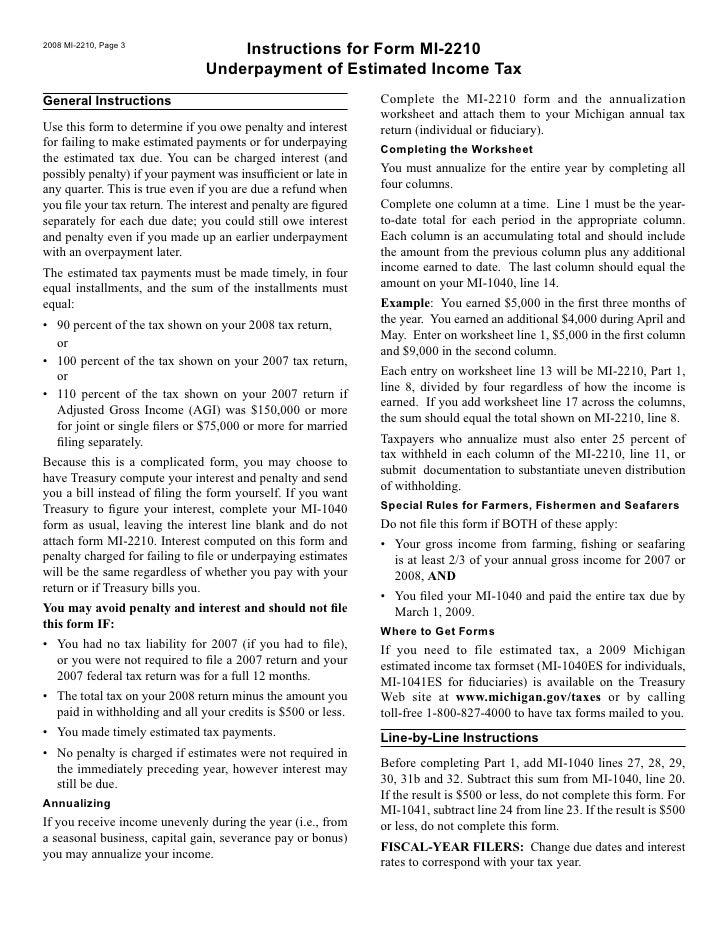

Form Mi 2210

Form Mi 2210 - Web instructions included on form: Web 2022 individual income tax forms and instructions need a different form? Save or instantly send your ready documents. Underpayment of estimated income tax: Michigan annual tax return (individual or fiduciary). Web see instructions before completing this form. Upload, modify or create forms. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Complete, edit or print tax forms instantly. Department of the treasury internal revenue service.

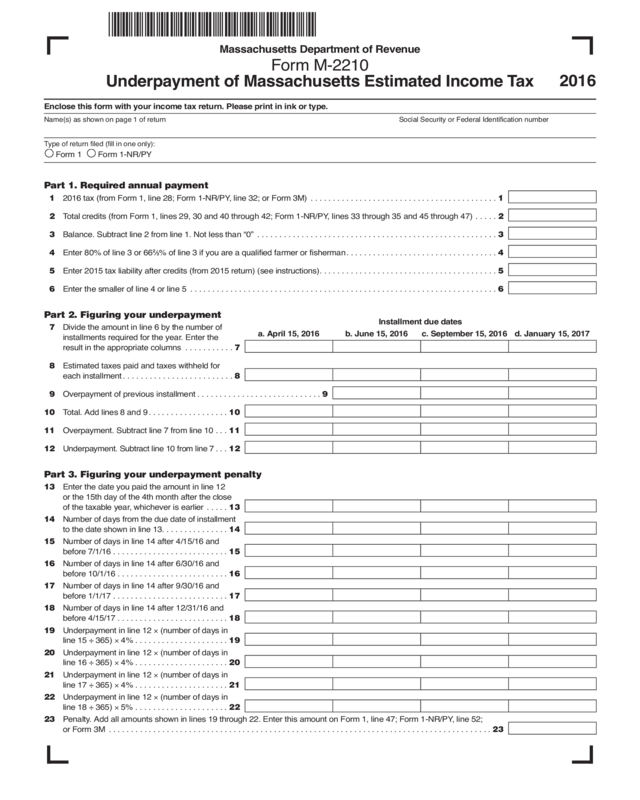

Web 2022 individual income tax forms and instructions need a different form? Upload, modify or create forms. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Easily fill out pdf blank, edit, and sign them. Department of the treasury internal revenue service. File this form if your tax liability is $500 or more after credits and withholding, and you did not pay the required amount of estimated. This form is for income earned in tax year 2022, with tax returns due in april. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web instructions included on form: If the result is $500 or less, do.

Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. This form is for income earned in tax year 2022, with tax returns due in april. The irs will generally figure your penalty for you and you should not file form 2210. Web instructions included on form: Department of the treasury internal revenue service. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Web 2022 individual income tax forms and instructions need a different form? Figure your 2020 tax from your 2020 return.

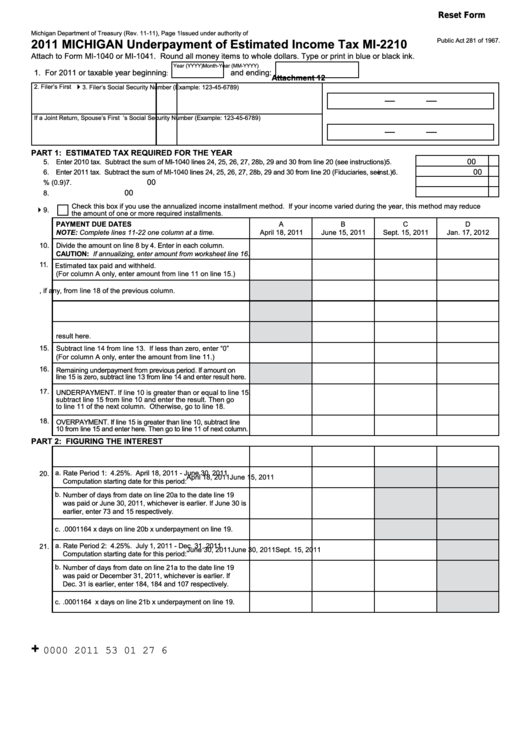

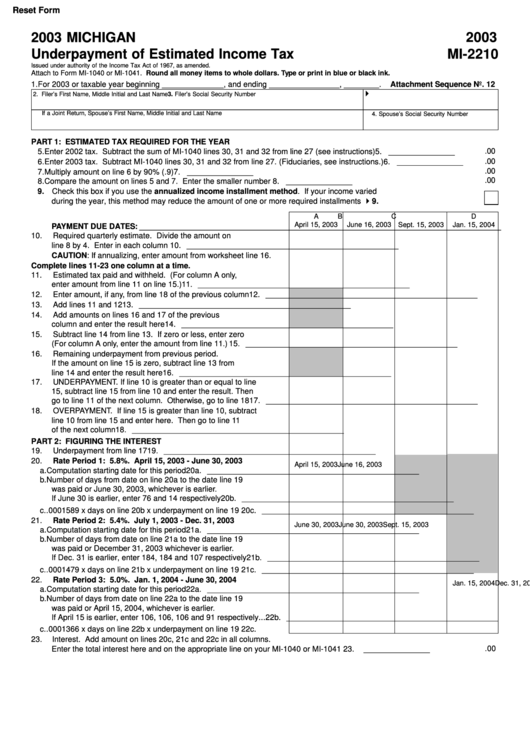

MI2210_260848_7 michigan.gov documents taxes

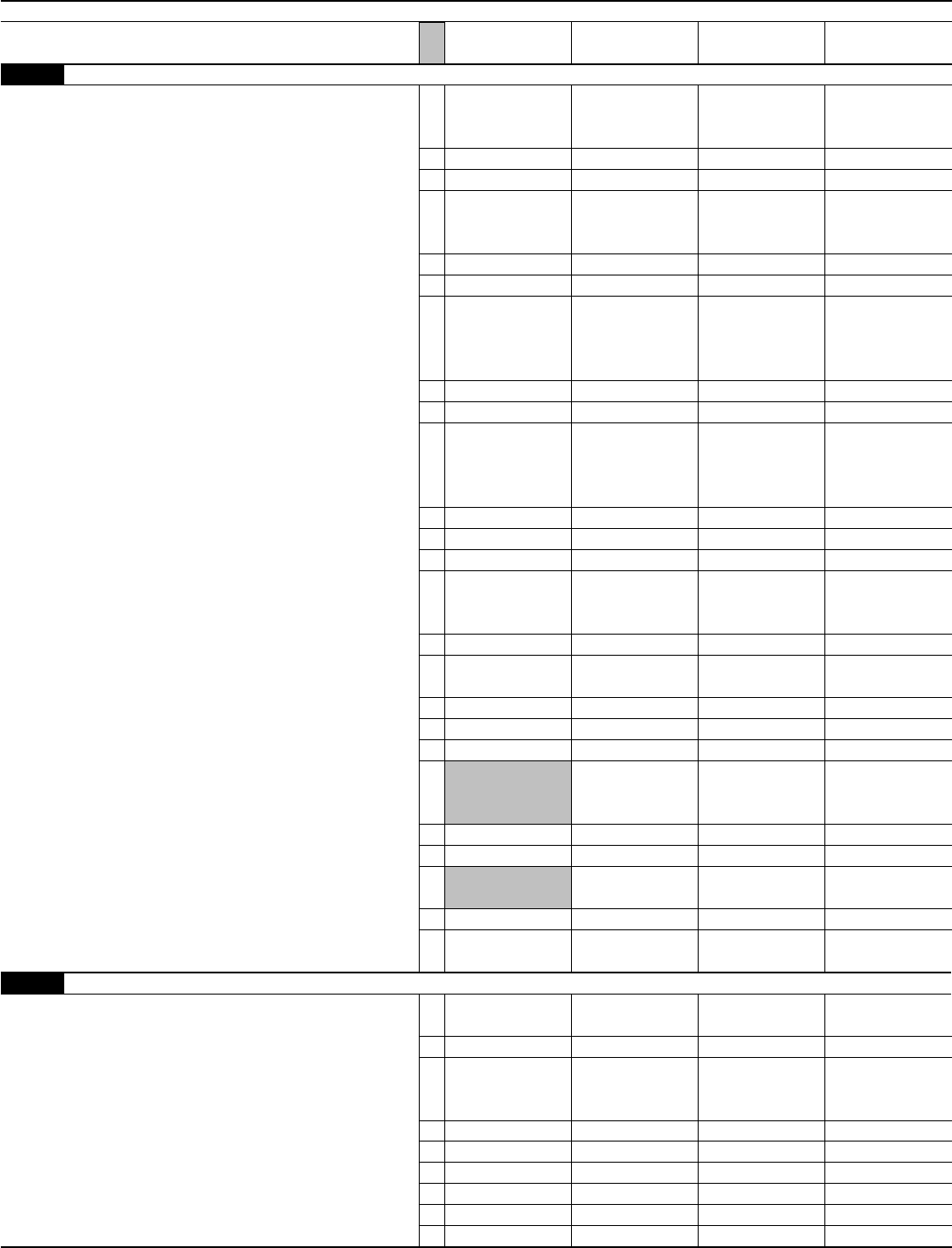

Michigan annual tax return (individual or fiduciary). Underpayment of estimated tax by individuals, estates, and trusts. This form is for income earned in tax year 2022, with tax returns due in april. File this form if your tax liability is $500 or more after credits and withholding, and you did not pay the required amount of estimated. Web form 2210.