Instructions For Form 8825

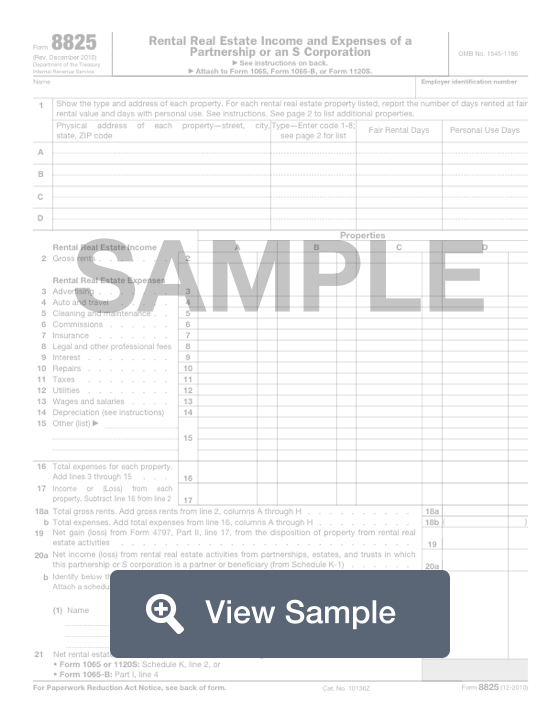

Instructions For Form 8825 - November 2018) department of the treasury internal revenue service. Web at a minimum, your irs tax form 8825 must contain the following information (for each declared property): Then it flows through to the owner’s return. Do not report on form 8825 any: Web why is there a diagnostic for form 8825 when disposing of a rental property? The rental income and expenses are. In plain english, it is the company version of the schedule e rental real estate form we often see. You reported a gain (or loss) from the sale of business property of zero. Relatively few people are eligible for the hctc. Web information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related forms, and instructions on how to file.

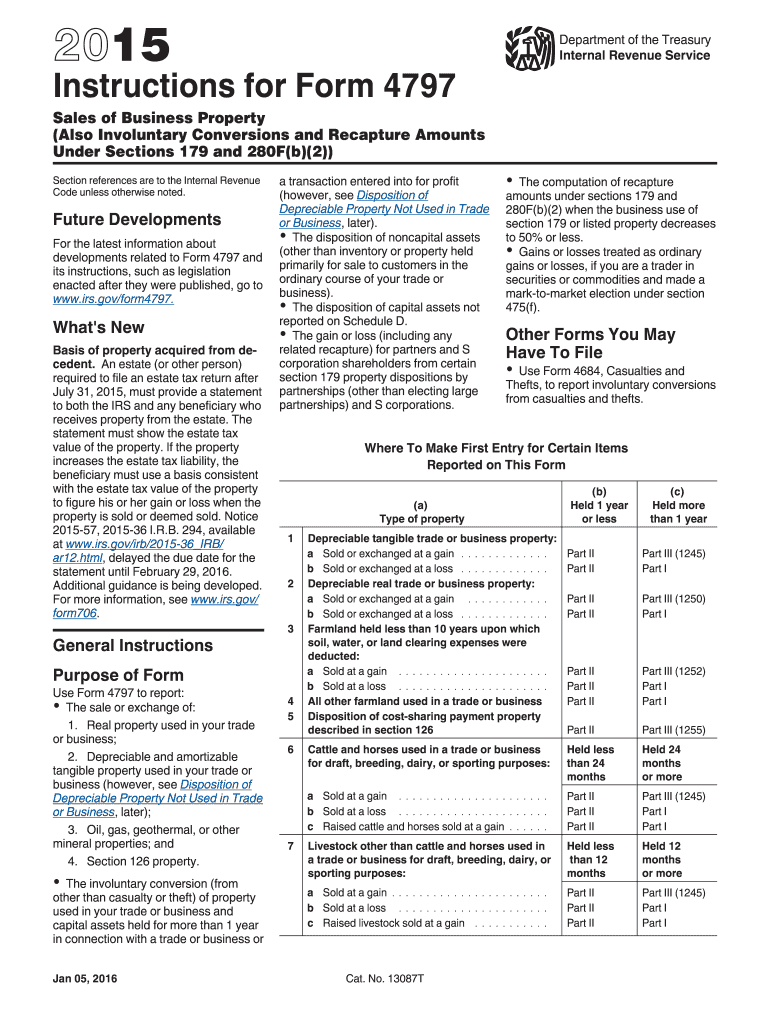

General instructions purpose of form You reported a gain (or loss) from the sale of business property of zero. The first two pages have instructions for the form, so you will want to read these to make sure that you are filling out the form correctly. November 2018) department of the treasury internal revenue service. In plain english, it is the company version of the schedule e rental real estate form we often see. Rental real estate income and expenses of a. The third page is where you will write down the income and expenses that you incurred during the year. Web form 8825 instructions generally, there are three pages to the form. Before completing this form, be sure to Web at a minimum, your irs tax form 8825 must contain the following information (for each declared property):

