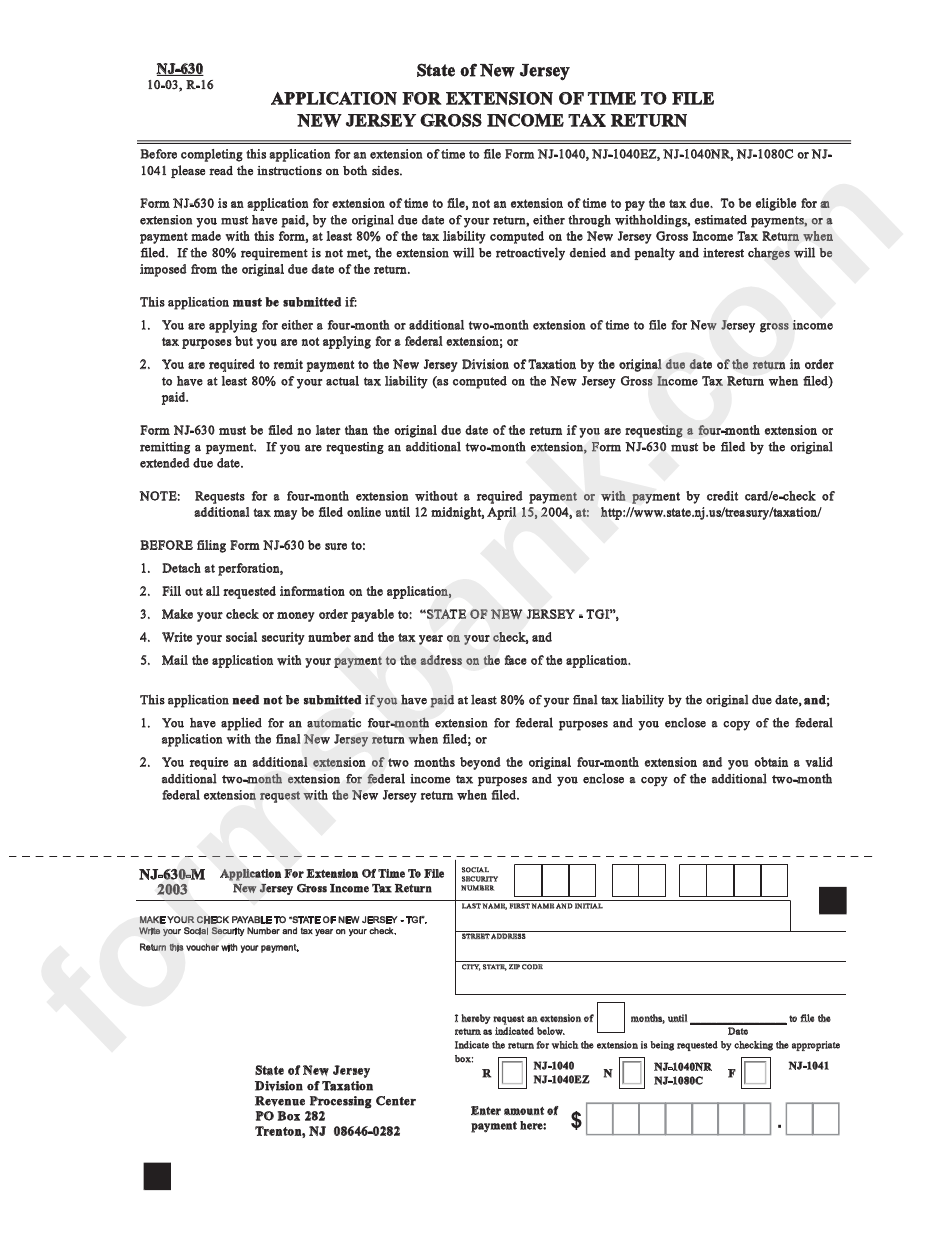

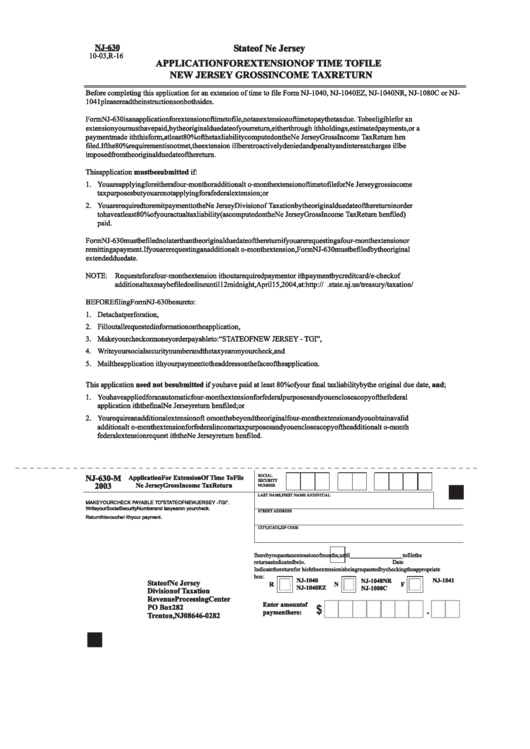

Form Nj 630

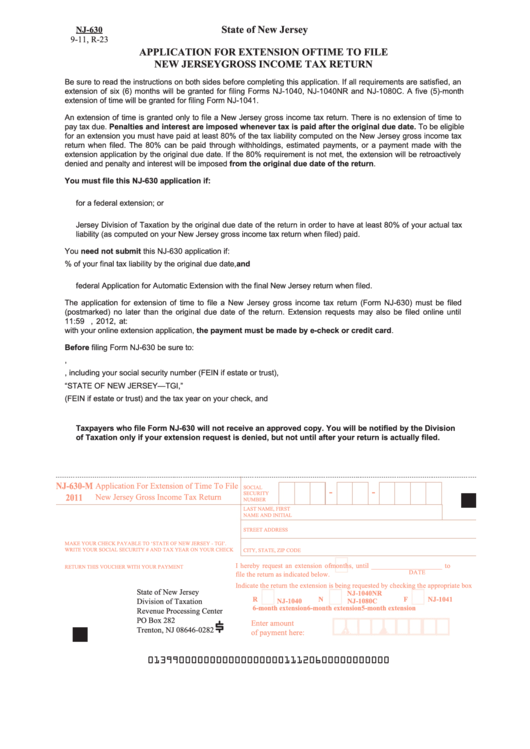

Form Nj 630 - You must pay at least 80% of your tax liability in order for new jersey to accept your extension, you. Web follow the simple instructions below: The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Save or instantly send your ready documents. This form is for income earned in tax year 2022, with tax returns due in april. Method #2 ‐ indicates a. Easily fill out pdf blank, edit, and sign them. Enter social security number or federal identification. Nowadays, most americans tend to prefer to do their own income taxes and, furthermore, to complete papers in electronic format. Web method #1 ‐ indicates the detailed spreadsheet (a‐3730‐uez‐1) is submitted in electronic form on a compact disc for claims with 25 or more transactions.

Web method #1 ‐ indicates the detailed spreadsheet (a‐3730‐uez‐1) is submitted in electronic form on a compact disc for claims with 25 or more transactions. Nowadays, most americans tend to prefer to do their own income taxes and, furthermore, to complete papers in electronic format. Mail the completed extension application and any. This form is for income earned in tax year 2022, with tax returns due in april. Application for extension of time to file income tax return. Enter social security number or federal identification. The request must be made under the filing entity’s federal identification number. The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Easily fill out pdf blank, edit, and sign them. Web you may file the form:

The request must be made under the filing entity’s federal identification number. To be eligible for an extension you must have paid, by the original due date. Easily fill out pdf blank, edit, and sign them. Nj division of taxation subject: Method #2 ‐ indicates a. This form is for income earned in tax year 2022, with tax returns due in april. Use fill to complete blank online the state. Save or instantly send your ready documents. The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Web method #1 ‐ indicates the detailed spreadsheet (a‐3730‐uez‐1) is submitted in electronic form on a compact disc for claims with 25 or more transactions.