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web see instructions before completing this form. Round all money items to whole. Easily fill out pdf blank, edit, and sign them. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax.

Ssurvivor Form 2210 Instructions 2020

Web the michigan form 2210, underpayment of estimated income tax, is used to determine if you owe penalties and/or interest for failing to make estimated payments or for. Round all money items to whole. Web instructions included on form: Try it for free now! This form is for income earned in tax year 2022, with tax returns due in april.

Form 2210 Edit, Fill, Sign Online Handypdf

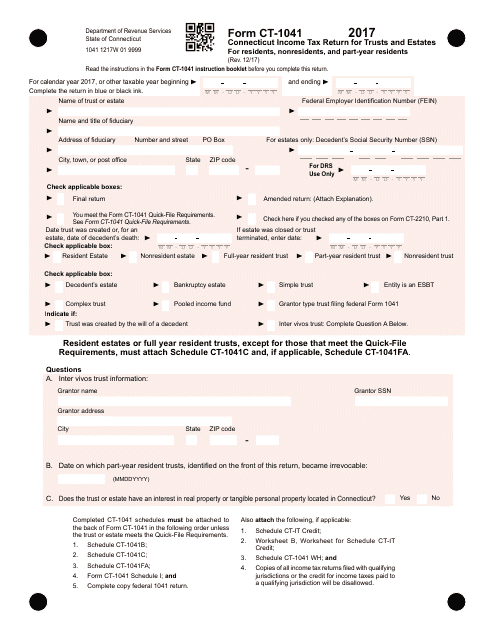

Department of the treasury internal revenue service. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. This form is for income earned in tax year 2022, with tax returns due in april. Underpayment of estimated tax by individuals, estates, and trusts. Web 2022 individual income tax forms and instructions need a different form?

