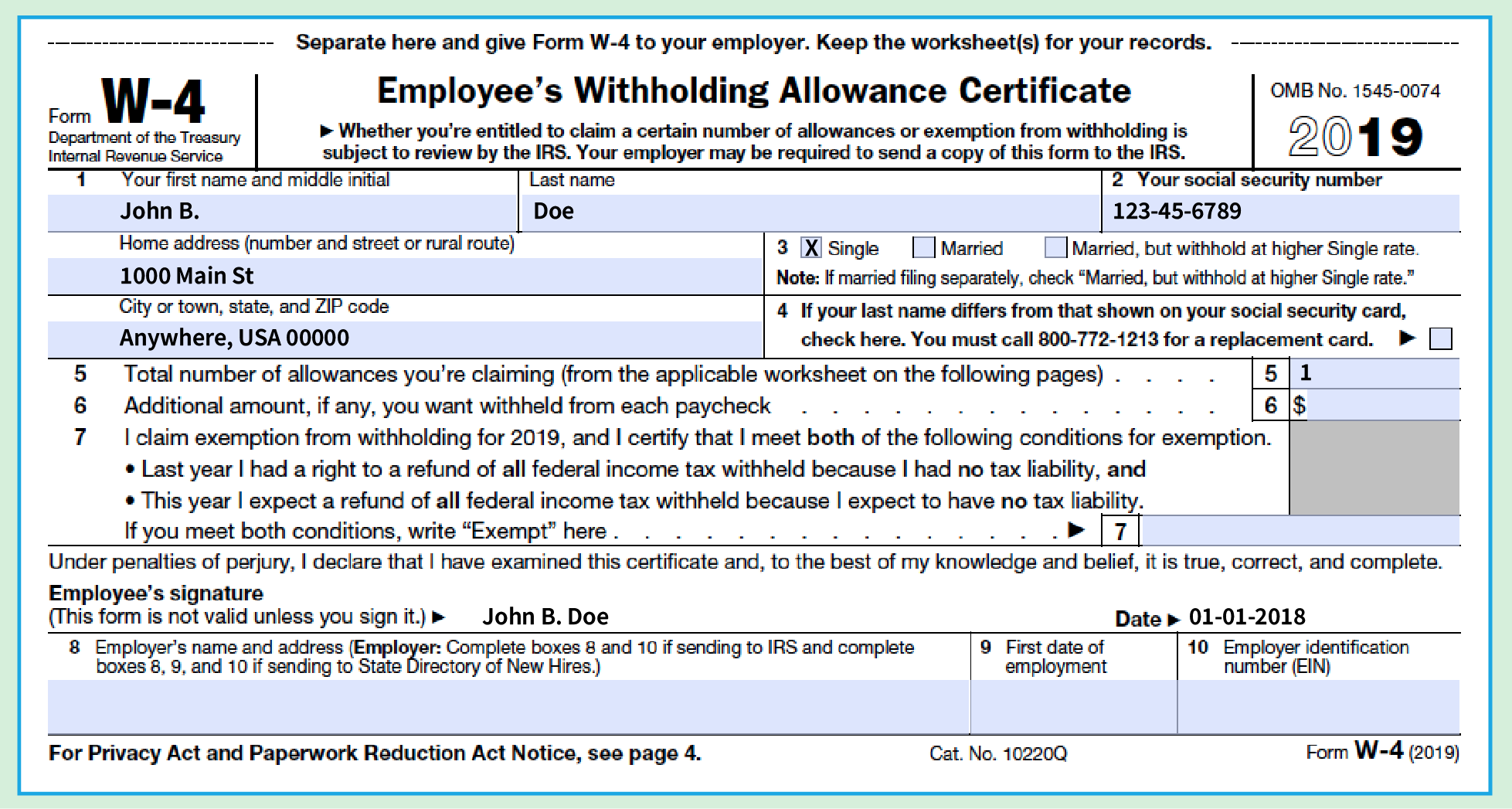

Form W4 2019

Form W4 2019 - Your withholding is subject to review by the irs. More money now or refund later? If too much is withheld, you will generally be due a refund. Any additional amount you wanted to be withheld from your paycheck. Web form w‐4p is for u.s. Also, choosing the new form reduces complexity and makes sure that your employee’s withholding is done simpler with more accuracy. The latest info & advice to help you run your business. Web the tax cuts & jobs act also doubled the maximum child tax credit (from $1,000 to $2,000). Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s). The new design is simple, accurate, and gives employees privacy while minimizing the burden on employers and the payroll process.

The number of allowances you were claiming. This form is crucial in determining your balance due or. Your withholding is subject to review by the irs. The new design is simple, accurate, and gives employees privacy while minimizing the burden on employers and the payroll process. Web in this video you’ll learn: Employee's withholding certificate form 941; If too much is withheld, you will generally be due a refund. Puede reclamar la exención de la retención para 2019 si ambas The latest info & advice to help you run your business. Any additional amount you wanted to be withheld from your paycheck.

Generally, you may claim head of household filing status on your tax return only if you are unmarried and pay more State and local tax authorities are also. Puede reclamar la exención de la retención para 2019 si ambas Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s). This form is crucial in determining your balance due or. The number of allowances you were claiming. Your withholding is subject to review by the irs. ____________________________________________ what’s changed on the new w. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Your withholding is subject to review by the irs.

2019 Form W4 Federal Tax Form Rea CPA

The number of allowances you were claiming. Your withholding is subject to review by the irs. The latest info & advice to help you run your business. Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. Web form w‐4p is for u.s.

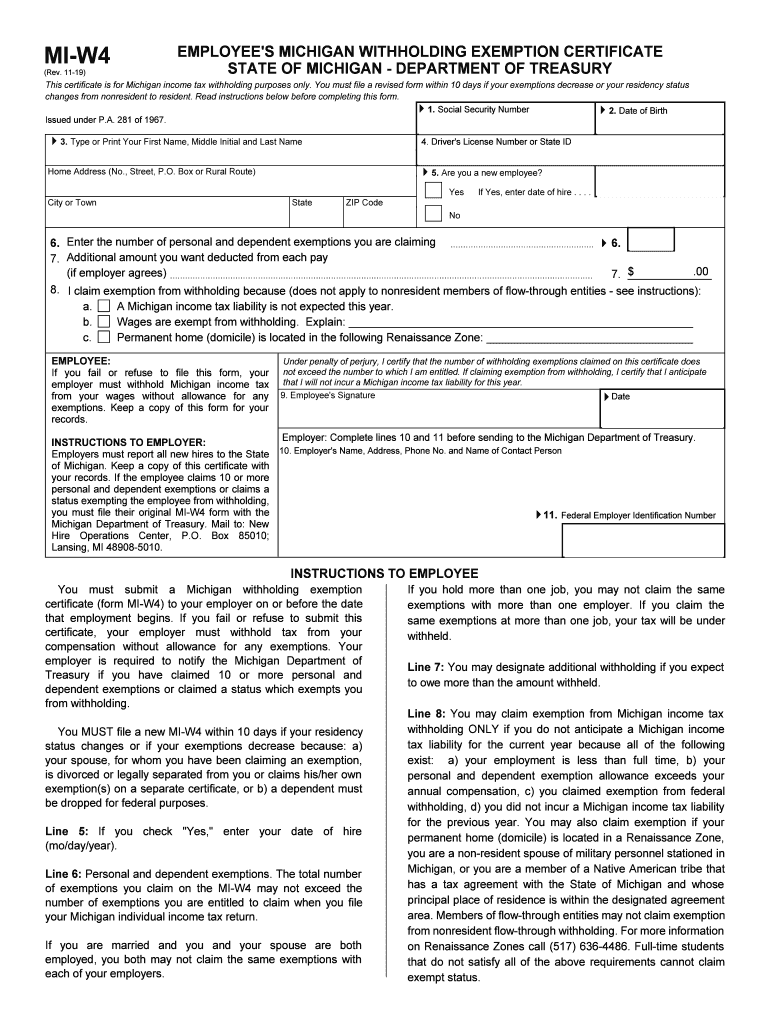

MI MIW4 2019 Fill out Tax Template Online US Legal Forms

This form tells your employer how much federal income tax withholding to keep from each paycheck. Your withholding is subject to review by the irs. Puede reclamar la exención de la retención para 2019 si ambas The new design is simple, accurate, and gives employees privacy while minimizing the burden on employers and the payroll process. Several changes are fundamental.

