Ga Form 600 Instructions 2022

Ga Form 600 Instructions 2022 - Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law, and the taxpayers filing requirements. Computation of tax due or overpayment (round to nearest dollar) schedule 4. Web we last updated the corporate tax return in january 2023, so this is the latest version of form 600, fully updated for tax year 2022. Web complete, save and print the form online using your browser. Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month. Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. 07/20/22) page 1 corporation tax return 2022 georgia department of revenue (approved web2 version) income tax return beginning ending 2023 net worth tax return beginning original return initial net worth amended return amended due to irs audit consolidated ga parent return (attach approval) You can print other georgia tax forms here. Kemp governor electronic filing the georgia department of revenue accepts visa, american express, mastercard, and discover credit cards for payment of: To successfully complete the form, you must download and use the current version of adobe acrobat reader.

To successfully complete the form, you must download and use the current version of adobe acrobat reader. To successfully complete the form, you must download and use the current version of. 2022 it611 corporate income tax instruction booklet (871.18 kb) 2021 it611 corporate income tax instruction booklet (587.11 kb) 2020 it611 corporate income tax instruction booklet (2.63 mb) Web file form 600 and pay the tax electronically. Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. You can print other georgia tax forms here. Web complete, save and print the form online using your browser. 07/20/22) page 1 corporation tax return 2022 georgia department of revenue (approved web2 version) income tax return beginning ending 2023 net worth tax return beginning original return initial net worth amended return amended due to irs audit consolidated ga parent return (attach approval) Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month. Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date.

You can print other georgia tax forms here. Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Computation of tax due or overpayment (round to nearest dollar) schedule 4. 07/20/22) page 1 corporation tax return 2022 georgia department of revenue (approved web2 version) income tax return beginning ending 2023 net worth tax return beginning original return initial net worth amended return amended due to irs audit consolidated ga parent return (attach approval) Web file form 600 and pay the tax electronically. To successfully complete the form, you must download and use the current version of adobe acrobat reader. Web complete, save and print the form online using your browser. Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law, and the taxpayers filing requirements. Any tax credits from schedule 11 may be applied against income tax liability only, not. Kemp governor electronic filing the georgia department of revenue accepts visa, american express, mastercard, and discover credit cards for payment of:

