How Do I Get My 1099 Sa Form Optum Bank

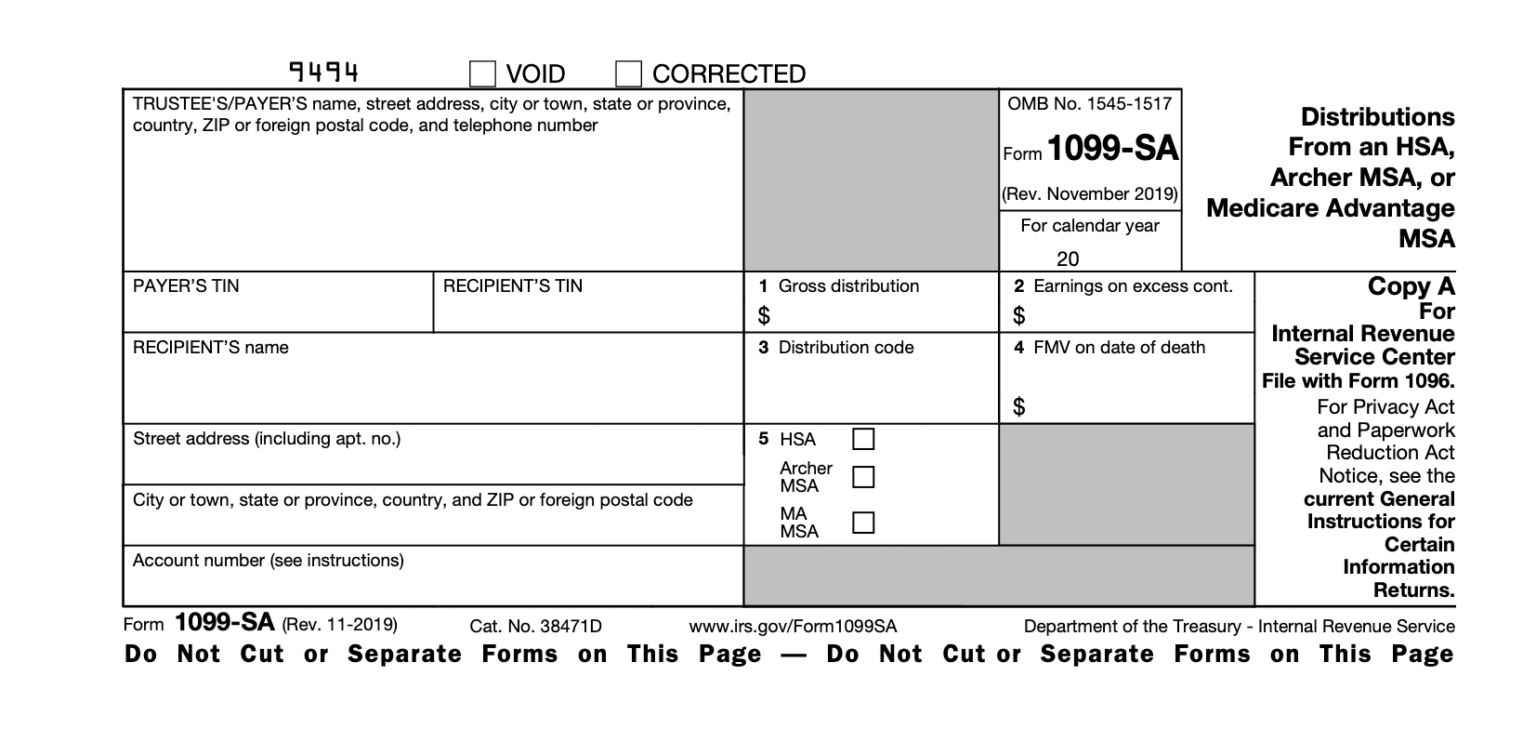

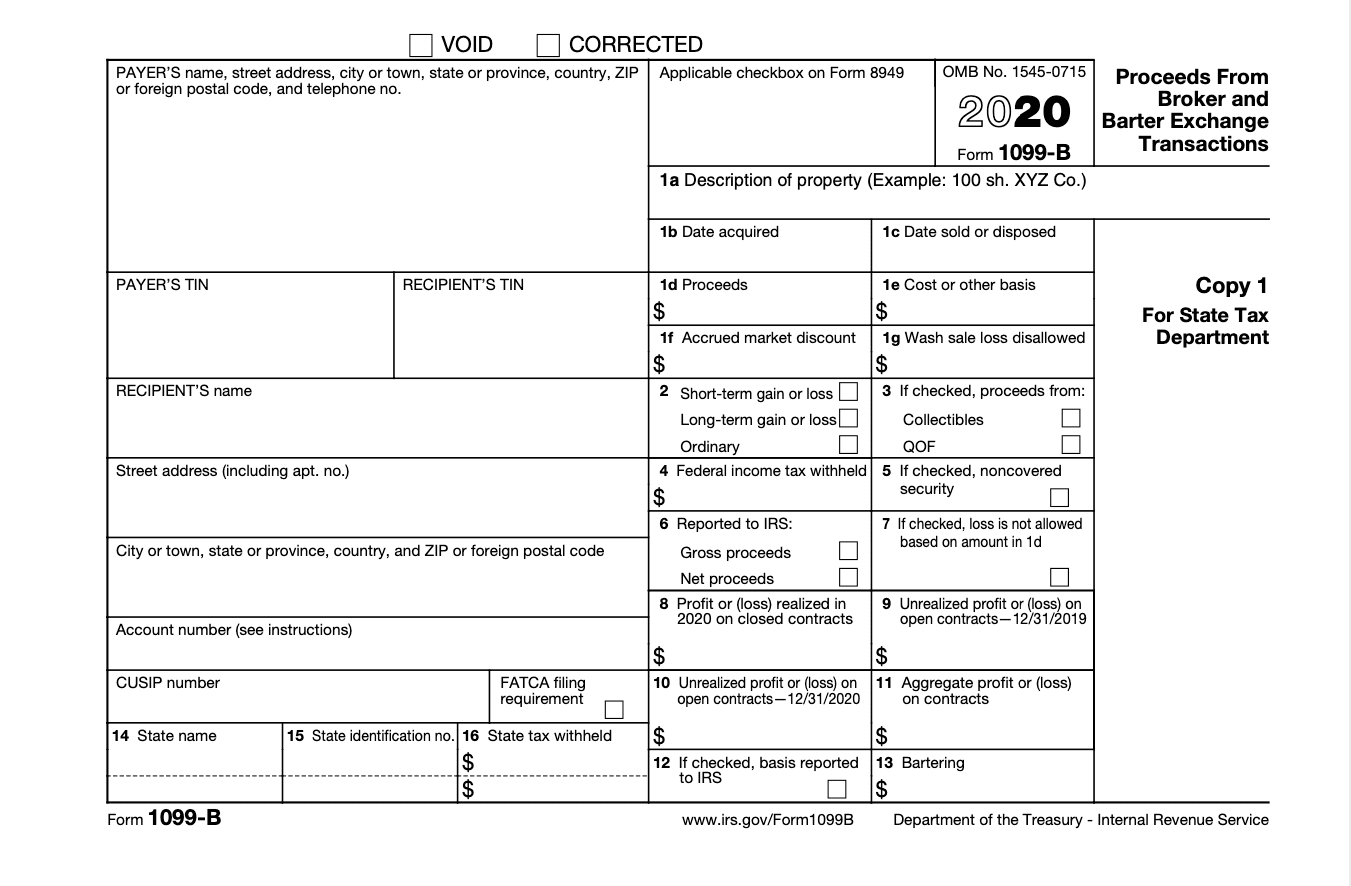

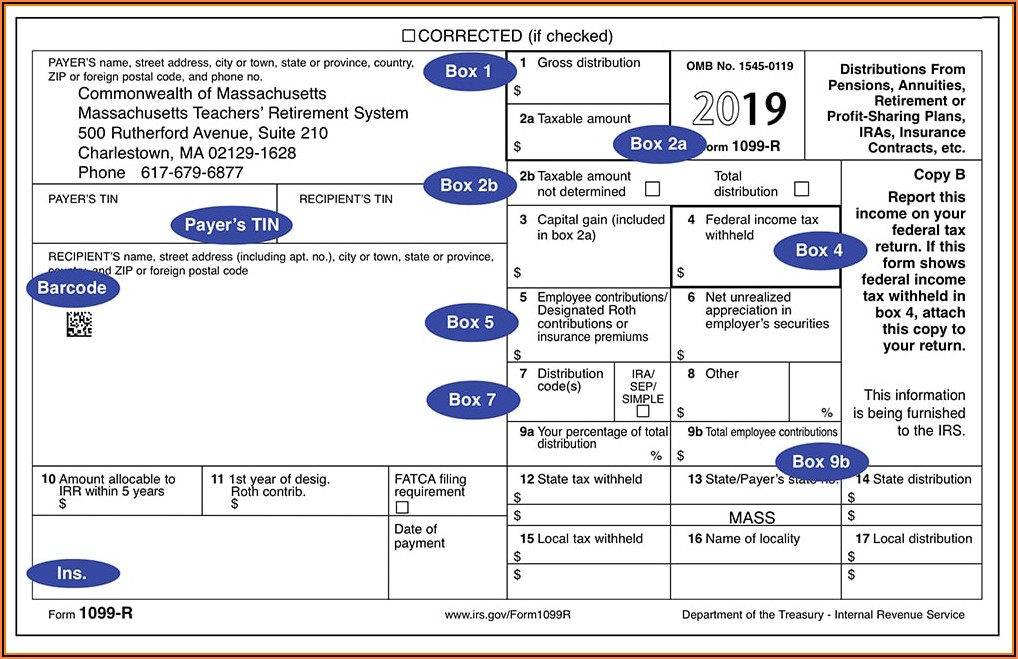

How Do I Get My 1099 Sa Form Optum Bank - Web if you are looking for additional support, please contact the following depending on your account type (s) or product inquiry: There are three tax forms associated with health savings accounts (hsas): Use it online, in store or at your doctor. Provided you only use the funds to. Money you used) reported in box 1. Web up to 8% cash back your hsa card is a fast and convenient way to pay for qualified expenses while skipping the paperwork. Web report your total hsa contributions and distributions for the tax year. Web up to 8% cash back you can get this form by signing in to your account. Archer medical savings account (archer msa). The online version will be available.

Web report your total hsa contributions and distributions for the tax year. How an hsa works with domestic. Which forms do i need to file my taxes? Web up to 8% cash back your hsa card is a fast and convenient way to pay for qualified expenses while skipping the paperwork. Web up to 8% cash back q. That should give you plenty of time to make sure those 1099 forms are accurate in reporting. Money you used) reported in box 1. It should also be available online as well, once it has been created. Form 8889 is the only one you need to submit with your taxes. Web log into the optum bank website:

Which forms do i need to file my taxes? Web the majority of 1099 forms are due to you, the payee, by january 31. From trips to the doctor to everyday care like cold. It should also be available online as well, once it has been created. Web up to 8% cash back you can get this form by signing in to your account. Web log into the optum bank website: Web up to 8% cash back q. You can get this form by logging in to your account. There are three tax forms associated with health savings accounts (hsas): Use it online, in store or at your doctor.

[TAX]세금보고 1099 Form과 종류 아이테크코리아

Money you used) reported in box 1. Web report your total hsa contributions and distributions for the tax year. Web log into the optum bank website: The online version will be available. Web up to 8% cash back q.

1099 Contract Template HQ Printable Documents

Web log into the optum bank website: It should also be available online as well, once it has been created. These irs tax forms are. Web up to 8% cash back your hsa card is a fast and convenient way to pay for qualified expenses while skipping the paperwork. That should give you plenty of time to make sure those.

¿Qué es un formulario 1099 del IRS? Qué significa y cómo funciona?

The online version will be available. Web up to 8% cash back you can get this form by signing in to your account. These irs tax forms are. Web up to 8% cash back q. Which forms do i need to file my taxes?

11 Common Misconceptions About Irs Form 11 Form Information Free

Web the majority of 1099 forms are due to you, the payee, by january 31. Archer medical savings account (archer msa). The online version will be available. There are three tax forms associated with health savings accounts (hsas): Web if you are looking for additional support, please contact the following depending on your account type (s) or product inquiry:

1099INT Software to Print and Efile Form 1099INT

These irs tax forms are. Web if you are looking for additional support, please contact the following depending on your account type (s) or product inquiry: Web up to 8% cash back q. Which forms do i need to file my taxes? Web log into the optum bank website:

¿Qué es un formulario 1099 del IRS? Qué significa y cómo funciona?

There are three tax forms associated with health savings accounts (hsas): Money you used) reported in box 1. That should give you plenty of time to make sure those 1099 forms are accurate in reporting. Web if you are looking for additional support, please contact the following depending on your account type (s) or product inquiry: Form 8889 is the.

Ssa 1099 Form 2019 Pdf Fill Online, Printable, Fillable, Blank

Form 8889 is the only one you need to submit with your taxes. How an hsa works with domestic. Web up to 8% cash back your hsa card is a fast and convenient way to pay for qualified expenses while skipping the paperwork. Web the majority of 1099 forms are due to you, the payee, by january 31. Web if.

Where To Get Official 1099 Misc Forms Universal Network

Which forms do i need to file my taxes? Form 8889 is the only one you need to submit with your taxes. Provided you only use the funds to. Web log into the optum bank website: Web up to 8% cash back q.

How Do I Get A Form 1099 From Opm Faxed 20202021 Fill and Sign

Archer medical savings account (archer msa). It should also be available online as well, once it has been created. Web log into the optum bank website: Web report your total hsa contributions and distributions for the tax year. There are three tax forms associated with health savings accounts (hsas):

Tax Id Form For 1099 Form Resume Examples Wk9yBD6Y3D

Money you used) reported in box 1. Web the majority of 1099 forms are due to you, the payee, by january 31. Provided you only use the funds to. Web up to 8% cash back your hsa card is a fast and convenient way to pay for qualified expenses while skipping the paperwork. How an hsa works with domestic.

Web Log Into The Optum Bank Website:

Use it online, in store or at your doctor. These irs tax forms are. Web if you are looking for additional support, please contact the following depending on your account type (s) or product inquiry: Web up to 8% cash back your hsa card is a fast and convenient way to pay for qualified expenses while skipping the paperwork.

Web Up To 8% Cash Back Q.

Web the majority of 1099 forms are due to you, the payee, by january 31. That should give you plenty of time to make sure those 1099 forms are accurate in reporting. How an hsa works with domestic. Money you used) reported in box 1.

Web Up To 8% Cash Back You Can Get This Form By Signing In To Your Account.

From trips to the doctor to everyday care like cold. Web up to 8% cash back you may receive the following forms from optum bank®: Which forms do i need to file my taxes? Web report your total hsa contributions and distributions for the tax year.

There Are Three Tax Forms Associated With Health Savings Accounts (Hsas):

Form 8889 is the only one you need to submit with your taxes. Archer medical savings account (archer msa). It should also be available online as well, once it has been created. The online version will be available.

![[TAX]세금보고 1099 Form과 종류 아이테크코리아](https://i1.wp.com/www.itechkorea.com/wp-content/uploads/2020/03/Form-1099-INT.jpg?w=824&ssl=1)