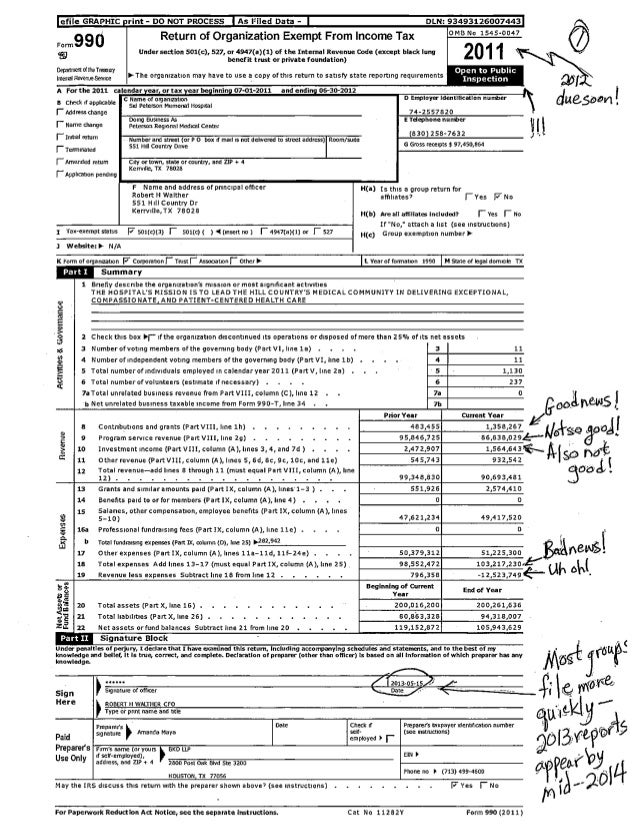

How To File Form 990 N

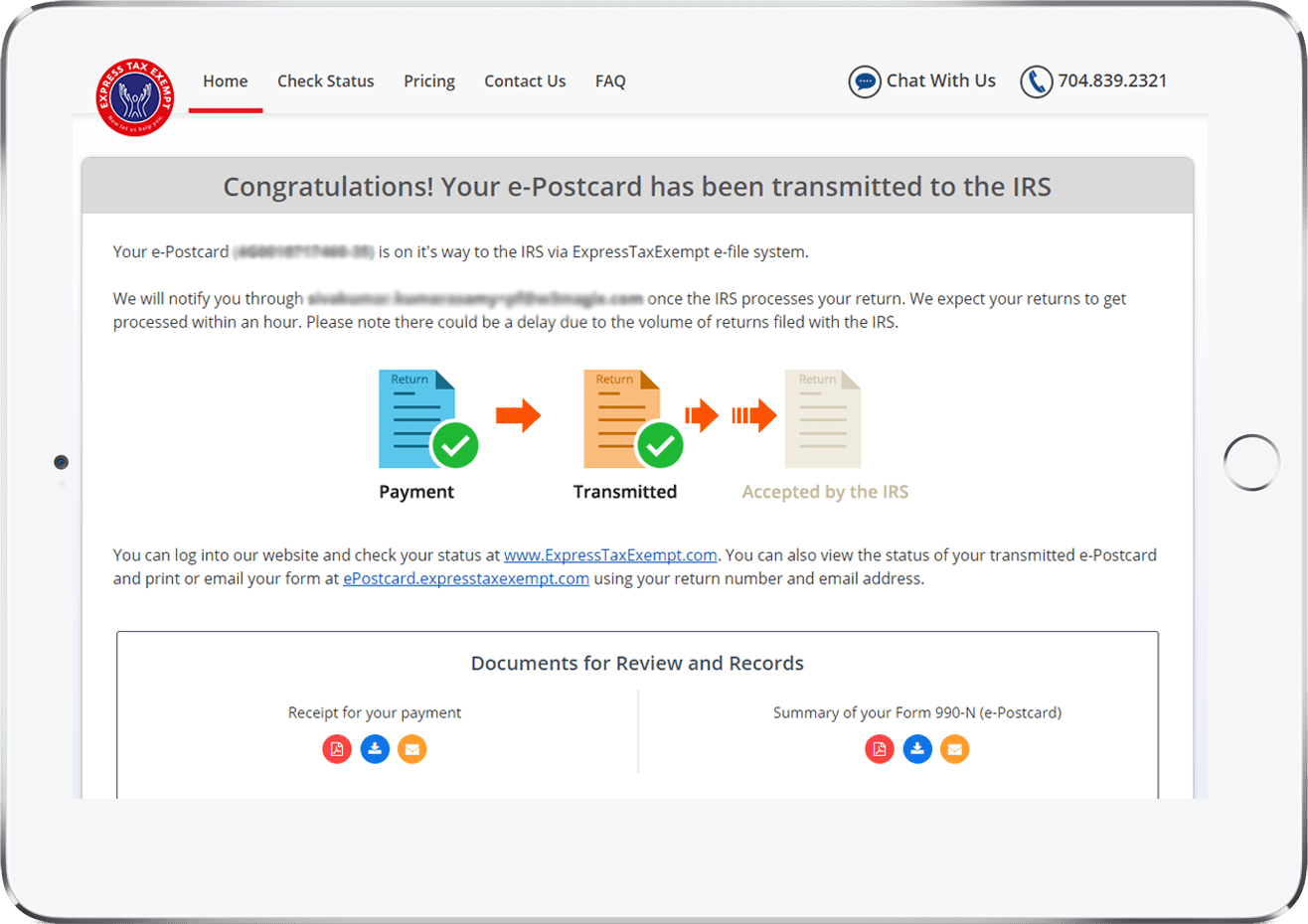

How To File Form 990 N - Web open the electronic filing page: 1 search organization’s ein 2 select filing year 3 review & transmit to the irs just. How often do i need to file? Complete, edit or print tax forms instantly. Private foundations must file form 990. Of course, this is primarily due to irs mandates, but the form is also important for a few. If gross receipts are normally $50,000 or less, it has the. Association of notre dame clubs, inc. Web filings as we established in our form 990 overview post, there are 5 versions of irs form 990, one or more of which is required to be filed annually by every 501 (c). Ad get ready for tax season deadlines by completing any required tax forms today.

Association of notre dame clubs, inc. Private foundations must file form 990. Of course, this is primarily due to irs mandates, but the form is also important for a few. How often do i need to file? Ad get ready for tax season deadlines by completing any required tax forms today. 1 search organization’s ein 2 select filing year 3 review & transmit to the irs just. If gross receipts are normally $50,000 or less, it has the. It cannot be filed until after the tax year ends. Web filings as we established in our form 990 overview post, there are 5 versions of irs form 990, one or more of which is required to be filed annually by every 501 (c). Complete, edit or print tax forms instantly.

Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. 1 search organization’s ein 2 select filing year 3 review & transmit to the irs just. Of course, this is primarily due to irs mandates, but the form is also important for a few. Web filings as we established in our form 990 overview post, there are 5 versions of irs form 990, one or more of which is required to be filed annually by every 501 (c). Private foundations must file form 990. It cannot be filed until after the tax year ends. Association of notre dame clubs, inc. How often do i need to file? If gross receipts are normally $50,000 or less, it has the.

