Iowa Non Resident Tax Form

Iowa Non Resident Tax Form - Web filing a nonresident tax return photo: You might have to file a nonresident tax return if you've earned money in a state where you don't live, as well as a resident tax return with your home state. The balance / julie bang it's more common than you might think for someone to live in one state while being employed in another. The taxpayer is allowed adjustments to income, a federal tax deduction, and standard or itemized deductions on the same basis as if the taxpayer were a resident of iowa. Web we last updated iowa form ia 126 in january 2023 from the iowa department of revenue. We will update this page with a new version of the form for 2024 as soon as it is made available by the iowa government. [+] does minnesota tax my income as a nonresident? The credit from this form is used to reduce total tax on the ia 1040. Wages earned in iowa capital gain on the sale of property self employment income earned while working in iowa Web you will need to complete the ia 1040 form lines 1 through 47 using income from all sources before you can complete the ia 126.

This is not a complete set of hunting and trapping laws but contains the information you are most likely to need to safely participate in these outdoor activities. The taxpayer is allowed adjustments to income, a federal tax deduction, and standard or itemized deductions on the same basis as if the taxpayer were a resident of iowa. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web we last updated iowa form ia 126 in january 2023 from the iowa department of revenue. Web nonresidents must file an iowa income tax return (ia 1040) if their net income from iowa sources is $1,000 or more. You are a permanent resident of another state or country you spent less than 183 days in minnesota do i need to file a minnesota income tax return? The credit from this form is used to reduce total tax on the ia 1040. Form ia 126 requires you to list multiple forms of income, such as wages, interest, or alimony. The balance / julie bang it's more common than you might think for someone to live in one state while being employed in another. You might have to file a nonresident tax return if you've earned money in a state where you don't live, as well as a resident tax return with your home state.

Web we last updated iowa form ia 126 in january 2023 from the iowa department of revenue. Wages earned in iowa capital gain on the sale of property self employment income earned while working in iowa The balance / julie bang it's more common than you might think for someone to live in one state while being employed in another. 2022/23 iowa hunting, trapping, and migratory game bird regulations [pdf] 2022/23 hunting seasons and limits, card [pdf] 2022/23 migratory game bird. You are a permanent resident of another state or country you spent less than 183 days in minnesota do i need to file a minnesota income tax return? This is not a complete set of hunting and trapping laws but contains the information you are most likely to need to safely participate in these outdoor activities. The taxpayer is allowed adjustments to income, a federal tax deduction, and standard or itemized deductions on the same basis as if the taxpayer were a resident of iowa. We will update this page with a new version of the form for 2024 as soon as it is made available by the iowa government. You might have to file a nonresident tax return if you've earned money in a state where you don't live, as well as a resident tax return with your home state. Web nonresidents you’re considered a nonresident of minnesota if both of these apply:

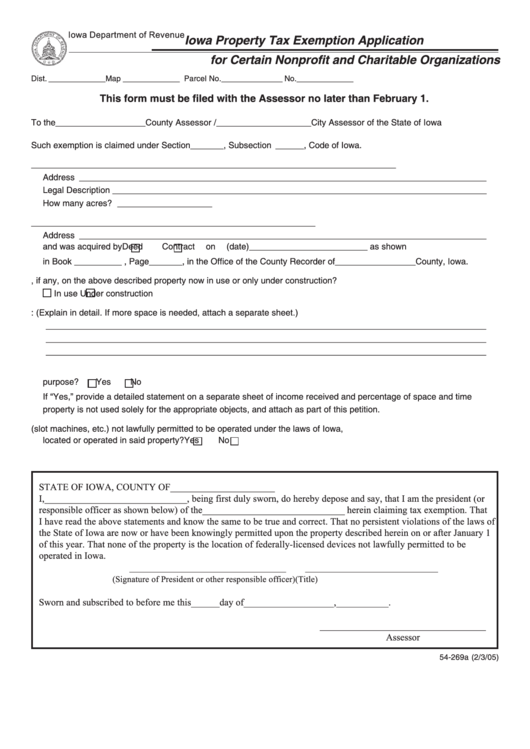

Form 54269a Iowa Property Tax Exemption Application For Certain

Web nonresidents must file an iowa income tax return (ia 1040) if their net income from iowa sources is $1,000 or more. Web nonresidents you’re considered a nonresident of minnesota if both of these apply: Web filing a nonresident tax return photo: Form ia 126 requires you to list multiple forms of income, such as wages, interest, or alimony. Wages.

Iowa NonResident Whitetail Deer Tag WSF World Headquarters

This form is for income earned in tax year 2022, with tax returns due in april 2023. The taxpayer is allowed adjustments to income, a federal tax deduction, and standard or itemized deductions on the same basis as if the taxpayer were a resident of iowa. Form ia 126 requires you to list multiple forms of income, such as wages,.

Iowa Nonresident Hunting License 1995 2nd Item Ships Free Etsy

Web nonresidents must file an iowa income tax return (ia 1040) if their net income from iowa sources is $1,000 or more. The credit from this form is used to reduce total tax on the ia 1040. [+] does minnesota tax my income as a nonresident? This form is for income earned in tax year 2022, with tax returns due.

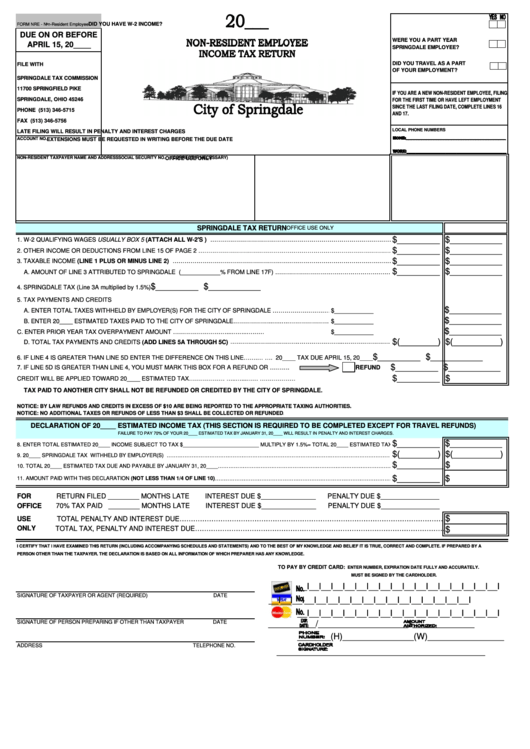

Form Nre NonResident Employee Tax Return printable pdf download

We will update this page with a new version of the form for 2024 as soon as it is made available by the iowa government. The taxpayer is allowed adjustments to income, a federal tax deduction, and standard or itemized deductions on the same basis as if the taxpayer were a resident of iowa. [+] does minnesota tax my income.

Have you received one of these? Is the Tax Office asking you to pay Non

This is not a complete set of hunting and trapping laws but contains the information you are most likely to need to safely participate in these outdoor activities. Wages earned in iowa capital gain on the sale of property self employment income earned while working in iowa The taxpayer is allowed adjustments to income, a federal tax deduction, and standard.

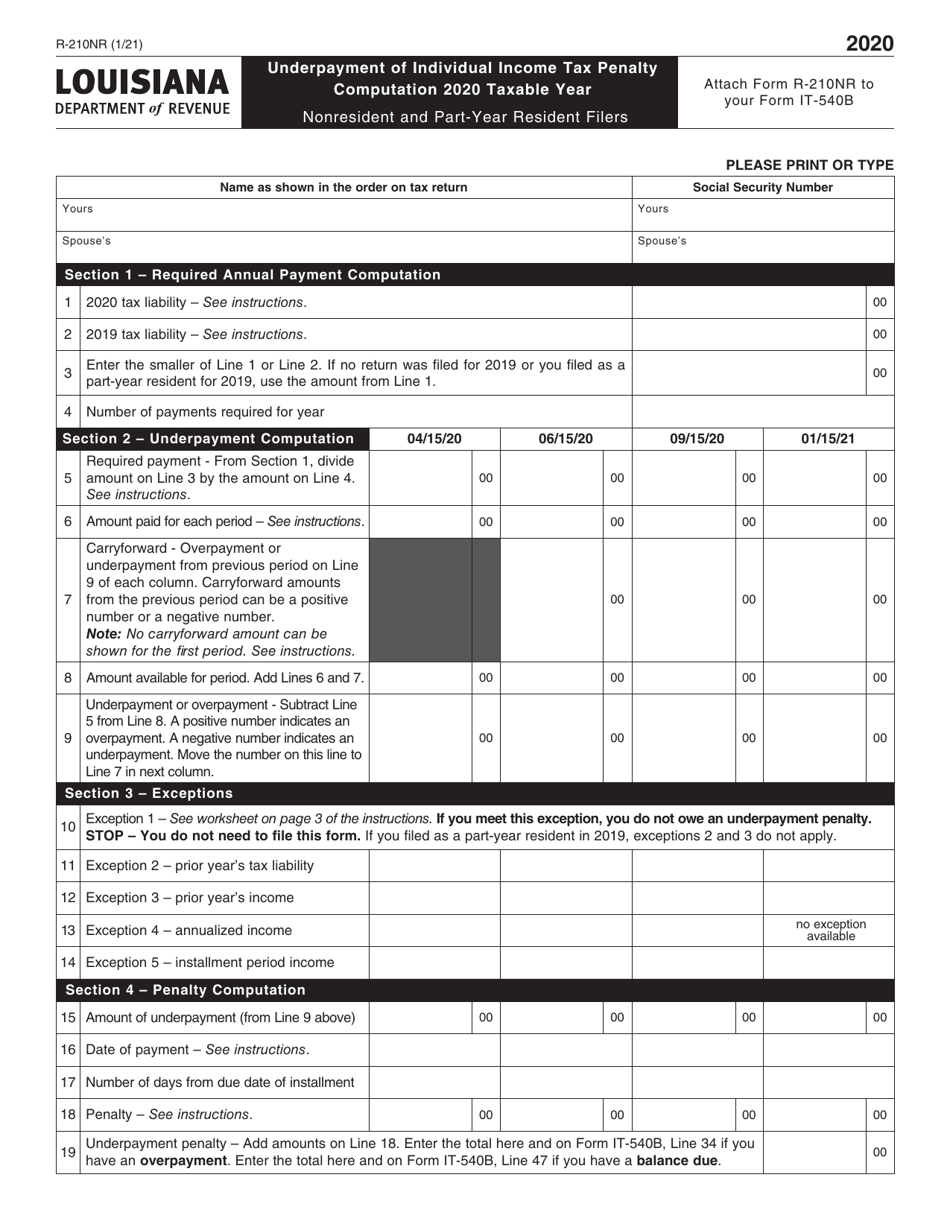

Form R210NR Download Fillable PDF or Fill Online Underpayment of

The taxpayer is allowed adjustments to income, a federal tax deduction, and standard or itemized deductions on the same basis as if the taxpayer were a resident of iowa. Web you will need to complete the ia 1040 form lines 1 through 47 using income from all sources before you can complete the ia 126. Web nonresidents you’re considered a.

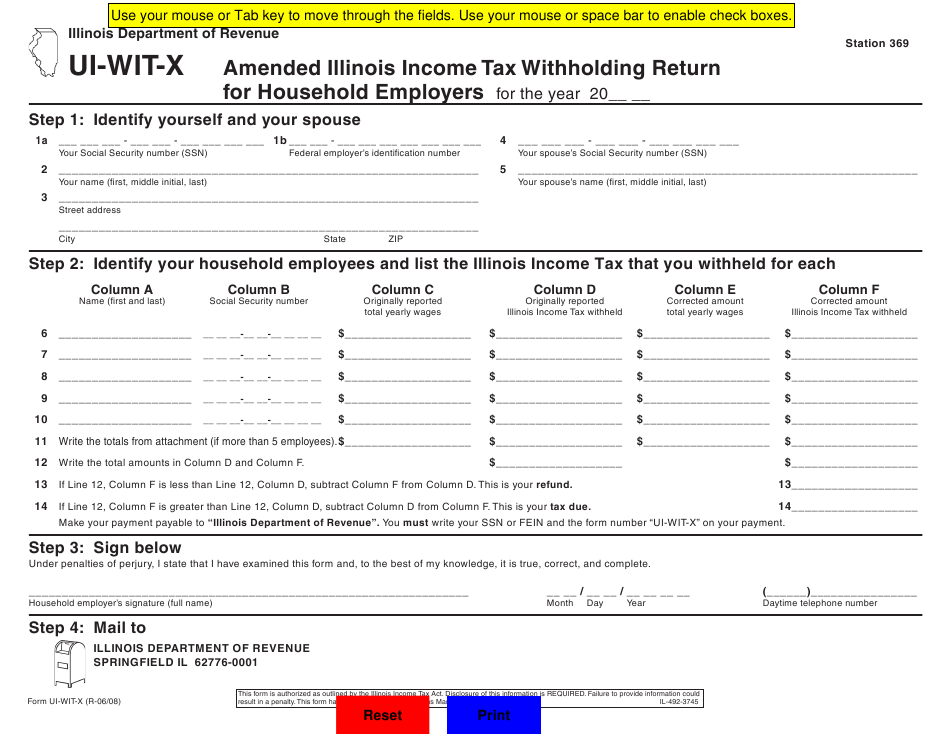

Illinois Tax Withholding Forms 2022 W4 Form

Web we last updated iowa form ia 126 in january 2023 from the iowa department of revenue. Web nonresidents you’re considered a nonresident of minnesota if both of these apply: Wages earned in iowa capital gain on the sale of property self employment income earned while working in iowa Web you will need to complete the ia 1040 form lines.

Tax on Dividend for Resident & Non residents & How to avoid TDS in

Wages earned in iowa capital gain on the sale of property self employment income earned while working in iowa Web filing a nonresident tax return photo: You are a permanent resident of another state or country you spent less than 183 days in minnesota do i need to file a minnesota income tax return? The credit from this form is.

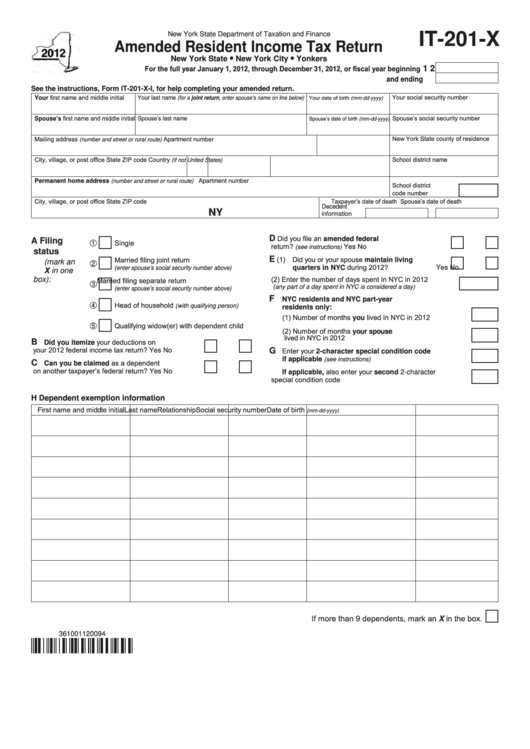

Fillable Form It201X Amended Resident Tax Return 2012

You might have to file a nonresident tax return if you've earned money in a state where you don't live, as well as a resident tax return with your home state. The taxpayer is allowed adjustments to income, a federal tax deduction, and standard or itemized deductions on the same basis as if the taxpayer were a resident of iowa..

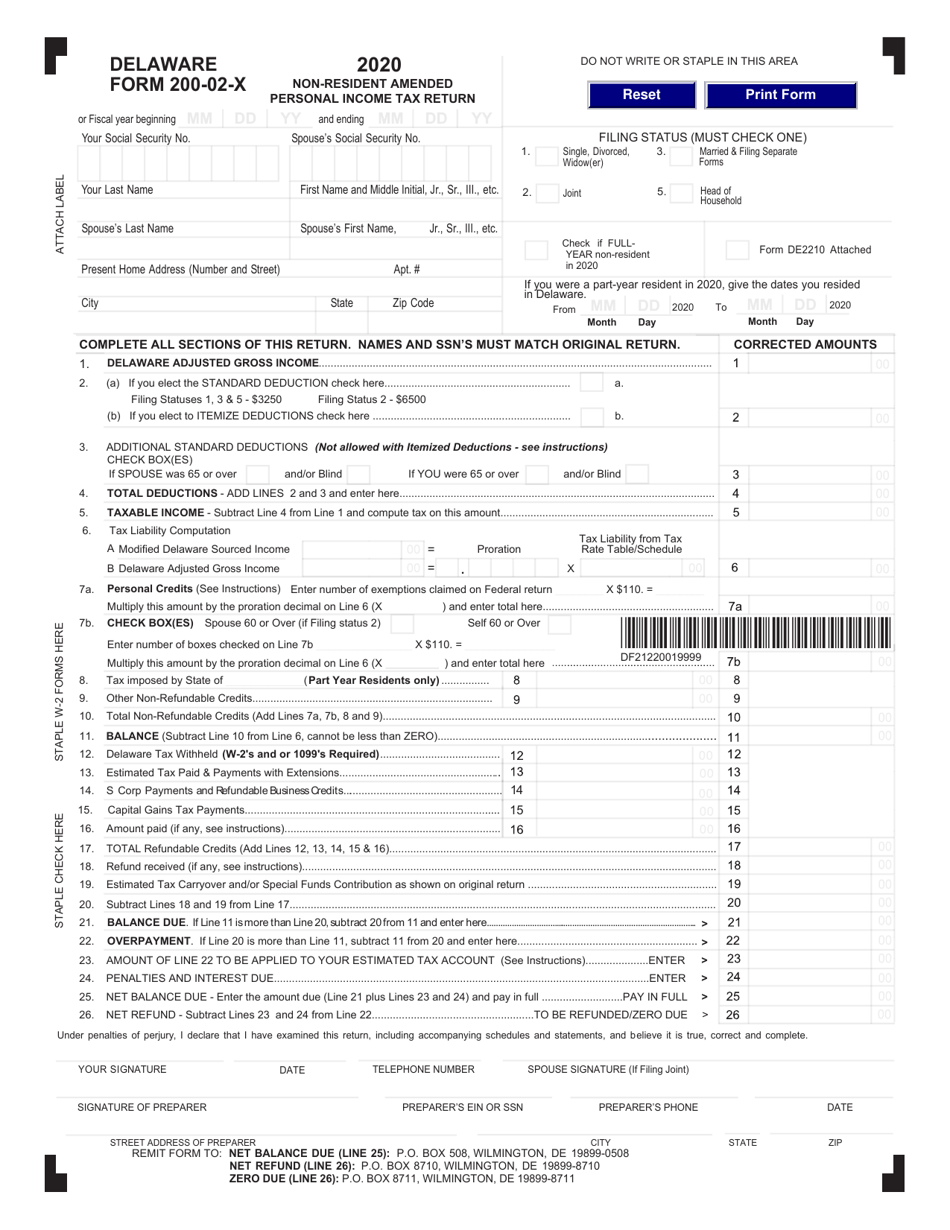

Form 20002X Download Fillable PDF or Fill Online Nonresident Amended

We will update this page with a new version of the form for 2024 as soon as it is made available by the iowa government. Web nonresidents you’re considered a nonresident of minnesota if both of these apply: Web filing a nonresident tax return photo: This form is for income earned in tax year 2022, with tax returns due in.

Web Nonresidents You’re Considered A Nonresident Of Minnesota If Both Of These Apply:

This form is for income earned in tax year 2022, with tax returns due in april 2023. Form ia 126 requires you to list multiple forms of income, such as wages, interest, or alimony. Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. The taxpayer is allowed adjustments to income, a federal tax deduction, and standard or itemized deductions on the same basis as if the taxpayer were a resident of iowa.

2022/23 Iowa Hunting, Trapping, And Migratory Game Bird Regulations [Pdf] 2022/23 Hunting Seasons And Limits, Card [Pdf] 2022/23 Migratory Game Bird.

We will update this page with a new version of the form for 2024 as soon as it is made available by the iowa government. Web nonresidents must file an iowa income tax return (ia 1040) if their net income from iowa sources is $1,000 or more. The balance / julie bang it's more common than you might think for someone to live in one state while being employed in another. Web you will need to complete the ia 1040 form lines 1 through 47 using income from all sources before you can complete the ia 126.

This Is Not A Complete Set Of Hunting And Trapping Laws But Contains The Information You Are Most Likely To Need To Safely Participate In These Outdoor Activities.

[+] does minnesota tax my income as a nonresident? Web we last updated iowa form ia 126 in january 2023 from the iowa department of revenue. The credit from this form is used to reduce total tax on the ia 1040. You are a permanent resident of another state or country you spent less than 183 days in minnesota do i need to file a minnesota income tax return?

Wages Earned In Iowa Capital Gain On The Sale Of Property Self Employment Income Earned While Working In Iowa

Web filing a nonresident tax return photo: You might have to file a nonresident tax return if you've earned money in a state where you don't live, as well as a resident tax return with your home state.