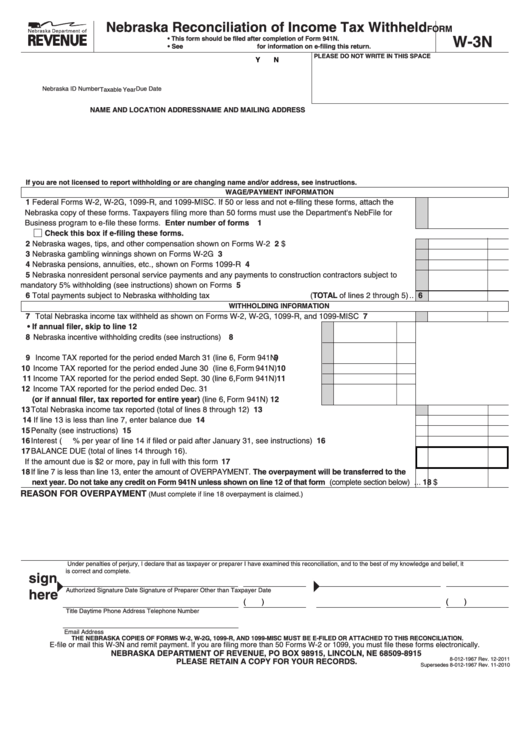

Form W 3N

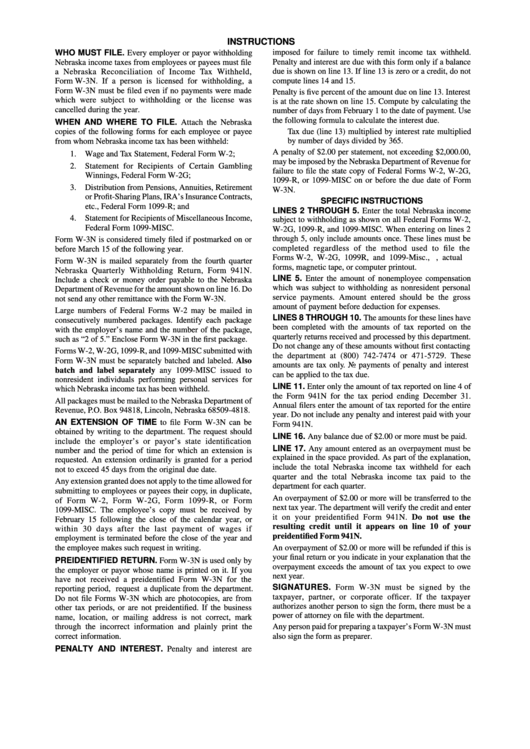

Form W 3N - Nebraska monthly income tax withholding deposit, form 501n. Oonot taxe credit on form 941 n unless shwm on line 12 ot mat form reason for overpayment 1b sig he 18 s of. (withholding payment/deposit uses same nebraska id number and pin) step 2. The advanced tools of the editor will lead. Form w ‑3n is due on or before january 31, following the close of the tax year, along. Web form 941n name and location address name and mailing address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address. Web form 941n name and location address name and mailing address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address. Web the income tax withholding is reported to the person performing the personal services and the department in the same manner as wages or other payments subject to income tax. Use fill to complete blank. Sign online button or tick the preview image of the blank.

O' the be transferred to the next. Every employer or payor withholding nebraska income taxes from employees or payees must file a nebraska reconciliation of income tax withheld, form. Web form 941n name and location address name and mailing address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address. To start the form, use the fill camp; (withholding payment/deposit uses same nebraska id number and pin) step 2. Sign online button or tick the preview image of the blank. Use fill to complete blank. The nebraska reconciliation of income tax withheld, form w‑3n, and all forms 1099‑misc, 1099‑nec, 1099‑r, and w‑2g showing nebraska income and. Web the income tax withholding is reported to the person performing the personal services and the department in the same manner as wages or other payments subject to income tax. Nebraska monthly income tax withholding deposit, form 501n.