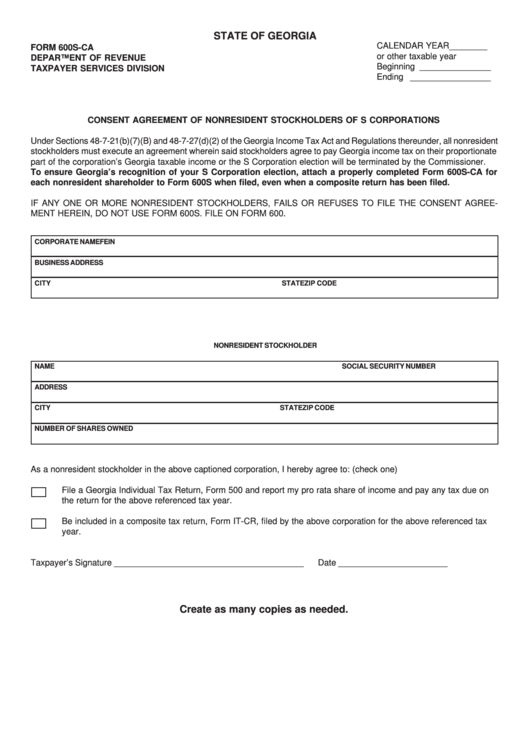

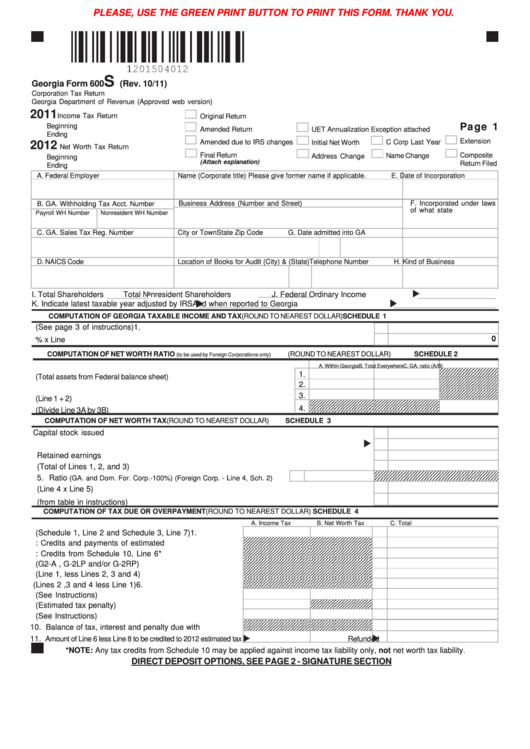

Top 5 Form 600s Templates free to download in PDF format

Computation of tax due or overpayment (round to nearest dollar) schedule 4. Corporation income tax general instructions booklet. 2022 it611 corporate income tax instruction booklet (871.18 kb) 2021 it611 corporate income tax instruction booklet (587.11 kb) 2020 it611 corporate income tax instruction booklet (2.63 mb) Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that.

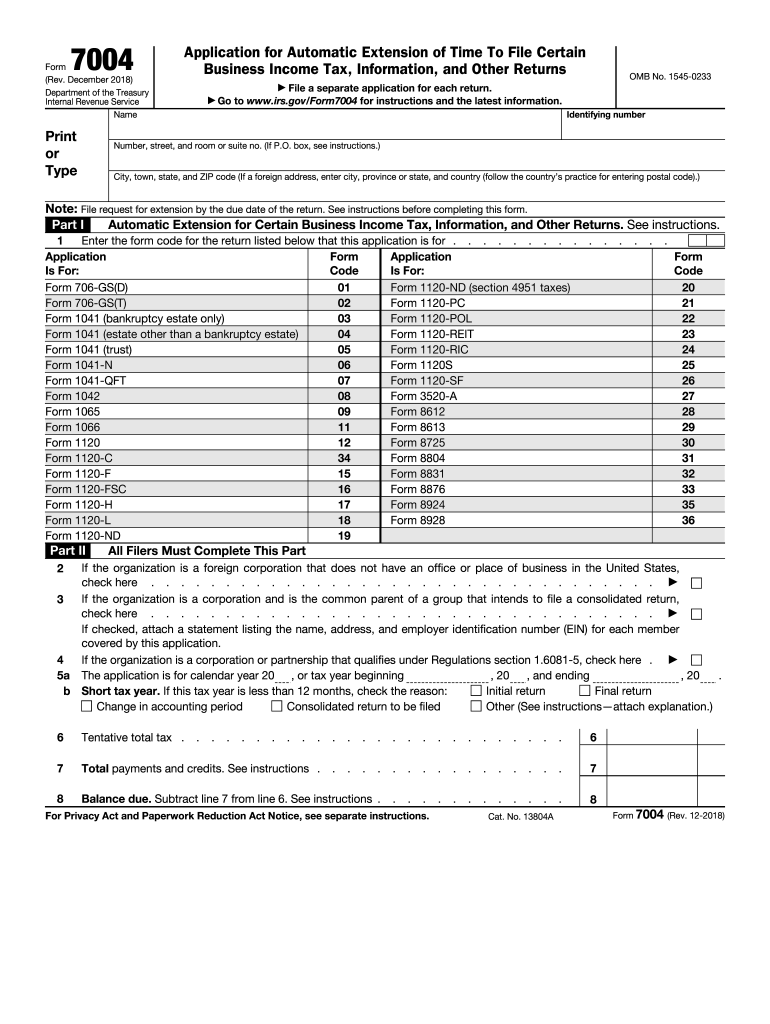

2016 form 7004 Fill out & sign online DocHub

Any tax credits from schedule 11 may be applied against income tax liability only, not. Kemp governor electronic filing the georgia department of revenue accepts visa, american express, mastercard, and discover credit cards for payment of: Computation of tax due or overpayment (round to nearest dollar) schedule 4. To successfully complete the form, you must download and use the current.

