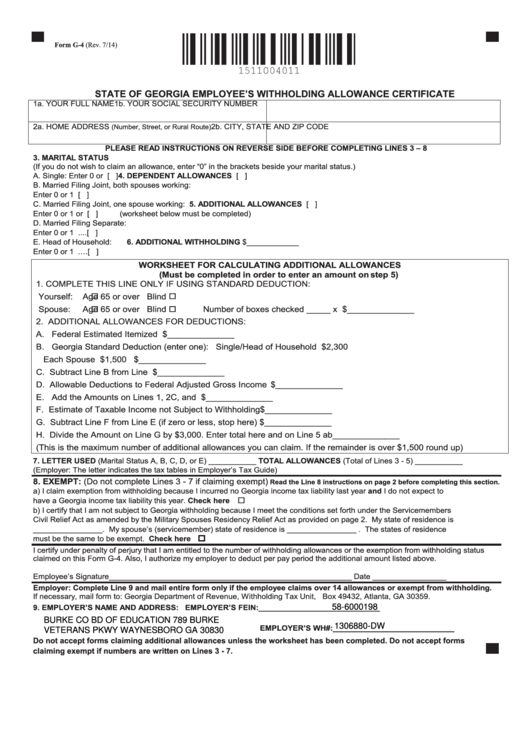

G4 Form 2023

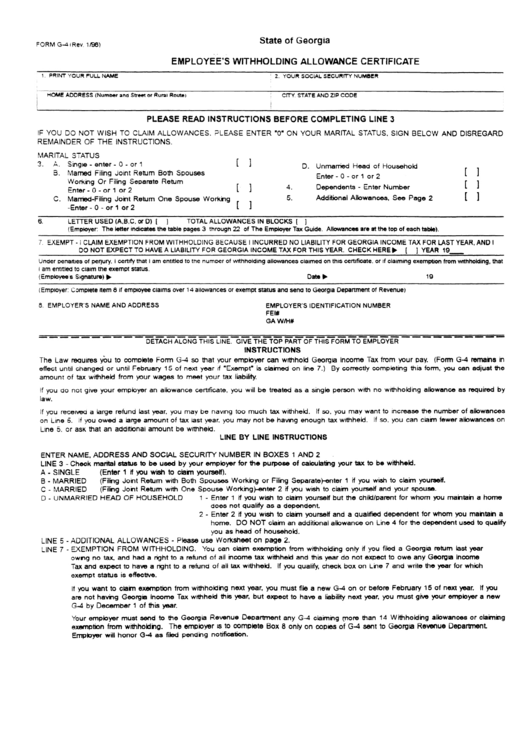

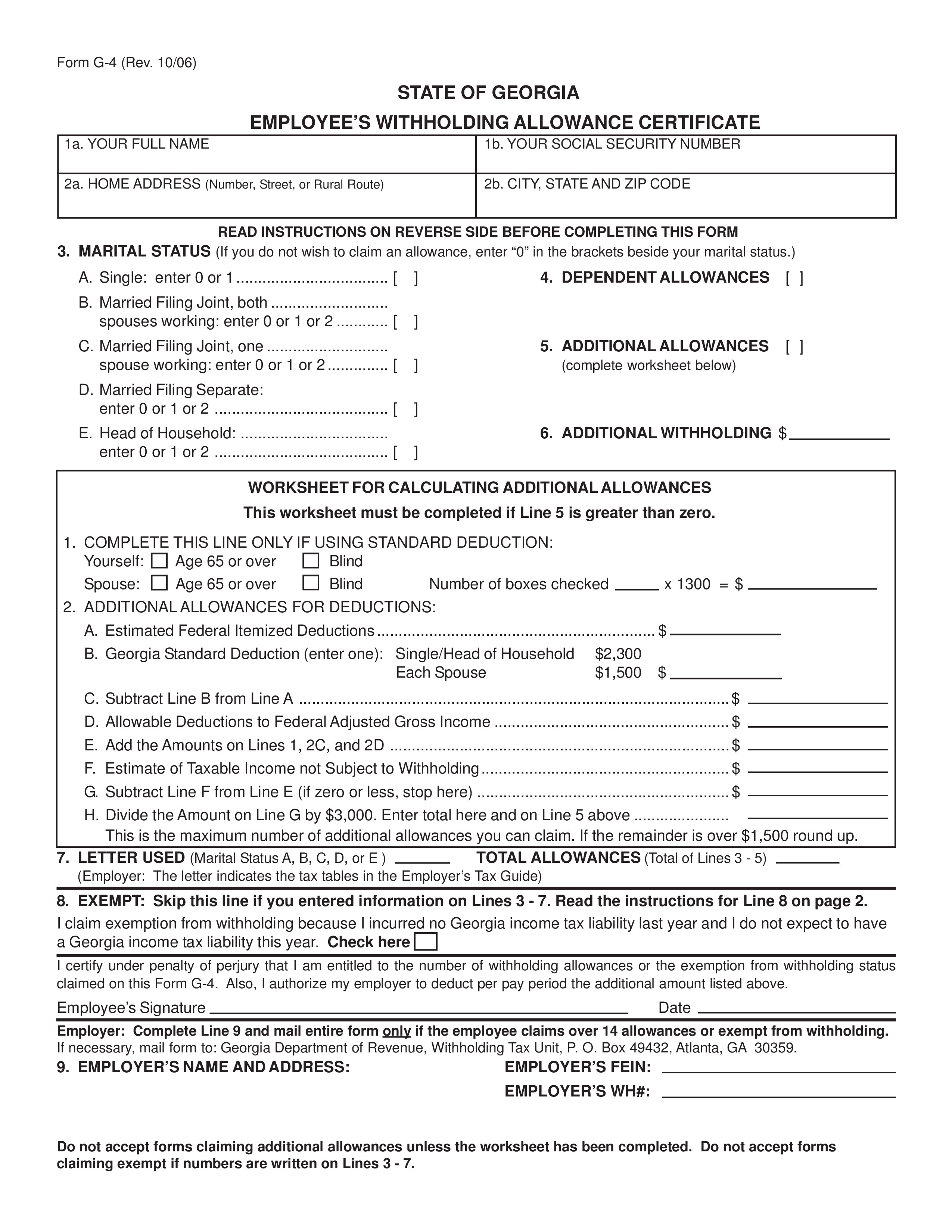

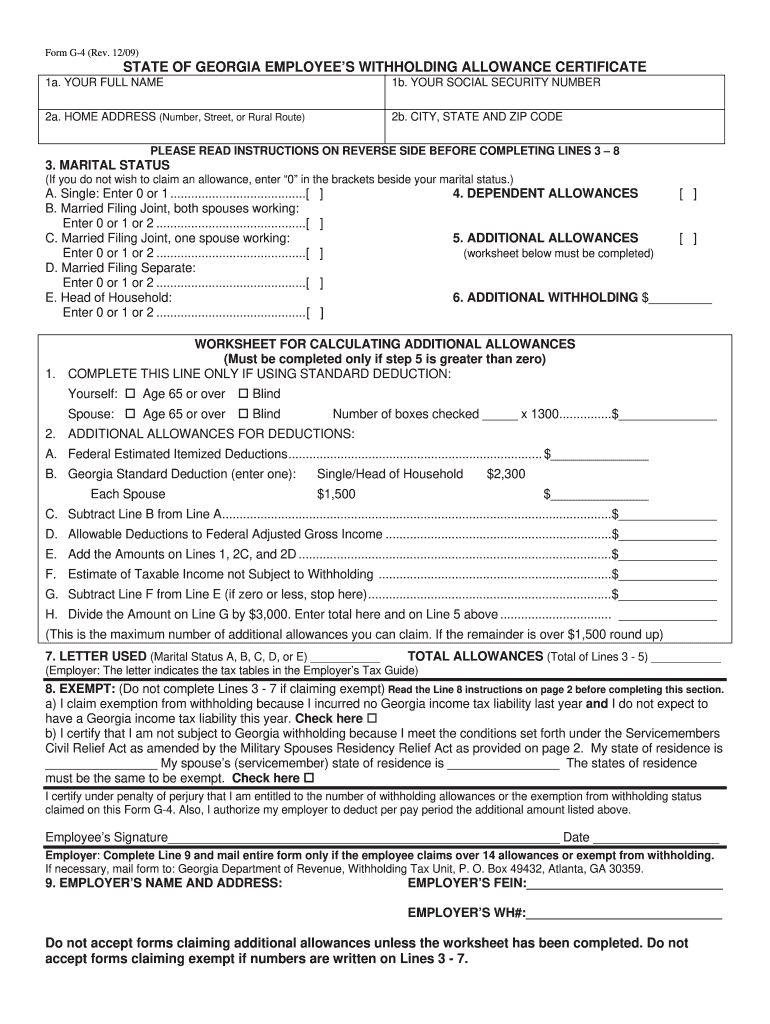

G4 Form 2023 - By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. _____________who miss the deadline may appeal for late consideration. Students *your date of birth: Save or instantly send your ready documents. Each choice affects the amount of tax the employer will withhold. Use this form to tell payers whether to withhold income tax and on what basis. This form must be emailed or postmarked by september 5, 2023 to be considered on time. Video of the day the single filing status is used only by taxpayers who are not legally married. Filling it in correctly and updating it when necessary ensures accurate payroll deductions. The forms will be effective with the first paycheck.

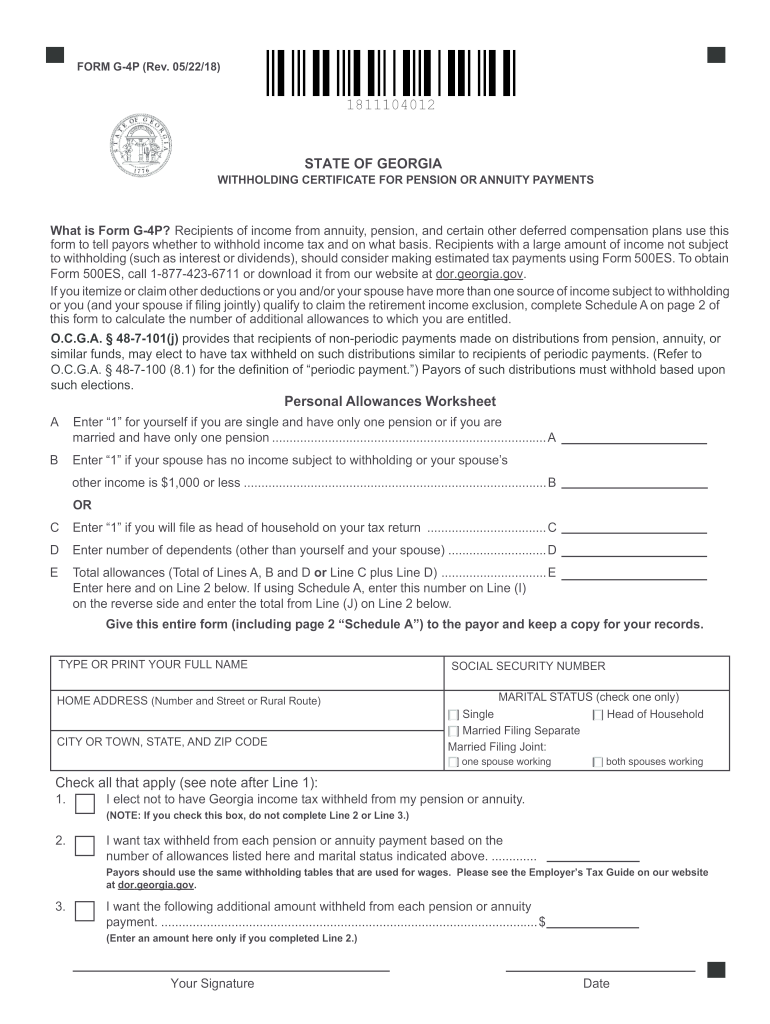

_____________who miss the deadline may appeal for late consideration. Video of the day the single filing status is used only by taxpayers who are not legally married. Use this form to tell payers whether to withhold income tax and on what basis. Students *your date of birth: This form must be emailed or postmarked by september 5, 2023 to be considered on time. Filling it in correctly and updating it when necessary ensures accurate payroll deductions. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. The forms will be effective with the first paycheck. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. For recipients of income from annuities, pensions, and certain other deferred compensation plans.

Save or instantly send your ready documents. Each choice affects the amount of tax the employer will withhold. Students *your date of birth: Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Use this form to tell payers whether to withhold income tax and on what basis. _____________who miss the deadline may appeal for late consideration. This form must be emailed or postmarked by september 5, 2023 to be considered on time. The forms will be effective with the first paycheck. For recipients of income from annuities, pensions, and certain other deferred compensation plans. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability.

G4SP0120200320123753 — ImgBB

Filling it in correctly and updating it when necessary ensures accurate payroll deductions. Students *your date of birth: (mm/dd/yyyy) *details on item 9 of page 3. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. The forms will be effective with the first paycheck.

2022 Mitsubishi Mirage G4 Arrives In Philippines, Check Out Its Price

This form must be emailed or postmarked by september 5, 2023 to be considered on time. Use this form to tell payers whether to withhold income tax and on what basis. For recipients of income from annuities, pensions, and certain other deferred compensation plans. Save or instantly send your ready documents. Web (if currently a hs senior, anticipated date) (mm/yyyy)deadline:

G4 15/06/2020 Página 10 YouTube

By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Web (if currently a hs senior, anticipated date) (mm/yyyy)deadline: Filling it in correctly and updating it when necessary ensures accurate payroll deductions. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages..

Fillable Form G4 Employee'S Withholding Allowance Certificate

This form must be emailed or postmarked by september 5, 2023 to be considered on time. (mm/dd/yyyy) *details on item 9 of page 3. The forms will be effective with the first paycheck. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents.

Fillable Form G4 Employee'S Withholding Allowance Certificate

(mm/dd/yyyy) *details on item 9 of page 3. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. This form must be emailed or postmarked by september 5, 2023 to be considered on time. Use this form to tell payers whether to withhold income tax and on what basis. The forms will.

G 4P Fill Out and Sign Printable PDF Template signNow

This form must be emailed or postmarked by september 5, 2023 to be considered on time. _____________who miss the deadline may appeal for late consideration. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Video of the day the single filing status is used only by taxpayers who are not legally.

State Employee Withholding Form 2023

Each choice affects the amount of tax the employer will withhold. Save or instantly send your ready documents. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Students *your date of birth: Use this form to tell payers whether to withhold income tax and on what basis.

Saving PDF as JPG for zoom.it, Camtasia, Articulate, LMS course Geesh

For recipients of income from annuities, pensions, and certain other deferred compensation plans. Easily fill out pdf blank, edit, and sign them. (mm/dd/yyyy) *details on item 9 of page 3. _____________who miss the deadline may appeal for late consideration. Save or instantly send your ready documents.

2000 Form GA DoR G4 Fill Online, Printable, Fillable, Blank PDFfiller

This form must be emailed or postmarked by september 5, 2023 to be considered on time. Filling it in correctly and updating it when necessary ensures accurate payroll deductions. Each choice affects the amount of tax the employer will withhold. Students *your date of birth: Video of the day the single filing status is used only by taxpayers who are.

Mirage g4 glx manual 2019

Filling it in correctly and updating it when necessary ensures accurate payroll deductions. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. (mm/dd/yyyy) *details on item 9 of page 3. Web.

Web (If Currently A Hs Senior, Anticipated Date) (Mm/Yyyy)Deadline:

By correctly completing this form, you can adjust the amount of tax withheld to meet your tax liability. Students *your date of birth: For recipients of income from annuities, pensions, and certain other deferred compensation plans. _____________who miss the deadline may appeal for late consideration.

Save Or Instantly Send Your Ready Documents.

Filling it in correctly and updating it when necessary ensures accurate payroll deductions. Each choice affects the amount of tax the employer will withhold. Use this form to tell payers whether to withhold income tax and on what basis. This form must be emailed or postmarked by september 5, 2023 to be considered on time.

(Mm/Dd/Yyyy) *Details On Item 9 Of Page 3.

The forms will be effective with the first paycheck. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Video of the day the single filing status is used only by taxpayers who are not legally married. Easily fill out pdf blank, edit, and sign them.