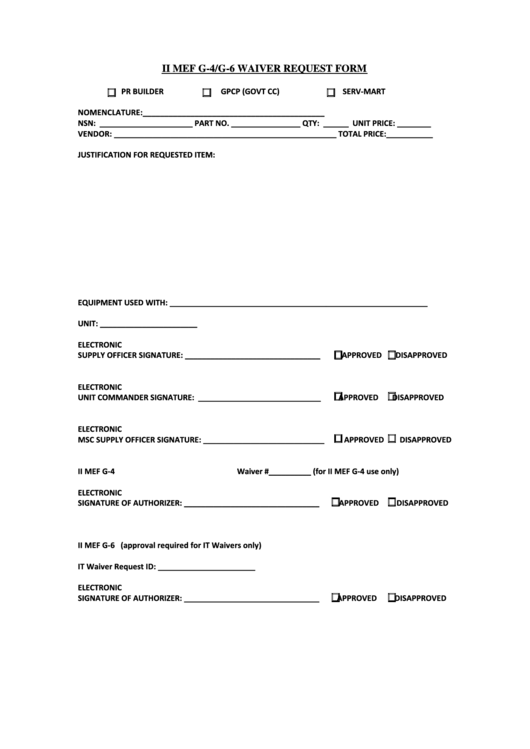

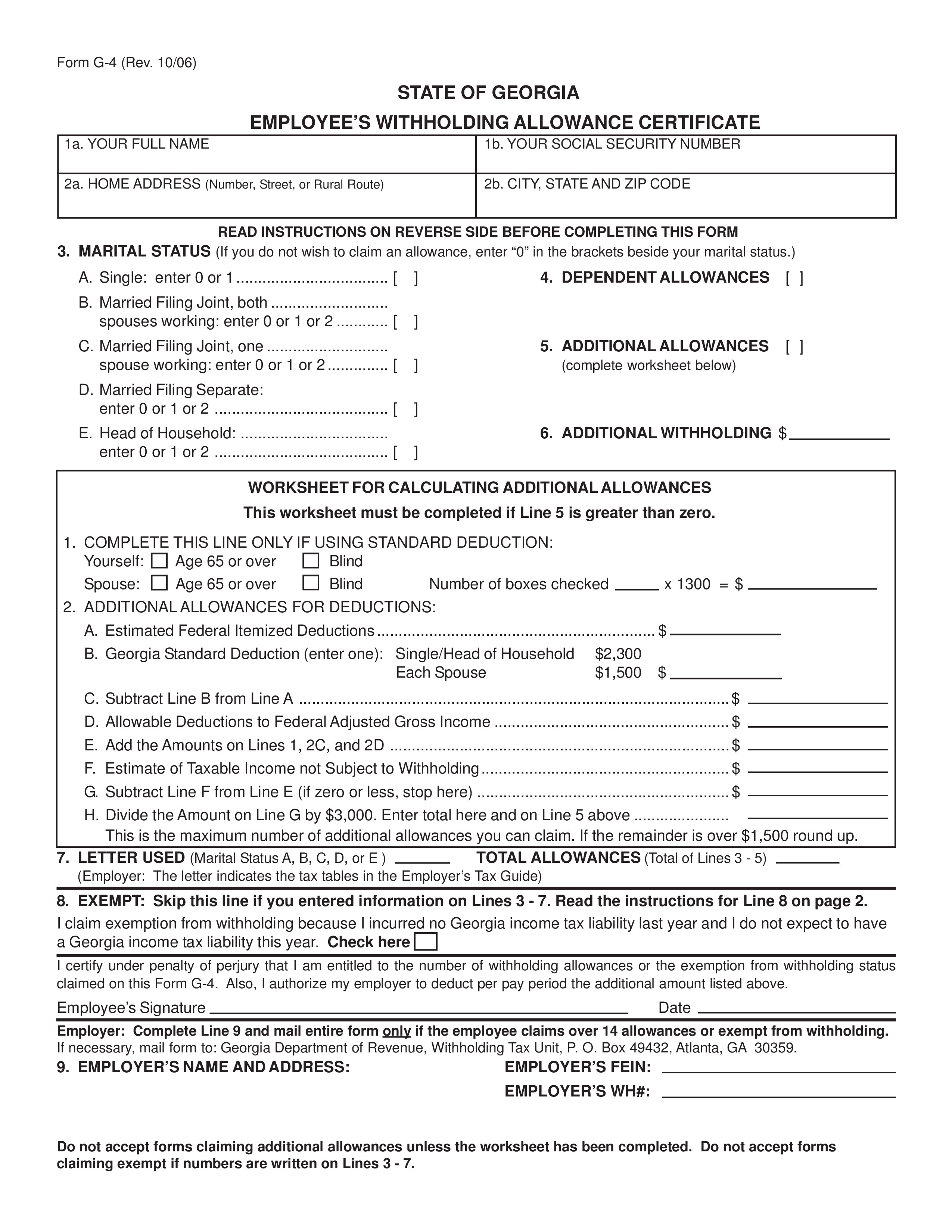

Georgia Tax Form G4

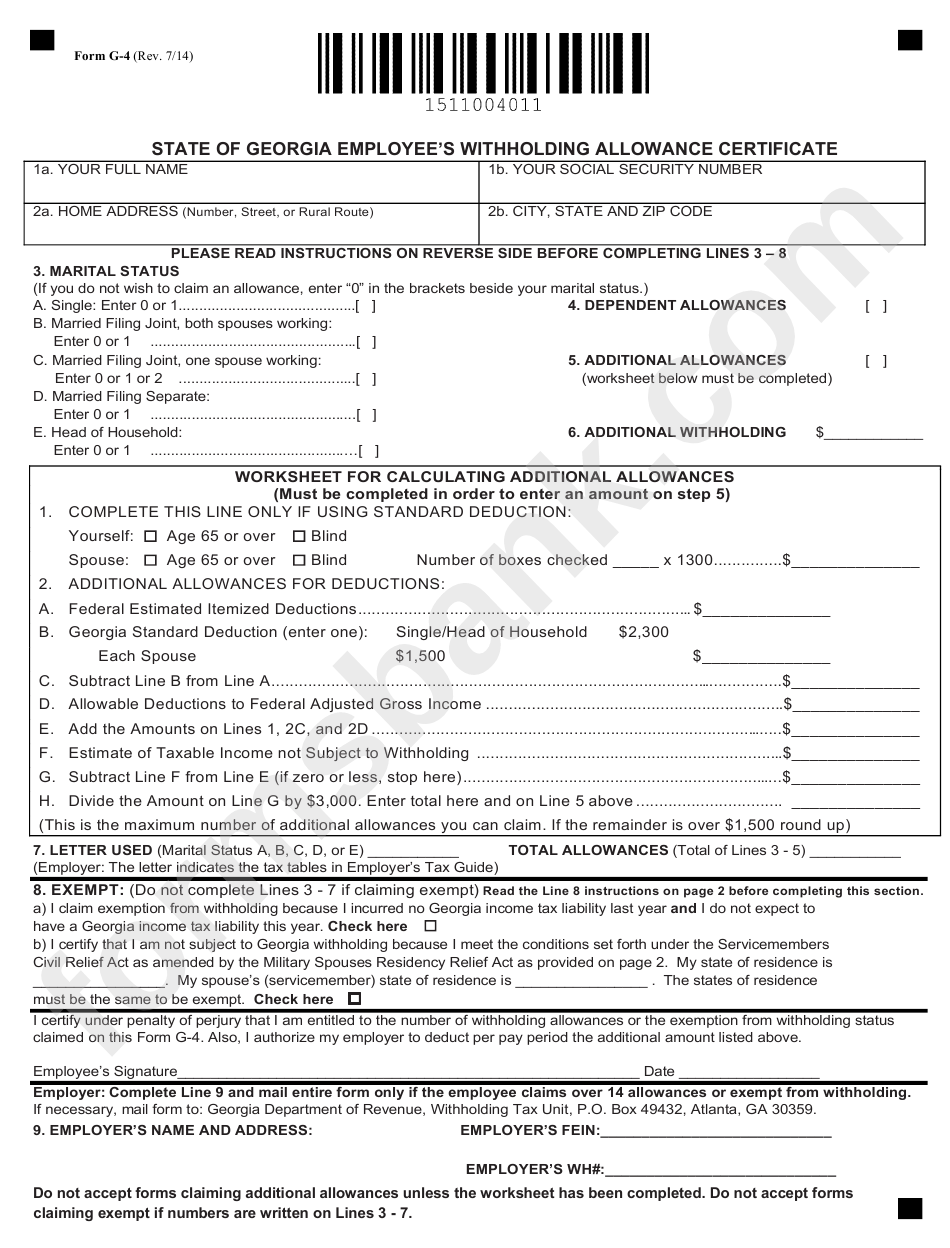

Georgia Tax Form G4 - Mail this completed form along with any other required documentation needed to process your request to the employees’ retirement system of. 7/14) state of georgia employee’s withholding allowance certificate do not accept forms claiming additional allowances unless the worksheet has been completed. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Web georgia depreciation and amortization form, includes information on listed property. The forms will be effective with the first paycheck. Complete, save and print the form online using your browser. Web they can only be printed and completed by hand. Your social security number 2a. 500 individual income tax return what's new? By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability.

Mail this completed form along with any other required documentation needed to process your request to the employees’ retirement system of. Your social security number 2a. 500 individual income tax return what's new? Complete, save and print the form online using your browser. The forms will be effective with the first paycheck. Web they can only be printed and completed by hand. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. 7/14) state of georgia employee’s withholding allowance certificate do not accept forms claiming additional allowances unless the worksheet has been completed. Web georgia depreciation and amortization form, includes information on listed property.

