How To Complete Form 941-X For Erc

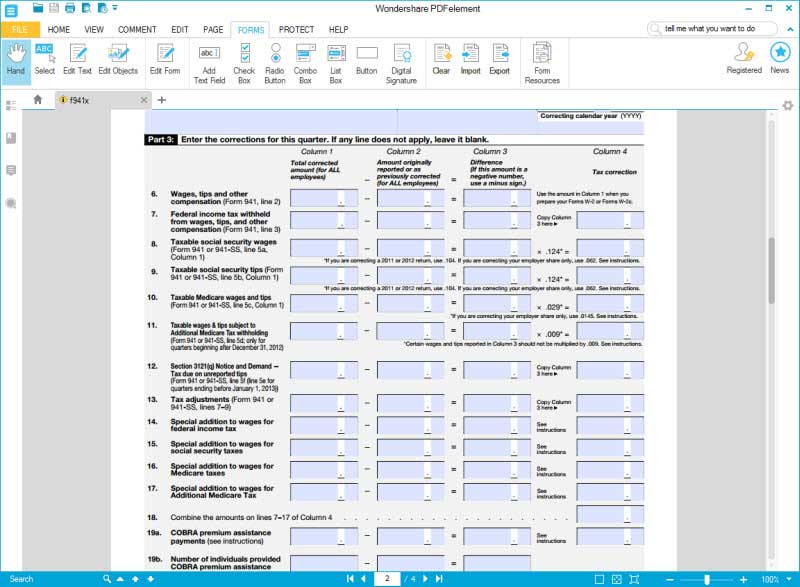

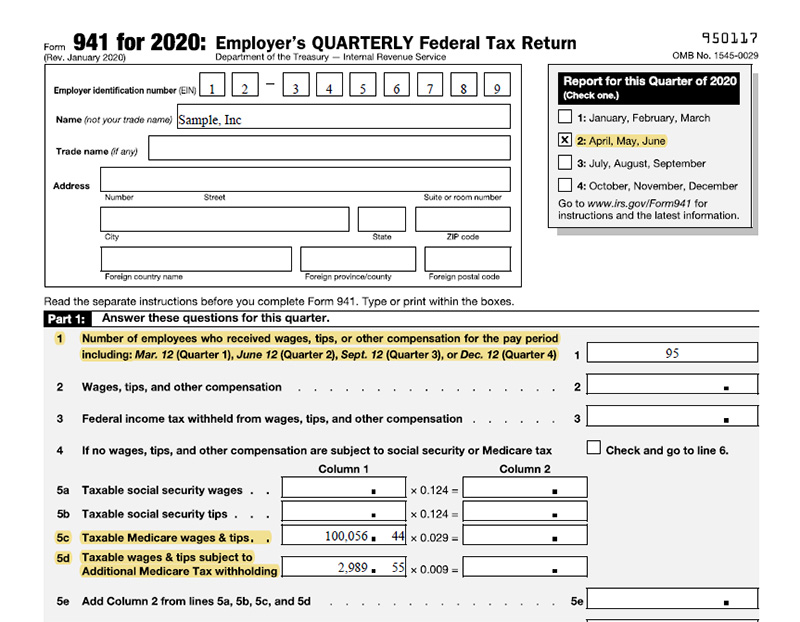

How To Complete Form 941-X For Erc - Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Companies qualify to get up to $26,000 per employee. Employers who underreported payroll tax should correct errors in the period. Businesses can receive up to $26k per eligible employee. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. Enter the numbers into part 3 6. Businesses can receive up to $26k per eligible employee. Complete the company information on each page, the. Note the type of return and filing period 3. Ad access irs tax forms.

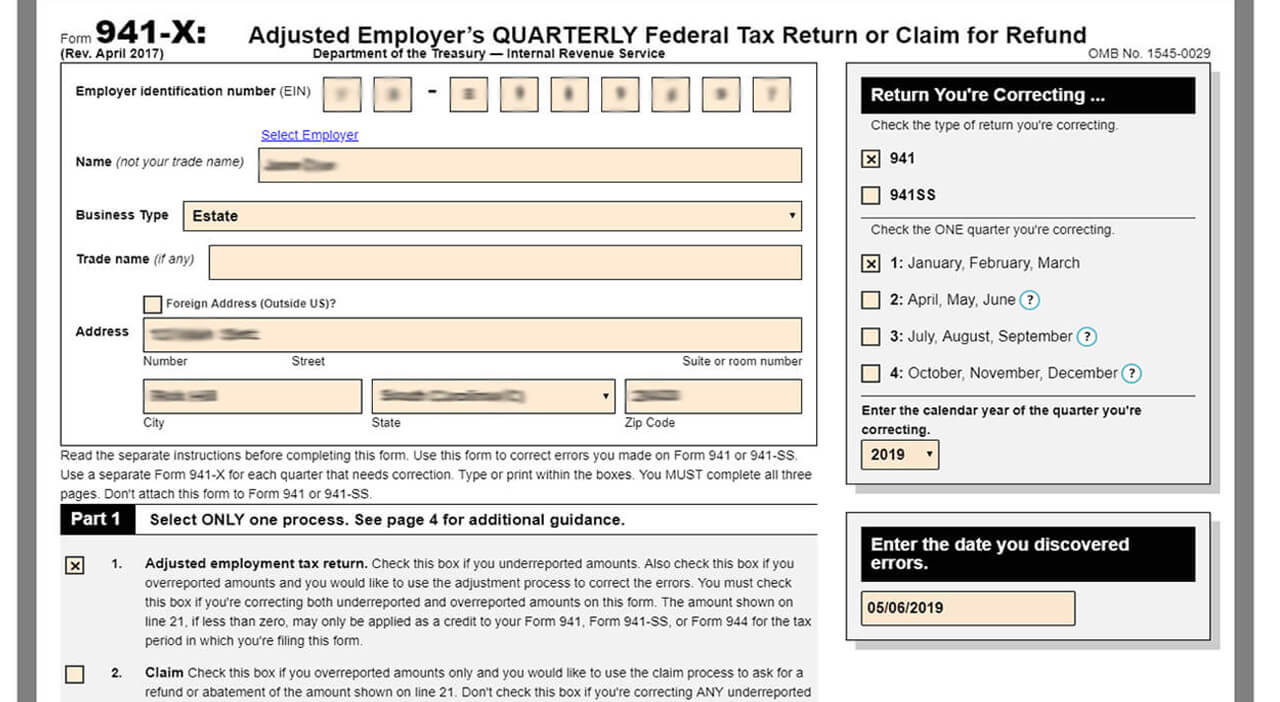

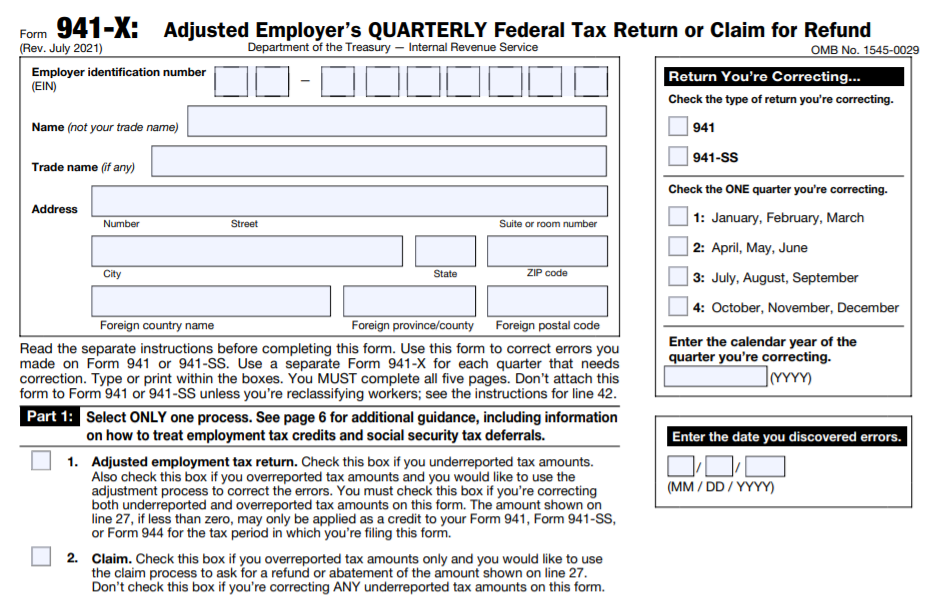

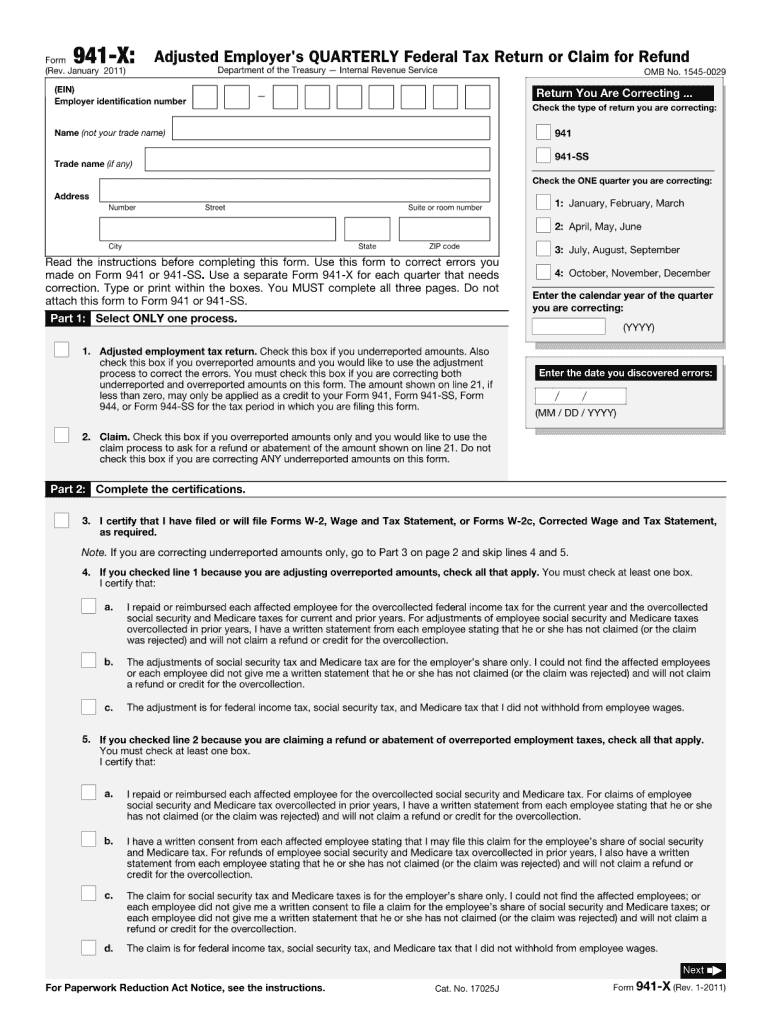

Enter the numbers into part 3 6. Businesses can receive up to $26k per eligible employee. Note the type of return and filing period 3. Use worksheet 1 for 941 3. Find the right form 2. Complete, edit or print tax forms instantly. April, may, june read the separate instructions before completing this form. Businesses can receive up to $26k per eligible employee. Complete irs tax forms online or print government tax documents. Ad access irs tax forms.

Employers who underreported payroll tax should correct errors in the period. There is no cost to you until you receive the funds from the irs. Businesses can receive up to $26k per eligible employee. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. See if you do in 2 min. Find the right form 2. Complete irs tax forms online or print government tax documents. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. Web 17k views 3 months ago. Companies qualify to get up to $26,000 per employee.

941X Amended Quarterly Return (DAS)

(a to z on how to get the erc all by. Then shift to line 23 and add the sums on lines 7 through 22 of column 4. Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. Web for 2020, the.