Relating to a form or its instructions must be retained as long as their contents may become material in the administration of any internal revenue law. The rental income and expenses are. You reported a gain (or loss) from the sale of business property of zero. Relatively few people are eligible for the hctc. The third page is where you will write down the income and expenses that you incurred during the year. Web information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related forms, and instructions on how to file. Web for the latest information about developments related to form 8885 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8885. Web an 8825 form is officially called a rental real estate income and expenses of a partnership or an s corp. General instructions purpose of form Do not report on form 8825 any:

Publication 559 (2017), Survivors, Executors, and Administrators

Web an 8825 form is officially called a rental real estate income and expenses of a partnership or an s corp. In plain english, it is the company version of the schedule e rental real estate form we often see. Before completing this form, be sure to November 2018) department of the treasury internal revenue service. If any portion of.

Form 8825 Rental Real Estate and Expenses of a Partnership or

Relating to a form or its instructions must be retained as long as their contents may become material in the administration of any internal revenue law. Generally, tax returns and return If any portion of this gain (or loss) is from rental real estate activities, you must also enter it on form 8825, rental real estate income and expenses, line.

LEGO 8825 Night Chopper Set Parts Inventory and Instructions LEGO

General instructions purpose of form Form 8825 is used to report income and deductible expenses from rental real estate activities. Web why is there a diagnostic for form 8825 when disposing of a rental property? Web information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related forms, and instructions.

Doc

Web for the latest information about developments related to form 8885 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8885. In plain english, it is the company version of the schedule e rental real estate form we often see. Web the 8825 is the real estate form and it flows to the schedule k instead.

Ir's Form 4797 Instructions Fill Out and Sign Printable PDF Template

Web the 8825 is the real estate form and it flows to the schedule k instead of the front page of the partnership return: General instructions purpose of form Form 8825 is used to report income and deductible expenses from rental real estate activities. November 2018) department of the treasury internal revenue service. Web why is there a diagnostic for.

LEGO 8825 Night Chopper Set Parts Inventory and Instructions LEGO

Do not report on form 8825 any: General instructions purpose of form The rental income and expenses are. In plain english, it is the company version of the schedule e rental real estate form we often see. Before completing this form, be sure to

Form 8825 Rental Real Estate and Expenses of a Partnership or

General instructions purpose of form Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from rental real estate activities that flow through from partnerships, estates, or trusts. Do not report on form 8825 any: Web an 8825 form is officially called a rental real estate income and.

Fill Free fillable F8825 Accessible Form 8825 (Rev. November 2018

Before completing this form, be sure to In plain english, it is the company version of the schedule e rental real estate form we often see. Relating to a form or its instructions must be retained as long as their contents may become material in the administration of any internal revenue law. Web form 8825 instructions generally, there are three.

Fillable IRS Form 8825 Free Printable PDF Sample FormSwift

Web form 8825 instructions generally, there are three pages to the form. Relating to a form or its instructions must be retained as long as their contents may become material in the administration of any internal revenue law. Partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss).

IRS Form 8825 Fill out & sign online DocHub

Then it flows through to the owner’s return. The rental income and expenses are. November 2018) department of the treasury internal revenue service. Web for the latest information about developments related to form 8885 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8885. Web at a minimum, your irs tax form 8825 must contain the.

You Reported A Gain (Or Loss) From The Sale Of Business Property Of Zero.

Web at a minimum, your irs tax form 8825 must contain the following information (for each declared property): General instructions purpose of form Relatively few people are eligible for the hctc. Web an 8825 form is officially called a rental real estate income and expenses of a partnership or an s corp.

Partnerships And S Corporations Use Form 8825 To Report Income And Deductible Expenses From Rental Real Estate Activities, Including Net Income (Loss) From Rental Real Estate Activities That Flow Through From Partnerships, Estates, Or Trusts.

See who can take this credit , later, to determine whether you can claim the credit. Generally, tax returns and return The first two pages have instructions for the form, so you will want to read these to make sure that you are filling out the form correctly. If any portion of this gain (or loss) is from rental real estate activities, you must also enter it on form 8825, rental real estate income and expenses, line 19.

Relating To A Form Or Its Instructions Must Be Retained As Long As Their Contents May Become Material In The Administration Of Any Internal Revenue Law.

Then it flows through to the owner’s return. Form 8825 is used to report income and deductible expenses from rental real estate activities. Web the 8825 is the real estate form and it flows to the schedule k instead of the front page of the partnership return: Web information about form 8825, rental real estate income and expenses of a partnership or an s corporation, including recent updates, related forms, and instructions on how to file.

Web Why Is There A Diagnostic For Form 8825 When Disposing Of A Rental Property?

If the owner is an individual, their share goes to schedule e, page two line 28 column f or g. Web form 8825 instructions generally, there are three pages to the form. Rental real estate income and expenses of a. November 2018) department of the treasury internal revenue service.