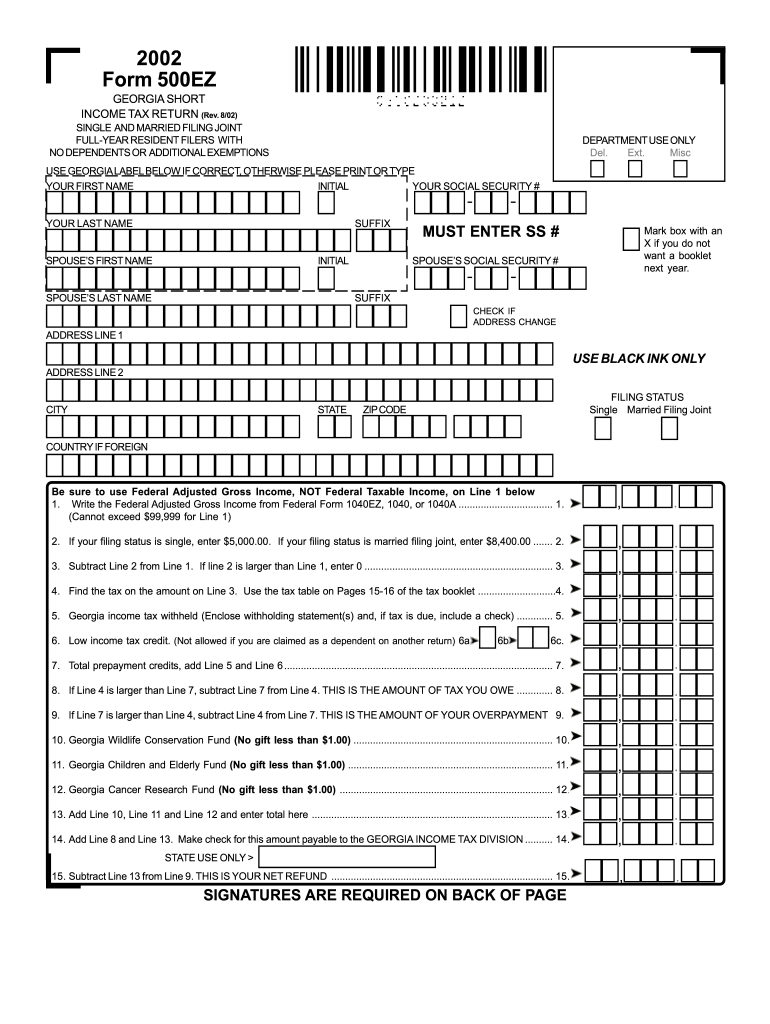

500 Form Fill Out and Sign Printable PDF Template signNow

Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. Corporation income tax general instructions booklet. Visit our website dor.georgia.gov for more information. 2022 it611 corporate.

