Irs Form 12203

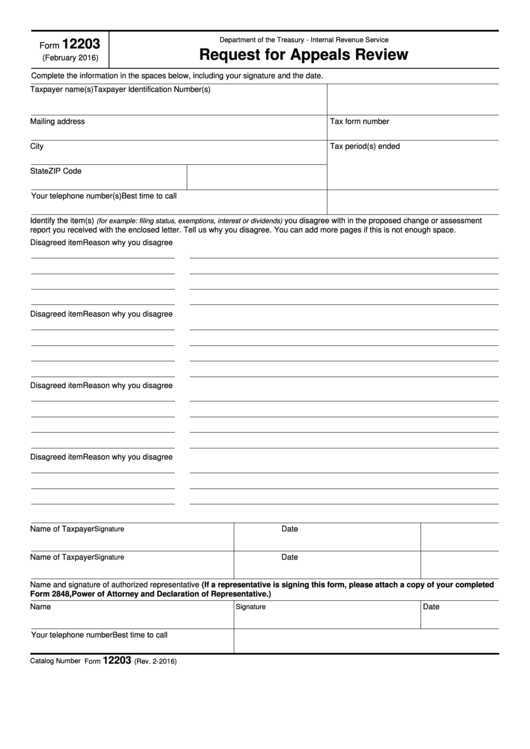

Irs Form 12203 - Complete, edit or print tax forms instantly. You may also make a. For higher amounts, create your own petition that includes the facts, law, argument, and your position. Get ready for tax season deadlines by completing any required tax forms today. Web information about form 2063, u.s. Web preparing a request for appeals | internal revenue service nov 19, 2020 — use form 12203, request for appeals review pdf, the form referenced in the letter you received. This irs form asks you for basic information, like your name, address, and tax periods associated with your appeal. Web if the taxpayer's total amount of tax and penalties for each tax period involved is $25,000 or less in the letter the taxpayer received, the taxpayer may make a small. If you owe more than $25,000, form 12203 is. Web to appeal an audit in which the irs claims you owe $25,000 or less in extra taxes, penalties, and interest, you may use irs form 12203, request for appeals.

