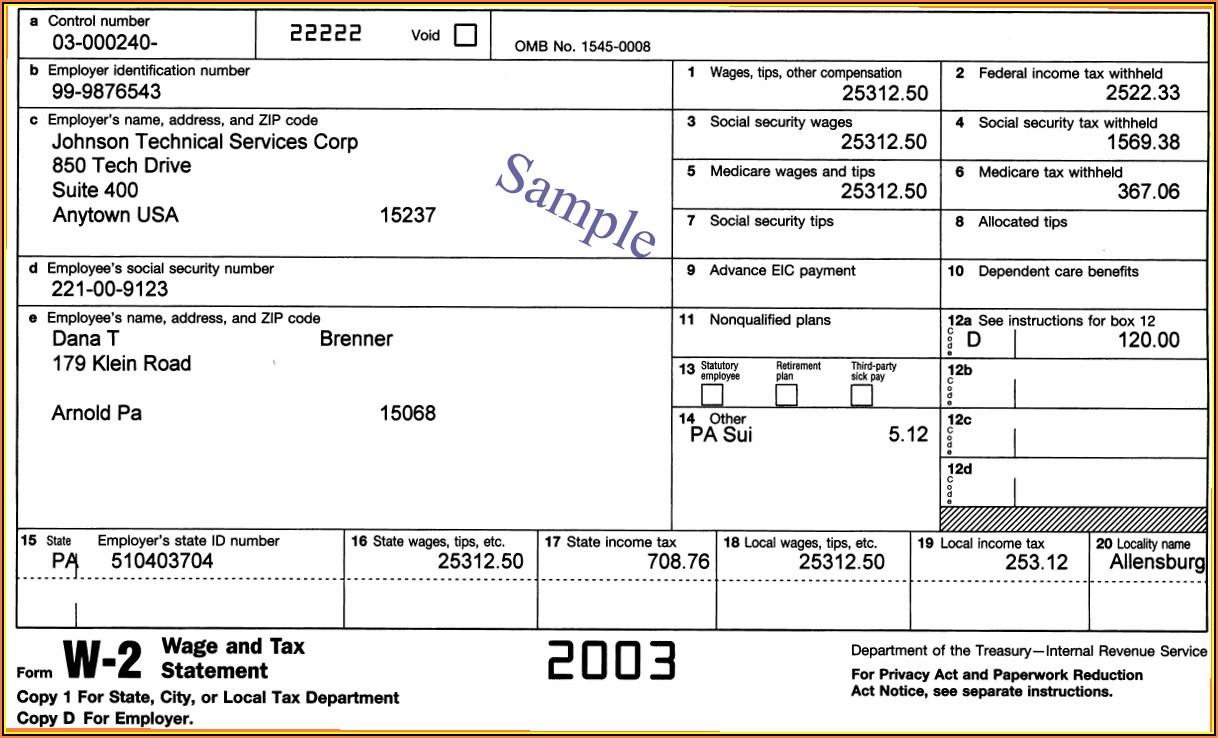

Income Reported To You On Form W-2 As Statutory Employee

Income Reported To You On Form W-2 As Statutory Employee - Social security and medicare tax should have been. Web copy 2 is used to report any state, city, or local income taxes. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately). Scroll down to the box 13 subsection. Copy c is for your records. The following examples use small dollar. Earnings as a statutory employee are.

Social security and medicare tax should have been. The following examples use small dollar. Web copy 2 is used to report any state, city, or local income taxes. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately). Scroll down to the box 13 subsection. Copy c is for your records. Earnings as a statutory employee are.

Copy c is for your records. Social security and medicare tax should have been. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately). Scroll down to the box 13 subsection. The following examples use small dollar. Earnings as a statutory employee are. Web copy 2 is used to report any state, city, or local income taxes.

Statutory From Employment / A triple whammy! Tax & Delay

Web copy 2 is used to report any state, city, or local income taxes. The following examples use small dollar. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately). Scroll down to the box 13 subsection. Copy c is for your records.

Box 12a State Of Alabama Withholding Form

The following examples use small dollar. Scroll down to the box 13 subsection. Web copy 2 is used to report any state, city, or local income taxes. Social security and medicare tax should have been. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately).

Statutory Employee Definition, Examples, And Management Tips Sling

Scroll down to the box 13 subsection. Copy c is for your records. Social security and medicare tax should have been. The following examples use small dollar. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately).

Statutory Employees and Your Retail Business Deputy

Copy c is for your records. The following examples use small dollar. Earnings as a statutory employee are. Web copy 2 is used to report any state, city, or local income taxes. Social security and medicare tax should have been.

IRS Form W2 Guide Understand How To Fill Out a W2 Form Ageras

Scroll down to the box 13 subsection. The following examples use small dollar. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately). Copy c is for your records. Earnings as a statutory employee are.

W2 Form Statutory Employee Form Resume Examples mx2Wxez96E

Web copy 2 is used to report any state, city, or local income taxes. Scroll down to the box 13 subsection. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately). Social security and medicare tax should have been. Earnings as a statutory employee are.

Statutory Employee Definition, Examples, And Management Tips Sling

Copy c is for your records. Scroll down to the box 13 subsection. The following examples use small dollar. Social security and medicare tax should have been. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately).

Form W2 Everything You Ever Wanted To Know

Web copy 2 is used to report any state, city, or local income taxes. Earnings as a statutory employee are. The following examples use small dollar. Copy c is for your records. Scroll down to the box 13 subsection.

Checking your W2 FireWalker Development Group

The following examples use small dollar. Web copy 2 is used to report any state, city, or local income taxes. Social security and medicare tax should have been. Earnings as a statutory employee are. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately).

Form W2 Easy to Understand Tax Guidelines 2020

Social security and medicare tax should have been. Copy c is for your records. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately). Scroll down to the box 13 subsection. Earnings as a statutory employee are.

Copy C Is For Your Records.

Scroll down to the box 13 subsection. Earnings as a statutory employee are. The following examples use small dollar. Web an employee’s income from $5,000 ($2,500 for married filing separately) to up to $10,500 ($5,250 for married filing separately).

Web Copy 2 Is Used To Report Any State, City, Or Local Income Taxes.

Social security and medicare tax should have been.