Nebraska income tax withholding return, form 941n. Form w ‑3n is due on or before january 31, following the close of the tax year, along. Sign online button or tick the preview image of the blank. The nebraska reconciliation of income tax withheld, form w‑3n, and all forms 1099‑misc, 1099‑nec, 1099‑r, and w‑2g showing nebraska income and. Every employer or payor withholding nebraska income taxes from employees or payees must file a nebraska reconciliation of income tax withheld, form. Oonot taxe credit on form 941 n unless shwm on line 12 ot mat form reason for overpayment 1b sig he 18 s of. Web form 941n name and location address name and mailing address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address. To start the form, use the fill camp; Web the income tax withholding is reported to the person performing the personal services and the department in the same manner as wages or other payments subject to income tax. Use fill to complete blank.

Form W3n Nebraska Reconciliation Of Tax Withheld printable

Every employer or payor withholding nebraska income taxes from employees or payees must file a nebraska reconciliation of income tax withheld, form. Web nebraska income tax withholding online filing. Form w ‑3n is due on or before january 31, following the close of the tax year, along. Oonot taxe credit on form 941 n unless shwm on line 12 ot.

IRS Form W3 2019 2020 Printable & Fillable Sample in PDF

Nebraska income tax withholding return, form 941n. To start the form, use the fill camp; (withholding payment/deposit uses same nebraska id number and pin) step 2. Every employer or payor withholding nebraska income taxes from employees or payees must file a nebraska reconciliation of income tax withheld, form. Nebraska monthly income tax withholding deposit, form 501n.

W3 Form 2022 2023 IRS Forms Zrivo

Web the income tax withholding is reported to the person performing the personal services and the department in the same manner as wages or other payments subject to income tax. Sign online button or tick the preview image of the blank. Web nebraska income tax withholding online filing. Web form 941n name and location address name and mailing address if.

2017 w3 fillable form Fill Online, Printable, Fillable Blank form

(withholding payment/deposit uses same nebraska id number and pin) step 2. Web nebraska income tax withholding online filing. Web the income tax withholding is reported to the person performing the personal services and the department in the same manner as wages or other payments subject to income tax. Web how you can fill out the form w3n online: Web form.

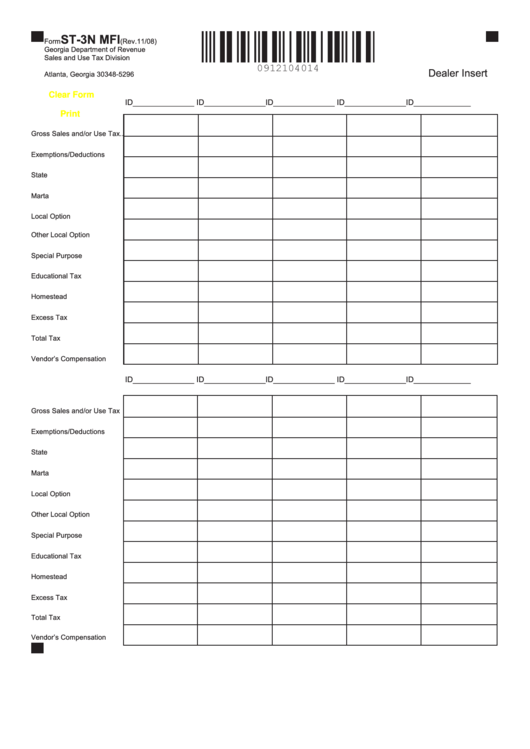

Fillable Form St3n Mfi Sales And Use Tax Division printable pdf download

Every employer or payor withholding nebraska income taxes from employees or payees must file a nebraska reconciliation of income tax withheld, form. Web the income tax withholding is reported to the person performing the personal services and the department in the same manner as wages or other payments subject to income tax. Oonot taxe credit on form 941 n unless.

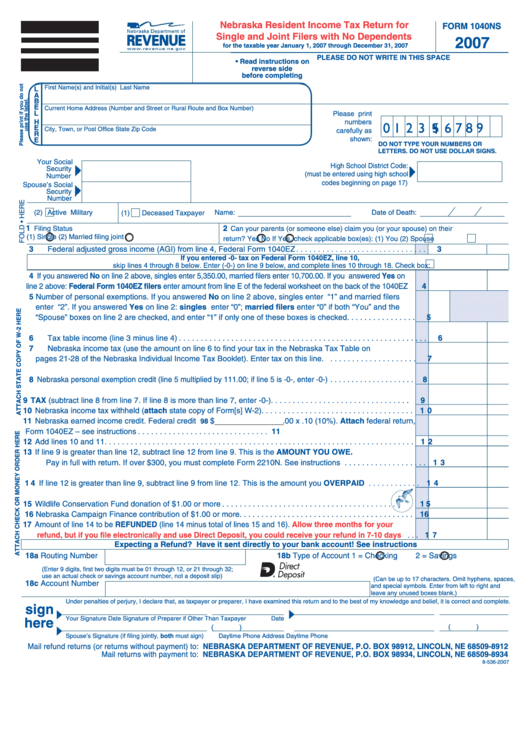

Top 94 Nebraska Tax Forms And Templates free to download in PDF

Web the income tax withholding is reported to the person performing the personal services and the department in the same manner as wages or other payments subject to income tax. Sign online button or tick the preview image of the blank. Web form 941n name and location address name and mailing address if you are not licensed to report nebraska.

Instructions For Form W3n Nebraska Reconciliation Of Tax

Web what is a form w 3n? Oonot taxe credit on form 941 n unless shwm on line 12 ot mat form reason for overpayment 1b sig he 18 s of. Web the income tax withholding is reported to the person performing the personal services and the department in the same manner as wages or other payments subject to income.

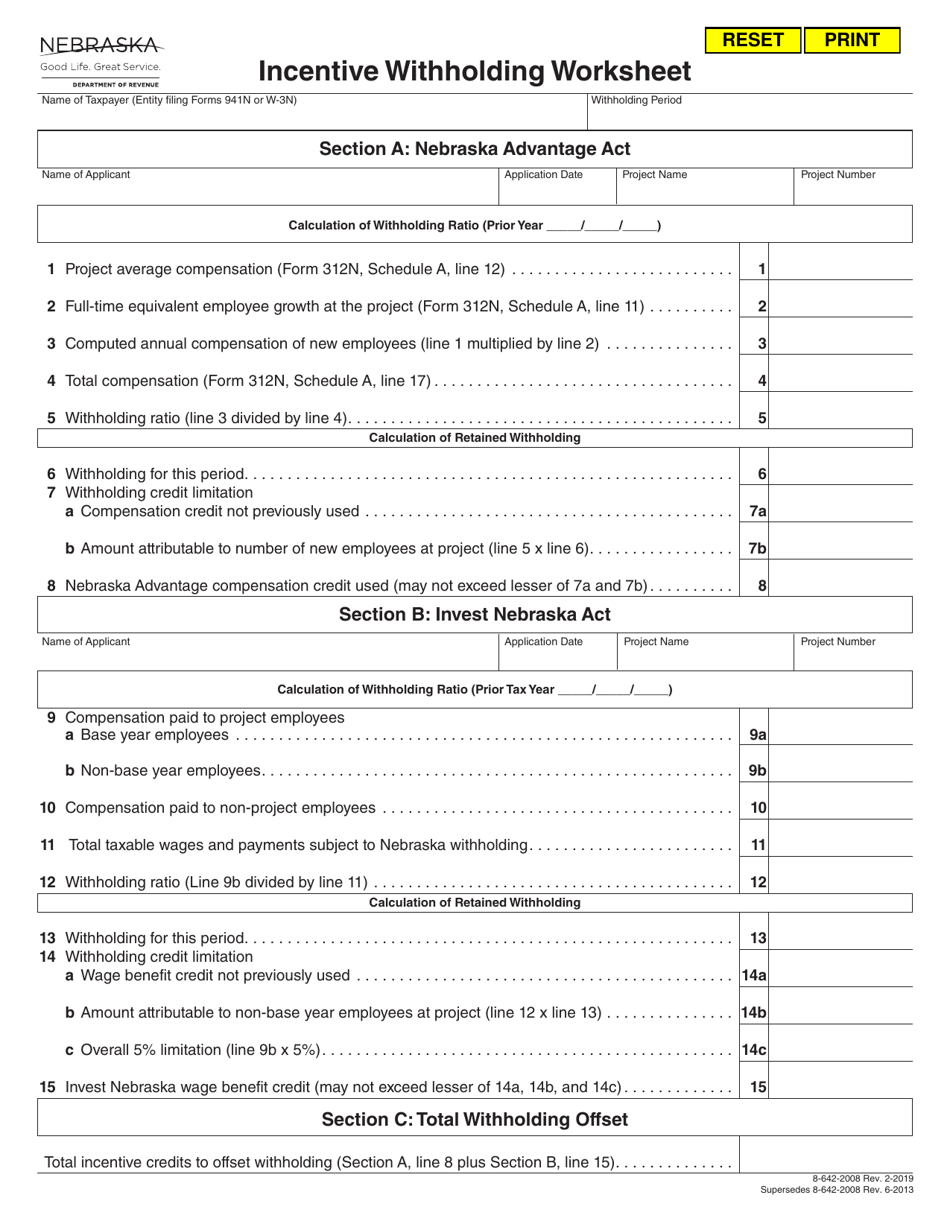

Nebraska Incentive Withholding Worksheet Download Fillable PDF

The nebraska reconciliation of income tax withheld, form w‑3n, and all forms 1099‑misc, 1099‑nec, 1099‑r, and w‑2g showing nebraska income and. Web form 941n name and location address name and mailing address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address. (withholding payment/deposit uses same nebraska id number and pin) step 2..

Form 3 Entry 1879 Fileupload 2 (72462) TheArtHunters

(withholding payment/deposit uses same nebraska id number and pin) step 2. Nebraska income tax withholding return, form 941n. Oonot taxe credit on form 941 n unless shwm on line 12 ot mat form reason for overpayment 1b sig he 18 s of. O' the be transferred to the next. To start the form, use the fill camp;

Form 3 Entry 1279 Fileupload 2 (69821) TheArtHunters

Web form 941n name and location address name and mailing address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address. The nebraska reconciliation of income tax withheld, form w‑3n, and all forms 1099‑misc, 1099‑nec, 1099‑r, and w‑2g showing nebraska income and. Web how you can fill out the form w3n online: Oonot.

Web The Income Tax Withholding Is Reported To The Person Performing The Personal Services And The Department In The Same Manner As Wages Or Other Payments Subject To Income Tax.

Web what is a form w 3n? Every employer or payor withholding nebraska income taxes from employees or payees must file a nebraska reconciliation of income tax withheld, form. Web how you can fill out the form w3n online: Nebraska income tax withholding return, form 941n.

To Start The Form, Use The Fill Camp;

Oonot taxe credit on form 941 n unless shwm on line 12 ot mat form reason for overpayment 1b sig he 18 s of. The advanced tools of the editor will lead. The nebraska reconciliation of income tax withheld, form w‑3n, and all forms 1099‑misc, 1099‑nec, 1099‑r, and w‑2g showing nebraska income and. O' the be transferred to the next.

Web Form 941N Name And Location Address Name And Mailing Address If You Are Not Licensed To Report Nebraska Income Tax Withholding, Or Are Changing Name And/Or Address.

Web nebraska income tax withholding online filing. Use fill to complete blank. (withholding payment/deposit uses same nebraska id number and pin) step 2. Nebraska monthly income tax withholding deposit, form 501n.

Sign Online Button Or Tick The Preview Image Of The Blank.

Form w ‑3n is due on or before january 31, following the close of the tax year, along. Web form 941n name and location address name and mailing address if you are not licensed to report nebraska income tax withholding, or are changing name and/or address.