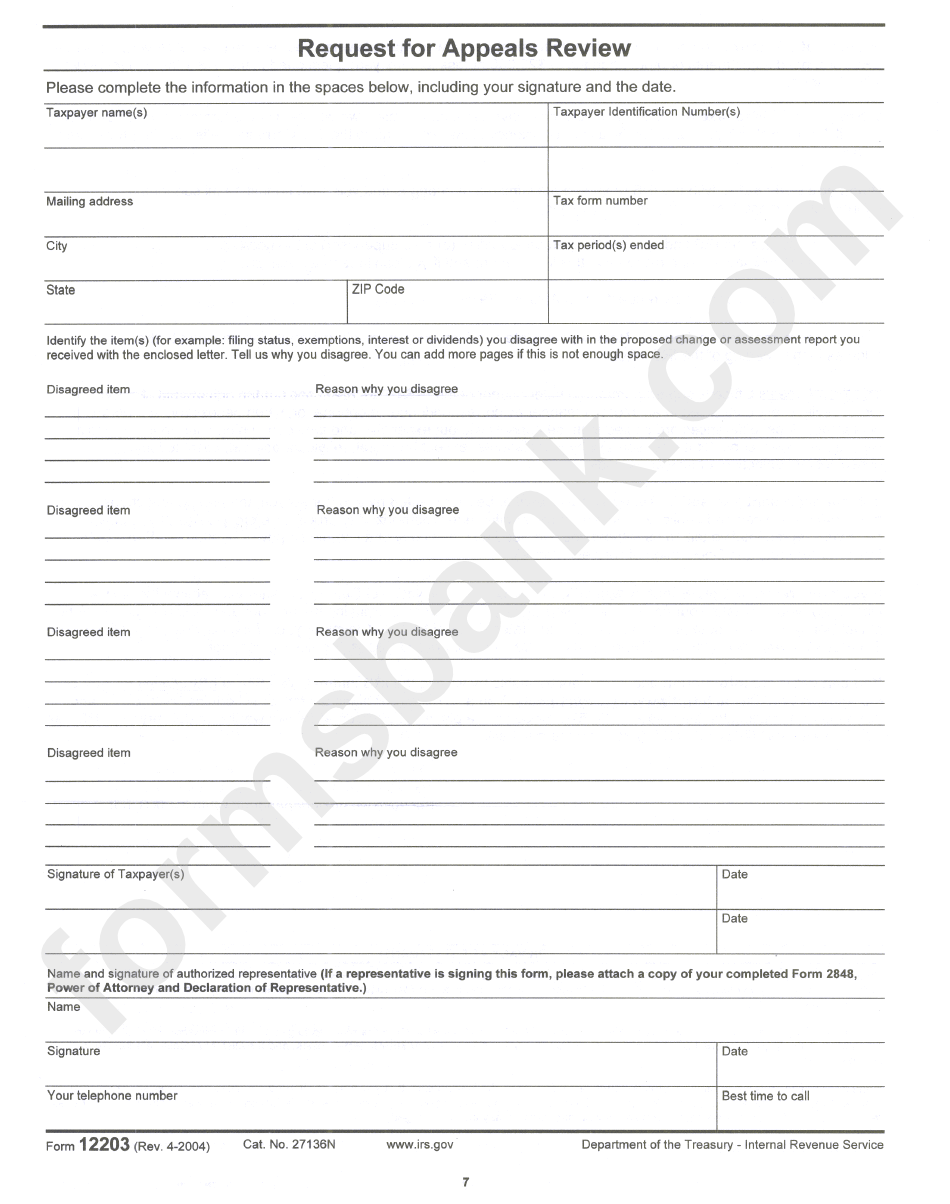

Web information about form 2063, u.s. Departing alien income tax statement, including recent updates, related forms and instructions on how to file. What is a 12203 form? Web to appeal an audit in which the irs claims you owe $25,000 or less in extra taxes, penalties, and interest, you may use irs form 12203, request for appeals. This form is used to request irs. The estimated average time is: Web i would suggest that you take your request for appeal and your relevant documents that show what you are appealing to the irs taxpayer assistance center at. For higher amounts, create your own petition that includes the facts, law, argument, and your position. Get ready for tax season deadlines by completing any required tax forms today. Change, if applicable, or you can use form 12203, request for appeals review.

Web form 12203, request for appeals review pdf this form is to be used to request an appeals review upon completion of an examination (audit) if you do not. Web for amounts less than $25,000, use irs form 12203. Web to appeal the complete irs audit or a denial of a claim for refund (letter 105c), you may present form 12203 if the amount at issue is less than $25,000. Web use form 12203, request for appeals review pdf, the form referenced in the letter you received to file your appeal or prepare a brief written statement. Change, if applicable, or you can use form 12203, request for appeals review. Departing alien income tax statement, including recent updates, related forms and instructions on how to file. Web if the taxpayer's total amount of tax and penalties for each tax period involved is $25,000 or less in the letter the taxpayer received, the taxpayer may make a small. The irs 12203 form (full title request for appeals review) is designed by the irs (internal revenue service) to collect the details from taxpayers. The estimated average time is: Get ready for tax season deadlines by completing any required tax forms today.

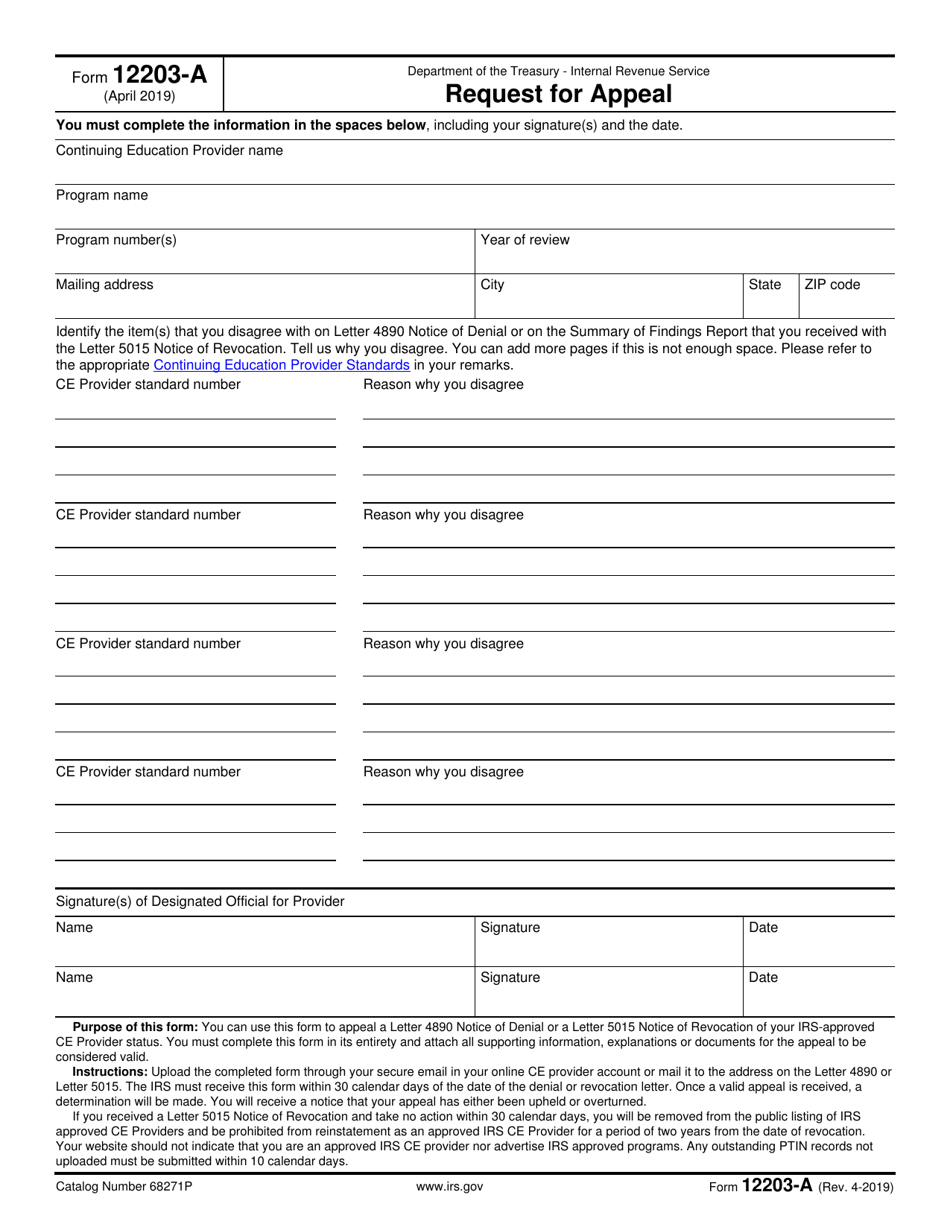

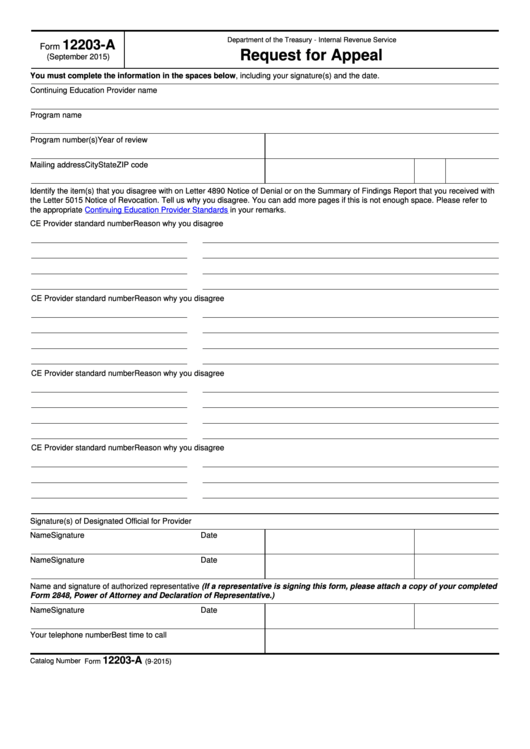

Form 12203A Request for Appeal (2015) Free Download

Web the time needed to complete and file this form will vary depending on individual circumstances. Get ready for tax season deadlines by completing any required tax forms today. Web or you can complete irs form 12203: This form is used to request irs. This irs form asks you for basic information, like your name, address, and tax periods associated.