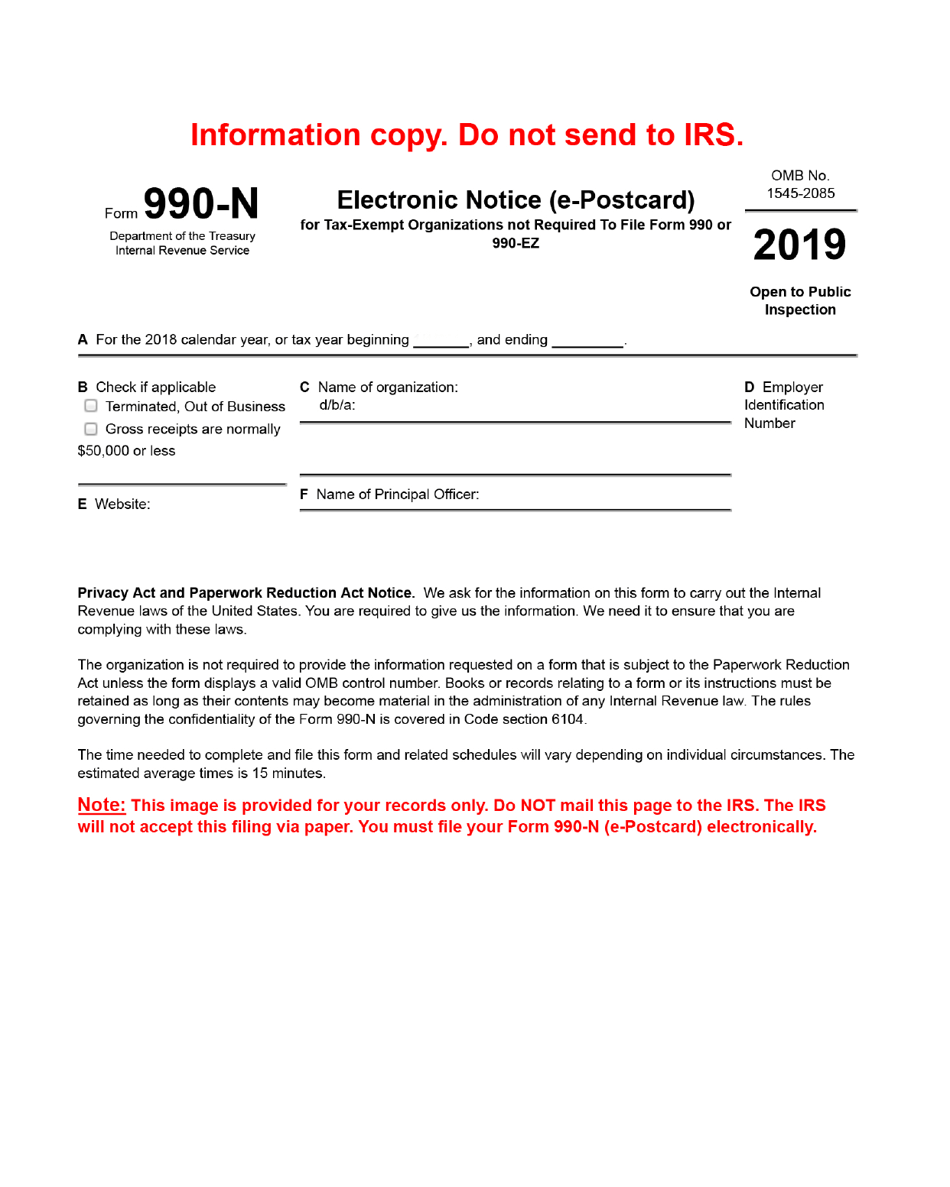

Efile Form 990N 2020 IRS Form 990N Online Filing

It cannot be filed until after the tax year ends. If gross receipts are normally $50,000 or less, it has the. Of course, this is primarily due to irs mandates, but the form is also important for a few. Ad get ready for tax season deadlines by completing any required tax forms today. Association of notre dame clubs, inc.

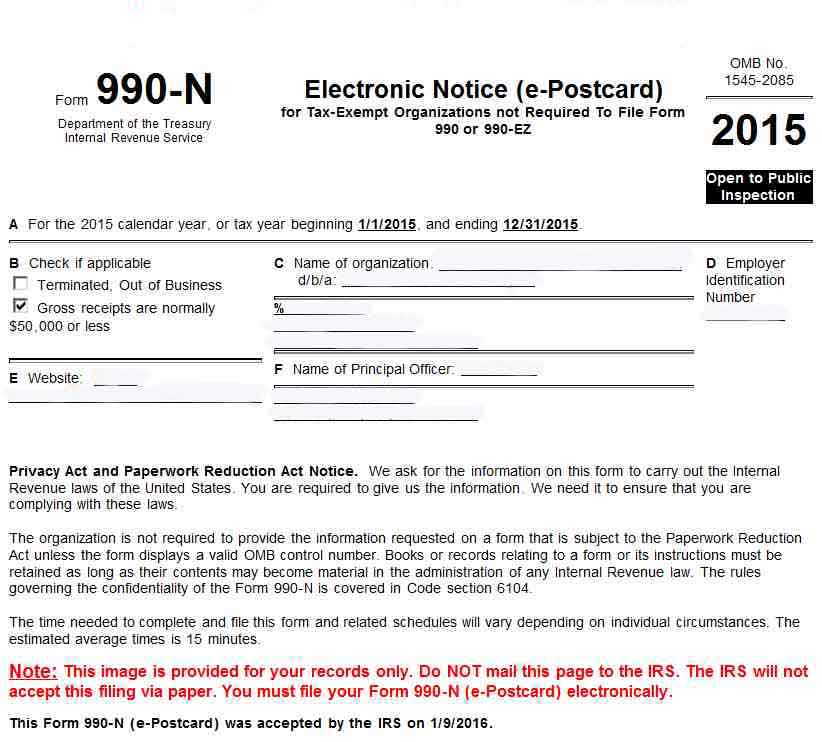

Printable 990 N Form Printable Form 2022

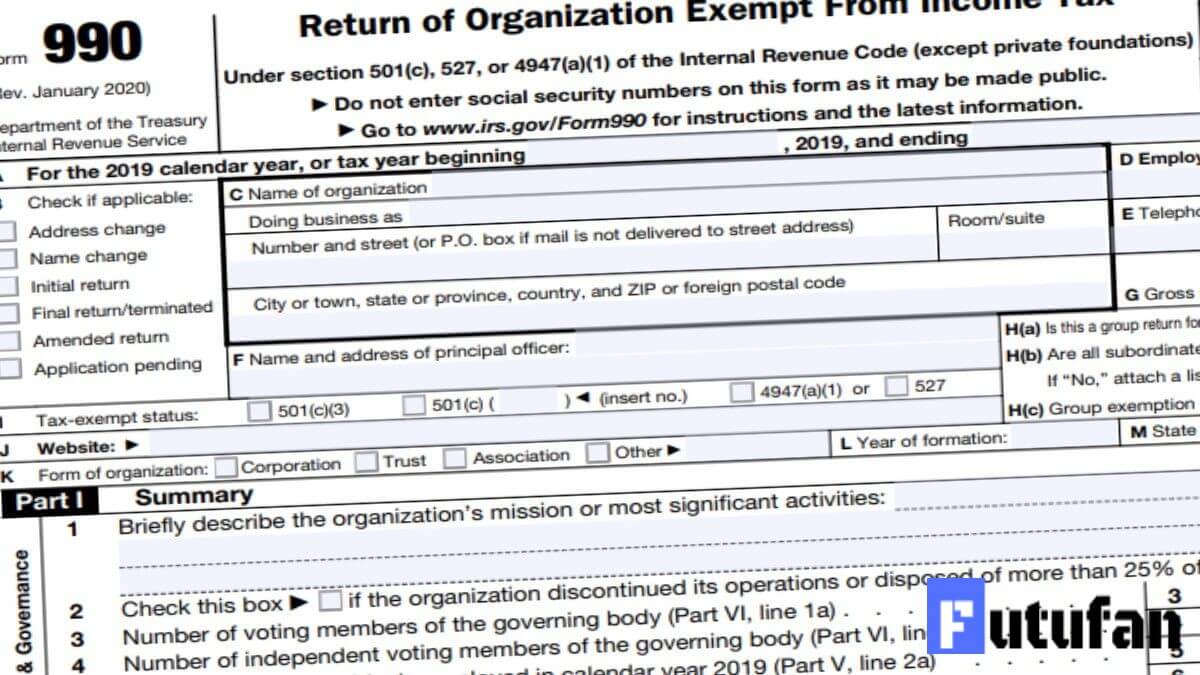

Web open the electronic filing page: Private foundations must file form 990. Association of notre dame clubs, inc. Complete, edit or print tax forms instantly. Web filings as we established in our form 990 overview post, there are 5 versions of irs form 990, one or more of which is required to be filed annually by every 501 (c).

small taxexempt organizations to file form 990n (epostcard

If gross receipts are normally $50,000 or less, it has the. It cannot be filed until after the tax year ends. Complete, edit or print tax forms instantly. Of course, this is primarily due to irs mandates, but the form is also important for a few. Congress enacted this filing requirement in 2007 to keep the irs up to date.

Form 990N ePostcard

Web filings as we established in our form 990 overview post, there are 5 versions of irs form 990, one or more of which is required to be filed annually by every 501 (c). 1 search organization’s ein 2 select filing year 3 review & transmit to the irs just. Private foundations must file form 990. Web open the electronic.

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

Of course, this is primarily due to irs mandates, but the form is also important for a few. Web filings as we established in our form 990 overview post, there are 5 versions of irs form 990, one or more of which is required to be filed annually by every 501 (c). Association of notre dame clubs, inc. If gross.

Steps to EFile IRS Form 990N How to file ePostcard with the IRS

Complete, edit or print tax forms instantly. Private foundations must file form 990. If gross receipts are normally $50,000 or less, it has the. 1 search organization’s ein 2 select filing year 3 review & transmit to the irs just. Congress enacted this filing requirement in 2007 to keep the irs up to date.

Form 990N (ePostcard) Online Efile 990N in 3Steps Prior Year

Association of notre dame clubs, inc. How often do i need to file? Complete, edit or print tax forms instantly. Private foundations must file form 990. Of course, this is primarily due to irs mandates, but the form is also important for a few.

Failure To File Form 990N free download programs ealetitbit

Web filings as we established in our form 990 overview post, there are 5 versions of irs form 990, one or more of which is required to be filed annually by every 501 (c). Association of notre dame clubs, inc. Complete, edit or print tax forms instantly. 1 search organization’s ein 2 select filing year 3 review & transmit to.

IRS Form 990N Download Printable PDF or Fill Online Electronic Notice

Congress enacted this filing requirement in 2007 to keep the irs up to date. Web open the electronic filing page: How often do i need to file? Private foundations must file form 990. 1 search organization’s ein 2 select filing year 3 review & transmit to the irs just.

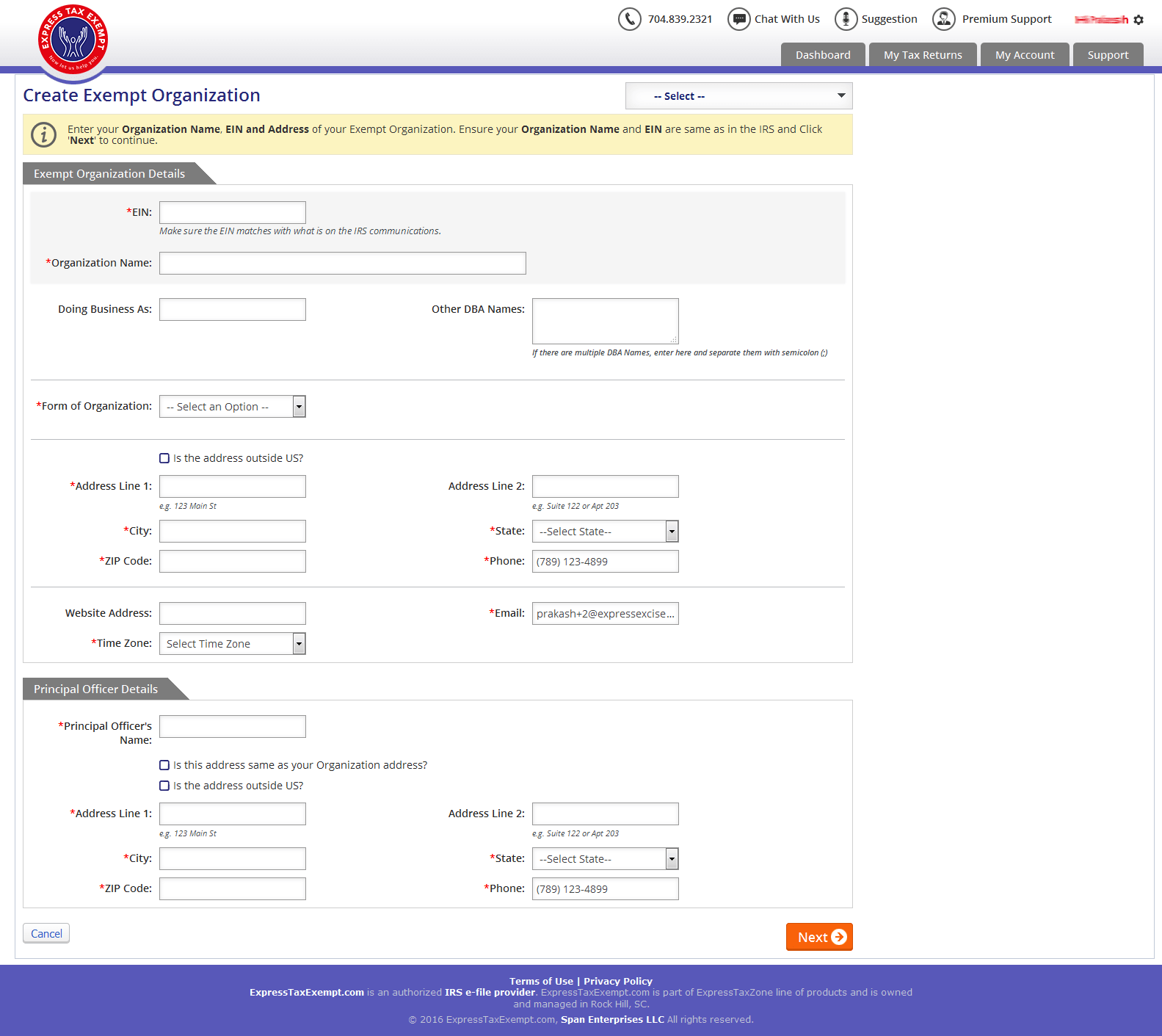

File Form 990N Online 990n e file Form 990N (ePostcard)

It cannot be filed until after the tax year ends. Web open the electronic filing page: If gross receipts are normally $50,000 or less, it has the. Congress enacted this filing requirement in 2007 to keep the irs up to date. 1 search organization’s ein 2 select filing year 3 review & transmit to the irs just.

How Often Do I Need To File?

1 search organization’s ein 2 select filing year 3 review & transmit to the irs just. Ad get ready for tax season deadlines by completing any required tax forms today. Congress enacted this filing requirement in 2007 to keep the irs up to date. Association of notre dame clubs, inc.

Private Foundations Must File Form 990.

Complete, edit or print tax forms instantly. Of course, this is primarily due to irs mandates, but the form is also important for a few. Web filings as we established in our form 990 overview post, there are 5 versions of irs form 990, one or more of which is required to be filed annually by every 501 (c). If gross receipts are normally $50,000 or less, it has the.

It Cannot Be Filed Until After The Tax Year Ends.

Web open the electronic filing page: