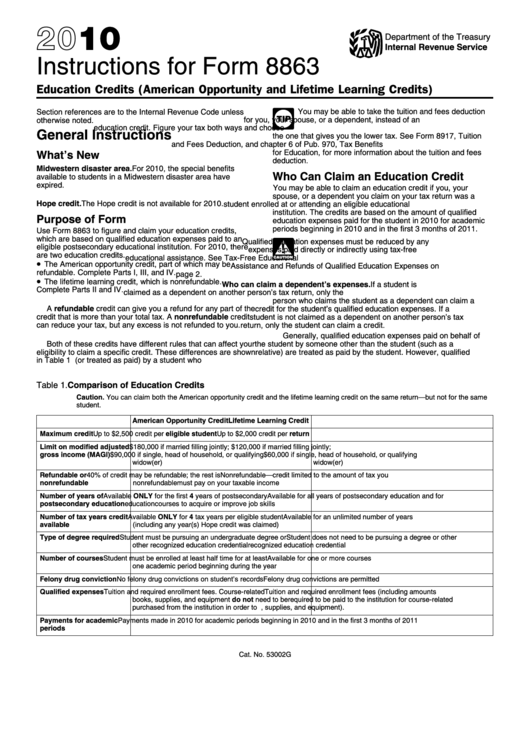

Instructions For Form 8863

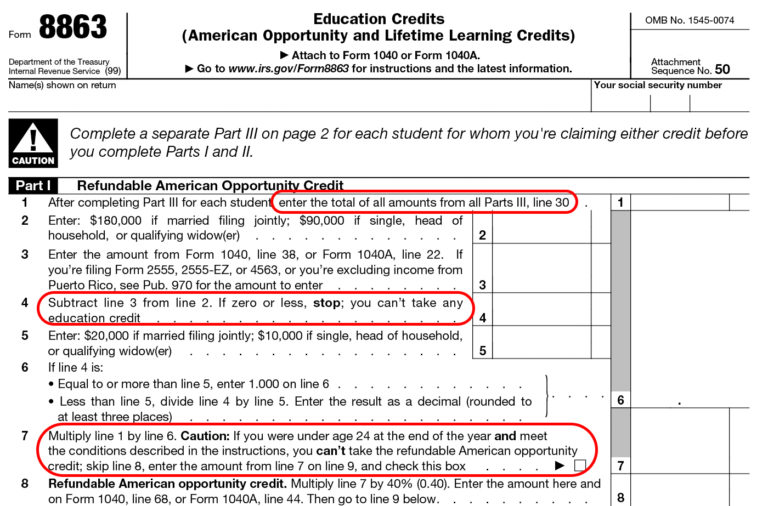

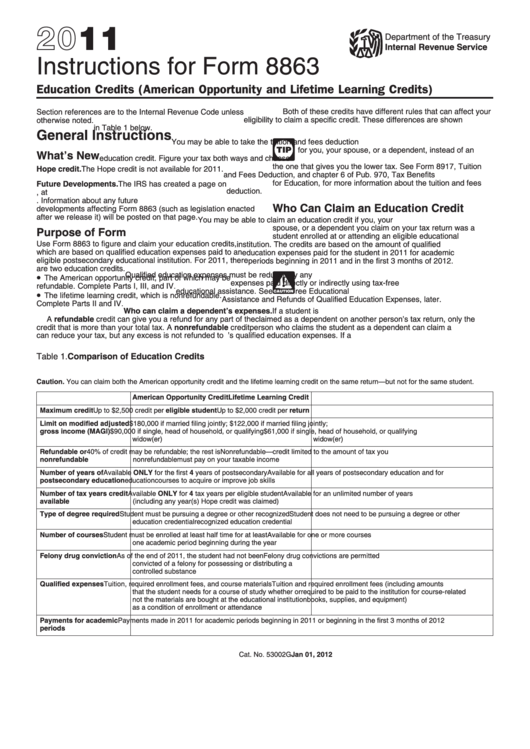

Instructions For Form 8863 - For 2022, there are two education credits. Go to www.irs.gov/form8863 for instructions and the latest information. Form 8863 helps students find and claim the right education credit for their situation. In this article, we’ll explore irs form 8863, education credits. Web overview if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. The american opportunity credit, part of which may be refundable. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). 50 name(s) shown on return Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary).

Web form 8863 typically accompanies your 1040 form, and this particular document contains information on expenses paid for qualifying students, along with their name and social security number. Go to www.irs.gov/form8863 for instructions and the latest information. If you can’t find it, or if your school didn’t send you one, it’s possible you can get an electronic copy from your school’s online portal. Web adjusted qualified education expenses worksheet (form 8863 instructions) total qualified education expenses paid for on behalf of the student in 2021 for the academic period. In this article, we’ll explore irs form 8863, education credits. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web irs form 8863 instructions. For 2022, there are two education credits. The american opportunity credit, part of which may be refundable. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.).

In this article, we’ll explore irs form 8863, education credits. Web adjusted qualified education expenses worksheet (form 8863 instructions) total qualified education expenses paid for on behalf of the student in 2021 for the academic period. This document is usually provided by the school and shows the amount billed or received for the given year. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). The types of educational credits this tax form covers what types of educational expenses qualify for these tax credits Go to www.irs.gov/form8863 for instructions and the latest information. Web scholarships, grants, and school loans faqs what is form 8863? Web step by step instructions comments in the united states, education credits can be one of the biggest tax benefits for many families. If you can’t find it, or if your school didn’t send you one, it’s possible you can get an electronic copy from your school’s online portal. Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution.

AOTC & LLC Two Higher Education Tax Benefits For US Taxpayers The

Web overview if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Web adjusted qualified education expenses worksheet (form 8863 instructions) total qualified education expenses paid for on behalf of the student in 2021 for the academic period. Web scholarships, grants, and school.

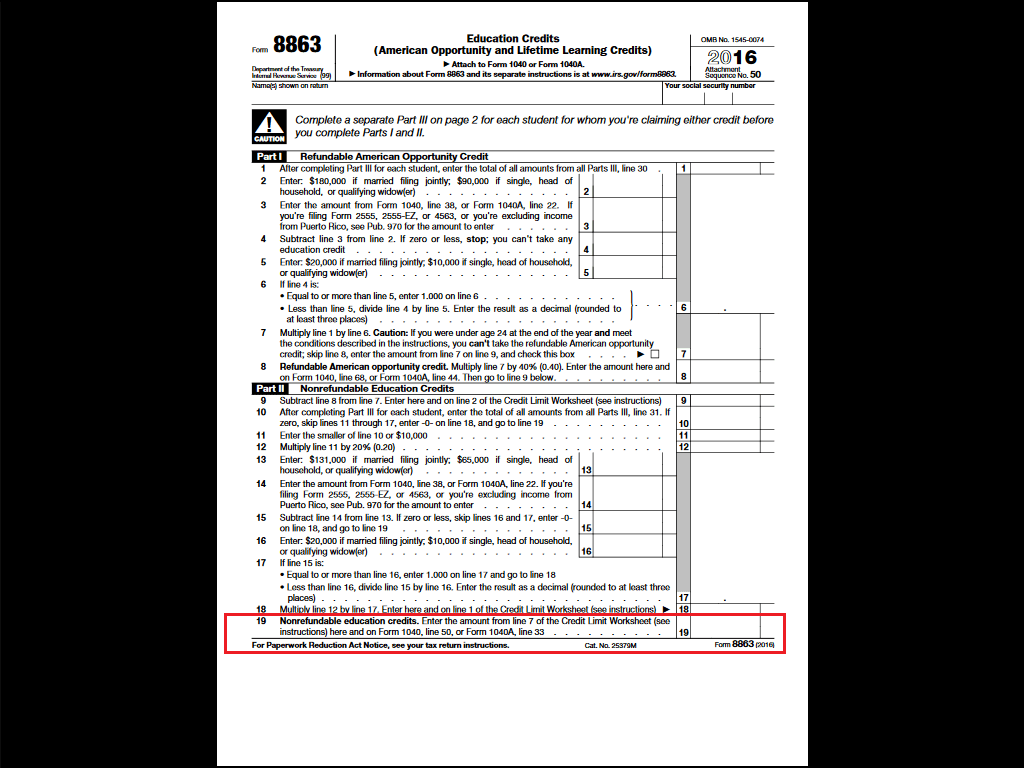

Instructions For Form 8863 Education Credits (American Opportunity

Web adjusted qualified education expenses worksheet (form 8863 instructions) total qualified education expenses paid for on behalf of the student in 2021 for the academic period. Web form 8863 typically accompanies your 1040 form, and this particular document contains information on expenses paid for qualifying students, along with their name and social security number. Go to www.irs.gov/form8863 for instructions and.

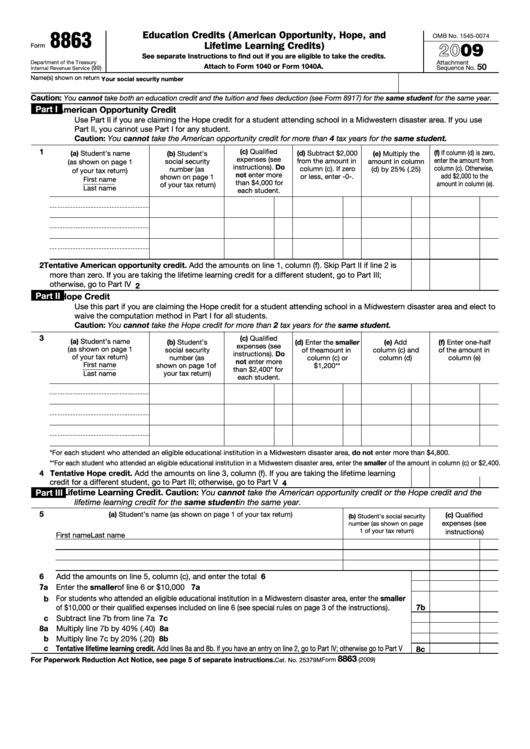

Fillable Form 8863 Education Credits (American Opportunity, Hope, And

Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Web scholarships, grants, and school loans faqs what is form 8863? Web form 8863 typically accompanies.

2012 Form IRS Instruction 8863 Fill Online, Printable, Fillable, Blank

Web overview if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. The types of educational credits this tax form covers what types of educational expenses qualify for these tax credits If you can’t find it, or if your school didn’t send you.

Form 8863 Education Credits (American Opportunity and Lifetime

Web step by step instructions comments in the united states, education credits can be one of the biggest tax benefits for many families. You can claim these expenses for yourself, your spouse, or a qualified dependent. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). In this article, we’ll explore.

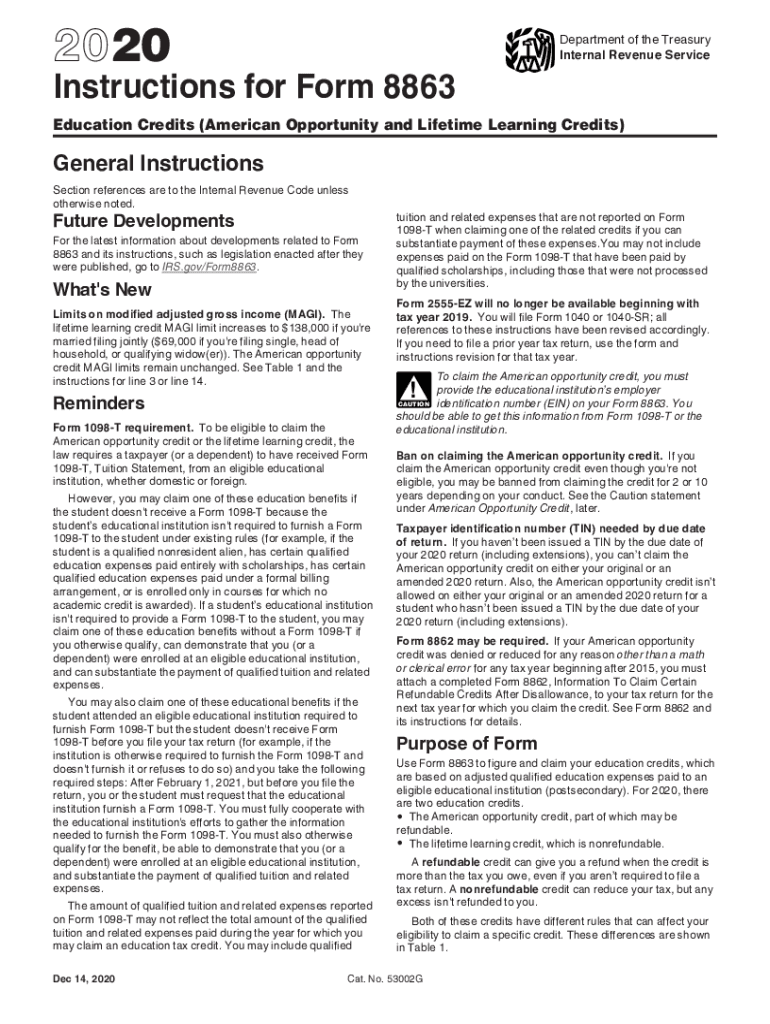

2020 Form IRS Instruction 8863 Fill Online, Printable, Fillable, Blank

Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). This document is usually provided by the school and shows the amount billed or received for the given year. Web scholarships, grants, and school loans faqs what is form 8863? The types of educational credits this tax form covers what types.

Form 8863 Instructions Information On The Education 1040 Form Printable

Web scholarships, grants, and school loans faqs what is form 8863? You can claim these expenses for yourself, your spouse, or a qualified dependent. Web overview if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Web form 8863 typically accompanies your 1040.

Instructions For Form 8863 Education Credits (American Opportunity

Form 8863 helps students find and claim the right education credit for their situation. Go to www.irs.gov/form8863 for instructions and the latest information. 50 name(s) shown on return Web form 8863 typically accompanies your 1040 form, and this particular document contains information on expenses paid for qualifying students, along with their name and social security number. Web irs form 8863.

Form 8863Education Credits

50 name(s) shown on return Web overview if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Go to www.irs.gov/form8863 for instructions and the.

IRS 8863 Line 23 Fill and Sign Printable Template Online US Legal Forms

Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Go to www.irs.gov/form8863 for instructions and the latest information. Web form.

For 2022, There Are Two Education Credits.

Web scholarships, grants, and school loans faqs what is form 8863? This document is usually provided by the school and shows the amount billed or received for the given year. Web step by step instructions comments in the united states, education credits can be one of the biggest tax benefits for many families. In this article, we’ll explore irs form 8863, education credits.

You Can Claim These Expenses For Yourself, Your Spouse, Or A Qualified Dependent.

If you can’t find it, or if your school didn’t send you one, it’s possible you can get an electronic copy from your school’s online portal. Web adjusted qualified education expenses worksheet (form 8863 instructions) total qualified education expenses paid for on behalf of the student in 2021 for the academic period. Form 8863 helps students find and claim the right education credit for their situation. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.).

The American Opportunity Credit, Part Of Which May Be Refundable.

Web overview if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. 50 name(s) shown on return Use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Go to www.irs.gov/form8863 for instructions and the latest information.

The Types Of Educational Credits This Tax Form Covers What Types Of Educational Expenses Qualify For These Tax Credits

Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Web form 8863 typically accompanies your 1040 form, and this particular document contains information on expenses paid for qualifying students, along with their name and social security number. Web irs form 8863 instructions.