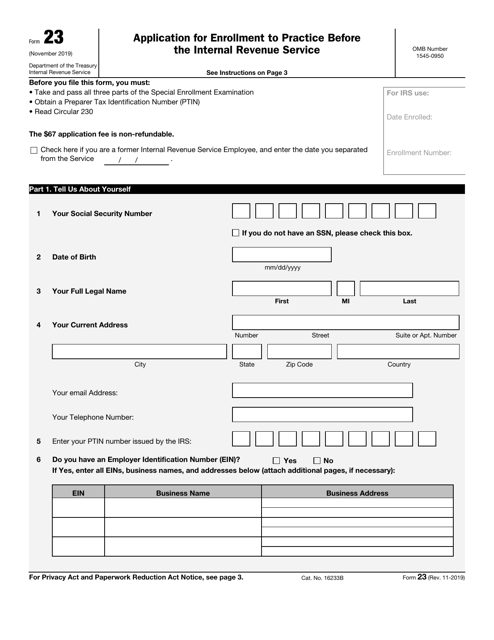

Irs Form 23

Irs Form 23 - Itr 1 is for residents with income from salaries and other sources, itr 2 is for those without business. Application for enrollment to practice before the internal revenue service. Before you file this form, you must: Web form 23 (november 2022) department of the treasury internal revenue service. California also has the highest annual fee at $820. Instructions for form 941 pdf For successful examination candidates, our goal is to have this process completed within 90 days of receipt of your application. Republicans, though, have seized on the unverified material as part of their. Every individual whose gross total income exceeds inr 2. • take and pass all three parts of the special enrollment examination

Every individual whose gross total income exceeds inr 2. • take and pass all three parts of the special enrollment examination Web form 23 (november 2022) department of the treasury internal revenue service. Application for enrollment to practice before the internal revenue service. Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. Confused about which itr form to use for filing taxes? In case of any doubt, please refer to relevant provisions Instructions for form 941 pdf For successful examination candidates, our goal is to have this process completed within 90 days of receipt of your application. California also has the highest annual fee at $820.

Before you file this form, you must: Republicans, though, have seized on the unverified material as part of their. California also has the highest annual fee at $820. Instructions for form 941 pdf Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. Web complete the pay.gov form 23 enrolled agent application and pay $140. Web employer's quarterly federal tax return. Confused about which itr form to use for filing taxes? In case of any doubt, please refer to relevant provisions Every individual whose gross total income exceeds inr 2.

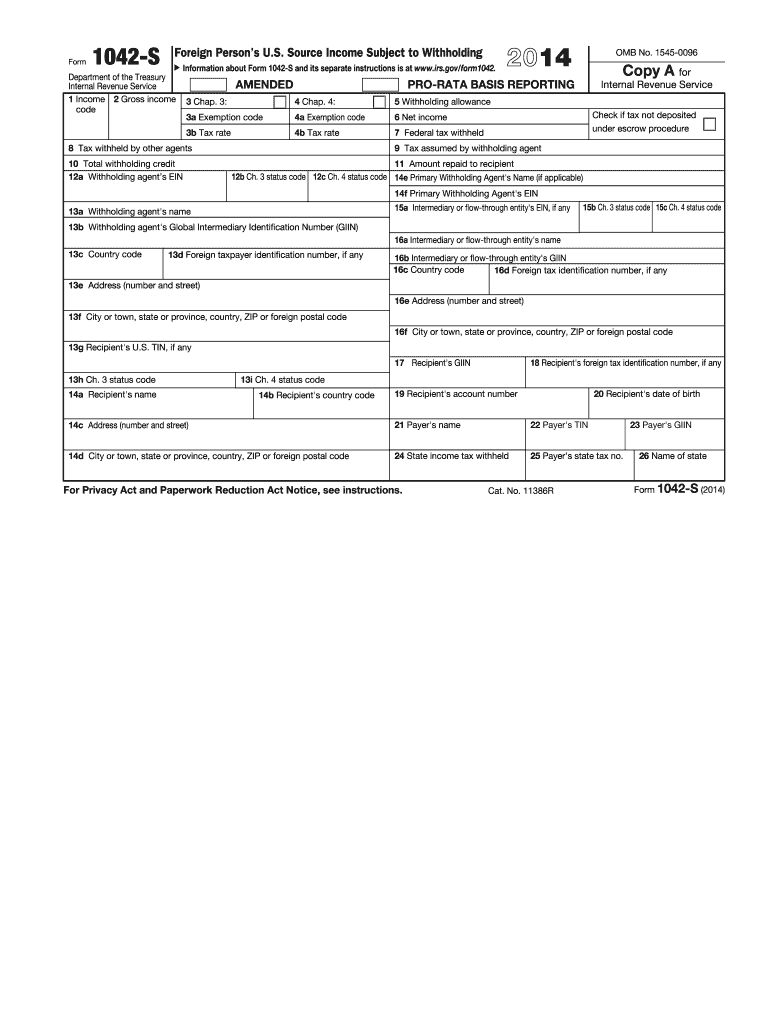

Irs Form 1040x 2018 All Are Here

Every individual whose gross total income exceeds inr 2. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web form 23 (november 2022) department of the treasury internal revenue service. In case of any doubt, please refer to relevant provisions Application for.

IRS Form 23 Download Fillable PDF or Fill Online Application for

In case of any doubt, please refer to relevant provisions Web complete the pay.gov form 23 enrolled agent application and pay $140. Web employer's quarterly federal tax return. California also has the highest annual fee at $820. See form 23 pdf for additional details.

IRS 8863 Line 23 Fill and Sign Printable Template Online US Legal Forms

Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. Republicans, though, have seized on the unverified material as part of their. California also has the highest annual fee at $820. Web employer's quarterly federal tax return. Web form 23 (november 2022) department of the treasury internal revenue service.

2014 Form IRS 1042S Fill Online, Printable, Fillable, Blank pdfFiller

Confused about which itr form to use for filing taxes? Before you file this form, you must: See form 23 pdf for additional details. Every individual whose gross total income exceeds inr 2. • take and pass all three parts of the special enrollment examination

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

Instructions for form 941 pdf In case of any doubt, please refer to relevant provisions Web form 23 (november 2022) department of the treasury internal revenue service. Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. Every individual whose gross total income exceeds inr 2.

IRS FORM 12333 PDF

See instructions on page 3. • take and pass all three parts of the special enrollment examination Republicans, though, have seized on the unverified material as part of their. Before you file this form, you must: Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security.

Form 23 Application for Enrollment to Practice before the IRS (2014

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. California also has the highest annual fee at $820. In case of any doubt, please refer to relevant provisions Confused about which itr form to use for filing taxes? Itr 1 is for.

File IRS 2290 Form Online for 20222023 Tax Period

For successful examination candidates, our goal is to have this process completed within 90 days of receipt of your application. Republicans, though, have seized on the unverified material as part of their. See form 23 pdf for additional details. California also has the highest annual fee at $820. Employers who withhold income taxes, social security tax, or medicare tax from.

IRS FORM 147C PDF

California also has the highest annual fee at $820. Confused about which itr form to use for filing taxes? Every individual whose gross total income exceeds inr 2. See instructions on page 3. For successful examination candidates, our goal is to have this process completed within 90 days of receipt of your application.

√99以上 2290 form irs.gov 6319142290 form irs.gov

• take and pass all three parts of the special enrollment examination Web employer's quarterly federal tax return. See instructions on page 3. Application for enrollment to practice before the internal revenue service. For successful examination candidates, our goal is to have this process completed within 90 days of receipt of your application.

Confused About Which Itr Form To Use For Filing Taxes?

For successful examination candidates, our goal is to have this process completed within 90 days of receipt of your application. See instructions on page 3. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Republicans, though, have seized on the unverified material as part of their.

Web The 1023 Form Memorializes Claims From An Fbi Informant, But It Doesn’t Provide Proof That The Allegations Are True.

See form 23 pdf for additional details. Before you file this form, you must: Application for enrollment to practice before the internal revenue service. Web employer's quarterly federal tax return.

Instructions For Form 941 Pdf

California also has the highest annual fee at $820. Every individual whose gross total income exceeds inr 2. • take and pass all three parts of the special enrollment examination Web form 23 (november 2022) department of the treasury internal revenue service.

Web Complete The Pay.gov Form 23 Enrolled Agent Application And Pay $140.

Itr 1 is for residents with income from salaries and other sources, itr 2 is for those without business. In case of any doubt, please refer to relevant provisions