Idaho Tax Extension Form 51

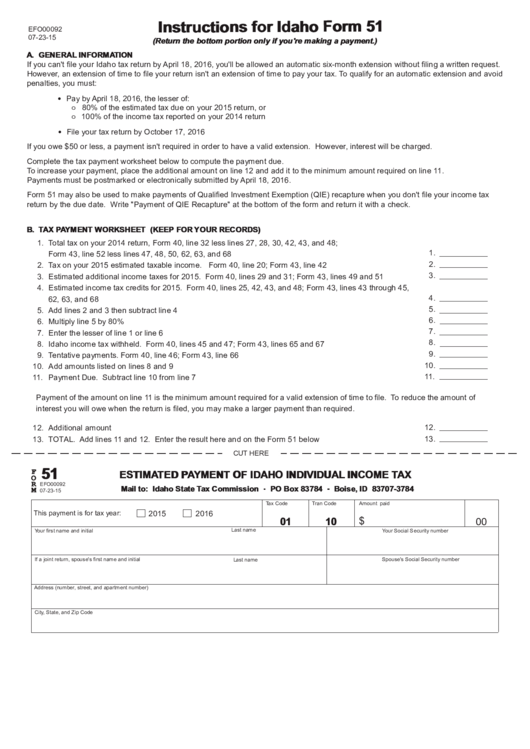

Idaho Tax Extension Form 51 - If you’re unsure whether you owe idaho tax or you want to. To make a payment and avoid a penalty, do one of the following: Web form 49r—recapture of idaho investment tax credit form cg—idaho capital gains deduction form 51—estimated payment of idaho individual income tax (extension. Web instead, idaho state tax commission provides form 51 solely to be used as a voucher to accompany an extension payment. Web use form 51 to calculate any payment due for a valid tax year 2021 extension or make estimated payments for tax year 2022 (check the appropriate year. Mail form 51 with your check or money order. Web tax extension idaho requires: Web it appears you don't have a pdf plugin for this browser. Make an online payment through the idaho state tax commission website. Web to see if you qualify for an extension, complete the worksheet on idaho form 51, estimated payment of individual income tax.

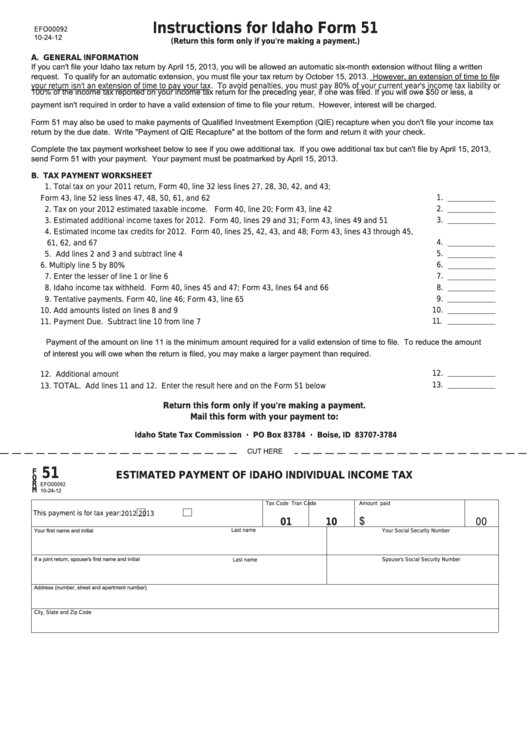

Web it appears you don't have a pdf plugin for this browser. Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment. Mail form 51 with your check or money order. Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment. Web mail form 51 with your check or money order. Web form 49r—recapture of idaho investment tax credit form cg—idaho capital gains deduction form 51—estimated payment of idaho individual income tax (extension. If you need to make a payment, you can mail the. Details on the form 51 payment voucher and. Web to see if you qualify for an extension, complete the worksheet on idaho form 51, estimated payment of individual income tax. Estimated payment of idaho individual income tax 2013.

Web if you do not owe idaho income taxes or expect a tax refund by the tax deadline, your accepted federal extension will be honored as a state extension, and you do not have. Web you can find form 51 at tax.idaho.gov. Web use form 51 to calculate any payment due for a valid tax year 2021 extension or make estimated payments for tax year 2022 (check the appropriate year. Web to see if you qualify for an extension, complete the worksheet on idaho form 51, estimated payment of individual income tax. Estimated payment of idaho individual income tax 2013. Web use form 51 to calculate any payment due for a valid tax year 2022 extension or make estimated payments for tax year 2023 (check the appropriate year. If you’re unsure whether you owe idaho tax or you want to. To make a payment and avoid a penalty, do one of the following: Make an online payment through the idaho state tax commission website. The state of idaho doesn’t require any extension form as it automatically grants extensions up to 6 months.

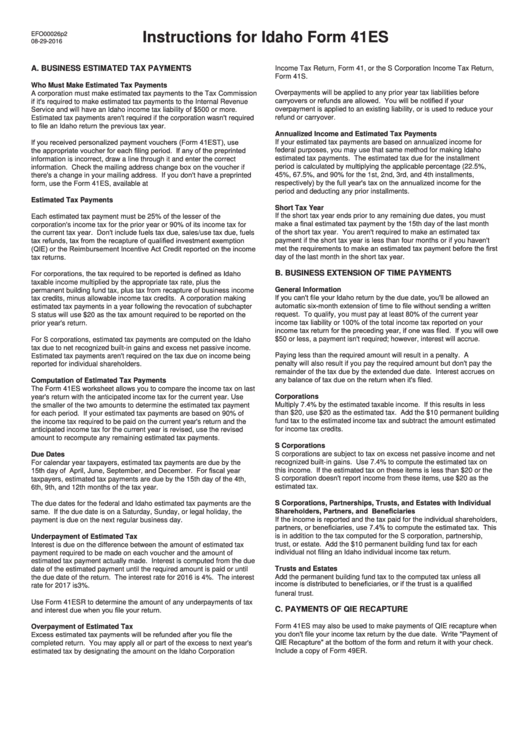

Instructions For Idaho Form 41es printable pdf download

Web it appears you don't have a pdf plugin for this browser. Make an online payment through the idaho state tax commission website. Estimated payment of idaho individual income tax 2014. Web you can find form 51 at tax.idaho.gov. The state of idaho doesn’t require any extension form as it automatically grants extensions up to 6 months.

Idaho Tax Relief Payments Head Out First Week of August

Web form 51 is an idaho individual income tax form. Web if you do not owe idaho income taxes or expect a tax refund by the tax deadline, your accepted federal extension will be honored as a state extension, and you do not have. General information if you can't file your idaho tax return. Web mail form 51 with your.

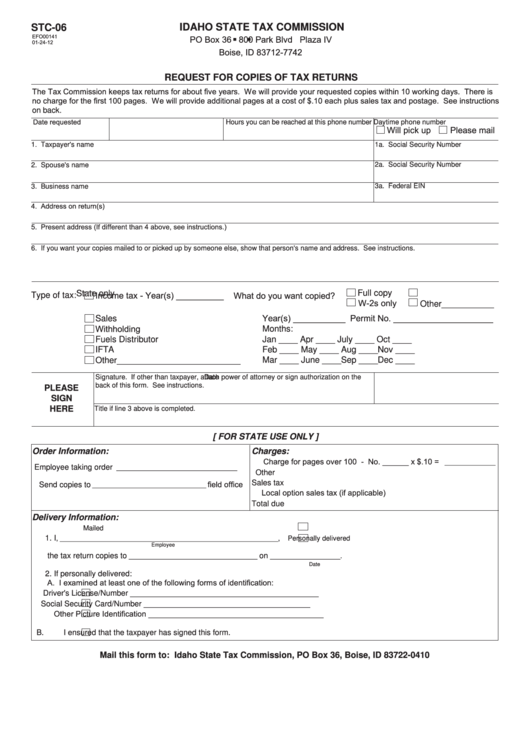

Fillable Form Stc06 Idaho State Tax Commission printable pdf download

Web if you do not owe idaho income taxes or expect a tax refund by the tax deadline, your accepted federal extension will be honored as a state extension, and you do not have. The state of idaho doesn’t require any extension form as it automatically grants extensions up to 6 months. Mail form 51 with your check or money.

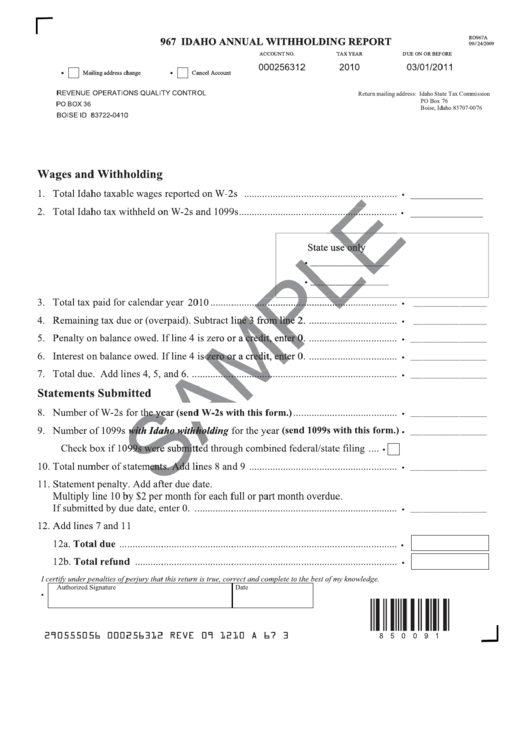

Form Ro967a Idaho Annual Withholding Report printable pdf download

The state of idaho doesn’t require any extension form as it automatically grants extensions up to 6 months. Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment. File this statement with the idaho state tax. General information if you can't file your idaho tax return. Web if you do not owe.

Idaho Sales Tax Guide

File this statement with the idaho state tax. Web if you do not owe idaho income taxes or expect a tax refund by the tax deadline, your accepted federal extension will be honored as a state extension, and you do not have. Make an online payment through the idaho state tax commission website. While most taxpayers have income taxes automatically.

Fillable Idaho Form 51 (2015) Estimated Payment Of Idaho Individual

Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment. Web use form 51 to calculate any payment due for a valid tax year 2021 extension or make estimated payments for tax year 2022 (check the appropriate year. Web you can find form 51 at tax.idaho.gov. Web to see if you qualify.

Idaho Sales Tax Exemption Form St 133 20202021 Fill and Sign

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money. Web it appears you don't have a pdf plugin for this browser. Details on the form 51 payment voucher and. Estimated payment of idaho individual income tax 2013. General information if you can't file your idaho tax return.

Idaho Corporate Tax Rate Decrease Enacted

Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment. Mail form 51 with your check or money order. Web tax extension idaho requires: To make a payment and avoid a penalty, do one of the following: If you’re unsure whether you owe idaho tax or you want to.

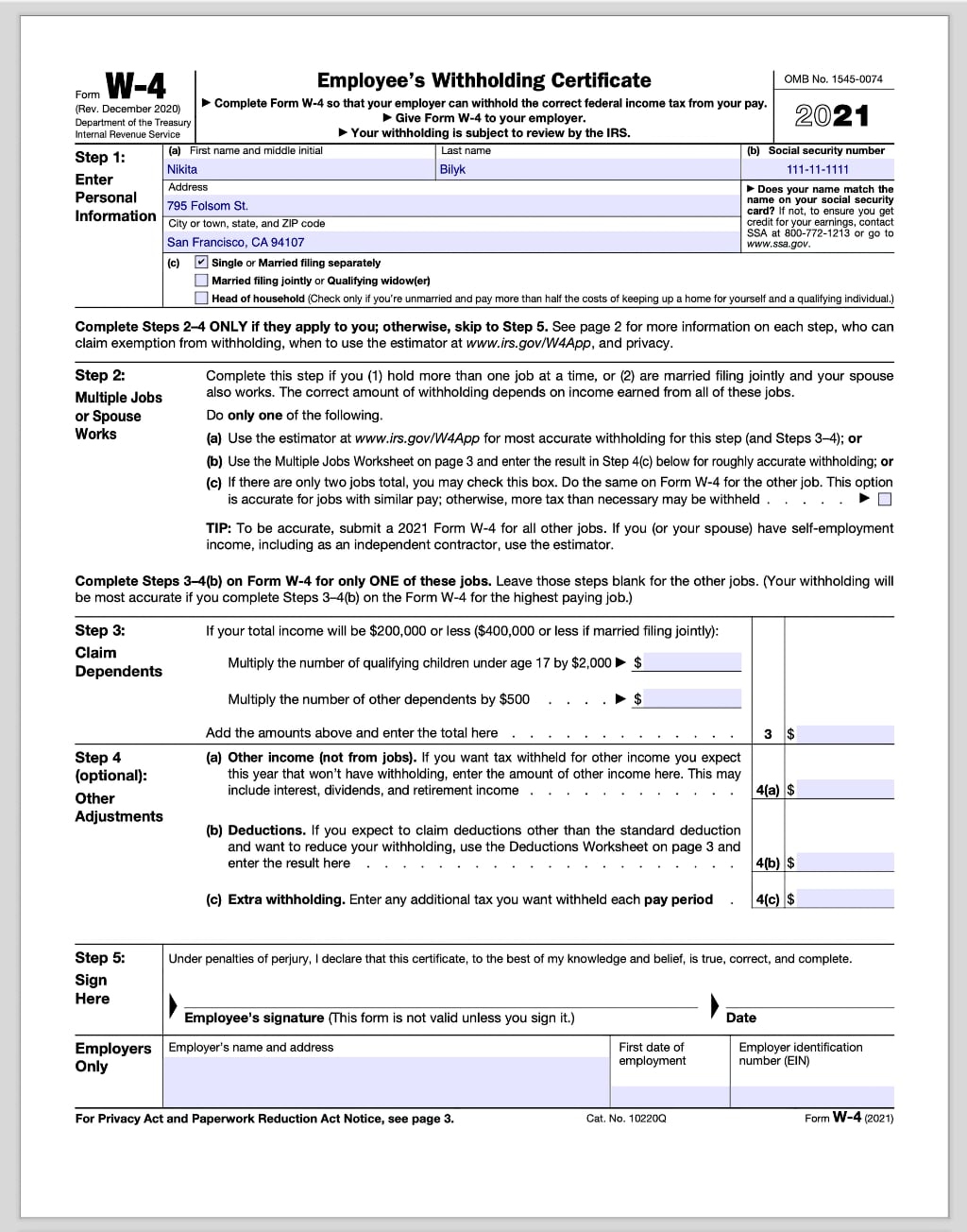

Idaho W 4 2021 2022 W4 Form

To make a payment and avoid a penalty, do one of the following: Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment. Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment. Mail form 51 with your check or money order. While most.

Fillable Form 51 Estimated Payment Of Idaho Individual Tax

Web to ensure you owe tax, use worksheet form 51. Web tax extension idaho requires: If you’re unsure whether you owe idaho tax or you want to. Web to see if you qualify for an extension, complete the worksheet on idaho form 51, estimated payment of individual income tax. The worksheet will help you figure.

The State Of Idaho Doesn’t Require Any Extension Form As It Automatically Grants Extensions Up To 6 Months.

Web form 51 is an idaho individual income tax form. Web instead, idaho state tax commission provides form 51 solely to be used as a voucher to accompany an extension payment. General information if you can't file your idaho tax return. Web use idaho form 51 (estimated payment of idaho individual income tax) to make a state extension payment.

The Worksheet Will Help You Figure.

Web form 49r—recapture of idaho investment tax credit form cg—idaho capital gains deduction form 51—estimated payment of idaho individual income tax (extension. Web to ensure you owe tax, use worksheet form 51. Web tax extension idaho requires: If you’re unsure whether you owe idaho tax or you want to.

Web Use Form 51 To Calculate Any Payment Due For A Valid Tax Year 2021 Extension Or Make Estimated Payments For Tax Year 2022 (Check The Appropriate Year.

Details on the form 51 payment voucher and. Mail form 51 with your check or money order. To make a payment and avoid a penalty, do one of the following: Estimated payment of idaho individual income tax 2013.

Mail Form 51 With Your Check Or Money Order.

Web you can find form 51 at tax.idaho.gov. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money. After you finish the worksheet, do one of the following: Web to see if you qualify for an extension, complete the worksheet on idaho form 51, estimated payment of individual income tax.