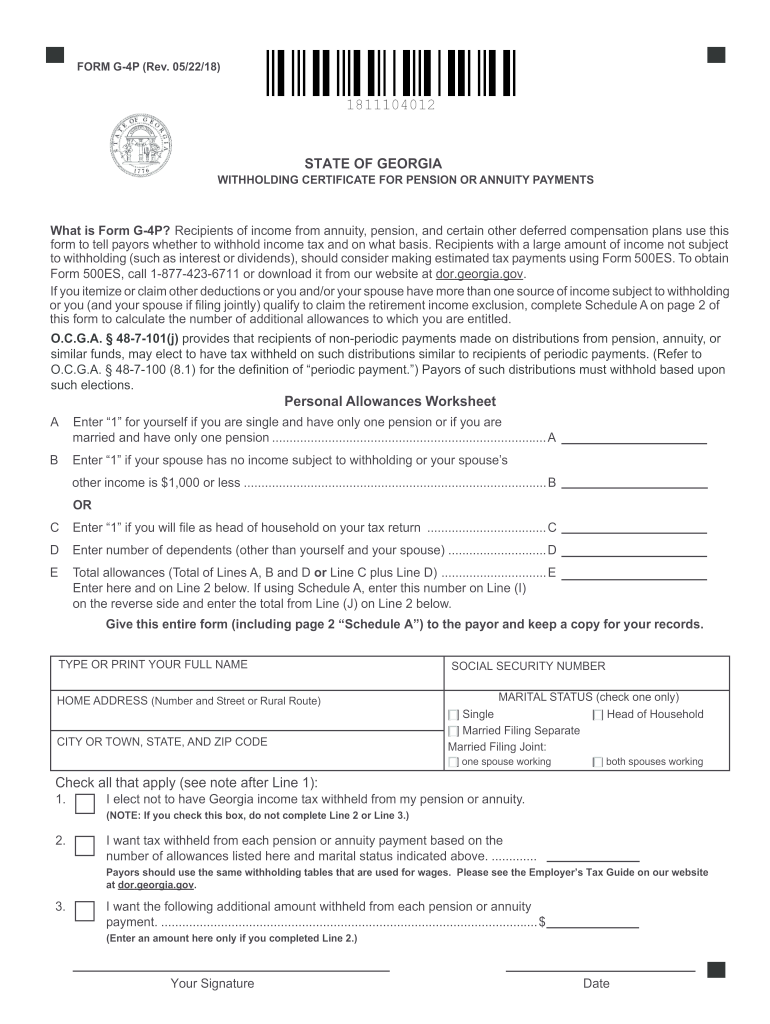

G 4P Fill Out and Sign Printable PDF Template signNow

Visit our website dor.georgia.gov for more information. Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law, and the taxpayers filing requirements. Web file form 600 and pay the tax electronically. Corporation income tax general instructions booklet. Kemp governor electronic filing the georgia department of revenue accepts visa, american express,.

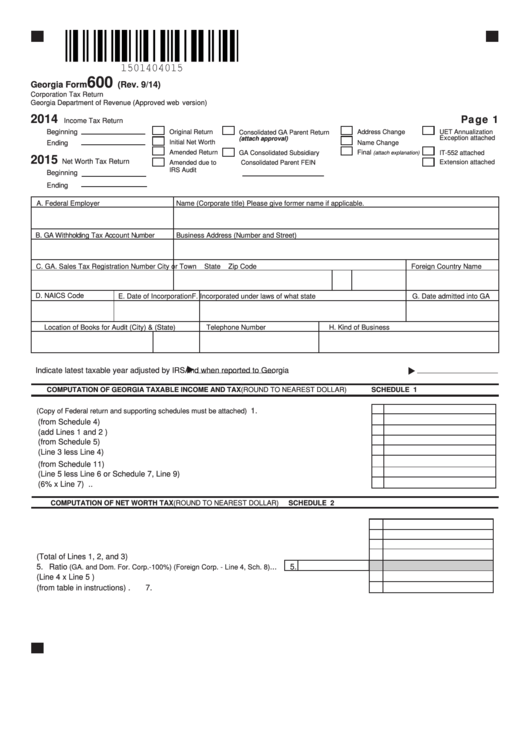

Fillable Form 600 Corporation Tax Return printable pdf download

Web we last updated the corporate tax return in january 2023, so this is the latest version of form 600, fully updated for tax year 2022. To successfully complete the form, you must download and use the current version of. Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law,.

