How To Form A Sole Proprietorship In Texas

How To Form A Sole Proprietorship In Texas - Decide on your business structure and register your business name 5. If the business is conducted under an assumed name (a name other than the surname of the individual), then an assumed name. Despite not being a legitimate corporate structure, it is the simplest and most possible way for small business owners to operate their companies and to make an average of $45,000 to $50,000. Texas law allows you to operate a sole proprietorship under a name other than your own. If you decide to incorporate, the secretary of state’s office (sos) website has information on choosing the right legal structure for you. In a sole proprietorship, a single individual engages in a business activity without necessity of formal organization. Web in general, sole proprietorships and partnerships need to register and file the business name (dba or assumed name) with their local county clerk’s office. File an assumed name certificate with your county. Web how to set up a sole proprietorship in texas 1. Determine business tax responsibilities 6.

If your business name is different from your own name, texas requires you to work with the country. A company that has one owner who controls and manages the business is known as a sole proprietorship. Web here’s how to start a sole proprietorship in seven steps: Web how to start a sole proprietorship in texas in 2023. Decide on a business name. If the business is conducted under an assumed name (a name other than the surname of the individual), then an assumed name. Figure out required licenses and permits 7. If you decide to incorporate, the secretary of state’s office (sos) website has information on choosing the right legal structure for you. Web if the business is conducted under an assumed name (a name other than the surname of the individual), then an assumed name certificate (commonly referred to as a dba) should be filed with the office of the county clerk in the county where a. Web how to set up a sole proprietorship in texas 1.

Figure out required licenses and permits 7. File an assumed name certificate with your county. Now that you have logged in to your alecs account, choose submit application. If you use a business name that's different from your legal name,. Web how to set up a sole proprietorship in texas 1. Coming up with a business name can be exciting―it is a representation of you and the product or. A company that has one owner who controls and manages the business is known as a sole proprietorship. Web how to start a sole proprietorship in texas in 2023. Select the type of ownership for the business. Web how to start a sole proprietorship in texas 1.

SOLE PROPRIETORSHIP Business Ownership

Write your business plan 2. If the business is conducted under an assumed name (a name other than the surname of the individual), then an assumed name. Coming up with a business name can be exciting―it is a representation of you and the product or. If you use a business name that's different from your legal name,. Web if the.

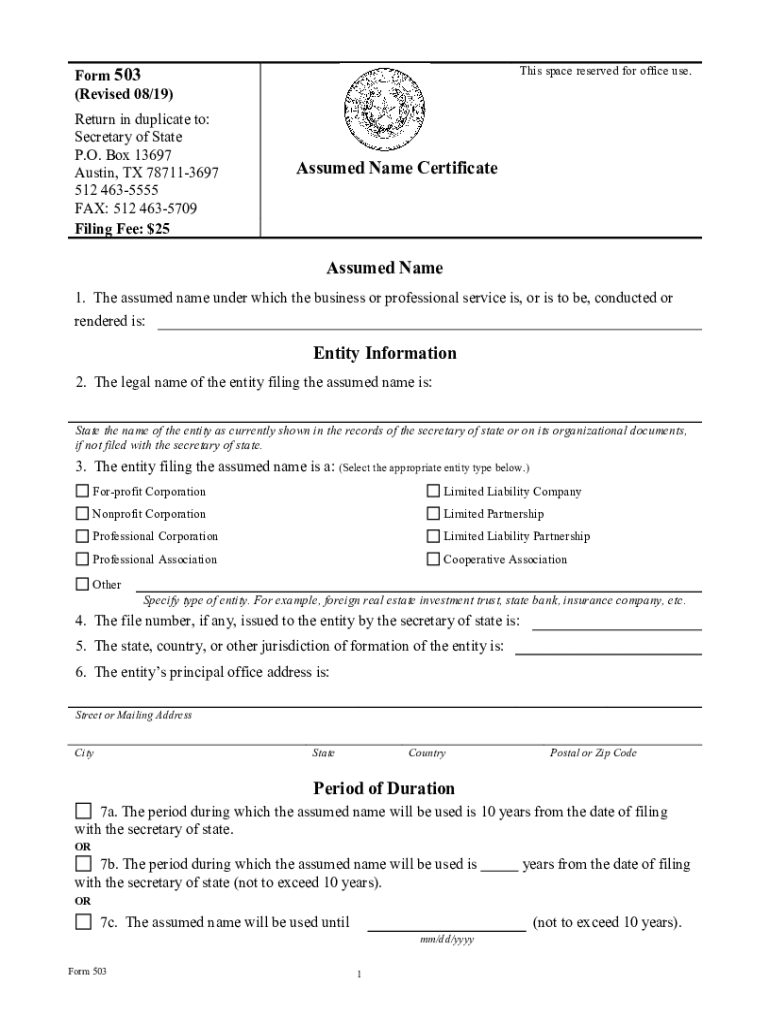

Get TX Form 503 2019 and fill it out in December 2022 pdffiller

Decide on a business name. Coming up with a business name can be exciting―it is a representation of you and the product or. Web getting started step 2: Web how to set up a sole proprietorship in texas 1. Web how to start a sole proprietorship in texas 1.

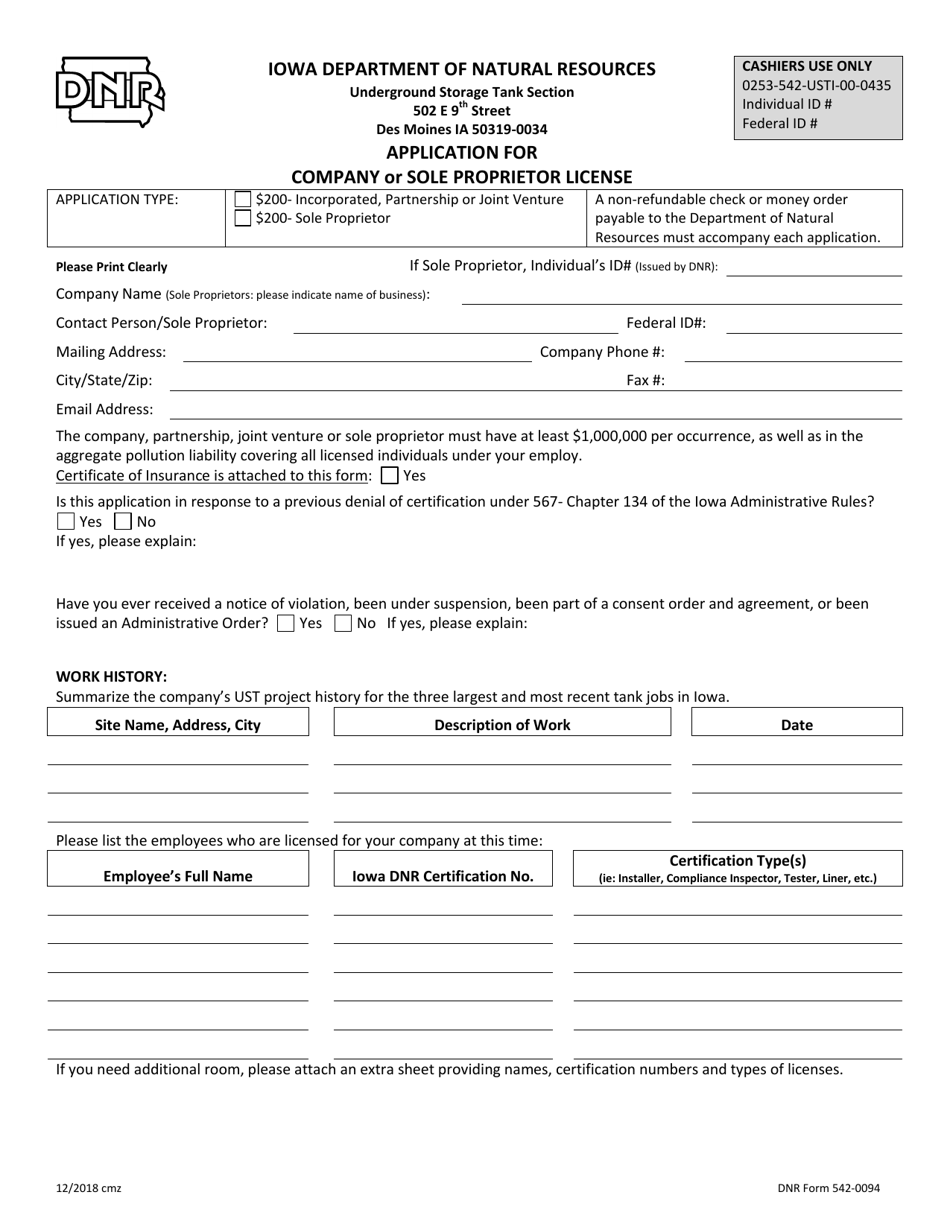

DNR Form 5420094 Download Fillable PDF or Fill Online Application for

The most common and the simplest form of business is the sole proprietorship. Web how to start a sole proprietorship in texas in 2023. In a sole proprietorship, a single individual engages in a business activity without necessity of formal organization. Select the type of ownership for the business. Web how to set up a sole proprietorship in texas 1.

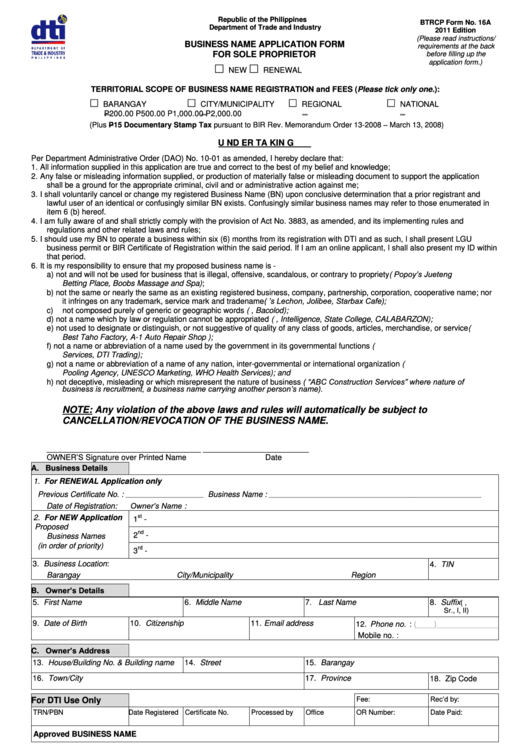

Business Name Application Form Sole Proprietorship Sole

A company that has one owner who controls and manages the business is known as a sole proprietorship. If you use a business name that's different from your legal name,. Web how to set up a sole proprietorship in texas 1. Select the type of ownership for the business. Web in general, sole proprietorships and partnerships need to register and.

Btrcp Form 16a Business Name Application Form For Sole Proprietor

Coming up with a business name can be exciting―it is a representation of you and the product or. Decide on a business name. In texas, a sole proprietor can use their own legal name or a trade name—also sometimes known. Write your business plan 2. Texas law allows you to operate a sole proprietorship under a name other than your.

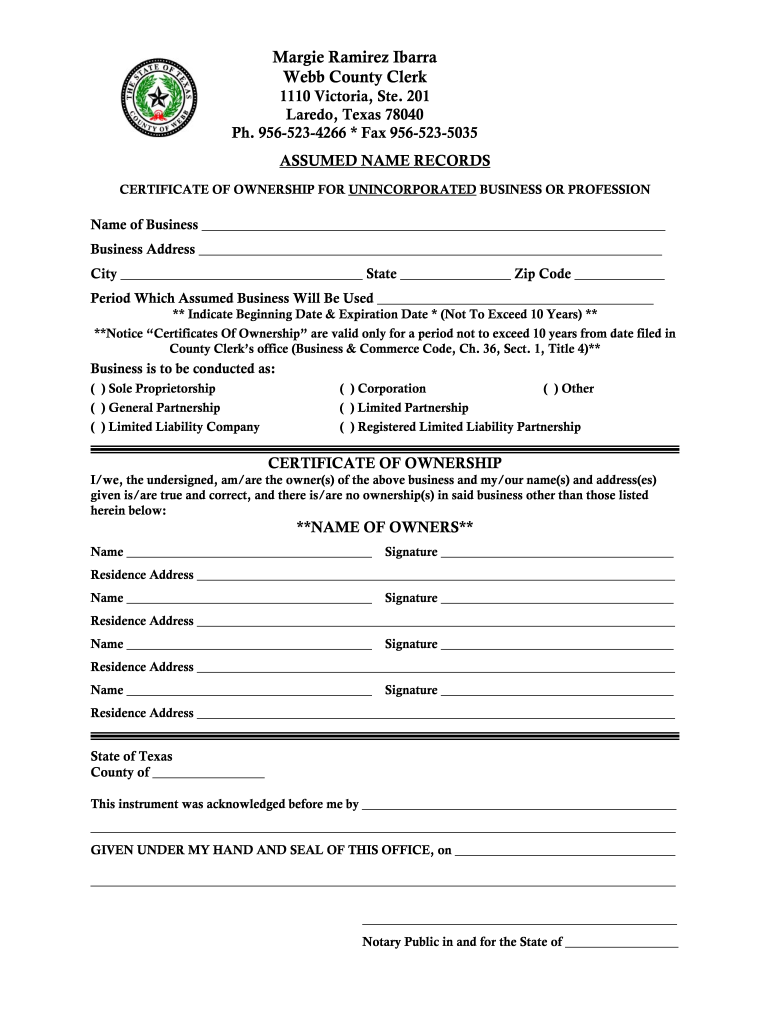

Dba Certificate Form Fill Out and Sign Printable PDF Template signNow

Select the type of ownership for the business. If you decide to incorporate, the secretary of state’s office (sos) website has information on choosing the right legal structure for you. Web how to start a sole proprietorship in texas in 2023. In a sole proprietorship, a single individual engages in a business activity without necessity of formal organization. Choose your.

Getting 147C Online (EIN Designation Confirmation Letter) by Vadym

Web if the business is conducted under an assumed name (a name other than the surname of the individual), then an assumed name certificate (commonly referred to as a dba) should be filed with the office of the county clerk in the county where a. A company that has one owner who controls and manages the business is known as.

Assumed Name Certificate Texas Sole Proprietorship Form champion

The most common and the simplest form of business is the sole proprietorship. Decide on your business structure and register your business name 5. If the business is conducted under an assumed name (a name other than the surname of the individual), then an assumed name. Next, choose the type of license for which you want to apply. Web in.

Sole Proprietorship Paper Form Fill Out and Sign Printable PDF

Web how to start a sole proprietorship in texas in 2023. Texas law allows you to operate a sole proprietorship under a name other than your own. Now that you have logged in to your alecs account, choose submit application. If you use a business name that's different from your legal name,. Web here’s how to start a sole proprietorship.

Agreement for Sale of Business by Sole Proprietorship including

Choose your business location 3. File an assumed name certificate with your county. Write your business plan 2. In a sole proprietorship, a single individual engages in a business activity without necessity of formal organization. Determine business tax responsibilities 6.

Web Getting Started Step 2:

Now that you have logged in to your alecs account, choose submit application. Web how to start a sole proprietorship in texas in 2023. In texas, a sole proprietor can use their own legal name or a trade name—also sometimes known. Web how to start a sole proprietorship in texas 1.

Texas Law Allows You To Operate A Sole Proprietorship Under A Name Other Than Your Own.

Figure out required licenses and permits 7. Select the type of ownership for the business. A company that has one owner who controls and manages the business is known as a sole proprietorship. Web how to set up a sole proprietorship in texas 1.

If The Business Is Conducted Under An Assumed Name (A Name Other Than The Surname Of The Individual), Then An Assumed Name.

The most common and the simplest form of business is the sole proprietorship. Next, choose the type of license for which you want to apply. Web here’s how to start a sole proprietorship in seven steps: Write your business plan 2.

In A Sole Proprietorship, A Single Individual Engages In A Business Activity Without Necessity Of Formal Organization.

Despite not being a legitimate corporate structure, it is the simplest and most possible way for small business owners to operate their companies and to make an average of $45,000 to $50,000. Web if the business is conducted under an assumed name (a name other than the surname of the individual), then an assumed name certificate (commonly referred to as a dba) should be filed with the office of the county clerk in the county where a. Choose your business location 3. Determine business tax responsibilities 6.