Home Equity Loan Bankruptcy Chapter 13

Home Equity Loan Bankruptcy Chapter 13 - Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years. You will need to have kept your credit clean since the bankruptcy and. How a home equity line of credit (heloc). Web calculating home equity protection in chapter 13 bankruptcy research your home's value. Start by checking websites like realtor.com and zillow.com when valuing. Keeping property—including home equity—using bankruptcy exemptions. Web debt from a home equity line of credit is discharged in bankruptcy, but the lender may foreclose depending on the circumstances. Web will having lots of home equity affect my chapter 13 bankruptcy? Web a person who has had a chapter 13 bankruptcy discharged can get a home equity loan.

Keeping property—including home equity—using bankruptcy exemptions. How a home equity line of credit (heloc). Web a person who has had a chapter 13 bankruptcy discharged can get a home equity loan. You will need to have kept your credit clean since the bankruptcy and. Web debt from a home equity line of credit is discharged in bankruptcy, but the lender may foreclose depending on the circumstances. Start by checking websites like realtor.com and zillow.com when valuing. Web calculating home equity protection in chapter 13 bankruptcy research your home's value. Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years. Web will having lots of home equity affect my chapter 13 bankruptcy?

How a home equity line of credit (heloc). Web debt from a home equity line of credit is discharged in bankruptcy, but the lender may foreclose depending on the circumstances. Web calculating home equity protection in chapter 13 bankruptcy research your home's value. Start by checking websites like realtor.com and zillow.com when valuing. Web will having lots of home equity affect my chapter 13 bankruptcy? Keeping property—including home equity—using bankruptcy exemptions. Web a person who has had a chapter 13 bankruptcy discharged can get a home equity loan. Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years. You will need to have kept your credit clean since the bankruptcy and.

Using a Home Equity Loan for Debt Consolidation NextAdvisor with TIME

Web calculating home equity protection in chapter 13 bankruptcy research your home's value. Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years. You will need to have kept your credit clean since the bankruptcy and. Web a person who has had a chapter 13 bankruptcy discharged can.