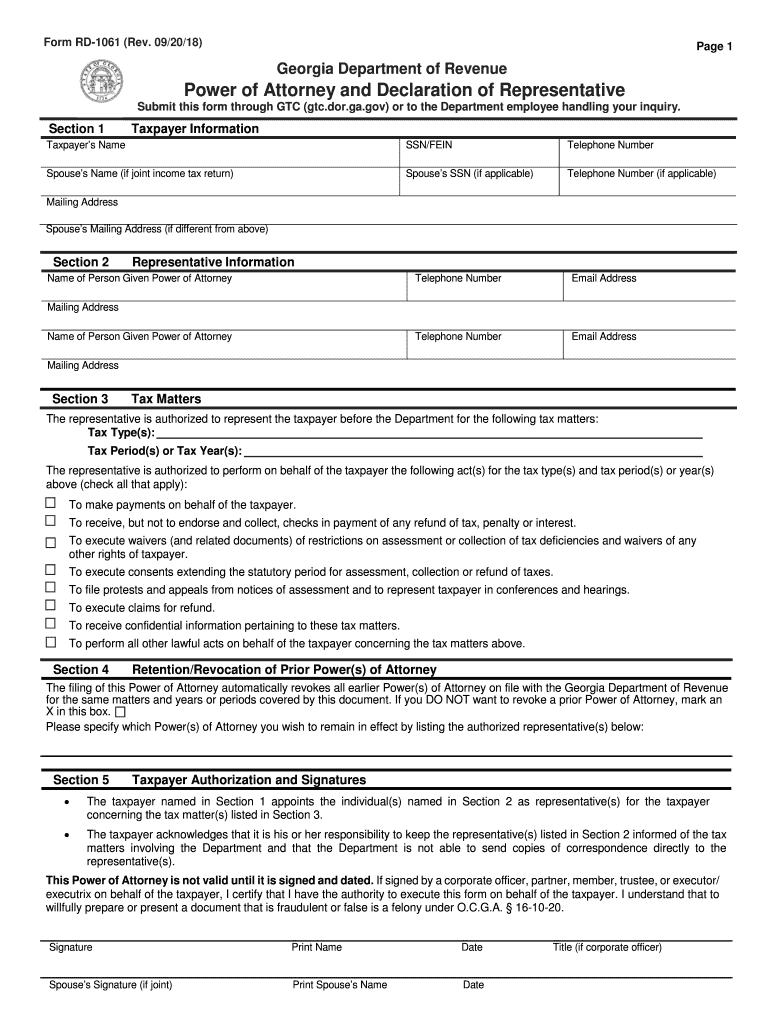

20182022 Form GA RD1061 Fill Online, Printable, Fillable, Blank

Credit card payments it 611 rev. To successfully complete the form, you must download and use the current version of adobe acrobat reader. Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month. Computation of tax due or overpayment (round to nearest dollar) schedule 4. Web georgia.

Fillable Form 600s Corporation Tax Return printable pdf download

You can print other georgia tax forms here. Georgia individual income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by georgia law, and the taxpayers filing requirements. Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month. Any tax credits from.

