Ihss Tax Exempt Form

Ihss Tax Exempt Form - Tubular upper & lower arms. As of january 31, 2020, form 1023 applications for recognition of exemption must be submitted. Quarterly payroll and excise tax returns normally due on may 1. You had no federal income tax liability in 2020 and you expect to have no federal income tax. Select the form you received and follow the instructions to enter your payment in turbotax. Caregivers are typically employees of the individuals for whom they provide services because they work. Web you claim exemption, you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2023 tax return. Over 550,000 ihss providers currently. Web if you think you may qualify for an exemption 2, the provider, or the recipients on behalf of the provider, may submit the request for exemption for workweek limits for extraordinary circumstances (exemption 2) form (soc 2305) to the county ihss office.the county. For state withholding, use the worksheets on this form.

For more information and forms, go to the. Web if you think you may qualify for an exemption 2, the provider, or the recipients on behalf of the provider, may submit the request for exemption for workweek limits for extraordinary circumstances (exemption 2) form (soc 2305) to the county ihss office.the county. 505, tax withholding and estimated tax. Web california law allows an exclusion from gross income for ihss supplementary payments received by ihss providers. Select the form you received and follow the instructions to enter your payment in turbotax. Web american indian exemption for titled and/or registered vehicles and vessels (idaho sales and use tax administrative rules 091 and 107) the seller must see proof that the buyer is an enrolled member of an indian tribe for the sale to be exempt. Caregivers are typically employees of the individuals for whom they provide services because they work. Tubular upper & lower arms. These forms are unique to. As of january 31, 2020, form 1023 applications for recognition of exemption must be submitted.

As of january 31, 2020, form 1023 applications for recognition of exemption must be submitted. If you wish to claim. To check in turbotax online: Ihss providers only receive a supplementary payment if they paid a sales tax on the ihss services they provide. Web if you think you may qualify for an exemption 2, the provider, or the recipients on behalf of the provider, may submit the request for exemption for workweek limits for extraordinary circumstances (exemption 2) form (soc 2305) to the county ihss office.the county. Web applying for tax exempt status. Some states require government travelers to submit a form for this exemption. You may claim exemption from withholding for 2021 if you meet both of the following conditions: Caregivers are typically employees of the individuals for whom they provide services because they work. In order for the certificate to be accepted in good faith by the seller, the seller must exercise care that the property being sold is exempt.

FREE 10+ Sample Tax Exemption Forms in PDF

Some states require government travelers to submit a form for this exemption. Visit irs’s certain medicaid waiver payments may be excludable from. Web california law allows an exclusion from gross income for ihss supplementary payments received by ihss providers. Select the form you received and follow the instructions to enter your payment in turbotax. To check in turbotax online:

The IRS has developed a new Form W4, Employee's Withholding

Some states require government travelers to submit a form for this exemption. Select the form you received and follow the instructions to enter your payment in turbotax. You had no federal income tax liability in 2020 and you expect to have no federal income tax. We will update this page with a new. This form is for income earned in.

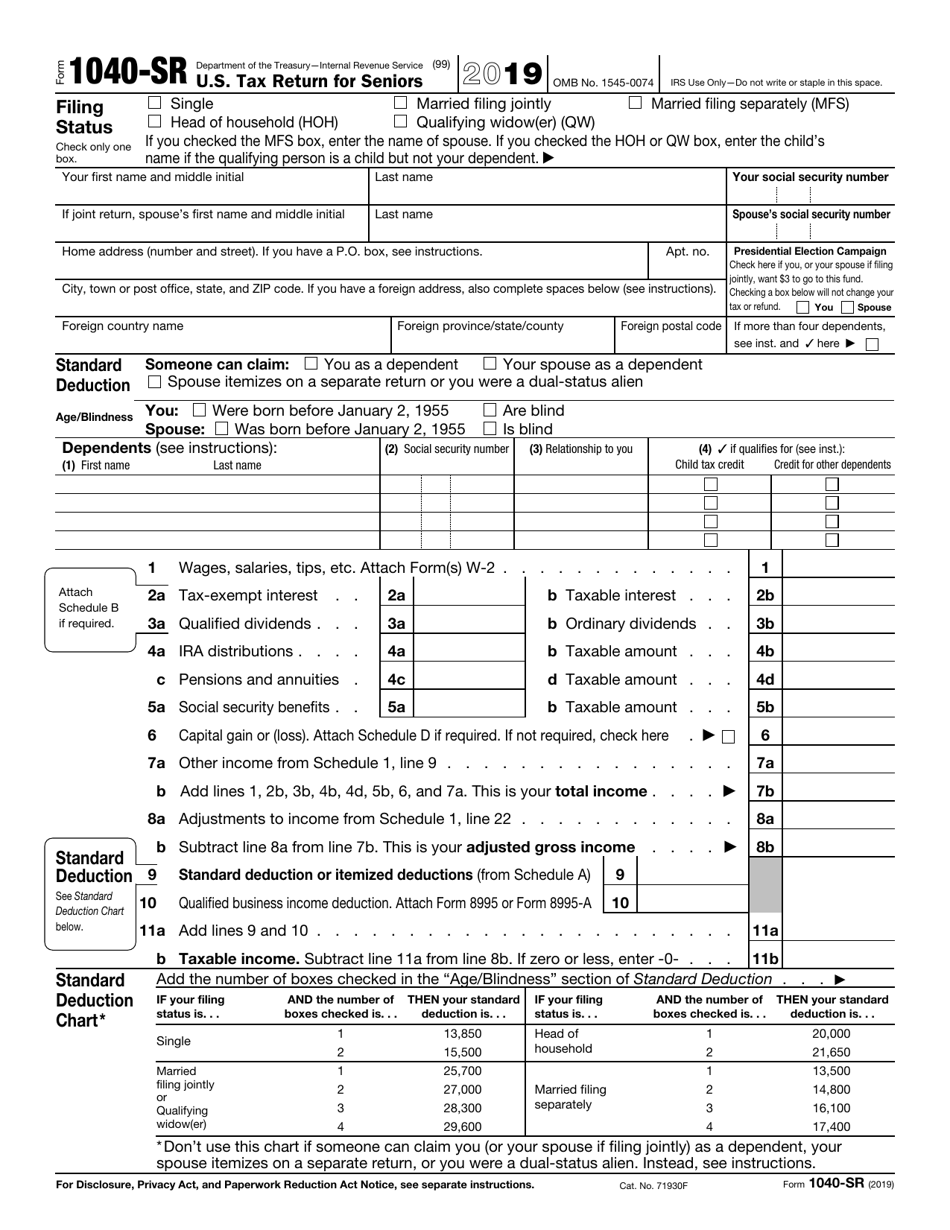

IRS Form 1040SR 2019 Fill Out, Sign Online and Download Fillable

These forms are unique to. To check in turbotax online: Web american indian exemption for titled and/or registered vehicles and vessels (idaho sales and use tax administrative rules 091 and 107) the seller must see proof that the buyer is an enrolled member of an indian tribe for the sale to be exempt. Tubular upper & lower arms. Some states.

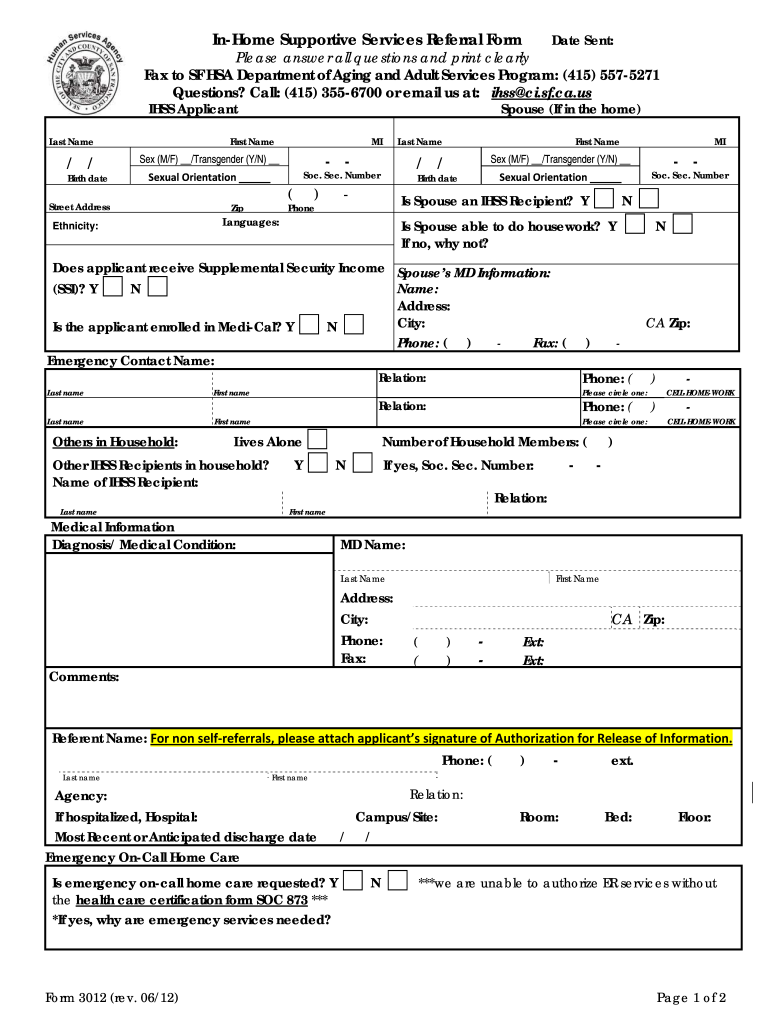

Ihss Application Form Fill Online, Printable, Fillable, Blank pdfFiller

Caregivers are typically employees of the individuals for whom they provide services because they work. You had no federal income tax liability in 2020 and you expect to have no federal income tax. Web california law allows an exclusion from gross income for ihss supplementary payments received by ihss providers. Web click image to zoom. As of january 31, 2020,.

Military Tax Exempt form Easy Full List Of Property Tax Exemptions by State

In order for the certificate to be accepted in good faith by the seller, the seller must exercise care that the property being sold is exempt. Web applying for tax exempt status. Some states require government travelers to submit a form for this exemption. Web if you think you may qualify for an exemption 2, the provider, or the recipients.

Gm Service Manual Dvd In Home Supportive Services Direct Deposit Form

The supplementary payment is equal. Caregivers are typically employees of the individuals for whom they provide services because they work. Web if you think you may qualify for an exemption 2, the provider, or the recipients on behalf of the provider, may submit the request for exemption for workweek limits for extraordinary circumstances (exemption 2) form (soc 2305) to the.

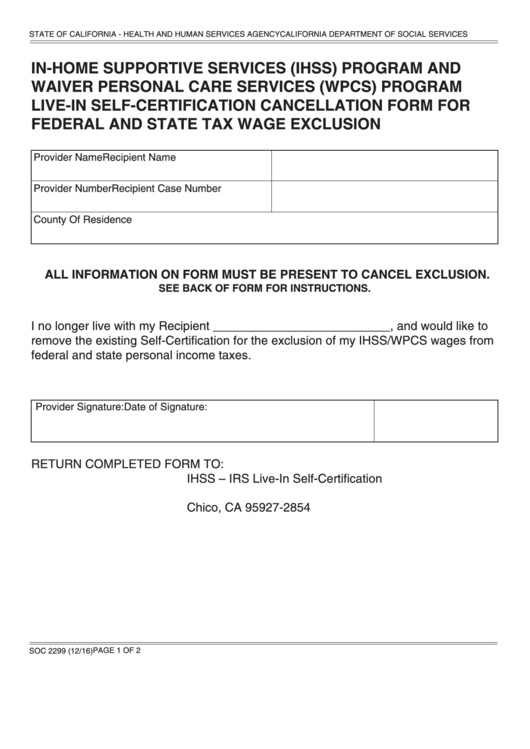

What Is Ihss Certification

You may claim exemption from withholding for 2021 if you meet both of the following conditions: To claim exemption from withholding, certify that you meet both of the conditions above by writing “exempt” on. Ihss providers only receive a supplementary payment if they paid a sales tax on the ihss services they provide. Web if you think you may qualify.

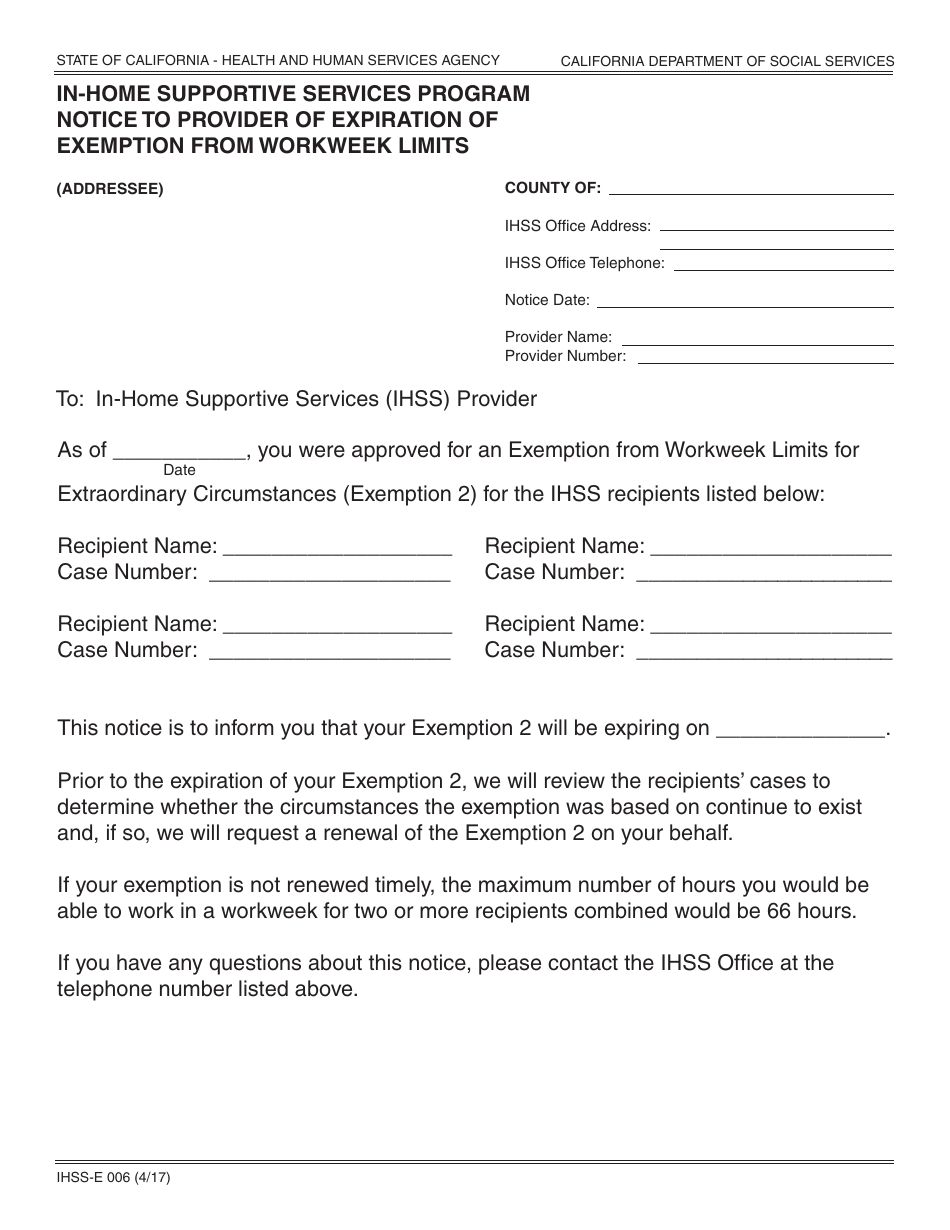

Form Ihsse006 Download Fillable Pdf Or Fill Online Inhome Supportive

Web you claim exemption, you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2023 tax return. If you wish to claim. Some states require government travelers to submit a form for this exemption. For more information and forms, go to the. Tubular upper & lower arms.

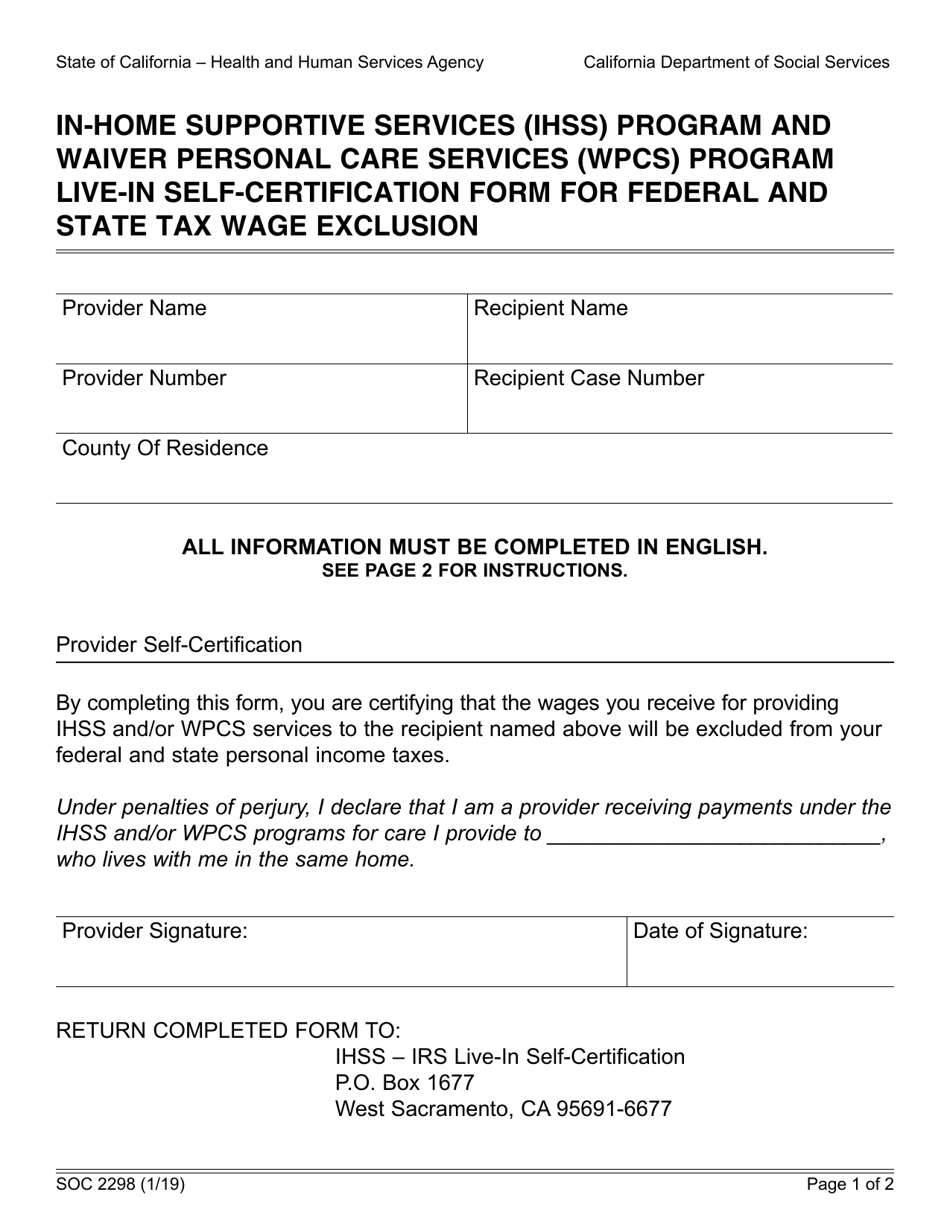

Soc 2298 20202022 Fill and Sign Printable Template Online US Legal

Over 550,000 ihss providers currently. Web click image to zoom. These forms are unique to. Web you claim exemption, you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2023 tax return. As of january 31, 2020, form 1023 applications for recognition of exemption must be submitted.

In Home Supportive Services Ihss Program Provider Enrollment Form

Ihss providers only receive a supplementary payment if they paid a sales tax on the ihss services they provide. Some states require government travelers to submit a form for this exemption. Select the form you received and follow the instructions to enter your payment in turbotax. You had no federal income tax liability in 2020 and you expect to have.

Caregivers Are Typically Employees Of The Individuals For Whom They Provide Services Because They Work.

To check in turbotax online: You had no federal income tax liability in 2020 and you expect to have no federal income tax. Web if you think you may qualify for an exemption 2, the provider, or the recipients on behalf of the provider, may submit the request for exemption for workweek limits for extraordinary circumstances (exemption 2) form (soc 2305) to the county ihss office.the county. Some states require government travelers to submit a form for this exemption.

Web Click Image To Zoom.

For state withholding, use the worksheets on this form. Web when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax. Web describe product or services purchased exempt from tax telephone number type of business. Quarterly payroll and excise tax returns normally due on may 1.

Select The Form You Received And Follow The Instructions To Enter Your Payment In Turbotax.

Web you claim exemption, you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2023 tax return. The supplementary payment is equal. Visit irs’s certain medicaid waiver payments may be excludable from. Web compare the state income tax withheld with your estimated total annual tax.

505, Tax Withholding And Estimated Tax.

These forms are unique to. As of january 31, 2020, form 1023 applications for recognition of exemption must be submitted. Web american indian exemption for titled and/or registered vehicles and vessels (idaho sales and use tax administrative rules 091 and 107) the seller must see proof that the buyer is an enrolled member of an indian tribe for the sale to be exempt. Tubular upper & lower arms.