How To Fill Form 2553

How To Fill Form 2553 - Ad form 2553, get ready for tax deadlines by filling online any tax form for free. Ad fill, sign, email irs 2553 & more fillable forms, try for free now! September 17, 2022 when you form a new business entity, a corporation or. Irs form 2553 can be filed with the irs by either mailing or faxing the form. Input the business’s employer identification number (ein) obtained from. Web find mailing addresses by state and date for filing form 2553. Most business owners file this form for tax. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. 18629r form 2553 part i election information (continued) note: Protection from creditor claims if you’re a sole proprietor, your personal assets are fair game for creditors and anyone that may file a legal claim.

Ad form 2553, get ready for tax deadlines by filling online any tax form for free. Web the purpose of form 2553 is to allow certain small businesses to choose to be taxed as an s corporation. Web how to file the irs form 2553. Identify your state and use the address to submit your form. Protection from creditor claims if you’re a sole proprietor, your personal assets are fair game for creditors and anyone that may file a legal claim. Web how to fill out form 2553 form 2553 includes four parts and is relatively complex. Name and address of each shareholder or former. Mailing address the title page of form 2553 highlights the address to send your application to. Web learn exactly how to fill out irs form 2553. Web in order for a business entity to qualify as an s corporation on its annual taxes, it must file form 2553 by the 15th day of the 3rd month after the start its tax year.

Ad form 2553, get ready for tax deadlines by filling online any tax form for free. 18629r form 2553 part i election information (continued) note: Protection from creditor claims if you’re a sole proprietor, your personal assets are fair game for creditors and anyone that may file a legal claim. The form is due no later t. September 17, 2022 when you form a new business entity, a corporation or. Web the main purpose of irs form 2553 is for a small business to register as an s corporation rather than the default c corporation. Part i mostly asks for general information, such as your employer identification. Irs form 2553 can be filed with the irs by either mailing or faxing the form. Currently, an online filing option does not exist for this form. Don't miss this 50% discount.

IRS Form 2553 Instructions How to Fill Out Form 2553 Excel Capital

Web the main purpose of irs form 2553 is for a small business to register as an s corporation rather than the default c corporation. Web in our simple guide, we'll walk you through form 2553 instructions so you can legally and officially start your new s corporation in the u.s. September 17, 2022 when you form a new business.

Ssurvivor Form 2553 Irs Fax Number

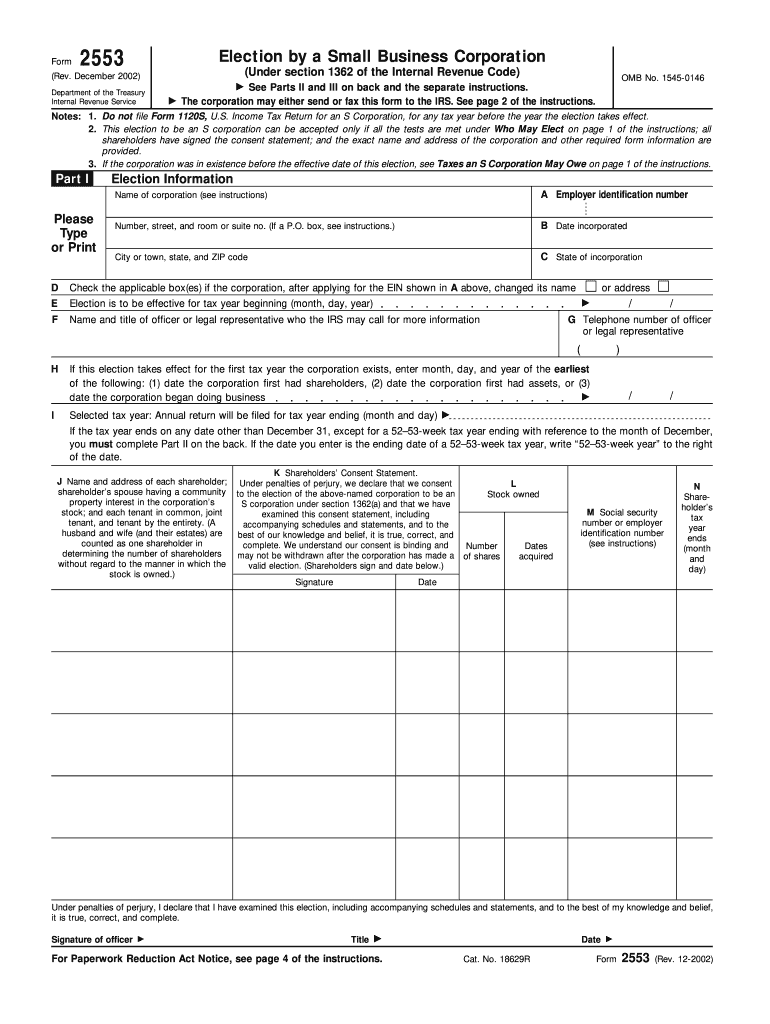

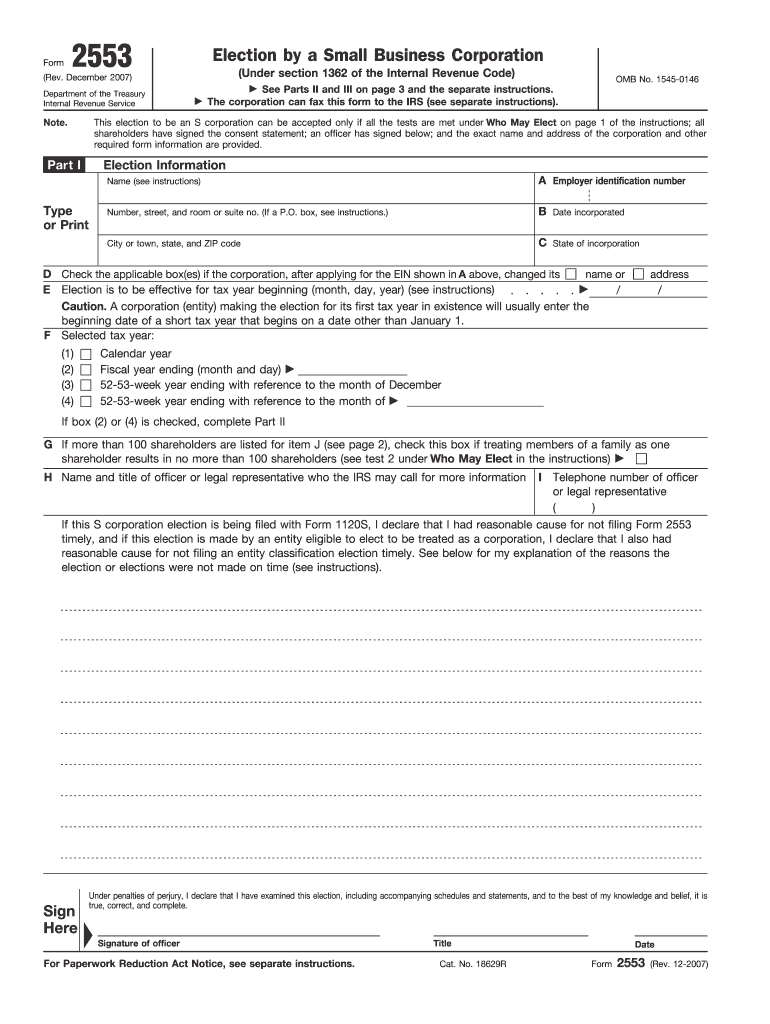

Under election information, fill in the corporation's name and address, along with your ein number and date and state of incorporation. September 17, 2022 when you form a new business entity, a corporation or. Protection from creditor claims if you’re a sole proprietor, your personal assets are fair game for creditors and anyone that may file a legal claim. Web.

IRS Form 2553 Instructions How to Fill Out Form 2553 Excel Capital

If the corporation's principal business, office, or agency is located in. Ad fill, sign, email irs 2553 & more fillable forms, try for free now! The form is due no later t. Web learn exactly how to fill out irs form 2553. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election.

Form 2553 Fill Out and Sign Printable PDF Template signNow

Web find mailing addresses by state and date for filing form 2553. Ad fill, sign, email irs 2553 & more fillable forms, try for free now! Web in order for a business entity to qualify as an s corporation on its annual taxes, it must file form 2553 by the 15th day of the 3rd month after the start its.

How to Fill Out Form 2553 Instructions, Deadlines [2023]

Web the purpose of form 2553 is to allow certain small businesses to choose to be taxed as an s corporation. 18629r form 2553 part i election information (continued) note: Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Part i mostly asks for general information, such as your employer identification. Under election information, fill in.

Form 2553 Instructions A Simple Guide For 2022 Forbes Advisor

Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Don't miss this 50% discount. If you need more rows, use additional copies of page 2. Web in our simple guide, we'll walk you through form 2553 instructions so you can legally and officially start your new s corporation in the u.s. Identify your state and use.

2002 Form IRS 2553 Fill Online, Printable, Fillable, Blank PDFfiller

Identify your state and use the address to submit your form. Ad form 2553, get ready for tax deadlines by filling online any tax form for free. Web the main purpose of irs form 2553 is for a small business to register as an s corporation rather than the default c corporation. If the corporation's principal business, office, or agency.

Form 2553 Fill Out and Sign Printable PDF Template signNow

If the corporation's principal business, office, or agency is located in. Web learn exactly how to fill out irs form 2553. 18629r form 2553 part i election information (continued) note: Name and address of each shareholder or former. Web how to fill out form 2553 form 2553 includes four parts and is relatively complex.

Ssurvivor Form 2553 Irs Phone Number

Name and address of each shareholder or former. Irs form 2553 can be filed with the irs by either mailing or faxing the form. Web learn exactly how to fill out irs form 2553. 18629r form 2553 part i election information (continued) note: Web in order for a business entity to qualify as an s corporation on its annual taxes,.

20172020 Form IRS Instruction 2553 Fill Online, Printable, Fillable

Protection from creditor claims if you’re a sole proprietor, your personal assets are fair game for creditors and anyone that may file a legal claim. Web the main purpose of irs form 2553 is for a small business to register as an s corporation rather than the default c corporation. Ad fill, sign, email irs 2553 & more fillable forms,.

If You Need More Rows, Use Additional Copies Of Page 2.

Ad fill, sign, email irs 2553 & more fillable forms, try for free now! Under election information, fill in the corporation's name and address, along with your ein number and date and state of incorporation. Download, print or email irs 2553 tax form on pdffiller for free. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes.

Web In Order For A Business Entity To Qualify As An S Corporation On Its Annual Taxes, It Must File Form 2553 By The 15Th Day Of The 3Rd Month After The Start Its Tax Year.

Irs form 2553 can be filed with the irs by either mailing or faxing the form. Web when filing form 2553 for a late s corporation election, the corporation (entity) must enter in the top margin of the first page of form 2553 “filed pursuant to rev. Web how to fill out form 2553 form 2553 includes four parts and is relatively complex. The form is due no later t.

Web In Our Simple Guide, We'll Walk You Through Form 2553 Instructions So You Can Legally And Officially Start Your New S Corporation In The U.s.

Name and address of each shareholder or former. Web find mailing addresses by state and date for filing form 2553. Web the main purpose of irs form 2553 is for a small business to register as an s corporation rather than the default c corporation. Input the business’s mailing address in the appropriate lines.

Input The Business’s Employer Identification Number (Ein) Obtained From.

September 17, 2022 when you form a new business entity, a corporation or. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Web the purpose of form 2553 is to allow certain small businesses to choose to be taxed as an s corporation. Most business owners file this form for tax.

![How to Fill Out Form 2553 Instructions, Deadlines [2023]](https://standwithmainstreet.com/wp-content/uploads/2021/03/pexels-photo-5273563.jpeg)