Form M2210 Edit, Fill, Sign Online Handypdf

Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. The irs will generally figure your penalty for you and you should not file form 2210. The irs will generally figure your penalty for you and you should not file. Upload, modify or create forms. Web 2022 individual income tax forms and.

Ssurvivor Irs Form 2210 For 2017

The irs will generally figure your penalty for you and you should not file. Web see instructions before completing this form. Michigan annual tax return (individual or fiduciary). Try it for free now! Round all money items to whole.

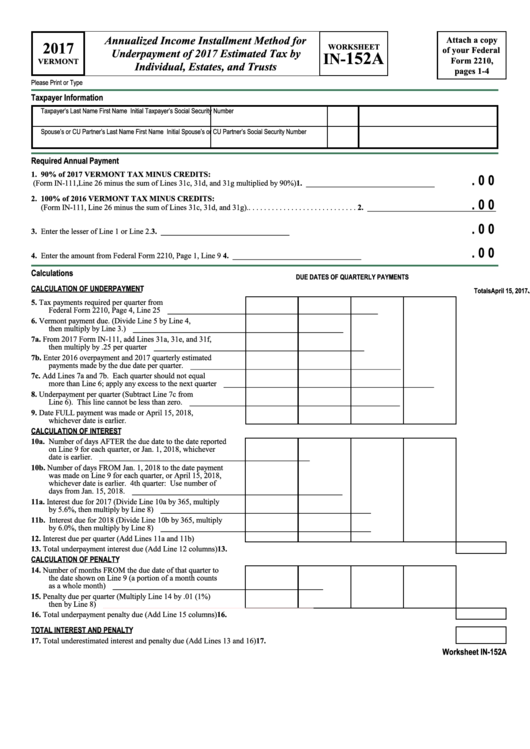

Form 2210 Worksheet In152a Annualized Installment Method

Department of the treasury internal revenue service. The irs will generally figure your penalty for you and you should not file. Figure your 2020 tax from your 2020 return. Try it for free now! File this form if your tax liability is $500 or more after credits and withholding, and you did not pay the required amount of estimated.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Department of the treasury internal revenue service. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Complete, edit or print tax forms instantly. The irs will generally figure your penalty for you and you should not file. Underpayment of estimated tax by individuals, estates, and trusts.

Fillable Form Mi2210 Michigan Underpayment Of Estimated Tax

Easily fill out pdf blank, edit, and sign them. Web 2022 individual income tax forms and instructions need a different form? If the result is $500 or less, do. Michigan annual tax return (individual or fiduciary). Underpayment of estimated income tax:

Fillable Form Mi2210 Michigan Underpayment Of Estimated Tax

Round all money items to whole. Complete, edit or print tax forms instantly. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Save or instantly send your ready documents. The irs will generally figure your penalty for you and you should not file.

The Irs Will Generally Figure Your Penalty For You And You Should Not File Form 2210.

Underpayment of estimated income tax: Look for forms using our forms search or view a list of income tax forms by year. Complete, edit or print tax forms instantly. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax.

File This Form If Your Tax Liability Is $500 Or More After Credits And Withholding, And You Did Not Pay The Required Amount Of Estimated.

Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Department of the treasury internal revenue service. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Round all money items to whole.

Web Instructions Included On Form:

Web 2022 individual income tax forms and instructions need a different form? Upload, modify or create forms. If the result is $500 or less, do. Save or instantly send your ready documents.

Underpayment Of Estimated Tax By Individuals, Estates, And Trusts.

Michigan annual tax return (individual or fiduciary). Web the michigan form 2210, underpayment of estimated income tax, is used to determine if you owe penalties and/or interest for failing to make estimated payments or for. Easily fill out pdf blank, edit, and sign them. Figure your 2020 tax from your 2020 return.