Irs Form 1127

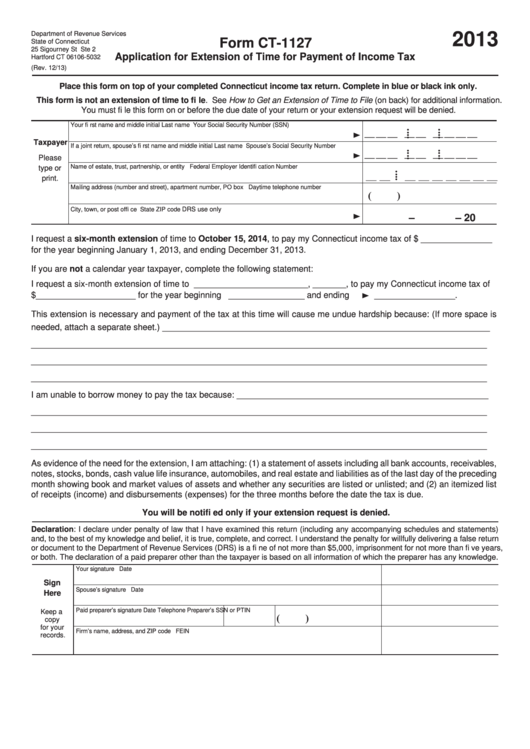

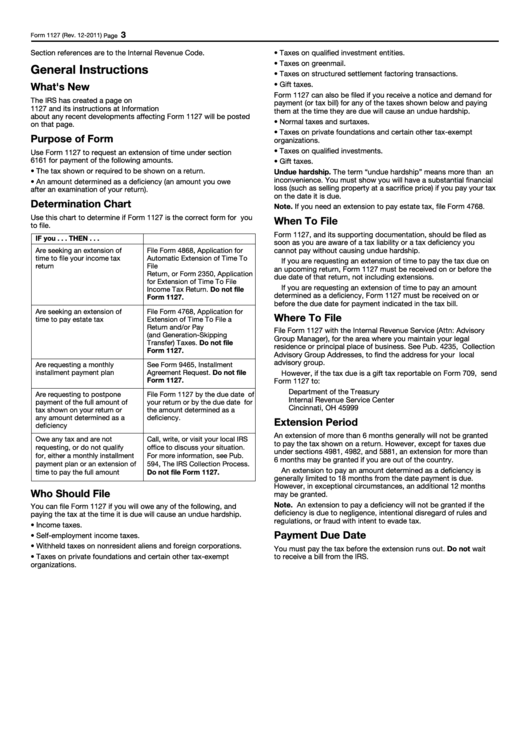

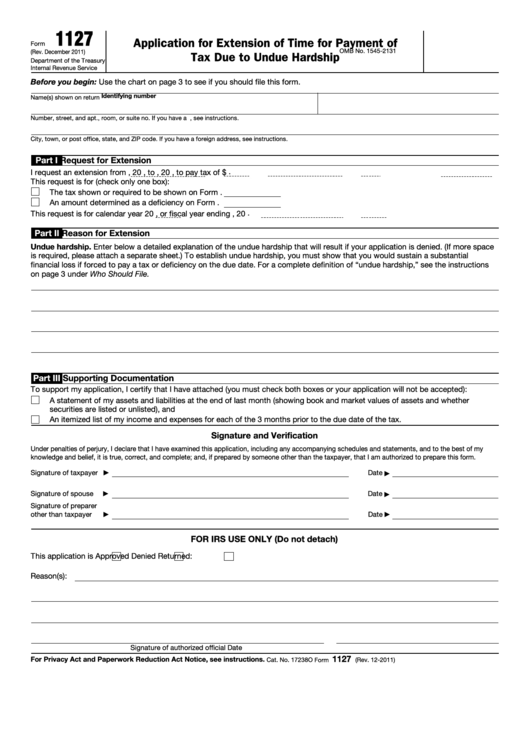

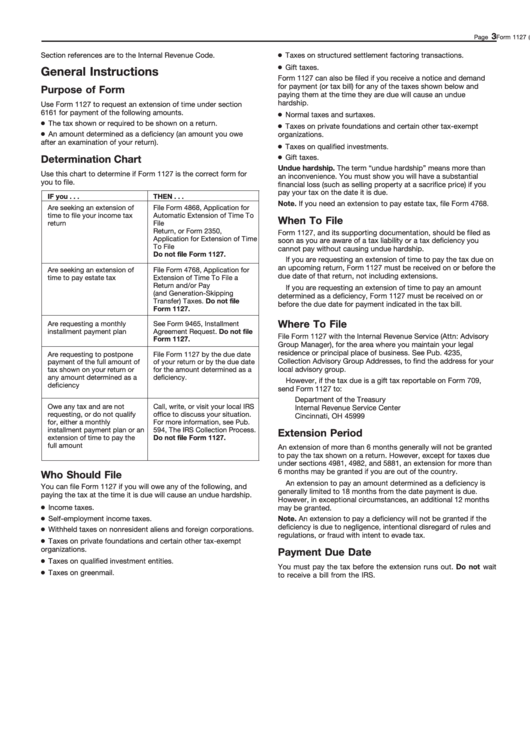

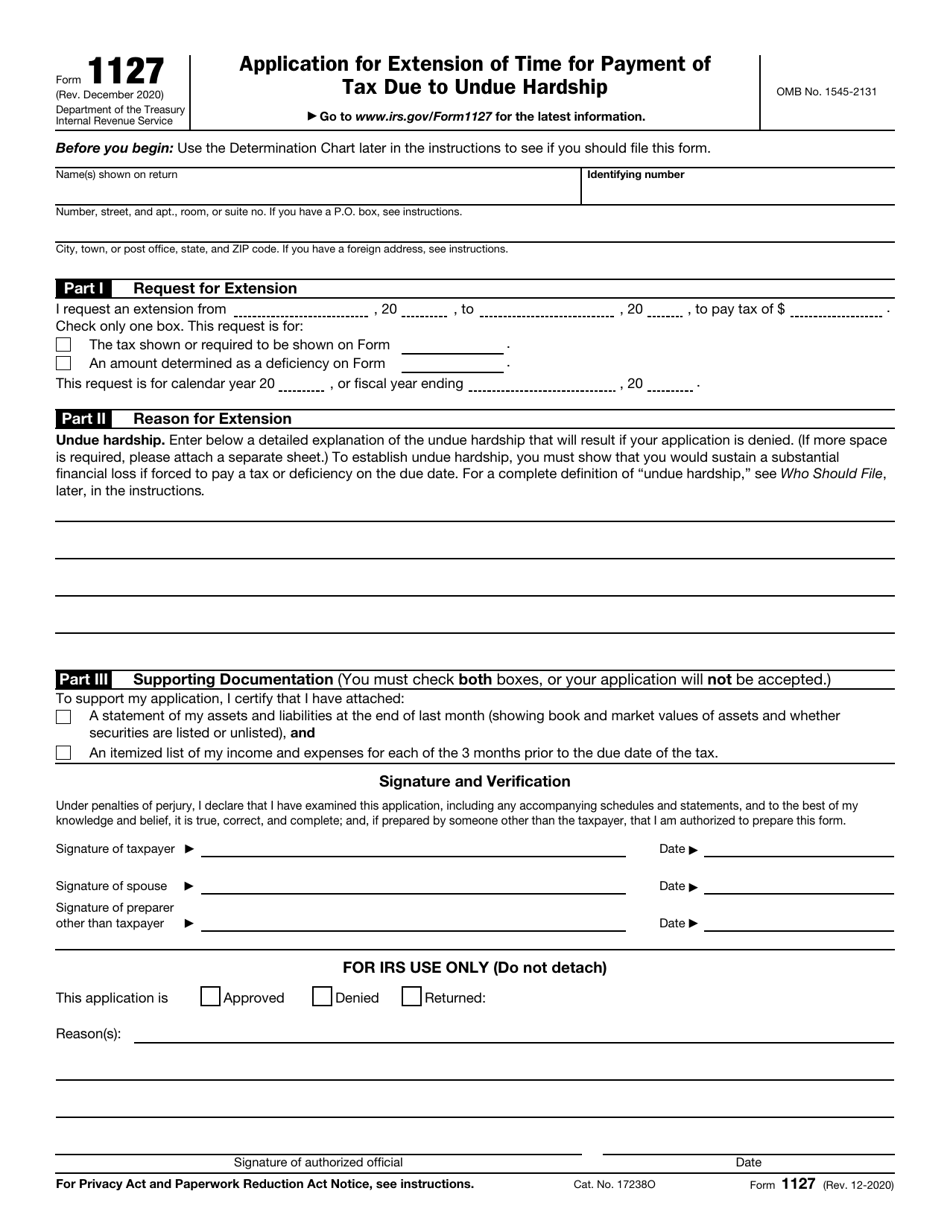

Irs Form 1127 - Web form 1127 is a tax form used by individuals and businesses to request an extension of time to pay certain taxes owed to the internal revenue service (irs). For details see form 1127, application for extension of time for. Form 1127 is a federal corporate income tax form. Fair market value (fmv) of assets. We help you understand and meet your federal tax responsibilities. Web who must file the 1127 tax return? In this case, you must submit to the section 1127 unit, no later. Do not file form 1127. Web an irs hardship extension — fileit — via form 1127 is the only way to get more time to pay your taxes due as the regular tax extension on form 4868 only gives you more time. Web • the taxpayer can request an extension of time to pay if paying the tax by the due date will be an undue hardship.

Web the irs is soliciting comments concerning form 1127, application for extension of time for payment of tax due to undue hardship. File form 4768, application for extension of time to file a return and/or pay u.s. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web who must file the 1127 tax return? Find irs forms and answers to tax questions. Web get federal tax return forms and file by mail. Do not file form 1127. Form 1127 is a federal corporate income tax form. In this case, you must submit to the section 1127 unit, no later. Web • for income set aside in prior tax years for which a deduction was claimed under section 642(c), • for charitable purposes for which a charitable deduction was claimed under.

Web who must file the 1127 tax return? If you work for the city of new york but live outside new york city and were hired on or after january 4, 1973, you must file form. Fair market value (fmv) of assets. Web application for irs individual taxpayer identification number. Web an irs hardship extension — fileit — via form 1127 is the only way to get more time to pay your taxes due as the regular tax extension on form 4868 only gives you more time. Any new york city employees who were a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an. Do not file form 1127. Web form 1127 is a tax form used by individuals and businesses to request an extension of time to pay certain taxes owed to the internal revenue service (irs). Web • for income set aside in prior tax years for which a deduction was claimed under section 642(c), • for charitable purposes for which a charitable deduction was claimed under. In this case, you must submit to the section 1127 unit, no later.

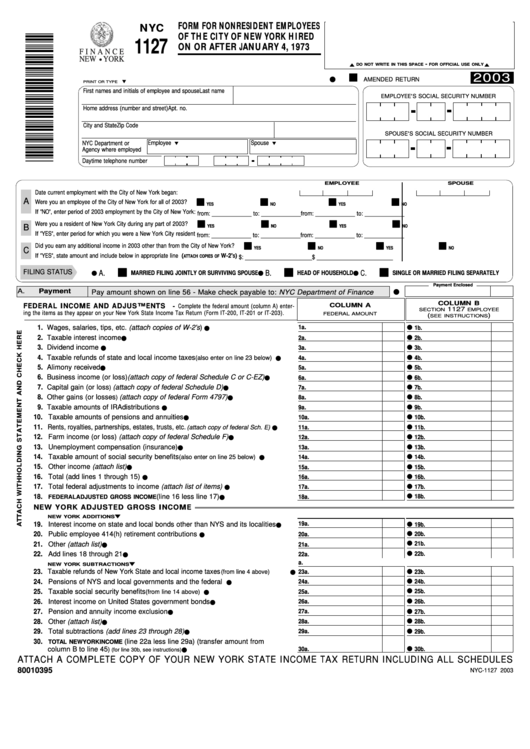

Fillable Form Nyc 1127 Form For Nonresident Employees Of The City Of

Manually enter the allocation for nyc and print. Web form 1127 is a tax form used by individuals and businesses to request an extension of time to pay certain taxes owed to the internal revenue service (irs). Who must file the 1127 tax return? Form 1127 is a federal corporate income tax form. Get or renew an individual taxpayer identification.

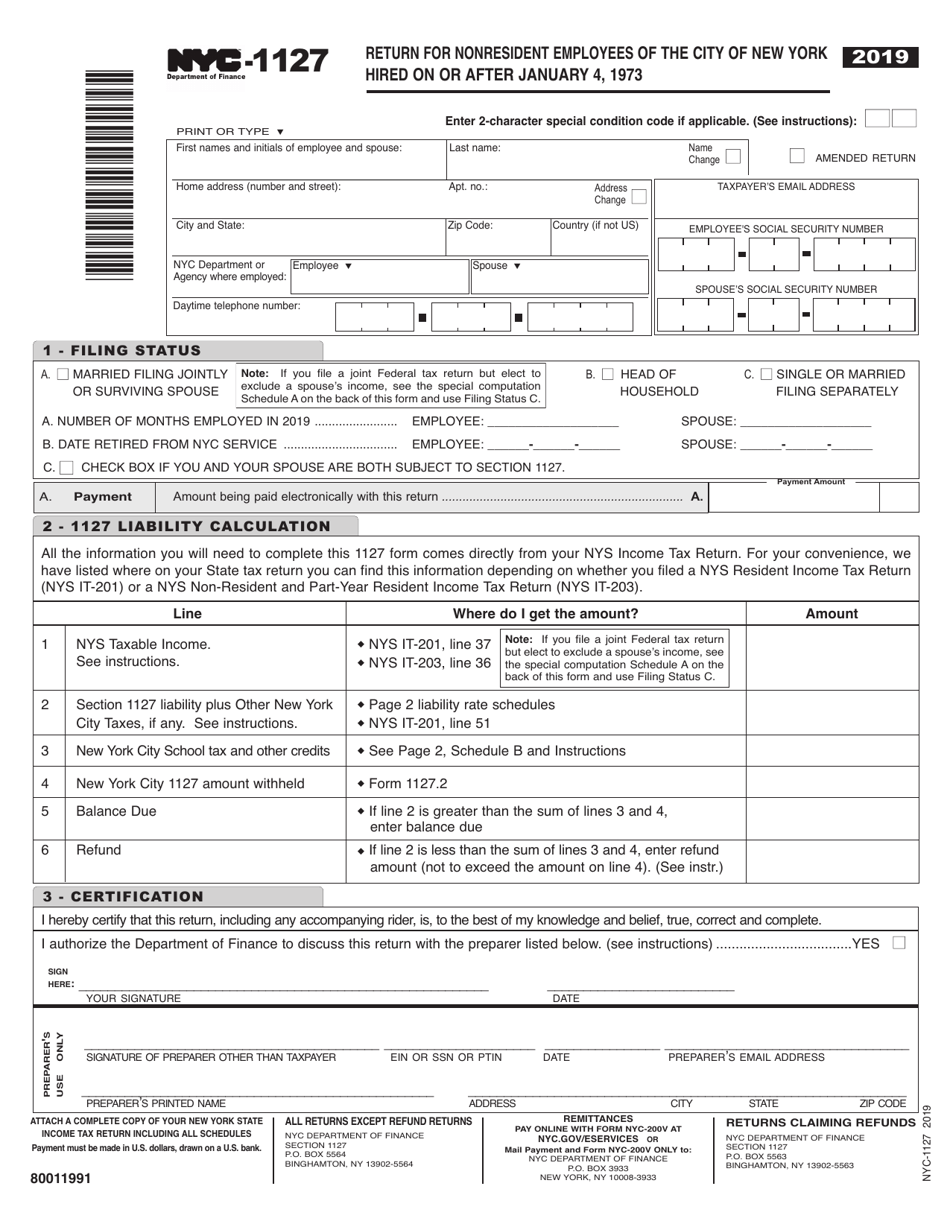

Form NYC1127 Download Printable PDF or Fill Online Return for

Any new york city employees who were a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an. Web get federal tax return forms and file by mail. Web who must file the 1127 tax return? In this case, you must submit to the section 1127 unit, no later. Manually enter.

Form Ct1127 Application For Extension Of Time For Payment Of

Any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an 1127. Who must file the 1127 tax return? Web • the taxpayer can request an extension of time to pay if paying the tax by the due date will be an undue hardship..

Instructions For Form 1127 2011 printable pdf download

Web who must file the 1127 tax return? Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not. To get an extension of time to file, you must file form 4868, application for automatic extension of. Manually enter the allocation for nyc and print. For details see form 1127, application for extension of.

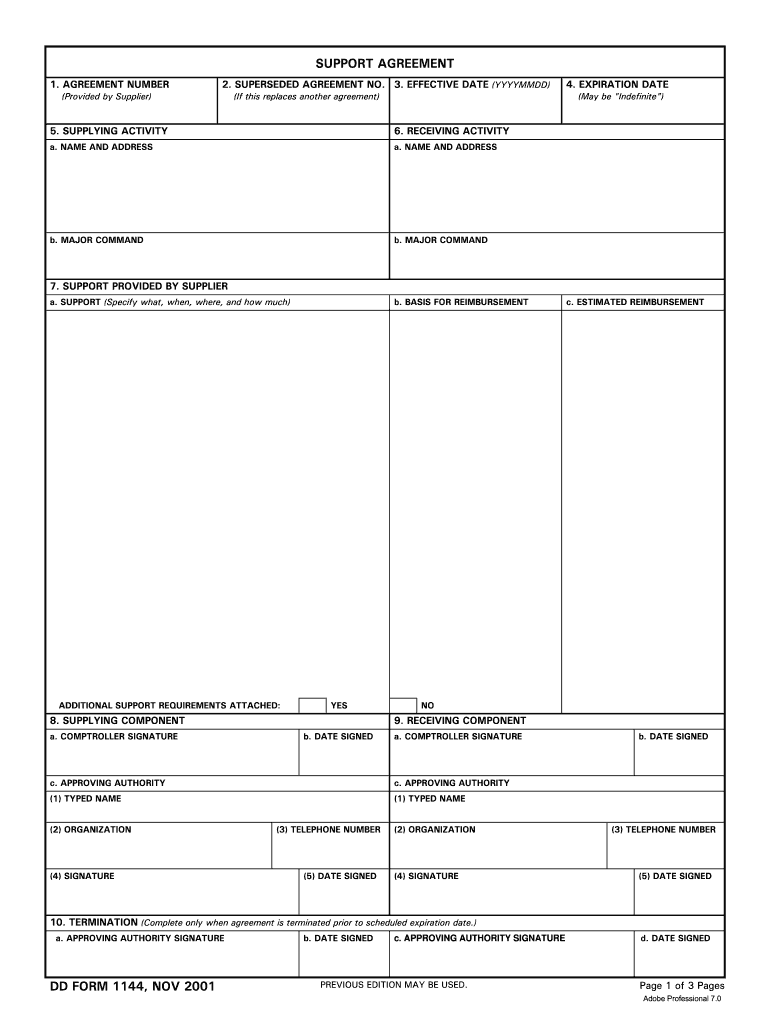

Irs Form 1144 Fill Online, Printable, Fillable, Blank pdfFiller

In this case, you must submit to the section 1127 unit, no later. Do not file form 1127. Fair market value (fmv) of assets. Any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an 1127. If you work for the city of new.

IRS Form form 1127 Download Printable PDF, Application for Extension of

If you work for the city of new york but live outside new york city and were hired on or after january 4, 1973, you must file form. Any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an 1127. We help you understand.

Fillable Form 1127 Application For Extension Of Time For Payment Of

File form 4768, application for extension of time to file a return and/or pay u.s. Any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an 1127. Web get federal tax return forms and file by mail. In this case, you must submit to.

Form 1127 General Instructions printable pdf download

Any new york city employee who was a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an 1127. To get an extension of time to file, you must file form 4868, application for automatic extension of. We help you understand and meet your federal tax responsibilities. If you work for.

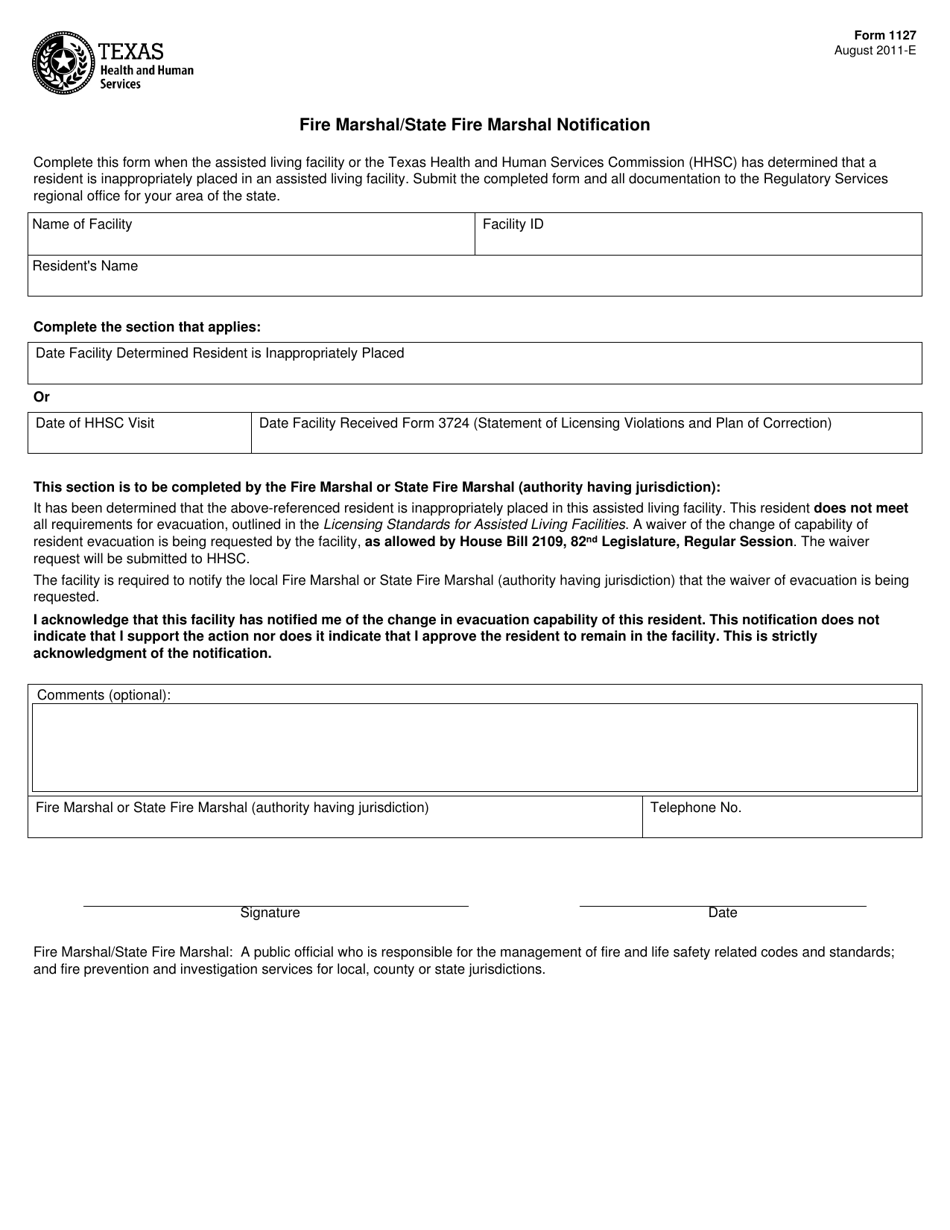

Form 1127 Download Fillable PDF or Fill Online Fire Marshal/State Fire

Web • for income set aside in prior tax years for which a deduction was claimed under section 642(c), • for charitable purposes for which a charitable deduction was claimed under. Find irs forms and answers to tax questions. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not. For details see form.

IRS Form 1127 Download Fillable PDF or Fill Online Application for

Who must file the 1127 tax return? Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. For details see form 1127, application for extension of time for. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not. Payment vouchers are provided to accompany checks mailed.

Form 1127 Is A Federal Corporate Income Tax Form.

To get an extension of time to file, you must file form 4868, application for automatic extension of. In this case, you must submit to the section 1127 unit, no later. File form 4768, application for extension of time to file a return and/or pay u.s. Who must file the 1127 tax return?

Any New York City Employee Who Was A Nonresident Of The City (The Five Nyc Boroughs) During Any Part Of A Particular Tax Year Must File An 1127.

Find irs forms and answers to tax questions. Any new york city employees who were a nonresident of the city (the five nyc boroughs) during any part of a particular tax year must file an. Web form 1127 is a tax form used by individuals and businesses to request an extension of time to pay certain taxes owed to the internal revenue service (irs). Web • for income set aside in prior tax years for which a deduction was claimed under section 642(c), • for charitable purposes for which a charitable deduction was claimed under.

Web Application For Irs Individual Taxpayer Identification Number.

Manually enter the allocation for nyc and print. If you work for the city of new york but live outside new york city and were hired on or after january 4, 1973, you must file form. Web an irs hardship extension — fileit — via form 1127 is the only way to get more time to pay your taxes due as the regular tax extension on form 4868 only gives you more time. Web get federal tax return forms and file by mail.

Payment Vouchers Are Provided To Accompany Checks Mailed To Pay Off Tax Liabilities, And Are Used By The.

Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web who must file the 1127 tax return? For details see form 1127, application for extension of time for. Do not file form 1127.