Nuova jolly Nj 630 in Hérault Power boats used 01999 iNautia

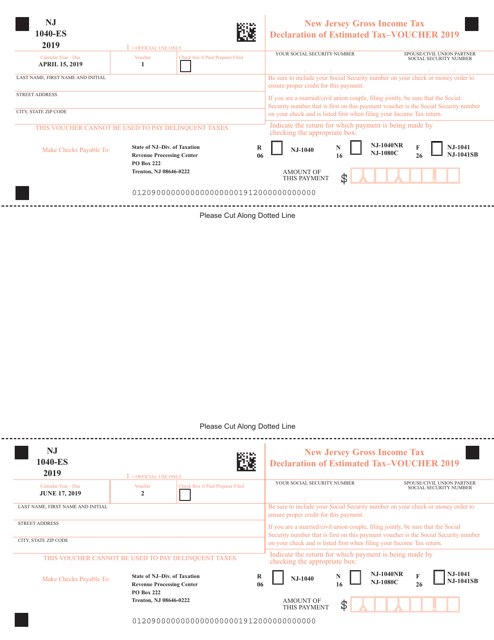

Nj division of taxation subject: Estimated income tax payment voucher for 2023. Easily fill out pdf blank, edit, and sign them. Use fill to complete blank online the state. This form is for income earned in tax year 2022, with tax returns due in april.

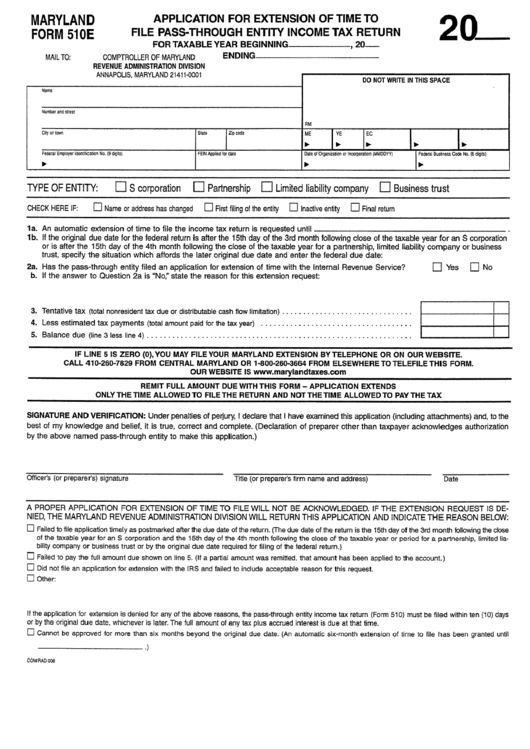

Maryland Form 510e Application For Extension Of Time To File Pass

Effortlessly add and underline text, insert images, checkmarks, and icons, drop new fillable areas, and rearrange or delete pages from your paperwork. Application for extension of time to file income tax return. Mail the completed extension application and any. Web follow the simple instructions below: Estimated income tax payment voucher for 2023.