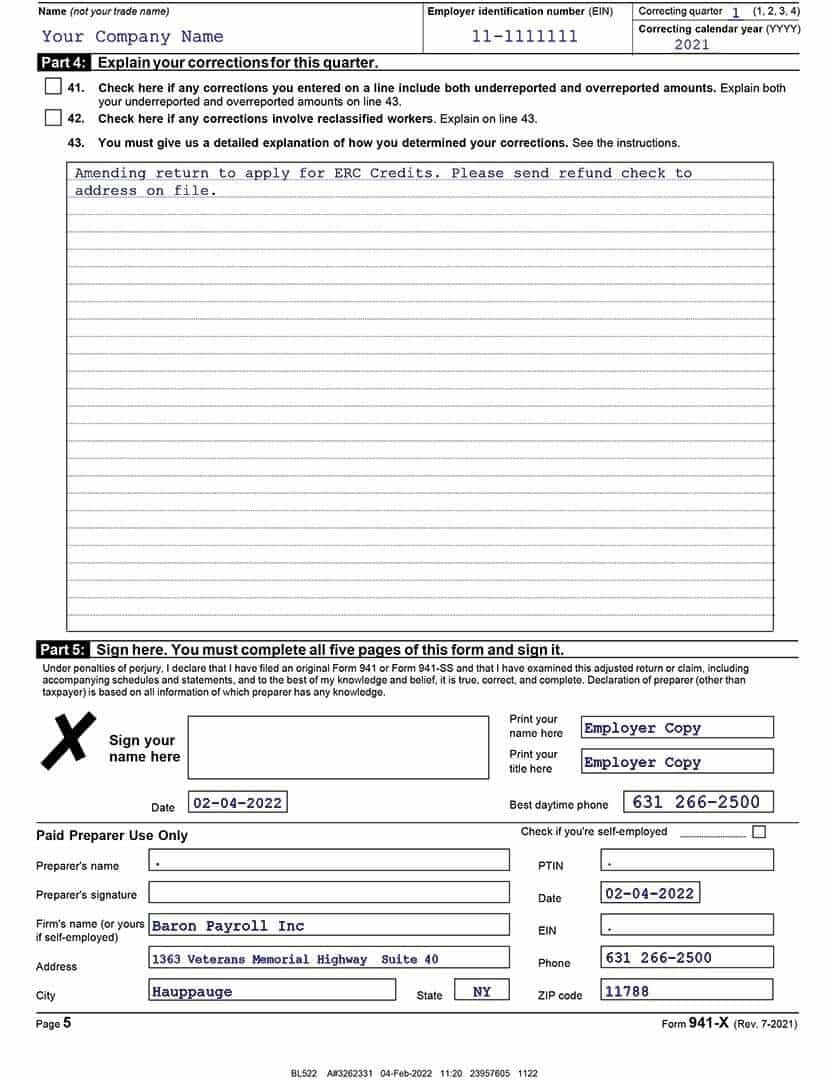

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

30, 2021 and before jan. (a to z on how to get the erc all by. Web 17k views 3 months ago. There is no cost to you until you receive the funds from the irs. Businesses can receive up to $26k per eligible employee.

How to Complete & Download Form 941X (Amended Form 941)?

Businesses can receive up to $26k per eligible employee. Complete irs tax forms online or print government tax documents. Note the type of return and filing period 3. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. Find the right form 2.

IRS Form 941X Complete & Print 941X for 2022

Enter the numbers into part 3 6. Complete the company information on each page, the. Employee wages, income tax withheld from wages, taxable social security wages, taxable social security tips, taxable medicare wages and tips,. Use worksheet 1 for 941 3. 30, 2021 and before jan.

Solved Required Complete Form 941 for Prevosti Farms and

Companies qualify to get up to $26,000 per employee. Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. Complete, edit or print tax forms instantly. Enter the numbers into part 3 6. Then shift to line 23 and add.

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

30, 2021 and before jan. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. Complete the company information on each page, the. Check the claim box 4. Use worksheet 1 for 941 3.

Worksheet 2 941x

Use worksheet 1 for 941 3. See if you do in 2 min. Companies qualify to get up to $26,000 per employee. Businesses can receive up to $26k per eligible employee. Find the right form 2.

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

Complete the company information on each page, the. (a to z on how to get the erc all by. Web 17k views 3 months ago. Check the claim box 4. Fill out your contact details 2.

ERC Calculator Tool ERTC Funding

Web recovery startup businesses 9 steps to apply for the ertc with irs form 941 1. See if you do in 2 min. Web 17k views 3 months ago. Then shift to line 23 and add the sums on lines 7 through 22 of column 4. Use worksheet 1 for 941 3.

Web Consequently, Most Employers Will Need To Instead File An Amended Return Or Claim For Refund For The Quarters Ended In June, September And December Of 2020 Using.

Web for 2020, the erc can be claimed by eligible employers who paid qualified wages after march 12, 2020, and before january 1, 2021, and who experienced a full or. Fill in the required details on the page header, such as the ein number, quarter, company name, and year. April, may, june read the separate instructions before completing this form. Use worksheet 1 for 941 3.

See If You Do In 2 Min.

Ad access irs tax forms. 30, 2021 and before jan. Web recovery startup businesses 9 steps to apply for the ertc with irs form 941 1. Businesses can receive up to $26k per eligible employee.

(A To Z On How To Get The Erc All By.

Complete, edit or print tax forms instantly. Businesses can receive up to $26k per eligible employee. Find the right form 2. Employers who underreported payroll tax should correct errors in the period.

Complete Irs Tax Forms Online Or Print Government Tax Documents.

Fill out your contact details 2. Check the claim box 4. Note the type of return and filing period 3. Complete the company information on each page, the.