Irs Form 14654

Irs Form 14654 - (2) that all required fbars have now been filed (see instruction 9 below); The form is part of the irs streamlined domestic offshore procedures. Person residing in the united states for streamlined domestic offshore procedures View more information about using irs forms, instructions, publications and other item files. Include the whole story including favorable and unfavorable facts. Fill out all required fields in the selected file with our professional pdf editor. With the internal revenue service making foreign. If you are having difficulty downloading or viewing pdf files, below are several options to assist you: The amended form 14654 must include all facts and circumstances concerning the error in the original streamlined submission. Web she must provide amended income tax returns for tax years 2012, 2013, and 2014, an amended streamlined certification on form 14654, and payment for increases in tax, interest, and the sdo mop.

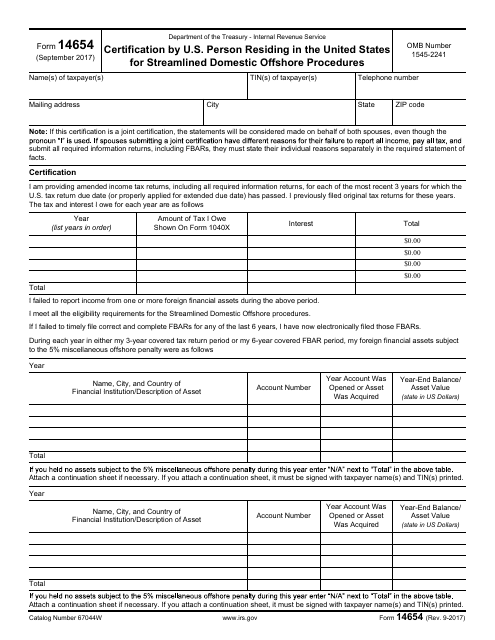

Irs recommends that you download pdf files to your local computer prior to opening them. Fill out all required fields in the selected file with our professional pdf editor. Web follow these tips to quickly and accurately submit irs 14654. Person residing outside of the united states for streamlined foreign offshore procedures, on which the taxpayer certifies that he or she is eligible for the streamlined procedures and has filed all required fbars and that the failure to file tax returns, report all income, pay all tax, and. Turn the wizard tool on to finish the procedure even easier. Specific reasons, whether favorable or Web catalog number 67044w www.irs.gov form 14654 (rev. Web forms and instructions trouble downloading pdf files? Web she must provide amended income tax returns for tax years 2012, 2013, and 2014, an amended streamlined certification on form 14654, and payment for increases in tax, interest, and the sdo mop. Web the latest versions of irs forms, instructions, and publications.

Web follow these tips to quickly and accurately submit irs 14654. The form is part of the irs streamlined domestic offshore procedures. Fill out all required fields in the selected file with our professional pdf editor. Specific reasons, whether favorable or Tried to get the form 14654 on different laptops with different windows and different adobe acrobat version but no luck. Turn the wizard tool on to finish the procedure even easier. Include the whole story including favorable and unfavorable facts. Web form 14654 form 14654: View more information about using irs forms, instructions, publications and other item files. The irs form 14654 is the certification by u.s.

IRS Instruction SS4 2017 Fill out Tax Template Online US Legal Forms

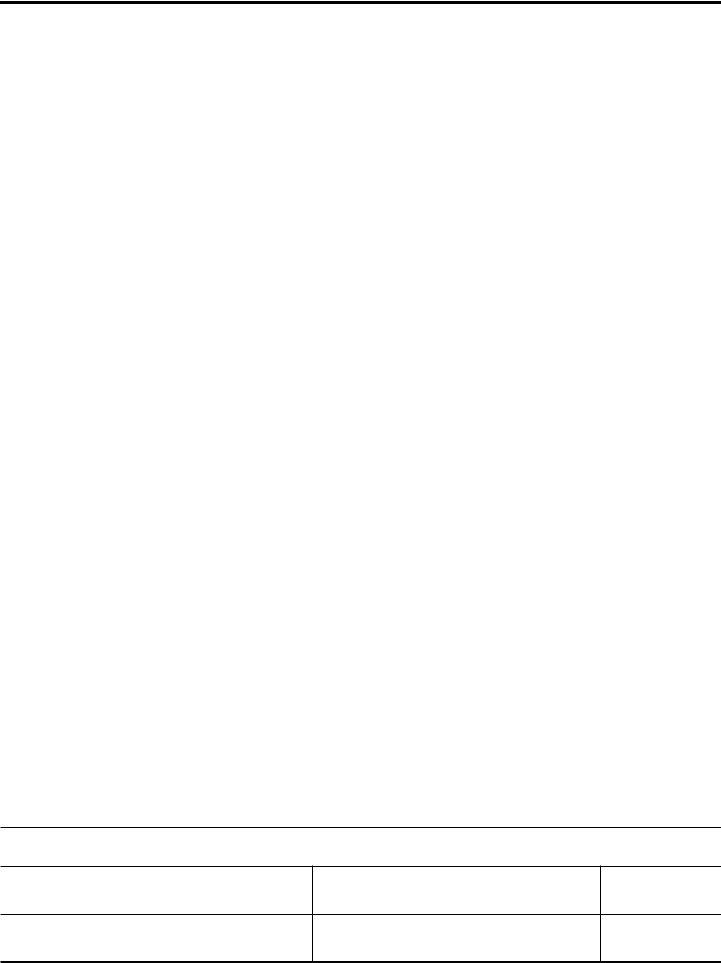

How you can complete the irs 14654 on the internet: Turn the wizard tool on to finish the procedure even easier. Click on a column heading to sort the list by the contents of that column. Include the whole story including favorable and unfavorable facts. Web when the form 14654 is requested on the irs website, a message pops up.

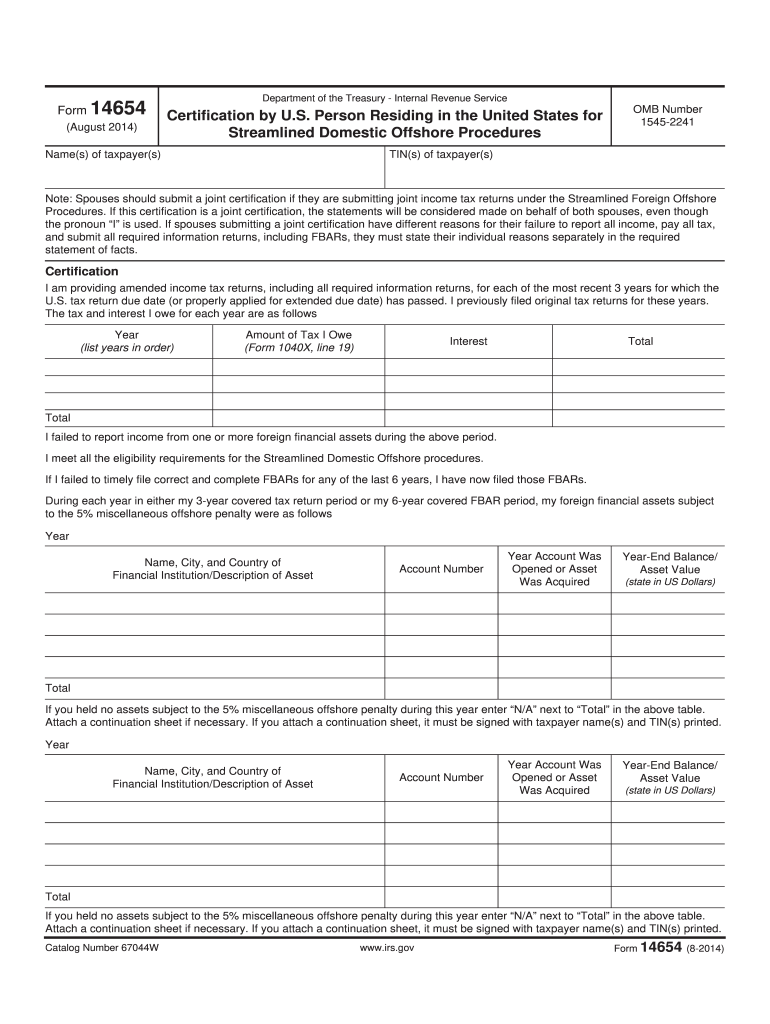

2014 Form IRS 14654 Fill Online, Printable, Fillable, Blank pdfFiller

View more information about using irs forms, instructions, publications and other item files. Person residing in the u.s. Click the button get form to open it and start editing. Turn the wizard tool on to finish the procedure even easier. Person residing in the united states for streamlined domestic offshore procedures

Federal Tax Table 2017 Pdf Review Home Decor

With the internal revenue service making foreign. Person residing in the u.s. How you can complete the irs 14654 on the internet: Include the whole story including favorable and unfavorable facts. Person residing in the u.s.

THE STREAMLINED AMNESTY PROGRAM’S NONWILLFUL CERTIFICATION (FORM 14653

Specific reasons, whether favorable or Web follow these tips to quickly and accurately submit irs 14654. The irs form 14654 is the certification by u.s. Person residing in the united states for streamlined domestic offshore procedures Tried to get the form 14654 on different laptops with different windows and different adobe acrobat version but no luck.

20202022 Form IRS 9423 Fill Online, Printable, Fillable, Blank pdfFiller

(3) that the failure to report all income, pay all tax, and submit all. Click on a column heading to sort the list by the contents of that column. Web forms and instructions trouble downloading pdf files? Web she must provide amended income tax returns for tax years 2012, 2013, and 2014, an amended streamlined certification on form 14654, and.

Ss 8 Fillable Form Printable Forms Free Online

Irs recommends that you download pdf files to your local computer prior to opening them. Person residing in the u.s. Fill out all required fields in the selected file with our professional pdf editor. How you can complete the irs 14654 on the internet: The form has many traps and pitfalls — and requires the u.s.

Form 14654 ≡ Fill Out Printable PDF Forms Online

How you can complete the irs 14654 on the internet: (3) that the failure to report all income, pay all tax, and submit all. The form is part of the irs streamlined domestic offshore procedures. Click on a column heading to sort the list by the contents of that column. Include the whole story including favorable and unfavorable facts.

Irs Form 8379 Pdf Form Resume Examples 3q9JkkdgYA

Web complete and sign irs form 14653, certification by u.s. The amended form 14654 must include all facts and circumstances concerning the error in the original streamlined submission. The form has many traps and pitfalls — and requires the u.s. If you are having difficulty downloading or viewing pdf files, below are several options to assist you: Tried to get.

IRS Form 14654 Download Fillable PDF, Certification by U.S. Person

The amended form 14654 must include all facts and circumstances concerning the error in the original streamlined submission. The irs form 14654 is the certification by u.s. Web she must provide amended income tax returns for tax years 2012, 2013, and 2014, an amended streamlined certification on form 14654, and payment for increases in tax, interest, and the sdo mop..

Form 14654 ≡ Fill Out Printable PDF Forms Online

(1) that you are eligible for the streamlined domestic offshore procedures; Web when the form 14654 is requested on the irs website, a message pops up about adobe acrobat version issue and does not move on to the form. Person residing outside of the united states for streamlined foreign offshore procedures, on which the taxpayer certifies that he or she.

The Form Is Part Of The Irs Streamlined Domestic Offshore Procedures.

(2) that all required fbars have now been filed (see instruction 9 below); Web form 14654 form 14654: Tried to get the form 14654 on different laptops with different windows and different adobe acrobat version but no luck. Person residing in the u.s.

The Form Has Many Traps And Pitfalls — And Requires The U.s.

The amended form 14654 must include all facts and circumstances concerning the error in the original streamlined submission. With the internal revenue service making foreign. How you can complete the irs 14654 on the internet: (3) that the failure to report all income, pay all tax, and submit all.

Specific Reasons, Whether Favorable Or

Click on a column heading to sort the list by the contents of that column. Turn the wizard tool on to finish the procedure even easier. Web complete and sign irs form 14653, certification by u.s. Web complete and sign a statement on the certification by u.s.

Verify That You Have The Current Version Of Adobe.

Person residing outside of the united states for streamlined foreign offshore procedures, on which the taxpayer certifies that he or she is eligible for the streamlined procedures and has filed all required fbars and that the failure to file tax returns, report all income, pay all tax, and. Fill out all required fields in the selected file with our professional pdf editor. Include the whole story including favorable and unfavorable facts. Click the button get form to open it and start editing.