Irs Form 14438 Fill Online, Printable, Fillable, Blank PDFfiller

Web or you can complete irs form 12203: Get ready for tax season deadlines by completing any required tax forms today. Web use form 12203, request for appeals review pdf, the form referenced in the letter you received to file your appeal or prepare a brief written statement. Web to appeal an audit in which the irs claims you owe.

IRS FORM 147C PDF

This irs form asks you for basic information, like your name, address, and tax periods associated with your appeal. Web if the taxpayer's total amount of tax and penalties for each tax period involved is $25,000 or less in the letter the taxpayer received, the taxpayer may make a small. You may also make a. The irs 12203 form (full.

IRS Form 12203A Download Fillable PDF or Fill Online Request for

Complete, edit or print tax forms instantly. Web to appeal an audit in which the irs claims you owe $25,000 or less in extra taxes, penalties, and interest, you may use irs form 12203, request for appeals. Web or you can complete irs form 12203: Get ready for tax season deadlines by completing any required tax forms today. Request for.

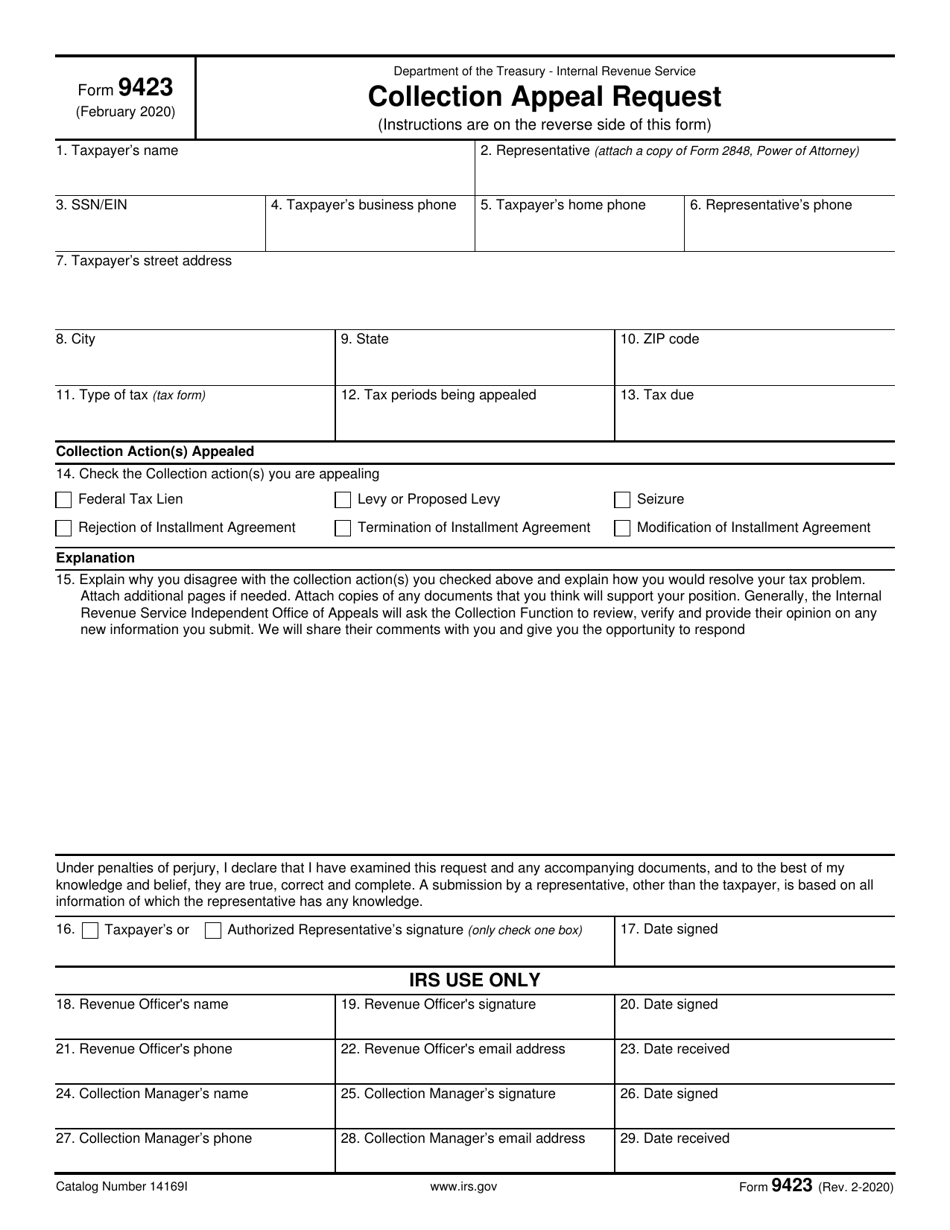

IRS Form 9423 Download Fillable PDF or Fill Online Collection Appeal

Web for amounts less than $25,000, use irs form 12203. Web form 12203, request for appeals review pdf this form is to be used to request an appeals review upon completion of an examination (audit) if you do not. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web.

Fillable Form 12203 Request For Appeals Review printable pdf download

Web the time needed to complete and file this form will vary depending on individual circumstances. Get ready for tax season deadlines by completing any required tax forms today. Change, if applicable, or you can use form 12203, request for appeals review. Departing alien income tax statement, including recent updates, related forms and instructions on how to file. Complete, edit.

Irs Form 8379 Pdf Form Resume Examples 3q9JkkdgYA

Web to appeal an audit in which the irs claims you owe $25,000 or less in extra taxes, penalties, and interest, you may use irs form 12203, request for appeals. Request for appeals review, which is downloadable from the irs website. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms.

Fillable Form 12203A Request For Appeal printable pdf download

For higher amounts, create your own petition that includes the facts, law, argument, and your position. You can use this form to request a review in appeals when you receive internal revenue service (irs) proposed adjustments or. Ad access irs tax forms. This form is used to request irs. Complete, edit or print tax forms instantly.

Irs Form 12203 Request For Appeals Review printable pdf download

Web to appeal the complete irs audit or a denial of a claim for refund (letter 105c), you may present form 12203 if the amount at issue is less than $25,000. If you owe more than $25,000, form 12203 is. Web or you can complete irs form 12203: Web for amounts less than $25,000, use irs form 12203. Ad access.

Irs Fillable Form Font Printable Forms Free Online

Change, if applicable, or you can use form 12203, request for appeals review. You can use this form to request a review in appeals when you receive internal revenue service (irs) proposed adjustments or. You may also make a. Ad access irs tax forms. Web use form 12203, request for appeals review pdf, the form referenced in the letter you.

Web If The Taxpayer's Total Amount Of Tax And Penalties For Each Tax Period Involved Is $25,000 Or Less In The Letter The Taxpayer Received, The Taxpayer May Make A Small.

Web i would suggest that you take your request for appeal and your relevant documents that show what you are appealing to the irs taxpayer assistance center at. Request for appeals review, which is downloadable from the irs website. Web form 12203, request for appeals review pdf this form is to be used to request an appeals review upon completion of an examination (audit) if you do not. What is a 12203 form?

Web Preparing A Request For Appeals | Internal Revenue Service Nov 19, 2020 — Use Form 12203, Request For Appeals Review Pdf, The Form Referenced In The Letter You Received.

Web to appeal an audit in which the irs claims you owe $25,000 or less in extra taxes, penalties, and interest, you may use irs form 12203, request for appeals. Web the time needed to complete and file this form will vary depending on individual circumstances. Web for amounts less than $25,000, use irs form 12203. This form is used to request irs.

This Irs Form Asks You For Basic Information, Like Your Name, Address, And Tax Periods Associated With Your Appeal.

Web information about form 2063, u.s. If you owe more than $25,000, form 12203 is. The estimated average time is: Change, if applicable, or you can use form 12203, request for appeals review.

Ad Access Irs Tax Forms.

For higher amounts, create your own petition that includes the facts, law, argument, and your position. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Web use form 12203, request for appeals review pdf, the form referenced in the letter you received to file your appeal or prepare a brief written statement.