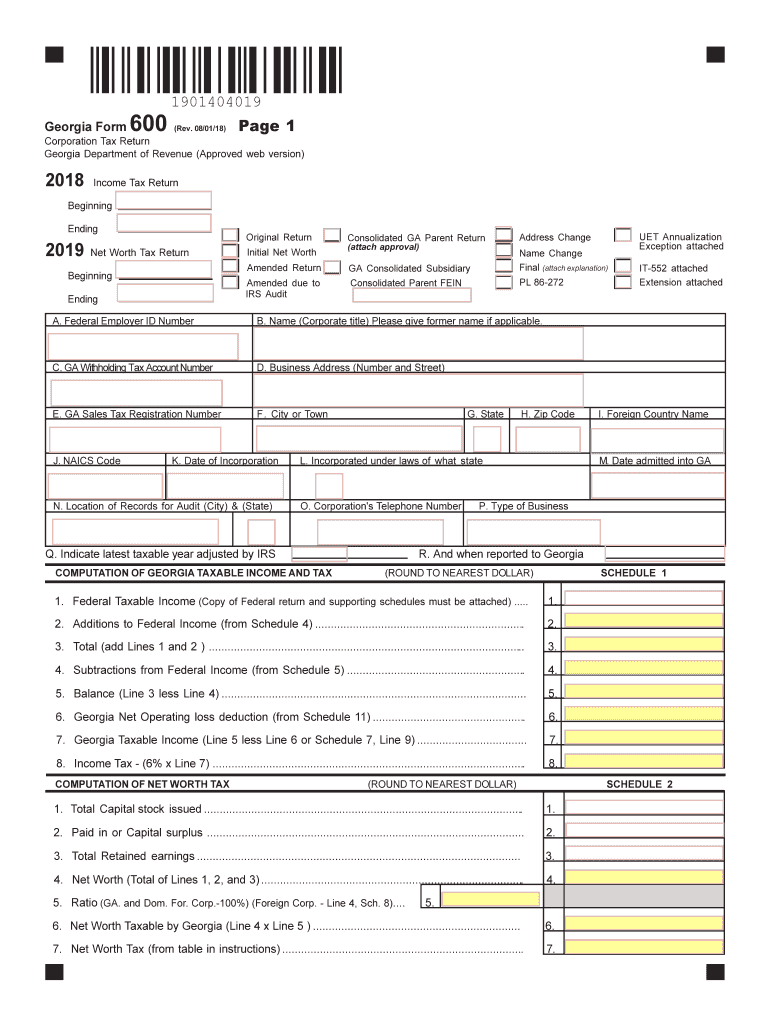

2018 Form GA DoR 600 Fill Online, Printable, Fillable, Blank pdfFiller

2022 it611 corporate income tax instruction booklet (871.18 kb) 2021 it611 corporate income tax instruction booklet (587.11 kb) 2020 it611 corporate income tax instruction booklet (2.63 mb) Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. Web complete, save and print the form.

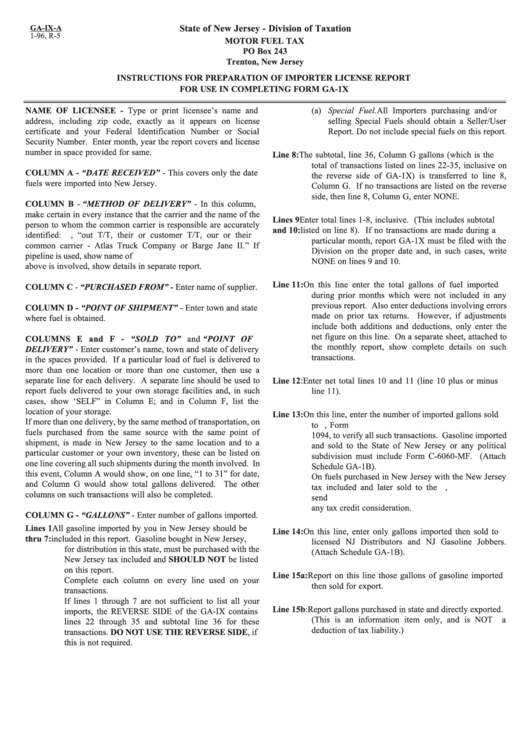

Form Ga1x Instructions For Preparation Of Importer License Report

Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. Visit our website dor.georgia.gov for more information. Web we last updated the corporate tax return in january 2023, so this is the latest version of form 600, fully updated for tax year 2022. To.

30 Separation Notice Fillable Example Document Template

Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month. Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month.

Kemp Governor Electronic Filing The Georgia Department Of Revenue Accepts Visa, American Express, Mastercard, And Discover Credit Cards For Payment Of:

Due dates for partnership returns partnership returns are due on or before the 15th day of the 3rd month following the close of the taxable year. Any tax credits from schedule 11 may be applied against income tax liability only, not. Visit our website dor.georgia.gov for more information. Web corporate income and net worth tax returns (form 600) must be filed on or before the 15th day of the 4th month.

Georgia Individual Income Tax Is Based On The Taxpayer's Federal Adjusted Gross Income, Adjustments That Are Required By Georgia Law, And The Taxpayers Filing Requirements.

Computation of tax due or overpayment (round to nearest dollar) schedule 4. Web we last updated the corporate tax return in january 2023, so this is the latest version of form 600, fully updated for tax year 2022. 2022 it611 corporate income tax instruction booklet (871.18 kb) 2021 it611 corporate income tax instruction booklet (587.11 kb) 2020 it611 corporate income tax instruction booklet (2.63 mb) 07/20/22) page 1 corporation tax return 2022 georgia department of revenue (approved web2 version) income tax return beginning ending 2023 net worth tax return beginning original return initial net worth amended return amended due to irs audit consolidated ga parent return (attach approval)

You Can Print Other Georgia Tax Forms Here.

To successfully complete the form, you must download and use the current version of adobe acrobat reader. Credit card payments it 611 rev. Web complete, save and print the form online using your browser. To successfully complete the form, you must download and use the current version of.

Corporation Income Tax General Instructions Booklet.

Web georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Web file form 600 and pay the tax electronically.