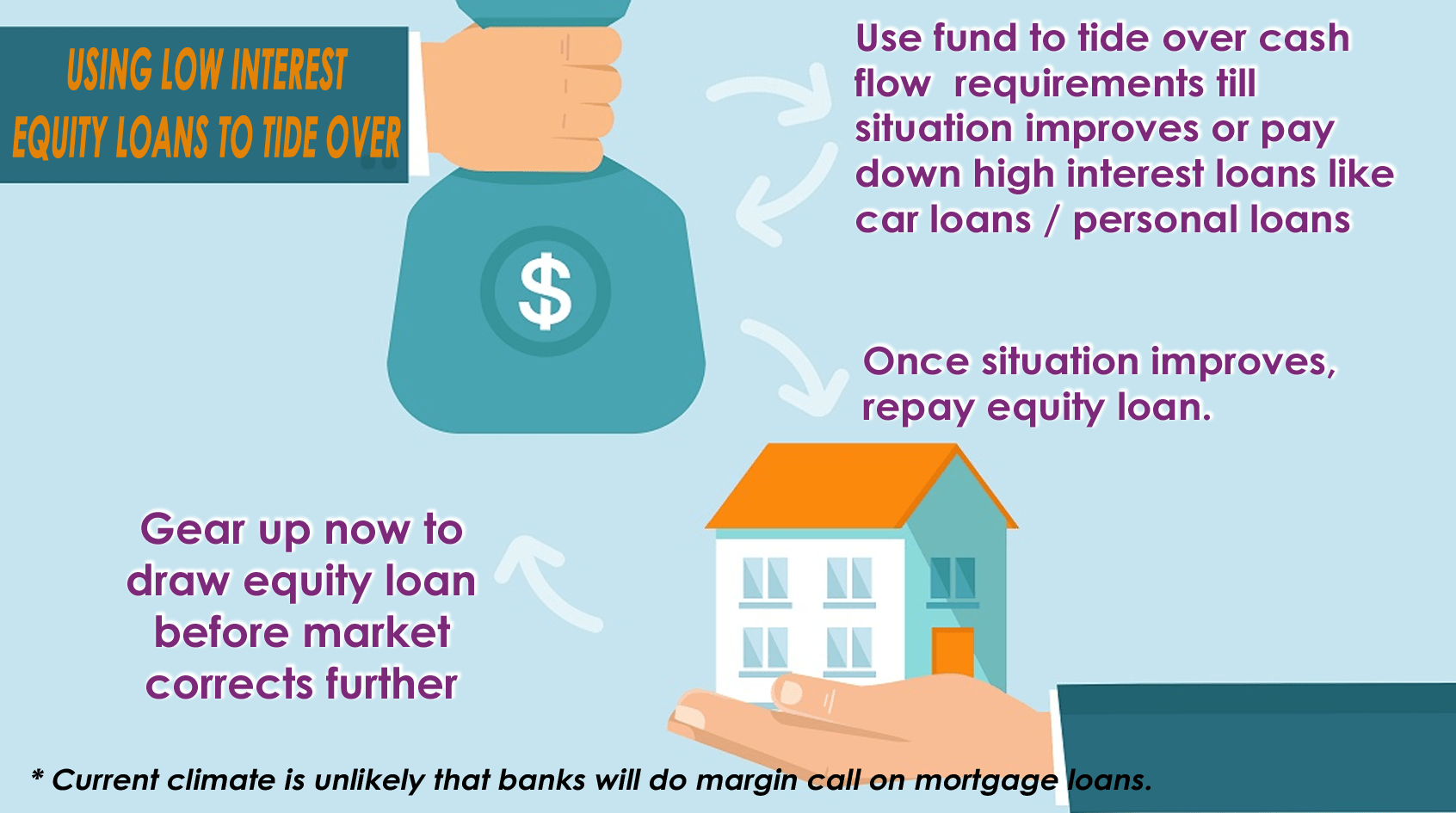

How a home equity term loan might save you from cash flow issue without

Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years. How a home equity line of credit (heloc). Start by checking websites like realtor.com and zillow.com when valuing. Web debt from a home equity line of credit is discharged in bankruptcy, but the lender may foreclose depending on.

Should I Use a Home Equity Loan to Pay Off Credit Cards?

Web a person who has had a chapter 13 bankruptcy discharged can get a home equity loan. Start by checking websites like realtor.com and zillow.com when valuing. You will need to have kept your credit clean since the bankruptcy and. Web debt from a home equity line of credit is discharged in bankruptcy, but the lender may foreclose depending on.

A Complete Guide To Home Equity Loans Revenues & Profits

How a home equity line of credit (heloc). Web will having lots of home equity affect my chapter 13 bankruptcy? Keeping property—including home equity—using bankruptcy exemptions. Web debt from a home equity line of credit is discharged in bankruptcy, but the lender may foreclose depending on the circumstances. You will need to have kept your credit clean since the bankruptcy.

Can I Get HELOC During or After Bankruptcy? [Home Equity Line of Credit

Web calculating home equity protection in chapter 13 bankruptcy research your home's value. Web a person who has had a chapter 13 bankruptcy discharged can get a home equity loan. Start by checking websites like realtor.com and zillow.com when valuing. Keeping property—including home equity—using bankruptcy exemptions. Web debt from a home equity line of credit is discharged in bankruptcy, but.

Home Equity Loan Instead of Bankruptcy? Bymaster Bankruptcy

Web calculating home equity protection in chapter 13 bankruptcy research your home's value. Keeping property—including home equity—using bankruptcy exemptions. Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years. How a home equity line of credit (heloc). Web will having lots of home equity affect my chapter 13.

Should You Use A Home Equity Loan For Debt Consolidation?

Web will having lots of home equity affect my chapter 13 bankruptcy? Keeping property—including home equity—using bankruptcy exemptions. Web debt from a home equity line of credit is discharged in bankruptcy, but the lender may foreclose depending on the circumstances. Web a person who has had a chapter 13 bankruptcy discharged can get a home equity loan. Web under chapter.

Home Loan Part Of Chapter 7 Bankruptcy Mortgage Guidelines

Web calculating home equity protection in chapter 13 bankruptcy research your home's value. Keeping property—including home equity—using bankruptcy exemptions. Start by checking websites like realtor.com and zillow.com when valuing. How a home equity line of credit (heloc). Web debt from a home equity line of credit is discharged in bankruptcy, but the lender may foreclose depending on the circumstances.

How Does My Home Equity Affect my Chapter 13 Bankruptcy? Bankruptcy

Web will having lots of home equity affect my chapter 13 bankruptcy? Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years. How a home equity line of credit (heloc). Web calculating home equity protection in chapter 13 bankruptcy research your home's value. Start by checking websites like.

WELLS, HOFFMAN, HOLLOWAY & MEDVESKY LLP Bankruptcy Chapter 13 How

Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years. Web a person who has had a chapter 13 bankruptcy discharged can get a home equity loan. How a home equity line of credit (heloc). Web calculating home equity protection in chapter 13 bankruptcy research your home's value..

You Will Need To Have Kept Your Credit Clean Since The Bankruptcy And.

Web under chapter 13 bankruptcy, you work with an arbitrator to formulate a repayment plan that usually lasts three to five years. Web calculating home equity protection in chapter 13 bankruptcy research your home's value. How a home equity line of credit (heloc). Start by checking websites like realtor.com and zillow.com when valuing.

Web Will Having Lots Of Home Equity Affect My Chapter 13 Bankruptcy?

Keeping property—including home equity—using bankruptcy exemptions. Web debt from a home equity line of credit is discharged in bankruptcy, but the lender may foreclose depending on the circumstances. Web a person who has had a chapter 13 bankruptcy discharged can get a home equity loan.