Irs Form 2553 Fax Number

Irs Form 2553 Fax Number - Tried all day yesterday and trying again today, but several times get our fax confirmation back that the number was busy and was not accepted. Filing tax forms by fax can be a fast, secure, and convenient option for those who need to meet tax deadlines, have an urgent matter to resolve with the irs, or want. Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business. You can fax this form to the irs. Web the irs will be able to provide you the form 2553 by mail or fax. Effective june 18, 2019, the filing address has changed for form 2553 filers located in certain states. Web internal revenue service. Has anybody else had this issue lately? Web generally, send the original election (no photocopies) or fax it to the internal revenue service center listed below. Web use the following irs center address or fax number connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont, virginia, west virginia, wisconsin

The irs has straightforward form 2553 fax instructions, but the number you’ll fax the form to will vary depending on your state. Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business. Web use the following irs center address or fax number connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont, virginia, west virginia, wisconsin Web where to fax form 2553. Download and install an online fax app on your device. Web fax form 2553 to irs from an online fax app. Effective june 18, 2019, the filing address has changed for form 2553 filers located in certain states. You can fax this form to the irs. Web fax number for s election form 2553 down/busy? Web generally, send the original election (no photocopies) or fax it to the internal revenue service center listed below.

Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business. You can fax this form to the irs. Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska, nevada, new mexico, north dakota, oklahoma, oregon, south dakota,. Has anybody else had this issue lately? The irs has straightforward form 2553 fax instructions, but the number you’ll fax the form to will vary depending on your state. Effective june 18, 2019, the filing address has changed for form 2553 filers located in certain states. Web where to fax form 2553. Open the app and enter the fax number. Filing tax forms by fax can be a fast, secure, and convenient option for those who need to meet tax deadlines, have an urgent matter to resolve with the irs, or want. Web fax number for s election form 2553 down/busy?

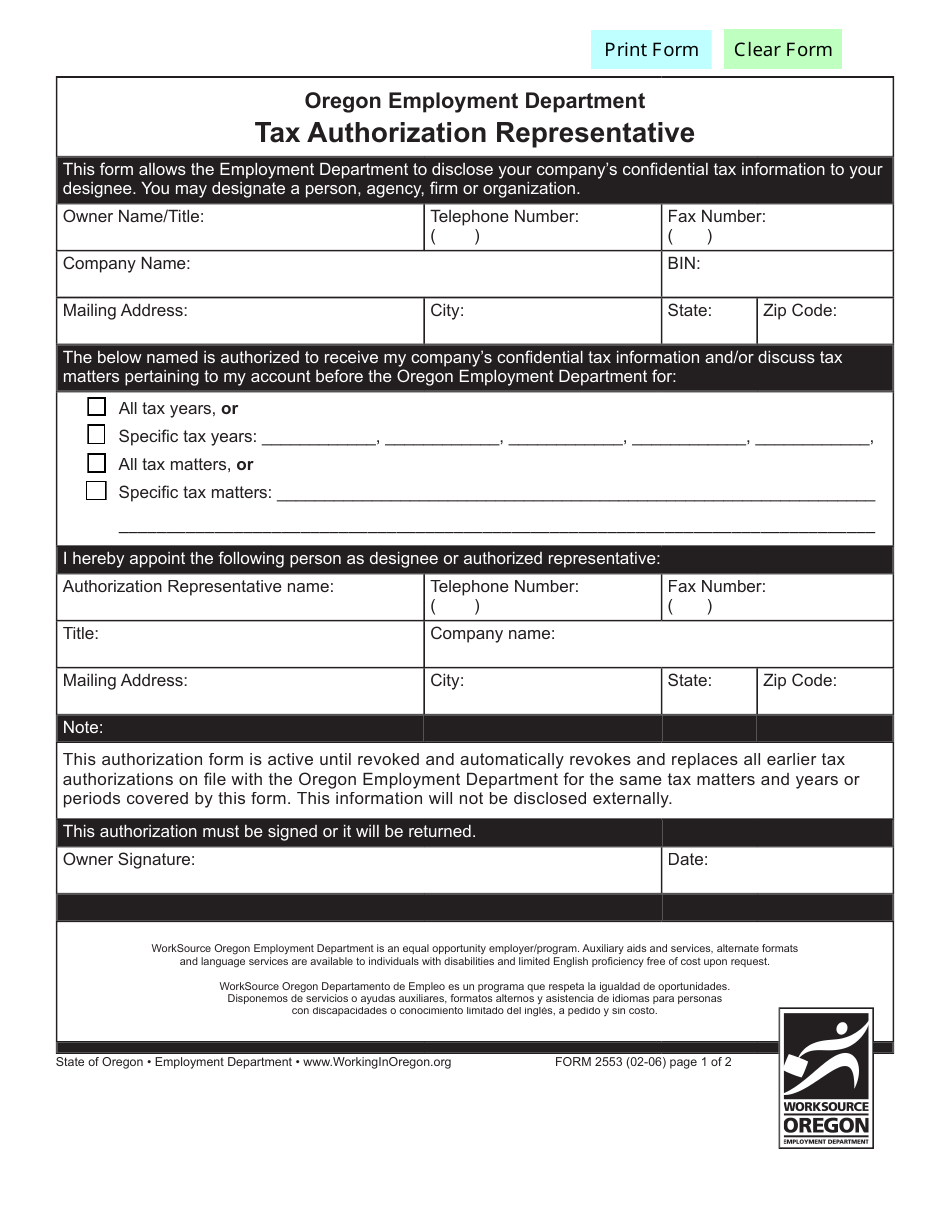

Form 2553 Download Fillable PDF or Fill Online Tax Authorization

The irs has straightforward form 2553 fax instructions, but the number you’ll fax the form to will vary depending on your state. Web generally, send the original election (no photocopies) or fax it to the internal revenue service center listed below. Web internal revenue service. Web the irs will be able to provide you the form 2553 by mail or.

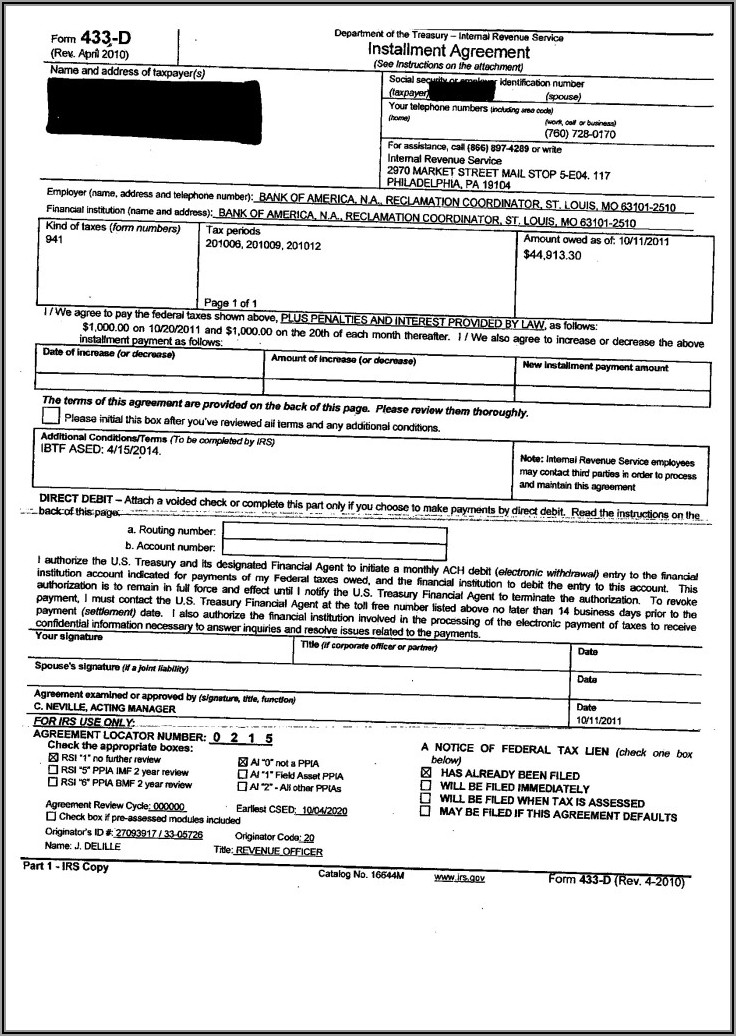

Fax Irs Form 433 D Form Resume Examples gq96lD1VOR

Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business. Has anybody else had this issue lately? Web where to fax form 2553. Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska, nevada, new mexico,.

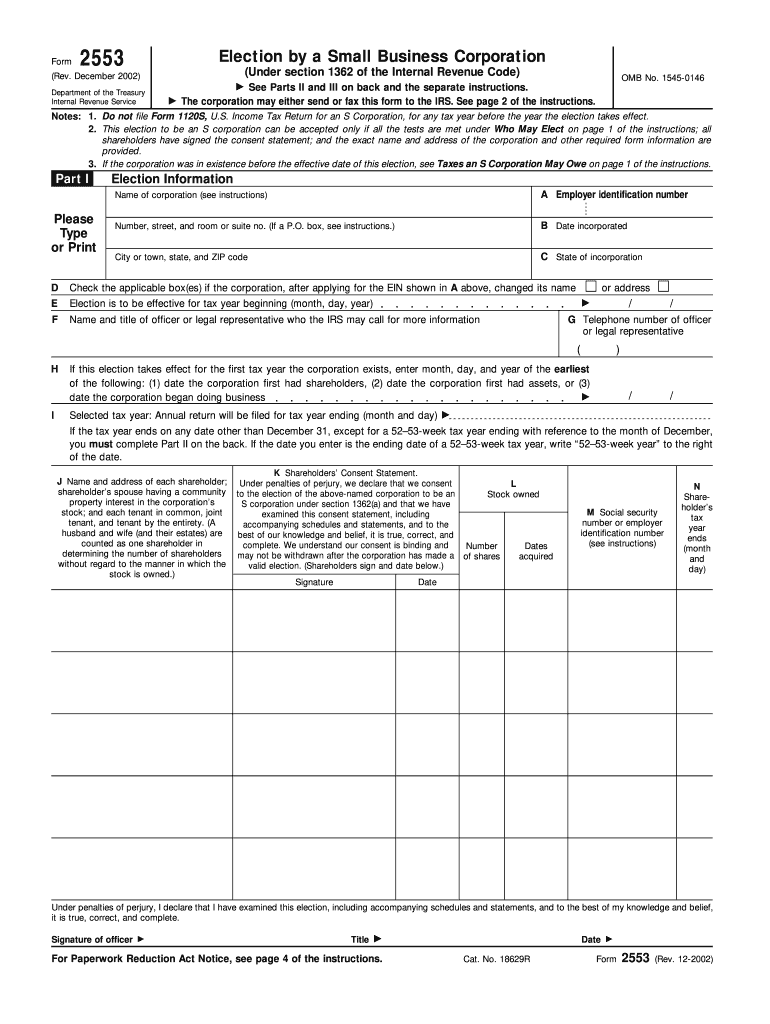

2002 Form IRS 2553 Fill Online, Printable, Fillable, Blank pdfFiller

Has anybody else had this issue lately? Tried all day yesterday and trying again today, but several times get our fax confirmation back that the number was busy and was not accepted. Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska, nevada, new mexico, north dakota, oklahoma, oregon, south dakota,. For details,.

IRS Form 2553 Instructions How and Where to File This Tax Form

Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business. For details, see where to file your taxes for form 2553. Download and install an online fax app on your device. Filing tax forms by fax can be a fast, secure, and convenient.

Where and How to Fax IRS Form 2553? Dingtone Fax

Open the app and enter the fax number. When faxing, include a cover sheet with your name, phone. Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business. Web internal revenue service. Web generally, send the original election (no photocopies) or fax it.

IRS Form 2553 How to Register as an SCorporation for Your Business

Alabama, alaska, arizona, arkansas, california, colorado, florida, hawaii, idaho, iowa, kansas, louisiana, minnesota, mississippi, missouri, montana, nebraska, nevada, new mexico, north dakota, oklahoma, oregon, south dakota,. Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business. Open the app and enter the fax.

IRS Form 2553 Instructions How to Fill Out Form 2553 Excel Capital

Web internal revenue service. Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business. Web use the following irs center address or fax number connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york,.

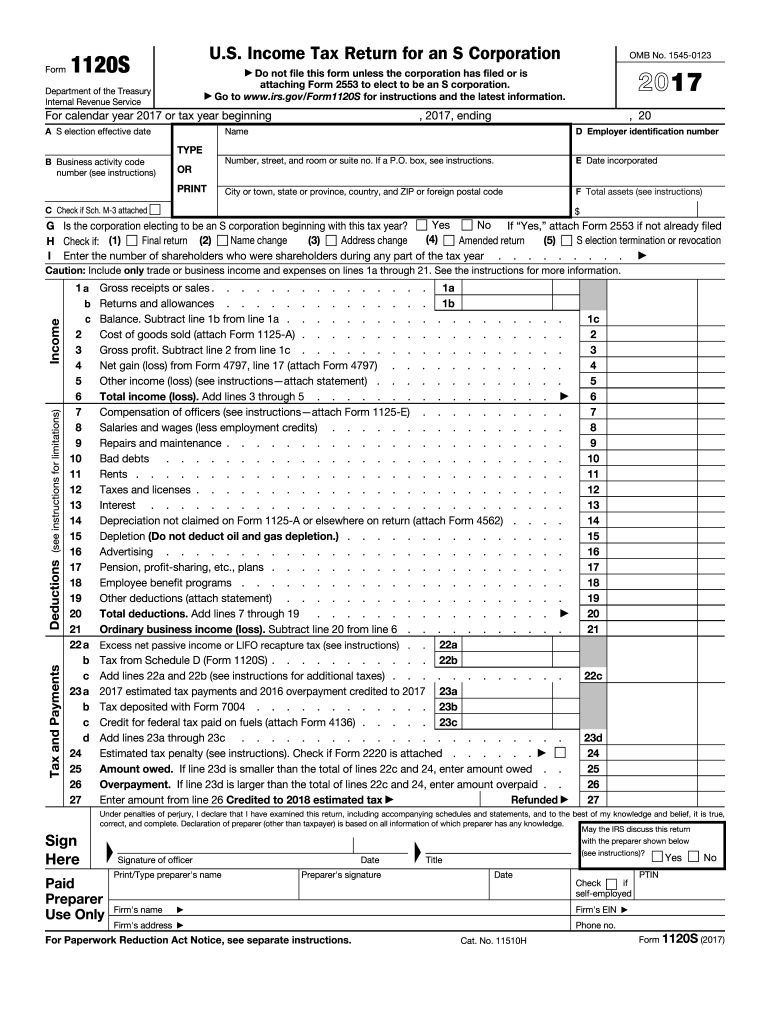

1120S Fill Out and Sign Printable PDF Template signNow

Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business. Open the app and enter the fax number. When faxing, include a cover sheet with your name, phone. Prepare your form 2553 in a paper or electronic form and get it filled with.

Ssurvivor Form 2553 Irs Fax Number

Prepare your form 2553 in a paper or electronic form and get it filled with your information compatible with requirements. Tried all day yesterday and trying again today, but several times get our fax confirmation back that the number was busy and was not accepted. Download and install an online fax app on your device. For details, see where to.

What is IRS Form 2553? Bench Accounting

For details, see where to file your taxes for form 2553. If the corporation (entity) files this election by fax, keep the original form 2553 with the corporation's (entity’s) permanent records. Attach to form 2553 a statement describing the relevant facts and circumstances and, if applicable, the gross receipts from sales and services necessary to establish a business. Web internal.

Web Use The Following Irs Center Address Or Fax Number Connecticut, Delaware, District Of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin

Has anybody else had this issue lately? When faxing, include a cover sheet with your name, phone. Web fax form 2553 to irs from an online fax app. Download and install an online fax app on your device.

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota,.

If the corporation (entity) files this election by fax, keep the original form 2553 with the corporation's (entity’s) permanent records. You can fax this form to the irs. Open the app and enter the fax number. Web where to fax form 2553.

Tried All Day Yesterday And Trying Again Today, But Several Times Get Our Fax Confirmation Back That The Number Was Busy And Was Not Accepted.

Prepare your form 2553 in a paper or electronic form and get it filled with your information compatible with requirements. Web the irs will be able to provide you the form 2553 by mail or fax. Effective june 18, 2019, the filing address has changed for form 2553 filers located in certain states. For details, see where to file your taxes for form 2553.

Web Internal Revenue Service.

Filing tax forms by fax can be a fast, secure, and convenient option for those who need to meet tax deadlines, have an urgent matter to resolve with the irs, or want. Web generally, send the original election (no photocopies) or fax it to the internal revenue service center listed below. The irs has straightforward form 2553 fax instructions, but the number you’ll fax the form to will vary depending on your state. Web fax number for s election form 2553 down/busy?