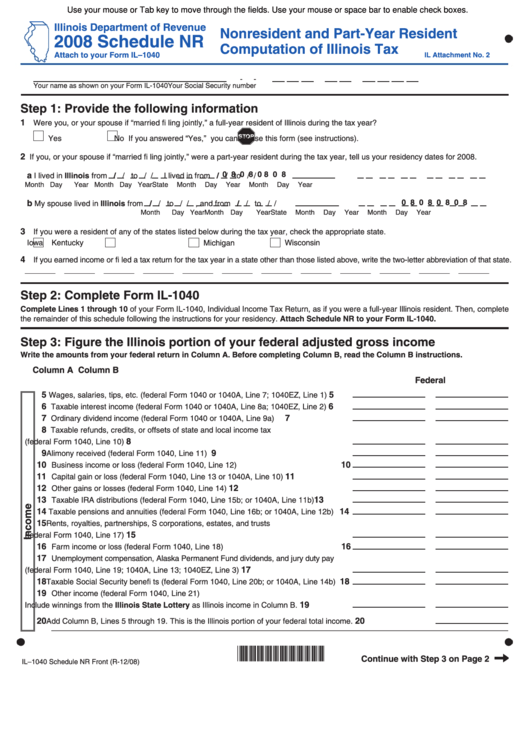

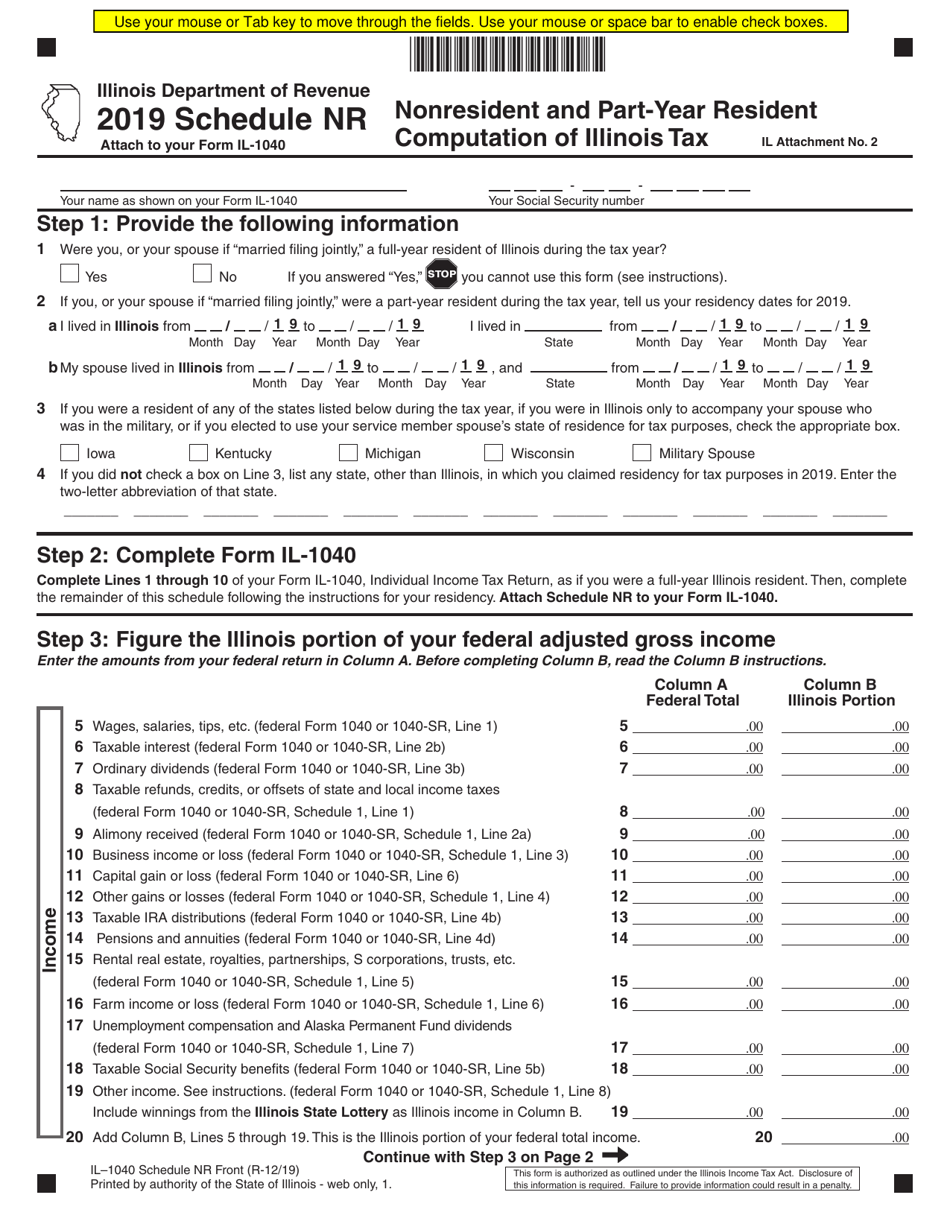

Illinois Non Resident Tax Form

Illinois Non Resident Tax Form - Web you must complete part 1 of this form if you are a resident of iowa, kentucky, michigan, or wisconsin and elect to claim exemption from withholding of illinois income tax under. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web resident computation of illinois tax, if you earned income from any source while you were a resident, you earned income from illinois sources while you were not a resident, or. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Web therefore, while these persons may believe they are no longer residents of illinois, they in fact may still be considered residents for illinois income tax purposes. Web registration sales & related withholding tax federal tax forms request certain forms from idor We last updated the nonresident income tax instruction. Here is a comprehensive list of. Web on august 26, 2019, illinois governor j.b. Complete, edit or print tax forms instantly.

Web schedule nr instruction booklet requires you to list multiple forms of income, such as wages, interest, or alimony. 2023 estimated income tax payments for individuals. Upon receipt of form il. Web registration sales & related withholding tax federal tax forms request certain forms from idor Web therefore, while these persons may believe they are no longer residents of illinois, they in fact may still be considered residents for illinois income tax purposes. Taxformfinder provides printable pdf copies of 76 current. Represented a deceased person who would have had to. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Here is a comprehensive list of. We last updated the nonresident income tax instruction.

Upon receipt of form il. Web schedule nr instruction booklet requires you to list multiple forms of income, such as wages, interest, or alimony. Complete, edit or print tax forms instantly. Were a nonresident alien engaged in a trade or business in the united states. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Taxformfinder provides printable pdf copies of 76 current. Illinois has a flat state income tax of 4.95% , which is administered by the illinois department of revenue. Web you must complete part 1 of this form if you are a resident of iowa, kentucky, michigan, or wisconsin and elect to claim exemption from withholding of illinois income tax under. Web therefore, while these persons may believe they are no longer residents of illinois, they in fact may still be considered residents for illinois income tax purposes. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and.

Which nonresident US tax forms you should file YouTube

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Web schedule nr instruction booklet requires you to list multiple forms of income, such as wages, interest, or alimony. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Web resident computation of.