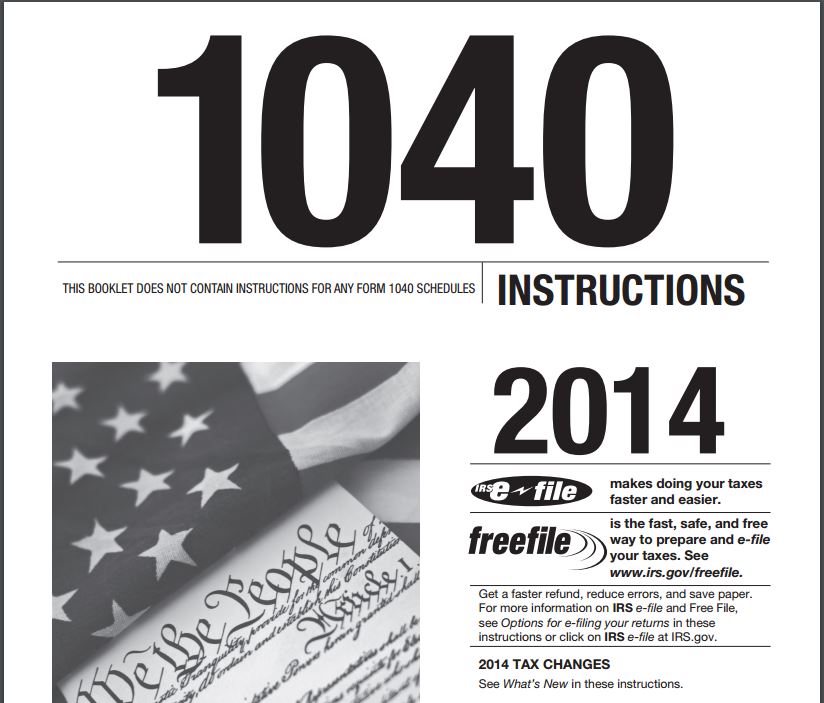

2014 Form 1040 Instructions

Estimated income tax payment voucher for 2023. Use fill to complete blank online the state. Nowadays, most americans tend to prefer to do their own income taxes and, furthermore, to complete papers in electronic format. Save or instantly send your ready documents. The request must be made under the filing entity’s federal identification number.

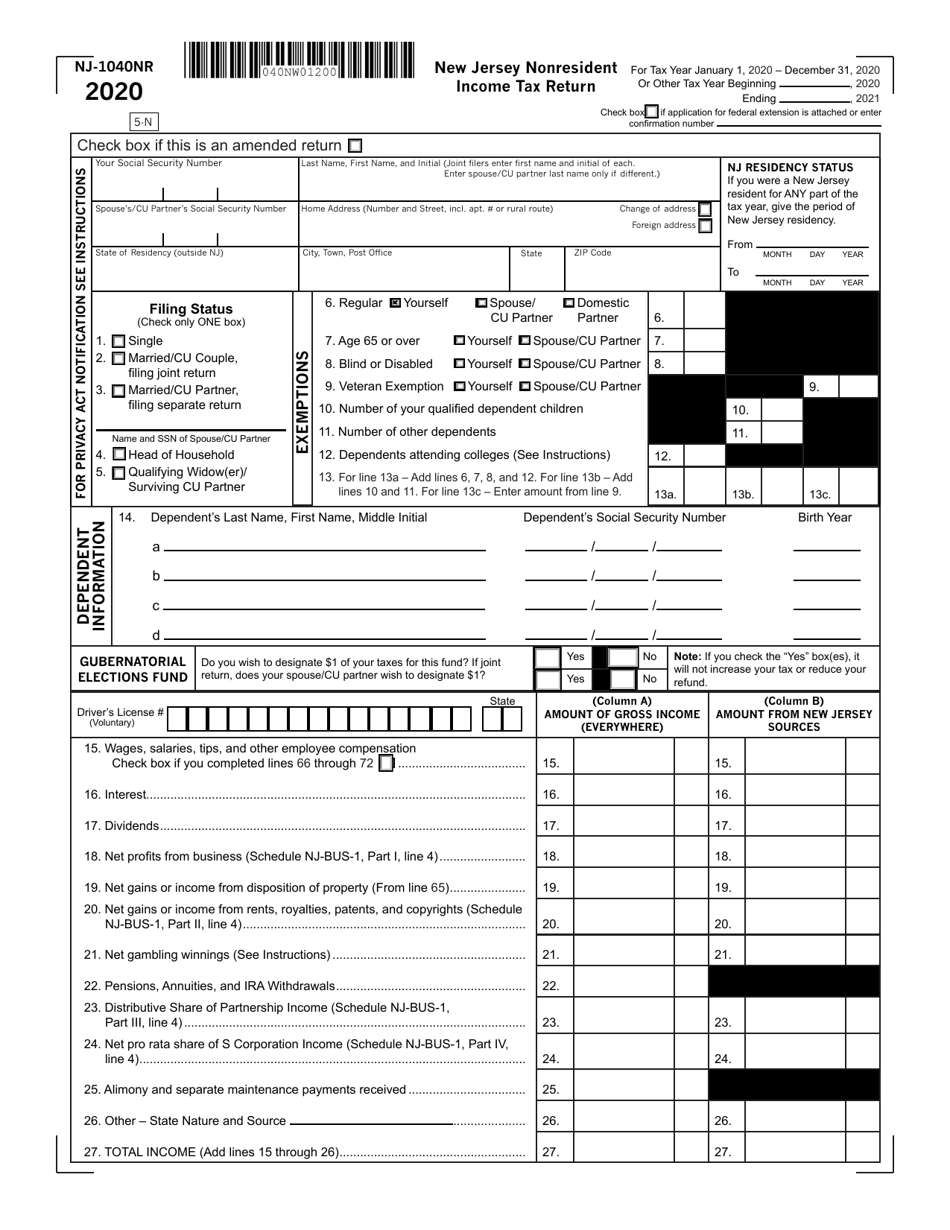

Form NJ1040NR Download Fillable PDF or Fill Online New Jersey

Nj division of taxation subject: Nowadays, most americans tend to prefer to do their own income taxes and, furthermore, to complete papers in electronic format. Effortlessly add and underline text, insert images, checkmarks, and icons, drop new fillable areas, and rearrange or delete pages from your paperwork. Enter social security number or federal identification. Web you may file the form:

NUOVA JOLLY NJ 630 in Var Rigid inflatable boats used 54546 iNautia

This form is for income earned in tax year 2022, with tax returns due in april. Web you may file the form: Method #2 ‐ indicates a. Web method #1 ‐ indicates the detailed spreadsheet (a‐3730‐uez‐1) is submitted in electronic form on a compact disc for claims with 25 or more transactions. The state grants an extension if you already.

Form NJ1040 Download Fillable PDF or Fill Online Resident Tax

Web follow the simple instructions below: Nj division of taxation subject: This form is for income earned in tax year 2022, with tax returns due in april. The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. You must pay at least 80% of your tax liability.

Form Nj630 Application For Extension Of Time To File New Jersey

Estimated income tax payment voucher for 2023. To be eligible for an extension you must have paid, by the original due date. Web follow the simple instructions below: Effortlessly add and underline text, insert images, checkmarks, and icons, drop new fillable areas, and rearrange or delete pages from your paperwork. Easily fill out pdf blank, edit, and sign them.

Form Nj630 Application For Extension Of Time To File New Jersey

Enter social security number or federal identification. This form is for income earned in tax year 2022, with tax returns due in april. Application for extension of time to file income tax return. Web follow the simple instructions below: Method #2 ‐ indicates a.

Form NJ1040ES Download Fillable PDF or Fill Online Estimated Tax

The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Nj division of taxation subject: You must pay at least 80% of your tax liability in order for new jersey to accept your extension, you. This form is for income earned in tax year 2022, with tax.

Fillable Form Nj630 Application For Extension Of Time To File New

To be eligible for an extension you must have paid, by the original due date. The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Use fill to complete blank online the state. You must pay at least 80% of your tax liability in order for new.

Application For Extension Of Time To File Income Tax Return.

Effortlessly add and underline text, insert images, checkmarks, and icons, drop new fillable areas, and rearrange or delete pages from your paperwork. The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Web you may file the form: Method #2 ‐ indicates a.

Mail The Completed Extension Application And Any.

Estimated income tax payment voucher for 2023. Nj division of taxation subject: Save or instantly send your ready documents. Enter social security number or federal identification.

You Must Pay At Least 80% Of Your Tax Liability In Order For New Jersey To Accept Your Extension, You.

The request must be made under the filing entity’s federal identification number. To be eligible for an extension you must have paid, by the original due date. Easily fill out pdf blank, edit, and sign them. This form is for income earned in tax year 2022, with tax returns due in april.

Web Method #1 ‐ Indicates The Detailed Spreadsheet (A‐3730‐Uez‐1) Is Submitted In Electronic Form On A Compact Disc For Claims With 25 Or More Transactions.

Use fill to complete blank online the state. Nowadays, most americans tend to prefer to do their own income taxes and, furthermore, to complete papers in electronic format. Web follow the simple instructions below: