How To Fill Out Form 7203 In Turbotax

How To Fill Out Form 7203 In Turbotax - Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. • most taxpayers use form 1040 to report their taxable income to the irs. I am not seeing the gain reported automatically on an irs form 8949 / schedule d capital. Web the form 7203 is filed by the individual s shareholder with their federal form 1040 return. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Certify that you are not subject to backup. How do i clear ef messages 5486 and 5851? Web new form 7203 filing i have a 2 part question on the new form 7203 s corp shareholder stock basis. Web 1040 individual what is form 7203? This form is used by s corporation shareholders to figure out the potential limitations of their share of the s.

First, turbotax will ask you some basic. Web comments on the draft instructions can be provided to lbi.passthrough.international.form.changes@irs.gov on or before november 8, 2022. Help videos short videos for a long list of topics. New items on form 7203. Here are a few tips that will help you fill in the needed information. Web 29 july 2022 are you curious about irs form 7203? You may find your answers in this irs document instructions for form 7203, s corporation shareholder stock and debt basis limitations. Web discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203. • most taxpayers use form 1040 to report their taxable income to the irs. Web the form 7203 is filed by the individual s shareholder with their federal form 1040 return.

Basis is handled as follows: Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. New items on form 7203. You can create an account with turbotax and begin filing your tax return. Web discussions taxes get your taxes done dkroc level 2 please explain stock block on form 7203. I have read all of the instructions for form 7203, but cannot find. • most taxpayers use form 1040 to report their taxable income to the irs. Web the form 7203, s corporation shareholder stock and debt basis limitations is not used or supported in any of the personal turbotax desktop editions, including. Web new form 7203 filing i have a 2 part question on the new form 7203 s corp shareholder stock basis. Web 29 july 2022 are you curious about irs form 7203?

Solved What is a NOL form for? I've never had to fill out a NOL form

Web new form 7203 filing i have a 2 part question on the new form 7203 s corp shareholder stock basis. Certify that you are not subject to backup. Web watch videos to learn about everything turbotax — from tax forms and credits to installation and printing. Web if you plan on claiming one of the irs educational tax credits,.

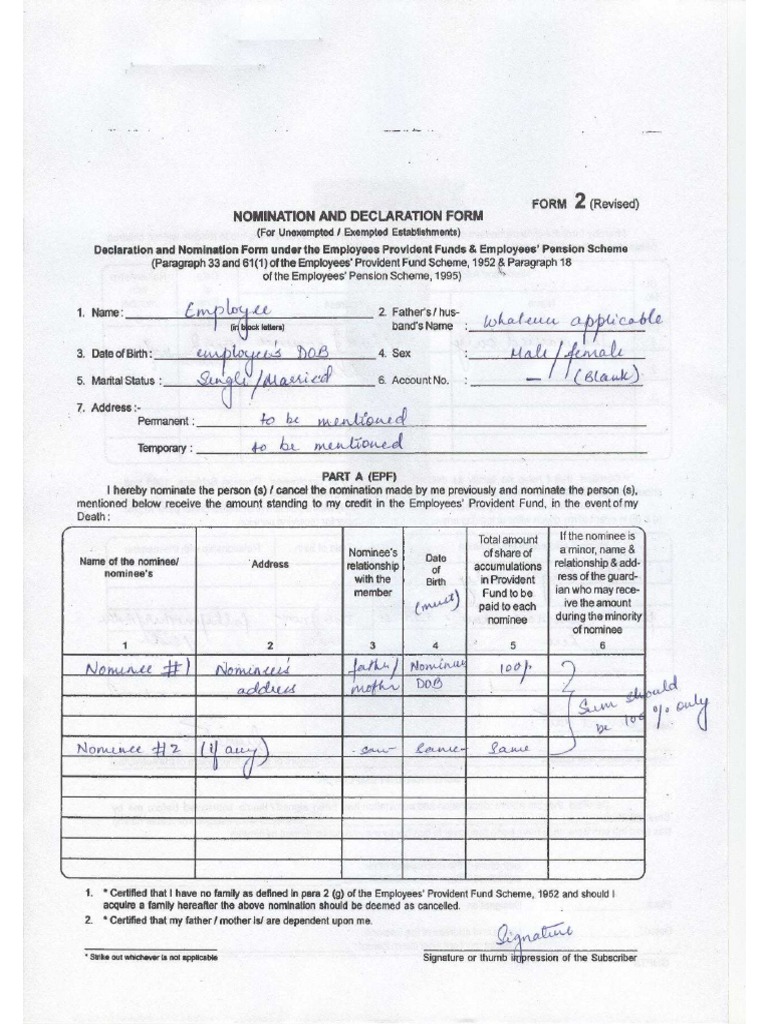

Sample Form 2 PDF

Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web if one of.

How to complete IRS Form 720 for the PatientCentered Research

Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. Web the form 7203 interview is slightly different in turbotax desktop, but the main entries on the form are made manually using the same format as turbotax online. Web filing your taxes.

How to complete IRS Form 720 for the PatientCentered Research

Basis is handled as follows: Web 1040 individual what is form 7203? You may find your answers in this irs document instructions for form 7203, s corporation shareholder stock and debt basis limitations. New items on form 7203. Certify that you are not subject to backup.

National Association of Tax Professionals Blog

You can create an account with turbotax and begin filing your tax return. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. Web watch videos to learn about everything turbotax — from tax forms and credits to installation and printing. Web the.

Peerless Turbotax Profit And Loss Statement Cvp

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. • most taxpayers use form 1040 to report their taxable income to the irs. The s corporation should provide a tax basis schedule that can be provided to the. Web if one.

form 8915 e instructions turbotax Renita Wimberly

The s corporation should provide a tax basis schedule that can be provided to the. Web comments on the draft instructions can be provided to lbi.passthrough.international.form.changes@irs.gov on or before november 8, 2022. Certify that the tin you are giving is correct (or you are waiting for a number to be issued), 2. Here are a few tips that will help.

Form 7202 Pdf Fill and Sign Printable Template Online US Legal Forms

I am not seeing the gain reported automatically on an irs form 8949 / schedule d capital. You can create an account with turbotax and begin filing your tax return. Web the form 7203, s corporation shareholder stock and debt basis limitations is not used or supported in any of the personal turbotax desktop editions, including. Web discussions taxes get.

form 2106 turbotax Fill Online, Printable, Fillable Blank

Basis is handled as follows: Web comments on the draft instructions can be provided to lbi.passthrough.international.form.changes@irs.gov on or before november 8, 2022. I am not seeing the gain reported automatically on an irs form 8949 / schedule d capital. Web if one of these requirements applies, then form 7203 is required. Certify that you are not subject to backup.

website design UI for multiple forms with several input fields needs

Web the form 7203 is filed by the individual s shareholder with their federal form 1040 return. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web new form 7203 filing i have a 2 part question on the new form 7203 s corp shareholder stock basis. First, turbotax will ask.

This Form Is Used By S Corporation Shareholders To Figure Out The Potential Limitations Of Their Share Of The S.

Here are a few tips that will help you fill in the needed information. • most taxpayers use form 1040 to report their taxable income to the irs. I have read all of the instructions for form 7203, but cannot find. Certify that you are not subject to backup.

First, Turbotax Will Ask You Some Basic.

Web 29 july 2022 are you curious about irs form 7203? Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web if you plan on claiming one of the irs educational tax credits, be sure to fill out a form 8863 and attach it to your tax return. You can create an account with turbotax and begin filing your tax return.

Starting In Tax Year 2021, Form 7203 Replaces The Shareholder's Basis Worksheet (Worksheet For.

Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be. Web 1040 individual what is form 7203? Web new form 7203 filing i have a 2 part question on the new form 7203 s corp shareholder stock basis. Web watch videos to learn about everything turbotax — from tax forms and credits to installation and printing.

Web The Form 7203 Interview Is Slightly Different In Turbotax Desktop, But The Main Entries On The Form Are Made Manually Using The Same Format As Turbotax Online.

Web if one of these requirements applies, then form 7203 is required. You may find your answers in this irs document instructions for form 7203, s corporation shareholder stock and debt basis limitations. Certify that the tin you are giving is correct (or you are waiting for a number to be issued), 2. Web irs form 7203 line 34 computes reportable gain on loan repayment.