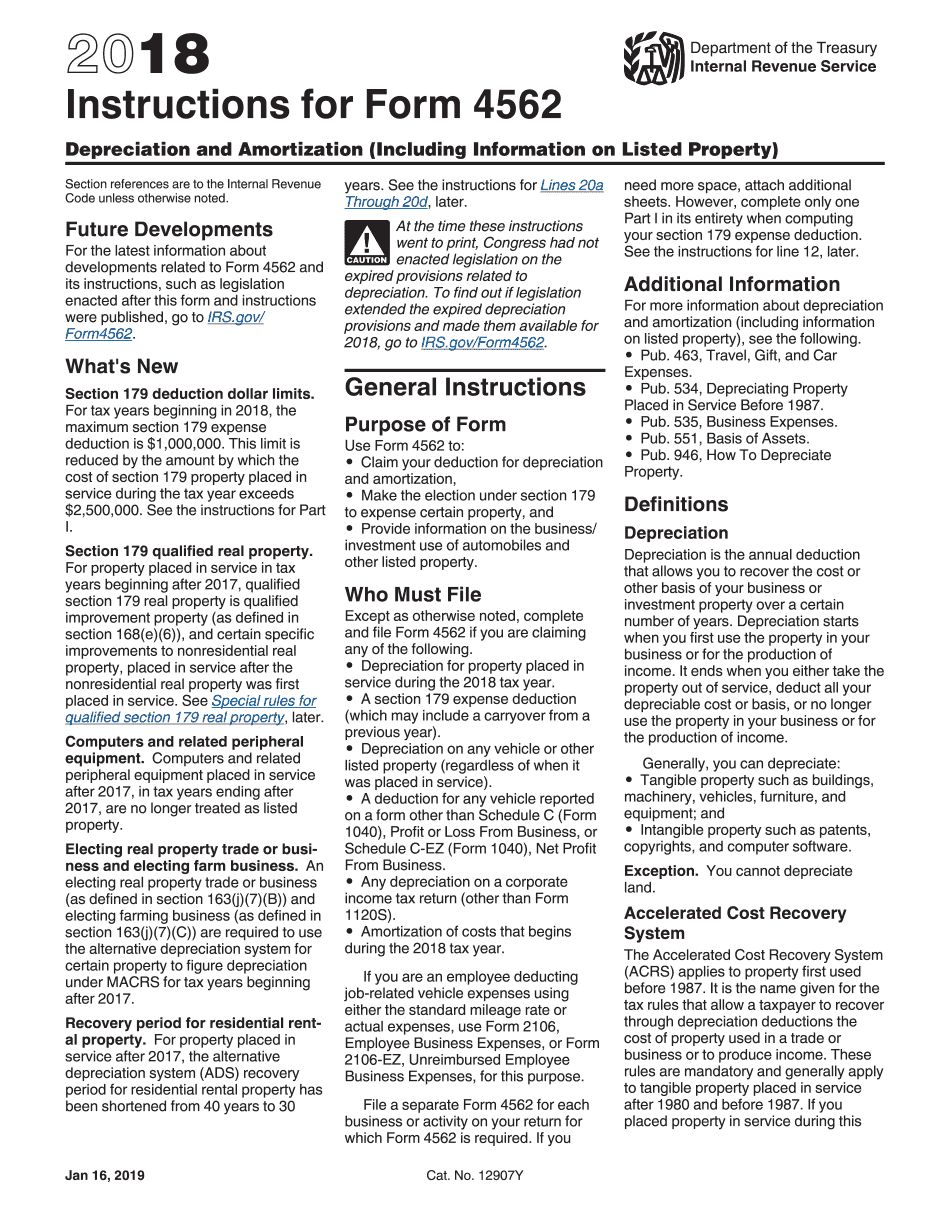

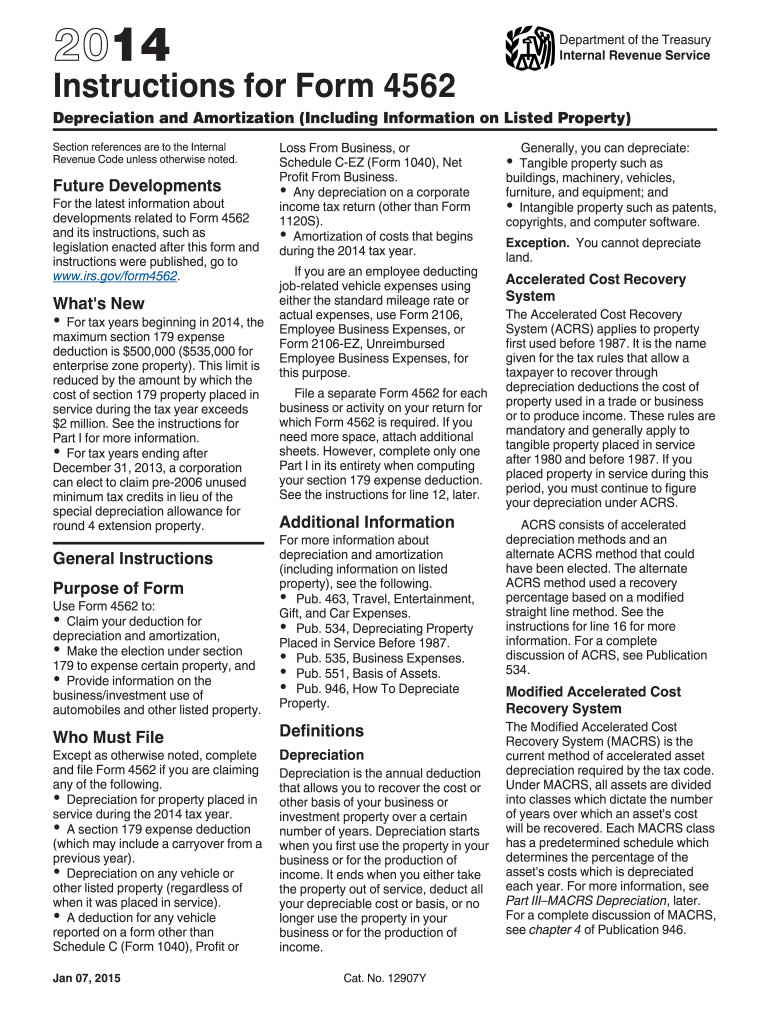

Instructions For Form 4562

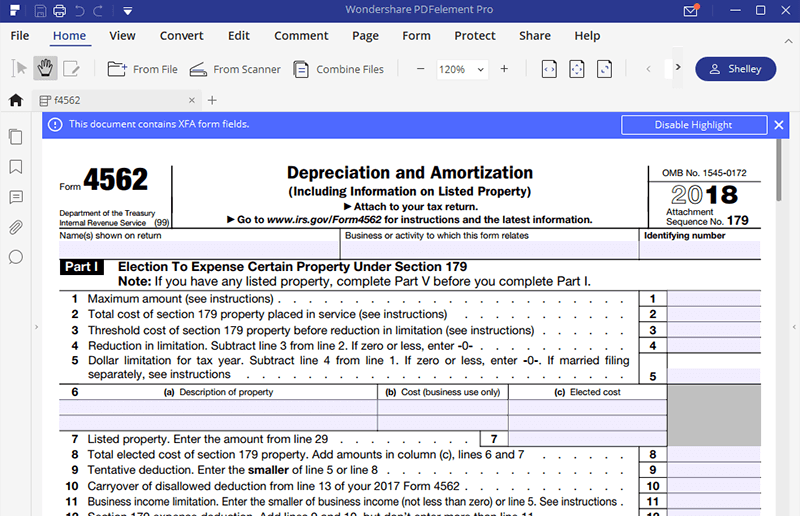

Instructions For Form 4562 - Form 4562 is used to claim a. 05/26/22) georgia depreciation and amortization (i ncludinginformationon. To properly fill out form 4562, you’ll need the. Something you’ll need to consider is that the amount you can deduct. Web developments related to form 4562 and its instructions, such as legislation enacted after this form and instructions were published, go to www.irs.gov/form4562. Web what information do you need for form 4562? Web instructions for form 4562 reflects changes property. Line 1 = $1 million, the maximum possible. Complete, edit or print tax forms instantly. First, you’ll need to gather all the financial records regarding your asset.

Line 1 = $1 million, the maximum possible. Web the instructions for form 4562 include a worksheet that you can use to complete part i. 05/26/22) georgia depreciation and amortization (i ncludinginformationon. Web what information do you need for form 4562? Form 4562 is used to claim a. This form is also available at public. See the instructions for lines 20a through 20d, later. To properly fill out form 4562, you’ll need the. First, you’ll need to gather all the financial records regarding your asset. Web get answers to frequently asked questions about form 4562 and section 179 in proseries professional and proseries basic:

Web instructions for how to complete irs form 4562 step 1: Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. First, you’ll need to gather all the financial records regarding your asset. Web developments related to form 4562 and its instructions, such as legislation enacted after this. Something you’ll need to consider is that the amount you can deduct. Web here’s what each line should look like as outlined in the irs form 4562 instructions, along with a few examples. • claim your deduction for depreciation and amortization, •. Web developments related to form 4562 and its instructions, such as legislation enacted after this form and instructions were published, go to www.irs.gov/form4562. Web get answers to frequently asked questions about form 4562 and section 179 in proseries professional and proseries basic: Get ready for tax season deadlines by completing any required tax forms today.

Pa Form W2 S Instructions Universal Network

Web here’s what each line should look like as outlined in the irs form 4562 instructions, along with a few examples. Web file a form 3115 with your return for the 2019 tax year or a subsequent tax year, to claim them. 05/26/22) georgia depreciation and amortization (i ncludinginformationon. Web instructions for form 4562 reflects changes property. Web instructions for.

Editable IRS Instructions 4562 2018 2019 Create A Digital Sample in PDF

See the instructions for lines 20a through 20d, later. Web developments related to form 4562 and its instructions, such as legislation enacted after this form and instructions were published, go to www.irs.gov/form4562. Get ready for tax season deadlines by completing any required tax forms today. Web file a form 3115 with your return for the 2019 tax year or a.

2020 Form IRS 4562 Instructions Fill Online, Printable, Fillable, Blank

Web instructions for form 4562 depreciation and amortization (including information on listed property) section references are to the internal revenue code unless otherwise noted. General instructions purpose of form use form 4562 to: Something you’ll need to consider is that the amount you can deduct. Download a copy of the irs form 4562 from the irs official website. Web the.

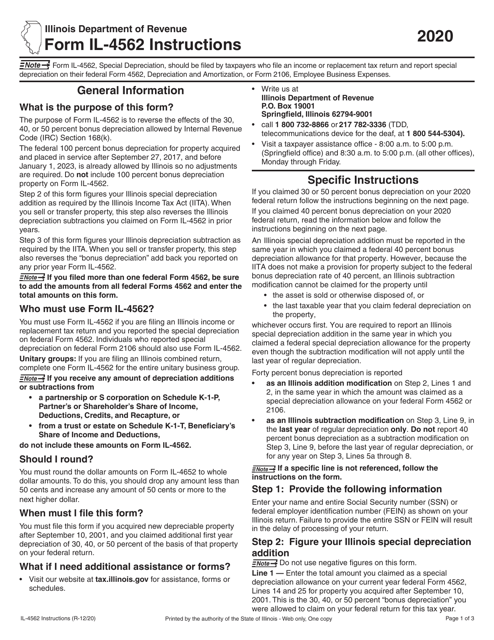

Download Instructions for Form IL4562 Special Depreciation PDF, 2020

General instructions purpose of form use form 4562 to: Web developments related to form 4562 and its instructions, such as legislation enacted after this form and instructions were published, go to www.irs.gov/form4562. Something you’ll need to consider is that the amount you can deduct. Web the instructions for form 4562 include a worksheet that you can use to complete part.

2012 Form 4562 Instructions Universal Network

This form is also available at public. First, you’ll need to gather all the financial records regarding your asset. Get ready for tax season deadlines by completing any required tax forms today. Web file a form 3115 with your return for the 2019 tax year or a subsequent tax year, to claim them. See the instructions for lines 20a through.

Irs Instructions Form 4562 Fill Out and Sign Printable PDF Template

See the instructions for lines 20a through 20d, later. To complete form 4562, you'll need to know the cost of assets like. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. This form is also available at public. 05/26/22) georgia depreciation and amortization (i ncludinginformationon.

Irs Form 990 Ez Instructions Universal Network

See the instructions for lines 20a through 20d, later. Web the instructions for form 4562 include a worksheet that you can use to complete part i. To properly fill out form 4562, you’ll need the. See the instructions for lines 14 affecting fiscal tax years beginning in 2008 and 25 for more details. Complete, edit or print tax forms instantly.

Form Boc 3 Instructions Universal Network

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web what information do you need for form 4562? To properly fill out form 4562, you’ll need the. Web instructions for form 4562.

for Fill how to in IRS Form 4562

To properly fill out form 4562, you’ll need the. See the instructions for lines 20a through 20d, later. Get ready for tax season deadlines by completing any required tax forms today. Web instructions for form 4562 reflects changes property. See the instructions for lines 14 affecting fiscal tax years beginning in 2008 and 25 for more details.

Irs Form 4562 Instructions 2012 Universal Network

Get ready for tax season deadlines by completing any required tax forms today. Download a copy of the irs form 4562 from the irs official website. Something you’ll need to consider is that the amount you can deduct. To complete form 4562, you'll need to know the cost of assets like. Line 1 = $1 million, the maximum possible.

Web Here’s What Each Line Should Look Like As Outlined In The Irs Form 4562 Instructions, Along With A Few Examples.

Complete, edit or print tax forms instantly. General instructions purpose of form use form 4562 to: Web instructions for form 4562 depreciation and amortization (including information on listed property) section references are to the internal revenue code unless otherwise noted. Web get answers to frequently asked questions about form 4562 and section 179 in proseries professional and proseries basic:

• Claim Your Deduction For Depreciation And Amortization, •.

See the instructions for lines 14 affecting fiscal tax years beginning in 2008 and 25 for more details. Web instructions for form 4562. 2022 georgi a department of revenue. Web instructions for form 4562 reflects changes property.

Web Developments Related To Form 4562 And Its Instructions, Such As Legislation Enacted After This.

Web developments related to form 4562 and its instructions, such as legislation enacted after this form and instructions were published, go to www.irs.gov/form4562. Get ready for tax season deadlines by completing any required tax forms today. Web file a form 3115 with your return for the 2019 tax year or a subsequent tax year, to claim them. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets.

Something You’ll Need To Consider Is That The Amount You Can Deduct.

To properly fill out form 4562, you’ll need the. To complete form 4562, you'll need to know the cost of assets like. Form 4562 is used to claim a. This form is also available at public.