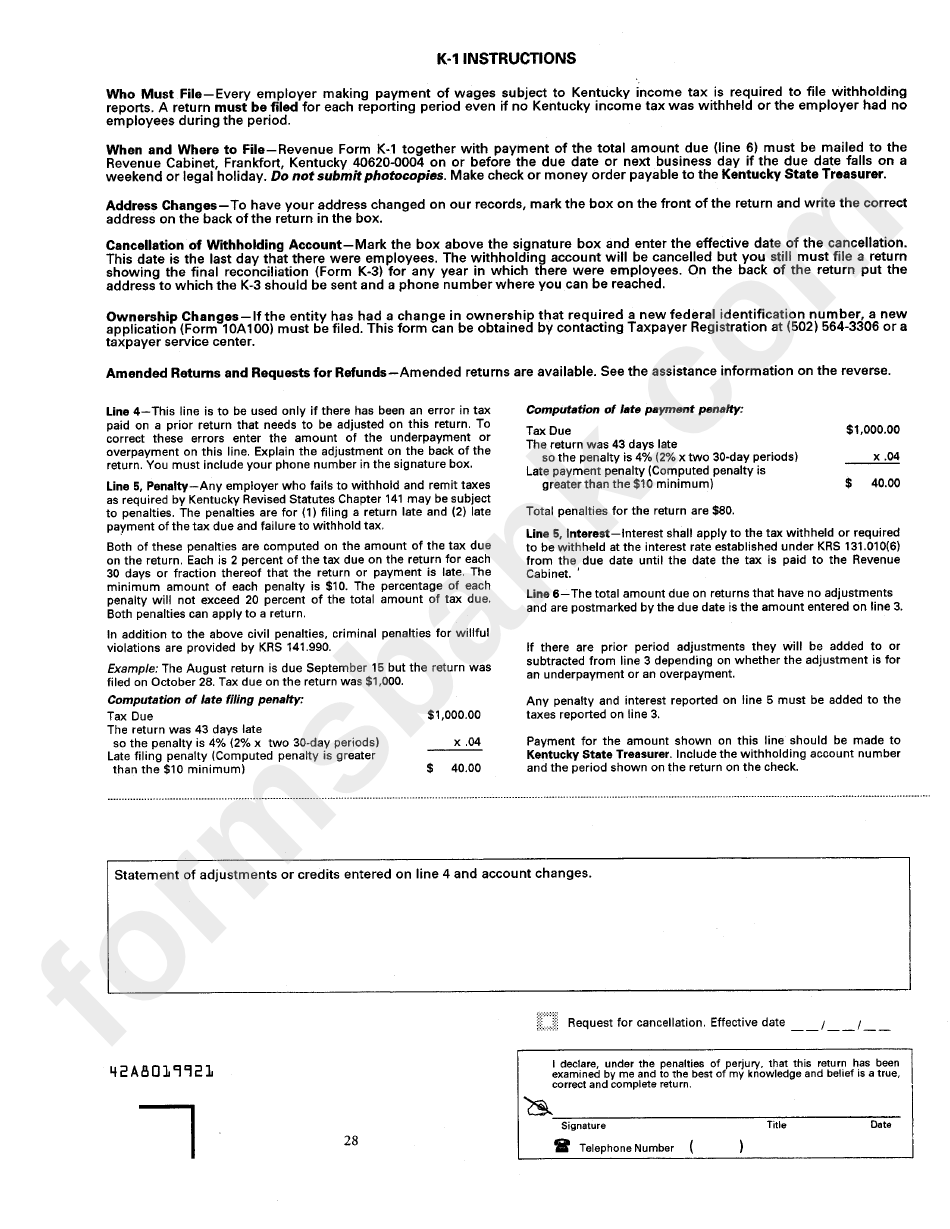

Form K1 Instructions

Form K1 Instructions - Department of the treasury internal revenue service. This code will let you know if you should. It is the partner's responsibility to. Web department of the treasury internal revenue service see back of form and instructions. The basis of your stock (generally, its cost) is adjusted annually as. So you may marry your fiancé (e); For calendar year 2022, or tax year beginning / / 2022. Ending / / partner’s share of income,. Citizen sponsor within 90 days of arrival. Your name, address, and tax identification number, as.

Web from federal form 1120s, schedule k, line 11 or federal form 1065, schedule k, line 12. So you may marry your fiancé (e); To await the approval of a. The basis of your stock (generally, its cost) is adjusted annually as. It is the partner's responsibility to. This code will let you know if you should. Complete, edit or print tax forms instantly. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Specific instructions part i—information about the estate or trust item e if the item e box is checked, this is the final year of the estate or. Web department of the treasury internal revenue service see back of form and instructions.

The basis of your stock (generally, its cost) is adjusted annually as. Your name, address, and tax identification number, as. Ending / / partner’s share of income,. Web department of the treasury internal revenue service see back of form and instructions. So you may marry your fiancé (e); Web from federal form 1120s, schedule k, line 11 or federal form 1065, schedule k, line 12. To await the approval of a. Enter the taxpayer’s apportioned amount of other deductions from federal form. This code will let you know if you should. Department of the treasury internal revenue service.

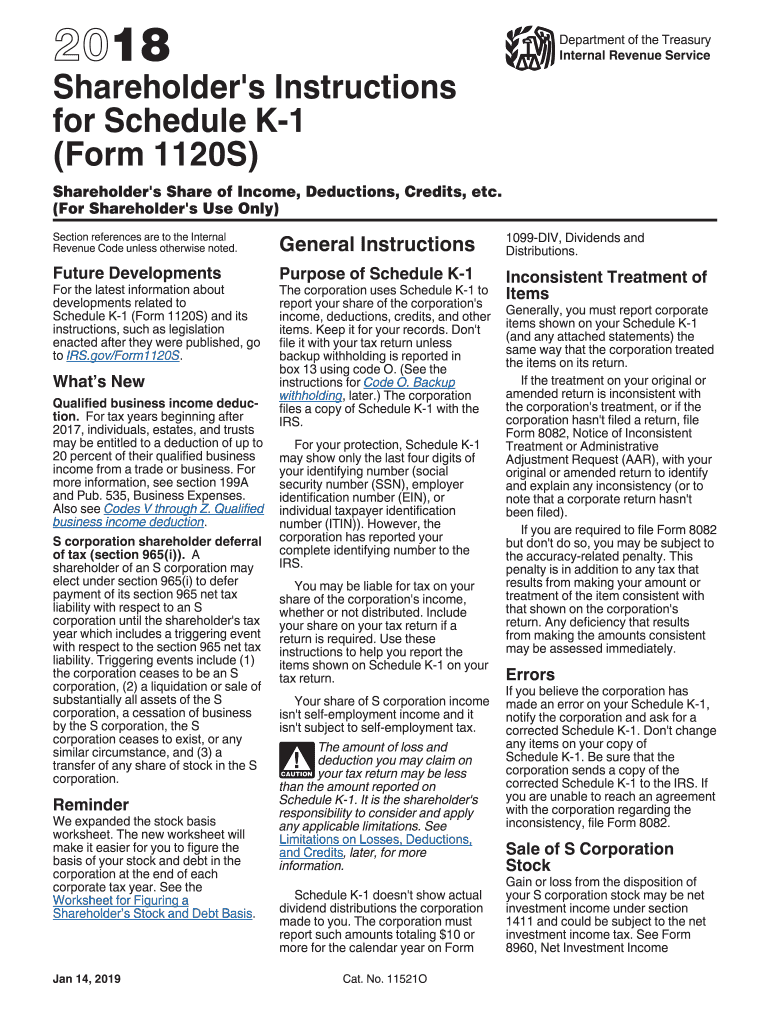

2018 Form IRS Instruction 1120S Schedule K1 Fill Online, Printable

Your name, address, and tax identification number, as. The basis of your stock (generally, its cost) is adjusted annually as. So you may marry your fiancé (e); Department of the treasury internal revenue service. Enter the taxpayer’s apportioned amount of other deductions from federal form.

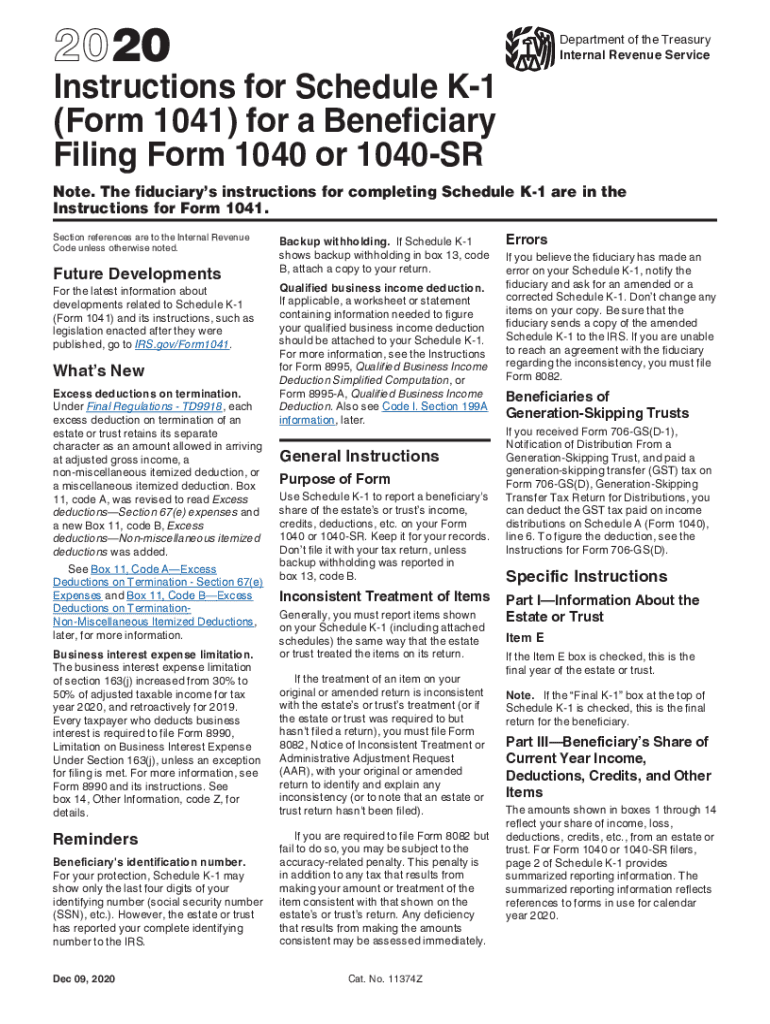

Instructions For Schedule K 1 Form 1041 For A Beneficiary Filing Form

For calendar year 2022, or tax year beginning / / 2022. Specific instructions part i—information about the estate or trust item e if the item e box is checked, this is the final year of the estate or. Your name, address, and tax identification number, as. Enter the taxpayer’s apportioned amount of other deductions from federal form. The basis of.

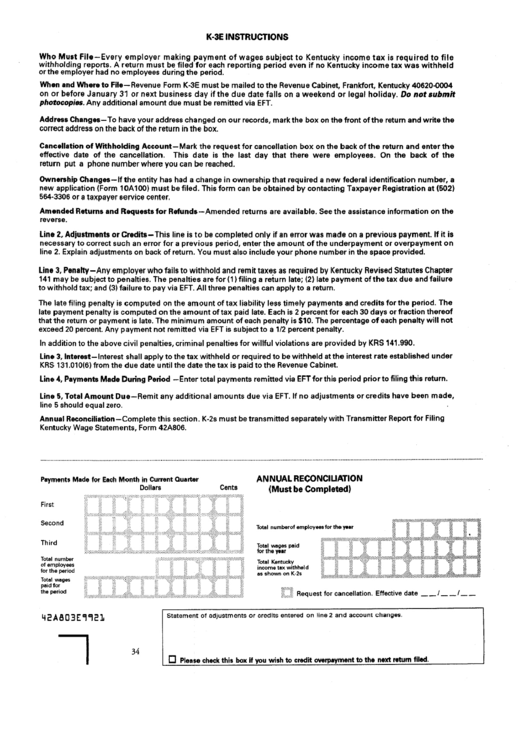

Form K3e Instructions printable pdf download

Citizen sponsor within 90 days of arrival. Department of the treasury internal revenue service. Enter the taxpayer’s apportioned amount of other deductions from federal form. Ending / / partner’s share of income,. Complete, edit or print tax forms instantly.

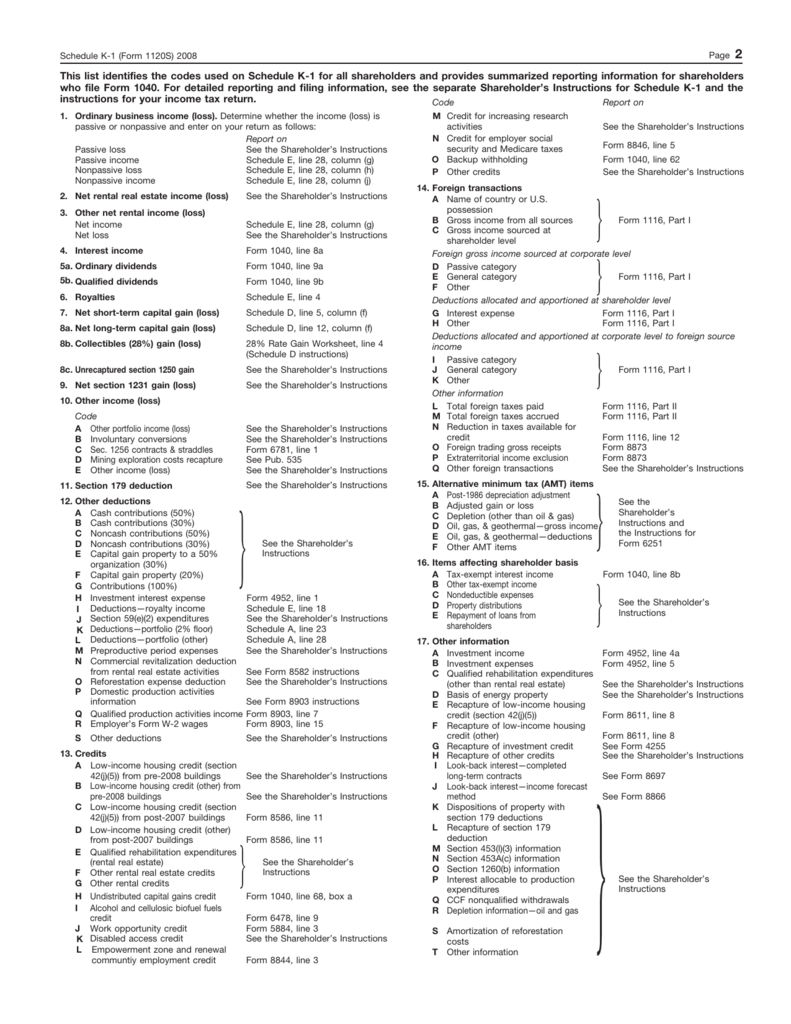

1120S K1 codes

Specific instructions part i—information about the estate or trust item e if the item e box is checked, this is the final year of the estate or. It is the partner's responsibility to. Ending / / partner’s share of income,. Web the partnership should use this code to report your share of income/gain that comes from your total net section.

Box 14 Code A Of Irs Schedule K1 (form 1065) Fafsa Armando Friend's

Department of the treasury internal revenue service. It is the partner's responsibility to. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Your name, address, and tax identification number, as. To await the approval of a.

Form K1 Instructions Tax Report printable pdf download

Department of the treasury internal revenue service. Specific instructions part i—information about the estate or trust item e if the item e box is checked, this is the final year of the estate or. This code will let you know if you should. Web from federal form 1120s, schedule k, line 11 or federal form 1065, schedule k, line 12..

schedule k1 instructions 2022 Choosing Your Gold IRA

Citizen sponsor within 90 days of arrival. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. To await the approval of a. Department of the treasury internal revenue service. Web from federal form 1120s, schedule k, line 11 or federal form 1065, schedule k, line.

Form K1 Download Fillable PDF or Fill Online Taxpayer's Share of

To await the approval of a. So you may marry your fiancé (e); Specific instructions part i—information about the estate or trust item e if the item e box is checked, this is the final year of the estate or. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly.

1120s k1 instructions Fill Online, Printable, Fillable Blank form

This code will let you know if you should. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Enter the taxpayer’s apportioned amount of other deductions from federal form. Web from federal form 1120s, schedule k, line 11 or federal form 1065, schedule k, line 12.

Learn How to Fill the Form k 1 Schedule K1 YouTube

Web from federal form 1120s, schedule k, line 11 or federal form 1065, schedule k, line 12. For calendar year 2022, or tax year beginning / / 2022. So you may marry your fiancé (e); Your name, address, and tax identification number, as. Web the partnership should use this code to report your share of income/gain that comes from your.

For Calendar Year 2022, Or Tax Year Beginning / / 2022.

Department of the treasury internal revenue service. Specific instructions part i—information about the estate or trust item e if the item e box is checked, this is the final year of the estate or. To await the approval of a. Enter the taxpayer’s apportioned amount of other deductions from federal form.

This Code Will Let You Know If You Should.

Citizen sponsor within 90 days of arrival. The basis of your stock (generally, its cost) is adjusted annually as. Web department of the treasury internal revenue service see back of form and instructions. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments.

Your Name, Address, And Tax Identification Number, As.

Ending / / partner’s share of income,. Web from federal form 1120s, schedule k, line 11 or federal form 1065, schedule k, line 12. It is the partner's responsibility to. Complete, edit or print tax forms instantly.