Your social security number 2a. Complete, save and print the form online using your browser. 500 individual income tax return what's new? Mail this completed form along with any other required documentation needed to process your request to the employees’ retirement system of. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Web georgia depreciation and amortization form, includes information on listed property. The forms will be effective with the first paycheck. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. 7/14) state of georgia employee’s withholding allowance certificate do not accept forms claiming additional allowances unless the worksheet has been completed. Web they can only be printed and completed by hand.

G4 Form

500 individual income tax return what's new? Complete, save and print the form online using your browser. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Web georgia depreciation and amortization form, includes information on listed property. Your social security number 2a.

G4 App

Web they can only be printed and completed by hand. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. The forms will be effective with the first paycheck. Web georgia depreciation and amortization form, includes information on listed property. Complete, save and print the form online using your browser.

Gallery of 2018 W 4 Fillable form New Tax forms G4 Fill Line

Mail this completed form along with any other required documentation needed to process your request to the employees’ retirement system of. 500 individual income tax return what's new? By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Form (g4) is to be completed and submitted to your employer in order to.

Form G4 State Of Employee'S Withholding Allowance

Web georgia depreciation and amortization form, includes information on listed property. Complete, save and print the form online using your browser. Web they can only be printed and completed by hand. 500 individual income tax return what's new? Your social security number 2a.

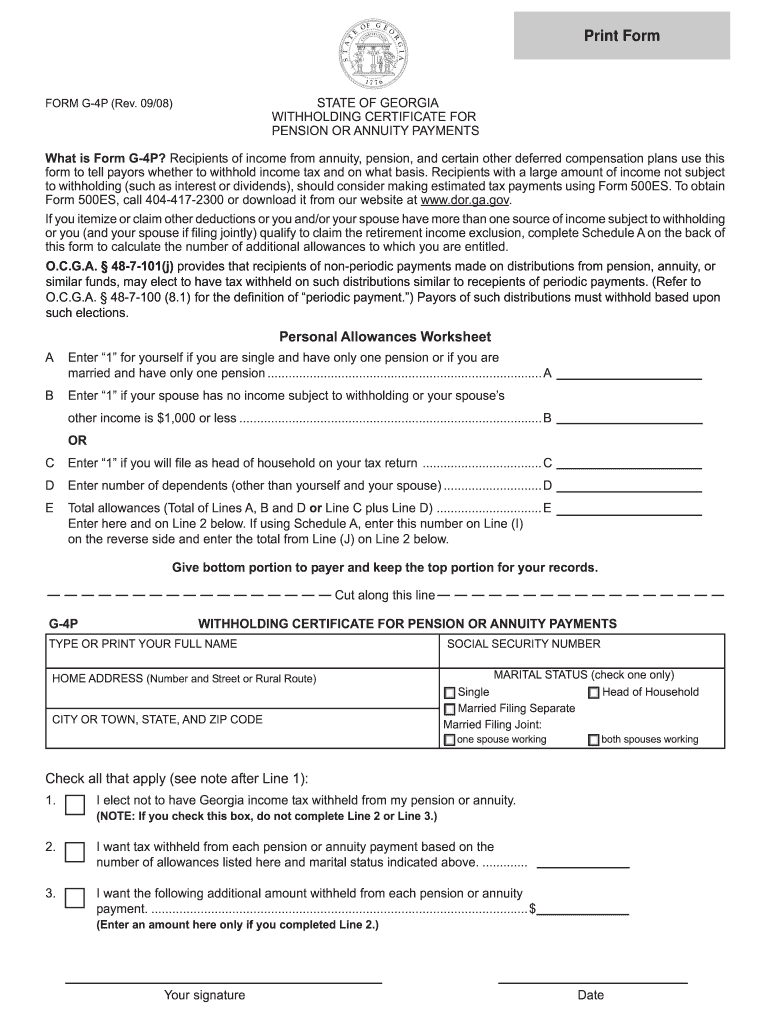

G 4P Form Fill Out and Sign Printable PDF Template signNow

Complete, save and print the form online using your browser. 500 individual income tax return what's new? Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Mail this completed form along with any other required documentation needed to process your request to the employees’ retirement system of. Web georgia.

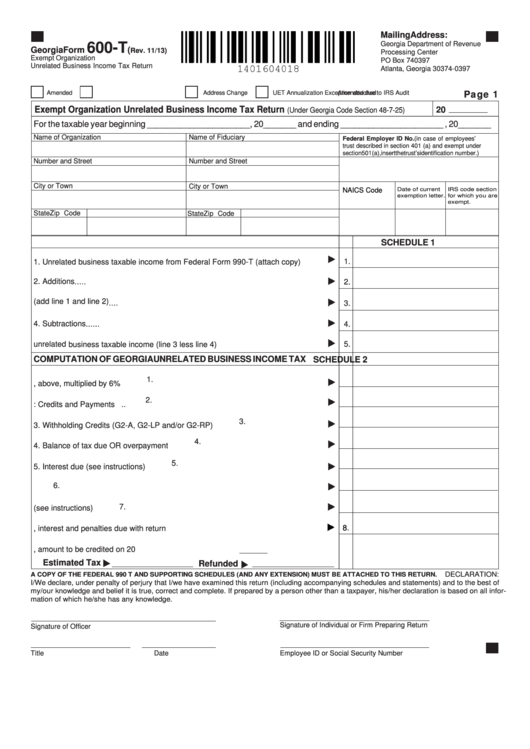

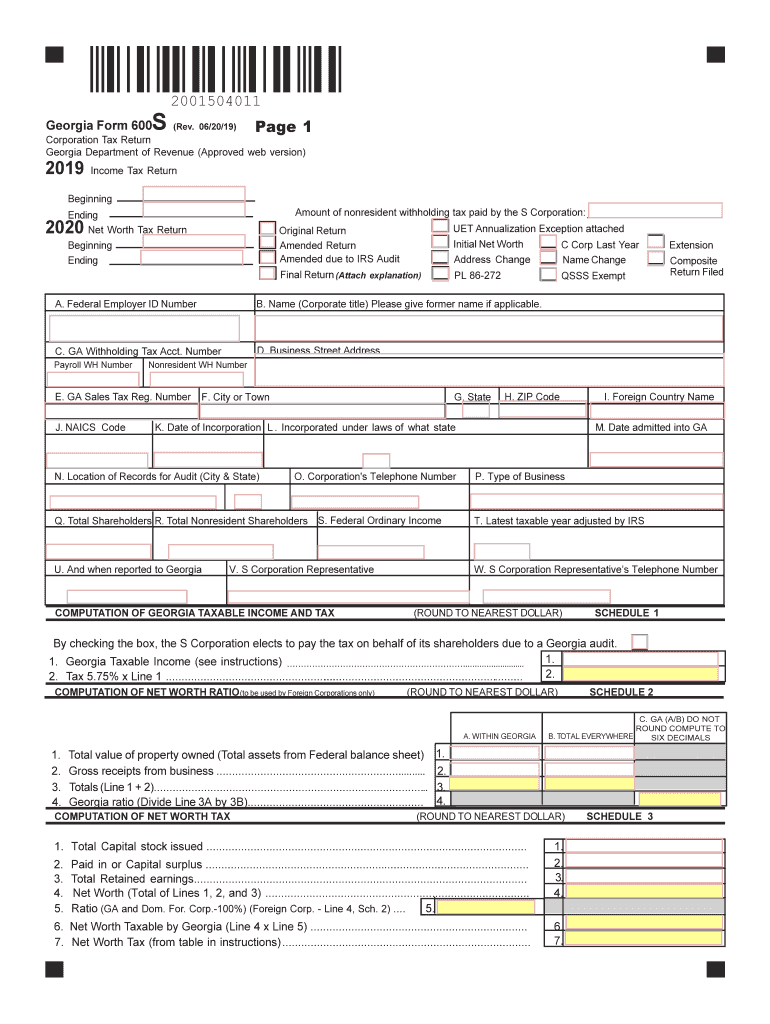

Fillable Form 600T Exempt Organization Unrelated Business

7/14) state of georgia employee’s withholding allowance certificate do not accept forms claiming additional allowances unless the worksheet has been completed. 500 individual income tax return what's new? Web they can only be printed and completed by hand. Mail this completed form along with any other required documentation needed to process your request to the employees’ retirement system of. Your.

Saving PDF as JPG for zoom.it, Camtasia, Articulate, LMS course Geesh

Mail this completed form along with any other required documentation needed to process your request to the employees’ retirement system of. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. The forms will be effective with the first paycheck. 500 individual income tax return what's new? 7/14) state of.

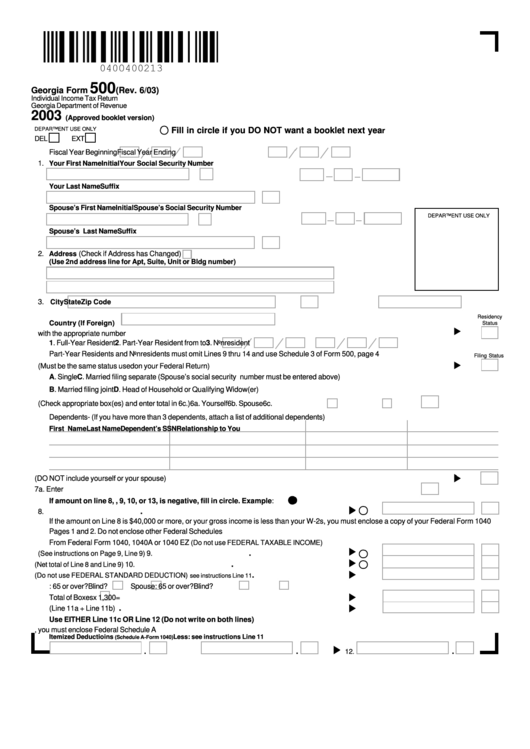

Form 500 Individual Tax Return 2003 printable pdf

Complete, save and print the form online using your browser. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Your social security number 2a. 7/14) state of georgia employee’s withholding allowance certificate do not accept forms claiming additional allowances unless the worksheet has been completed. By correctly completing this.

2018 W 4 Fillable form Beautiful Internal Revenue Bulletin 2018 39

The forms will be effective with the first paycheck. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Web they can only be printed and completed by hand. 500 individual income tax return what's new? Complete, save and print the form online using your browser.

Form 500 EZ Individual Tax Return Fill Out and Sign

Web georgia depreciation and amortization form, includes information on listed property. The forms will be effective with the first paycheck. Mail this completed form along with any other required documentation needed to process your request to the employees’ retirement system of. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Complete,.

500 Individual Income Tax Return What's New?

Mail this completed form along with any other required documentation needed to process your request to the employees’ retirement system of. Complete, save and print the form online using your browser. Your social security number 2a. The forms will be effective with the first paycheck.

Web Georgia Depreciation And Amortization Form, Includes Information On Listed Property.

Web they can only be printed and completed by hand. 7/14) state of georgia employee’s withholding allowance certificate do not accept forms claiming additional allowances unless the worksheet has been completed. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability.