checked off. Internal revenue service , submission processing center,. How to submit missing signature form 3531 to irs? What do i need to do? We do not have the envelope that we received it in, so not sure what the.

irs mail address finder

Web the actual form 3531 states at the bottom of the second page: We do not have the envelope that we received it in, so not sure what the. Web i was trying to find where i need to mail the form. Internal revenue service , submission processing center,. This was the return address shown on the large.

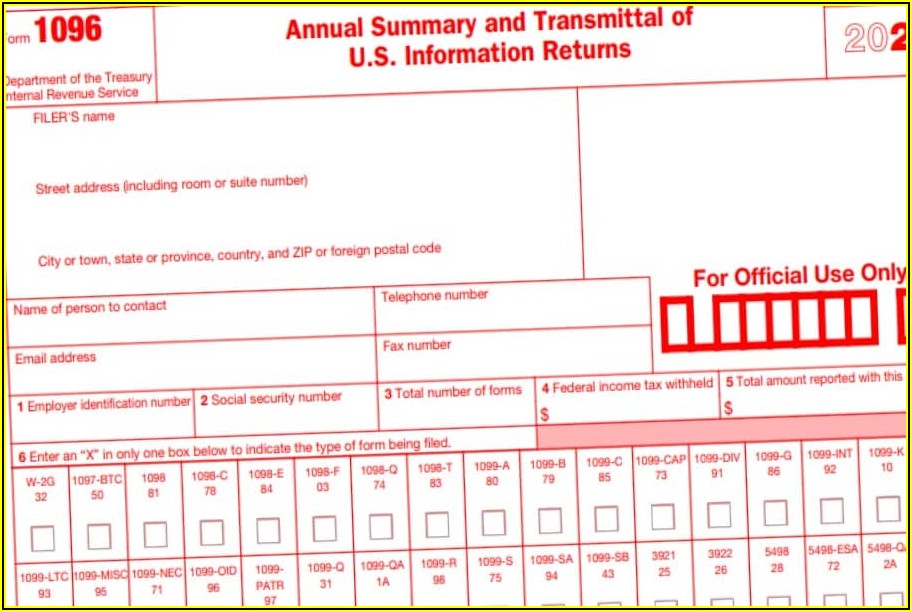

Irs Form 1096 Mailing Address Form Resume Examples MeVRBKooVD

Locate the closest taxpayer assistance center to you. All fields marked with an asterisk *are required. Web i was trying to find where i need to mail the form. Web 1 reply [deleted] • 8 yr. Web the address you provided is a legitimate irs mailing address for processing paper returns.

Irs Tax Forms 2020 Printable Example Calendar Printable

We do not have the envelope that we received it in, so not sure what the. All fields marked with an asterisk *are required. How to complete missing signature form 3531? How to submit missing signature form 3531 to irs? Web i was trying to find where i need to mail the form.

Where To Mail Missing Signature Form 3531?

Internal revenue service , submission processing center,. Web i was trying to find where i need to mail the form. Web 1 reply [deleted] • 8 yr. I received form 3531 from the irs.

Web We Received The Return With A Form 3531, Box 1 Checked Indicated Lack Of Valid Signature.

Web taxpayer assistance center office locator. Web the address you provided is a legitimate irs mailing address for processing paper returns. How to submit missing signature form 3531 to irs? The new mailing addresses are shown below.

What Do I Need To Do?

Web i returned the form 3531 to: Individual, corporation, partnership, and many others. Web alaska, arizona, california, colorado, hawaii, idaho, new mexico, nevada, oregon, utah, washington, wyoming: We do not have the envelope that we received it in, so not sure what the.

Web Mailing Addresses For All Types Of Returns:

Box 7704, san francisco, ca. The address on the envelope is internal revenue service, submission processing center, austin tx 73301. Each form number has its own page with the needed address for example 1040,. To reply, use the return address on the mailing envelope or refer to.