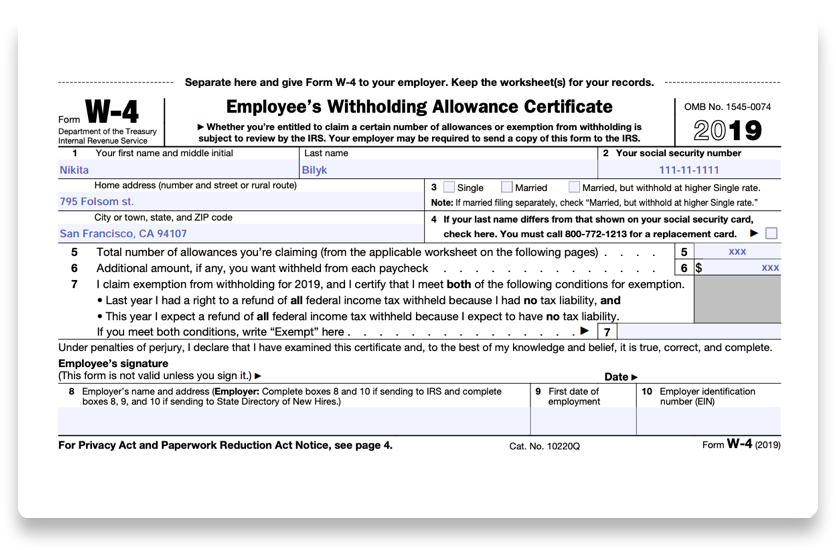

IRS unveils second draft W4 Tax Pro Today

Web form w‐4p is for u.s. Puede reclamar la exención de la retención para 2019 si ambas Web the tax cuts & jobs act also doubled the maximum child tax credit (from $1,000 to $2,000). Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. This form tells your employer.

2019 W4 Form How To Fill It Out and What You Need to Know

Web the tax cuts & jobs act also doubled the maximum child tax credit (from $1,000 to $2,000). Citizens, resident aliens, or their estates who are recipients of pensions, annuities (including commercial annuities), and certain other deferred compensation. Any additional amount you wanted to be withheld from your paycheck. ____________________________________________ what’s changed on the new w. More money now or.

W42022 Printable IRS Blank to Download in PDF

Also, choosing the new form reduces complexity and makes sure that your employee’s withholding is done simpler with more accuracy. The number of allowances you were claiming. Your withholding is subject to review by the irs. This form tells your employer how much federal income tax withholding to keep from each paycheck. Citizens, resident aliens, or their estates who are.

2019 W4 Form How To Fill It Out and What You Need to Know

Your withholding is subject to review by the irs. This form tells your employer how much federal income tax withholding to keep from each paycheck. The new design is simple, accurate, and gives employees privacy while minimizing the burden on employers and the payroll process. The latest info & advice to help you run your business. This form is crucial.

Il W 4 2020 2022 W4 Form

Web in this video you’ll learn: The new design is simple, accurate, and gives employees privacy while minimizing the burden on employers and the payroll process. More money now or refund later? Your withholding is subject to review by the irs. Your withholding is subject to review by the irs.

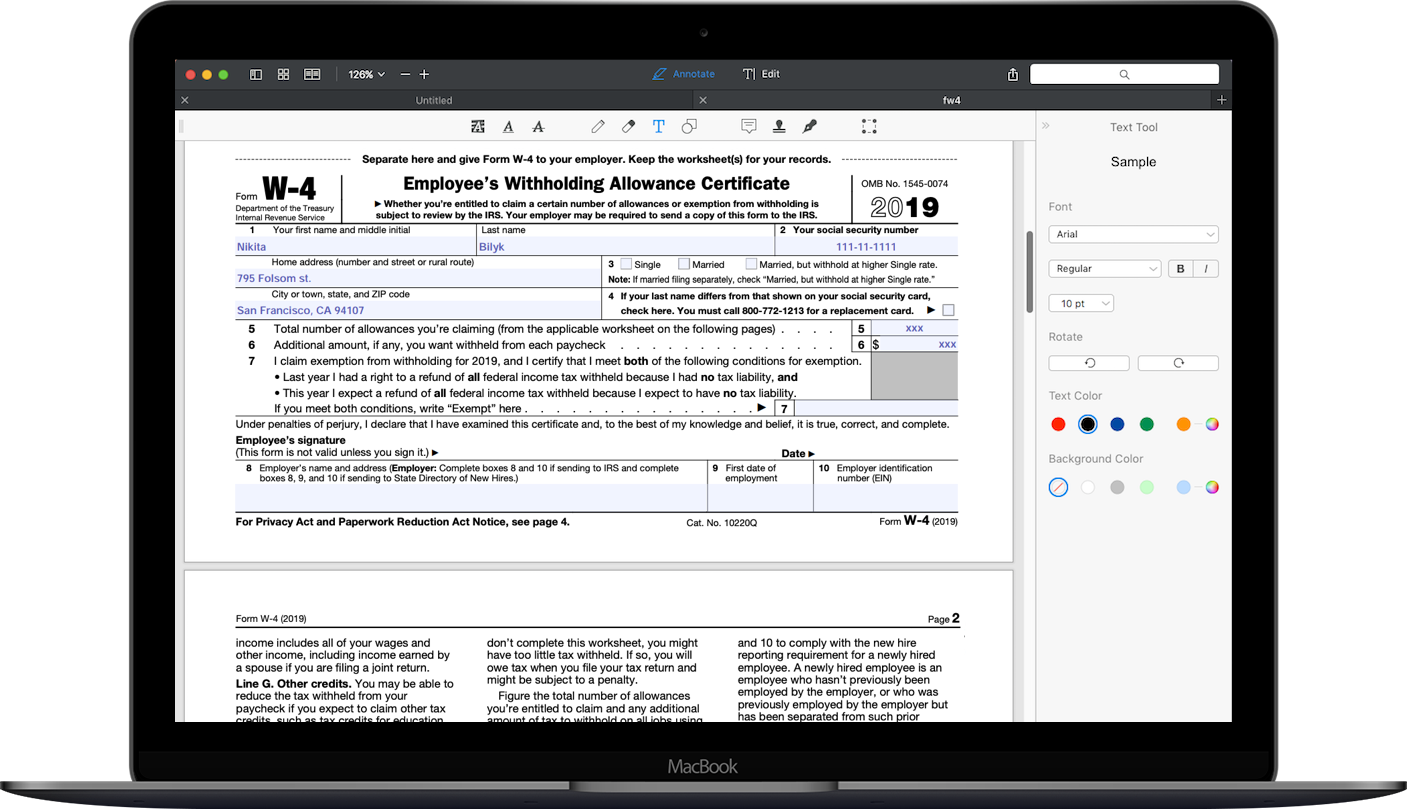

How to fill out 20192020 IRS Form W4 PDF Expert

Also, choosing the new form reduces complexity and makes sure that your employee’s withholding is done simpler with more accuracy. Your withholding is subject to review by the irs. Your withholding is subject to review by the irs. Employee's withholding certificate form 941; Web the tax cuts & jobs act also doubled the maximum child tax credit (from $1,000 to.

How to fill out 20192020 IRS Form W4 PDF Expert

Your withholding is subject to review by the irs. State and local tax authorities are also. Web form w‐4p is for u.s. Web in this video you’ll learn: This form tells your employer how much federal income tax withholding to keep from each paycheck.

2019 W4 Form How To Fill It Out and What You Need to Know

The number of allowances you were claiming. The new design is simple, accurate, and gives employees privacy while minimizing the burden on employers and the payroll process. Your withholding is subject to review by the irs. Web form w‐4p is for u.s. Web the tax cuts & jobs act also doubled the maximum child tax credit (from $1,000 to $2,000).

This Form Tells Your Employer How Much Federal Income Tax Withholding To Keep From Each Paycheck.

Employee's withholding certificate form 941; If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Use form w‐4p to tell payers the correct amount of federal income tax to withhold from your payment(s). State and local tax authorities are also.

Citizens, Resident Aliens, Or Their Estates Who Are Recipients Of Pensions, Annuities (Including Commercial Annuities), And Certain Other Deferred Compensation.

The number of allowances you were claiming. Any additional amount you wanted to be withheld from your paycheck. The latest info & advice to help you run your business. Employers engaged in a trade or business who pay compensation form 9465;

Web Form W‐4P Is For U.s.

Also, choosing the new form reduces complexity and makes sure that your employee’s withholding is done simpler with more accuracy. If too much is withheld, you will generally be due a refund. This form is crucial in determining your balance due or. Puede reclamar la exención de la retención para 2019 si ambas

Web In This Video You’ll Learn:

Web the tax cuts & jobs act also doubled the maximum child tax credit (from $1,000 to $2,000). Generally, you may claim head of household filing status on your tax return only if you are unmarried and pay more The new design is simple, accurate, and gives employees privacy while minimizing the burden on employers and the payroll process. More money now or refund later?