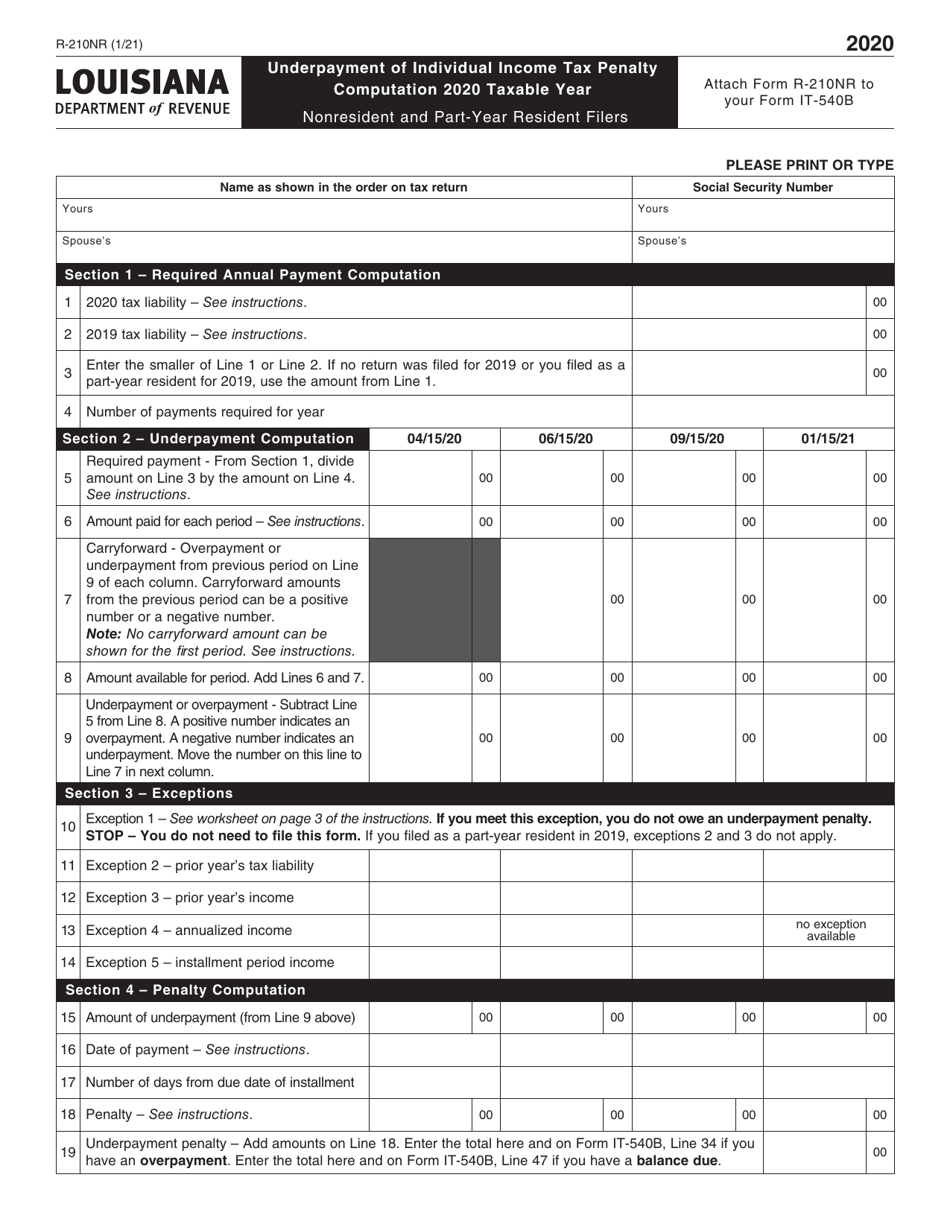

Form R210NR Download Fillable PDF or Fill Online Underpayment of

2023 estimated income tax payments for individuals. Web registration sales & related withholding tax federal tax forms request certain forms from idor Represented a deceased person who would have had to. We will update this page with a new version of the form for 2024 as soon as it is made available. Web schedule nr instruction booklet requires you to.

State Of Illinois Liquor License Fill Online, Printable, Fillable

Here is a comprehensive list of. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Illinois has a flat state income tax of 4.95% , which is administered by the illinois department of revenue. Web resident computation of illinois tax, if you earned income from any source while you were a.

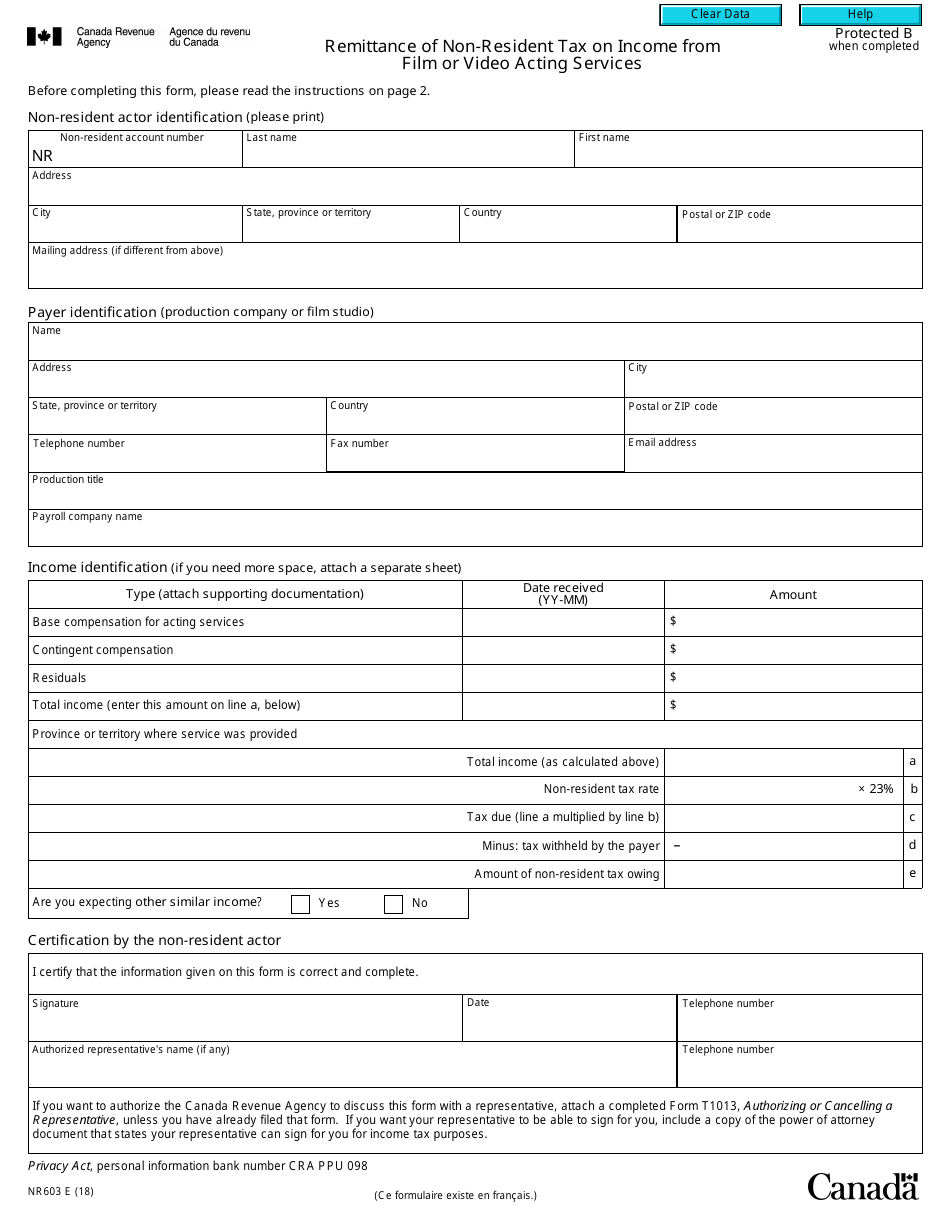

Form NR603 Download Fillable PDF or Fill Online Remittance of Non

Web resident computation of illinois tax, if you earned income from any source while you were a resident, you earned income from illinois sources while you were not a resident, or. Were a nonresident alien engaged in a trade or business in the united states. Taxformfinder provides printable pdf copies of 76 current. Represented a deceased person who would have.

Have you received one of these? Is the Tax Office asking you to pay Non

Web schedule nr instruction booklet requires you to list multiple forms of income, such as wages, interest, or alimony. Web resident computation of illinois tax, if you earned income from any source while you were a resident, you earned income from illinois sources while you were not a resident, or. Here is a comprehensive list of. Taxformfinder provides printable pdf.

Illinois Tax Withholding Forms 2022 W4 Form

Illinois has a flat state income tax of 4.95% , which is administered by the illinois department of revenue. Were a nonresident alien engaged in a trade or business in the united states. We will update this page with a new version of the form for 2024 as soon as it is made available. We last updated the nonresident income.

Delaware Non Resident Form 200 02 Fill Out and Sign Printable PDF

Web resident computation of illinois tax, if you earned income from any source while you were a resident, you earned income from illinois sources while you were not a resident, or. Web registration sales & related withholding tax federal tax forms request certain forms from idor We last updated the nonresident income tax instruction. 2023 estimated income tax payments for.

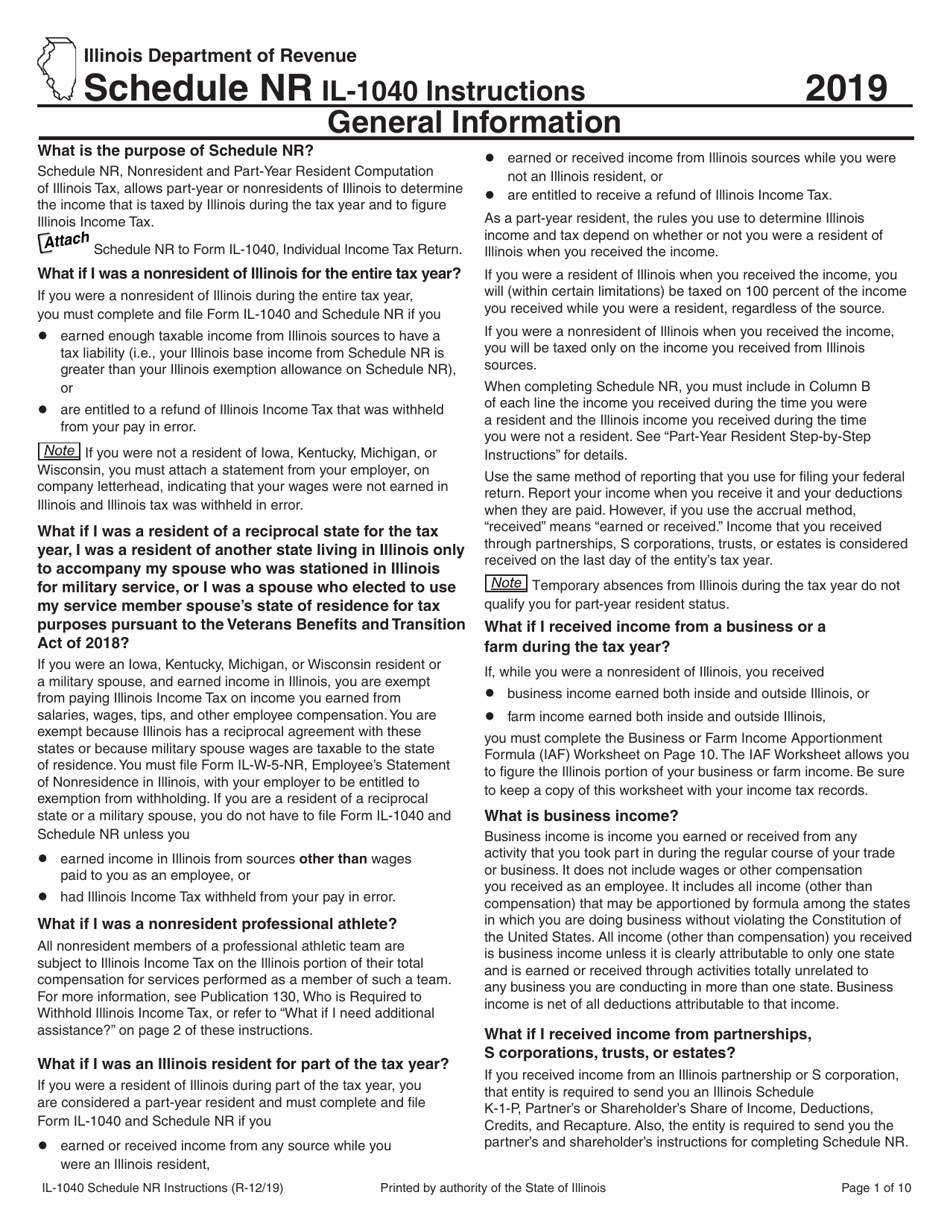

Download Instructions for Form IL1040 Schedule NR Nonresident and Part

We will update this page with a new version of the form for 2024 as soon as it is made available. Web therefore, while these persons may believe they are no longer residents of illinois, they in fact may still be considered residents for illinois income tax purposes. Illinois has a flat state income tax of 4.95% , which is.

Fillable Form Il1040 Schedule Nr Nonresident And PartYear

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. We last updated the nonresident income tax instruction. Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. Were a nonresident alien engaged in a trade or business in the united states. Taxformfinder.

Form IL1040 Schedule NR Download Fillable PDF or Fill Online

Complete, edit or print tax forms instantly. Here is a comprehensive list of. This form is used by illinois residents who file an individual income tax return. Web therefore, while these persons may believe they are no longer residents of illinois, they in fact may still be considered residents for illinois income tax purposes. Use this form for payments that.

Web Schedule Nr Instruction Booklet Requires You To List Multiple Forms Of Income, Such As Wages, Interest, Or Alimony.

Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Upon receipt of form il. Web what is the purpose of schedule nr? Web registration sales & related withholding tax federal tax forms request certain forms from idor

This Form Is Used By Illinois Residents Who File An Individual Income Tax Return.

Use this form for payments that are due on april 18, 2023, june 15, 2023, september 15, 2023, and. 2023 estimated income tax payments for individuals. Web therefore, while these persons may believe they are no longer residents of illinois, they in fact may still be considered residents for illinois income tax purposes. Represented a deceased person who would have had to.

We Last Updated The Nonresident Income Tax Instruction.

Web on august 26, 2019, illinois governor j.b. We will update this page with a new version of the form for 2024 as soon as it is made available. Taxformfinder provides printable pdf copies of 76 current. Were a nonresident alien engaged in a trade or business in the united states.

Here Is A Comprehensive List Of.

Complete, edit or print tax forms instantly. Illinois has a flat state income tax of 4.95% , which is administered by the illinois department of revenue. Web you must complete part 1 of this form if you are a resident of iowa, kentucky, michigan, or wisconsin and elect to claim exemption from withholding of illinois income tax under. Web resident computation of illinois tax, if you earned income from any source while you were a resident, you earned income from illinois sources while you were not a resident, or.