Form Dp-10

Form Dp-10 - This form is for income earned in tax year 2022,. Web leave of absence pursuant to psb no. You do not need to file this return. Enter the amount from line 2(a) of your federal return subtotal interest and dividends income. To be eligible for a leave under this policy, the employee should submit the form no later than. There is no filing requirement for nonresidents. Web this research is devoted to numerical and experimental analysis on deformation of completely removed component induced by wire arc additive. New hampshire department of revenue administration interest and dividends tax instructions (continued) a. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. Enter the amount from line 2(b) of your federal return (b) dividend income.

Fill out the personnel recovery debriefing statement online and print it out for free. There is no requirement for nonresidents. Web drop forms this page provides a complete list of the drop forms available to members. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. Enter the amount from line 2(b) of your federal return (b) dividend income. Web important enter the primary taxpayer and spousal information in the same order on all tax documents to avoid delays in processing. To be eligible for a leave under this policy, the employee should submit the form no later than. Web leave of absence pursuant to psb no. See www.revenue.nh.gov for instructions, the. This form is for income earned in tax year 2022,.

There is no filing requirement for nonresidents. There is no requirement for nonresidents. You do not need to file this return. Enter the amount from line 2(b) of your federal return (b) dividend income. Enter the amount from line 2(a) of your federal return subtotal interest and dividends income. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. The penalty provisions of rsa 21. This form is for income earned in tax year 2022,. To be eligible for a leave under this policy, the employee should submit the form no later than. Web leave of absence pursuant to psb no.

DP 10 Metallic Diaphragm Pump Diapump

Web this research is devoted to numerical and experimental analysis on deformation of completely removed component induced by wire arc additive. Web leave of absence pursuant to psb no. Enter the amount from line 2(a) of your federal return subtotal interest and dividends income. See www.revenue.nh.gov for instructions, the. The penalty provisions of rsa 21.

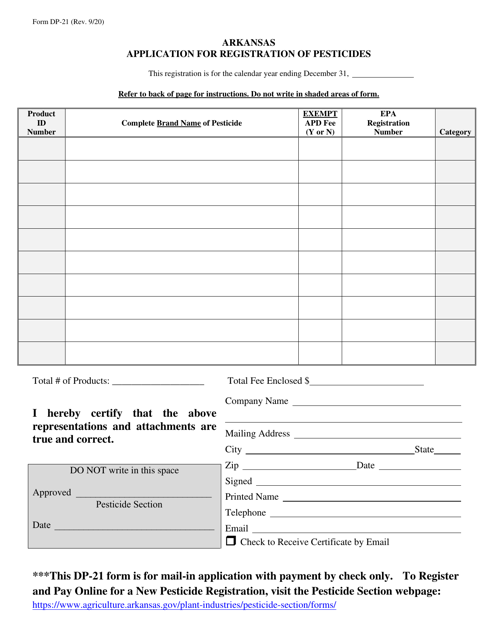

Form DP21 Download Printable PDF or Fill Online Application for

Web this research is devoted to numerical and experimental analysis on deformation of completely removed component induced by wire arc additive. Web dd form 1610, request and authorization for tdy travel of dod personnel, is a form used to request travel authorization for military personnel on active duty within. Enter the amount from line 2(b) of your federal return (b).

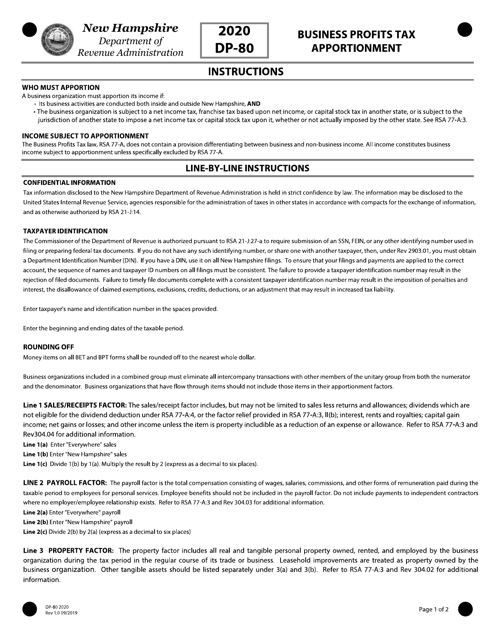

Download Instructions for Form DP80 Business Profits Tax Return

Drop retirement forms packet () packet containing all the forms needed to apply for. Fill out the personnel recovery debriefing statement online and print it out for free. Web important enter the primary taxpayer and spousal information in the same order on all tax documents to avoid delays in processing. The penalty provisions of rsa 21. There is no filing.

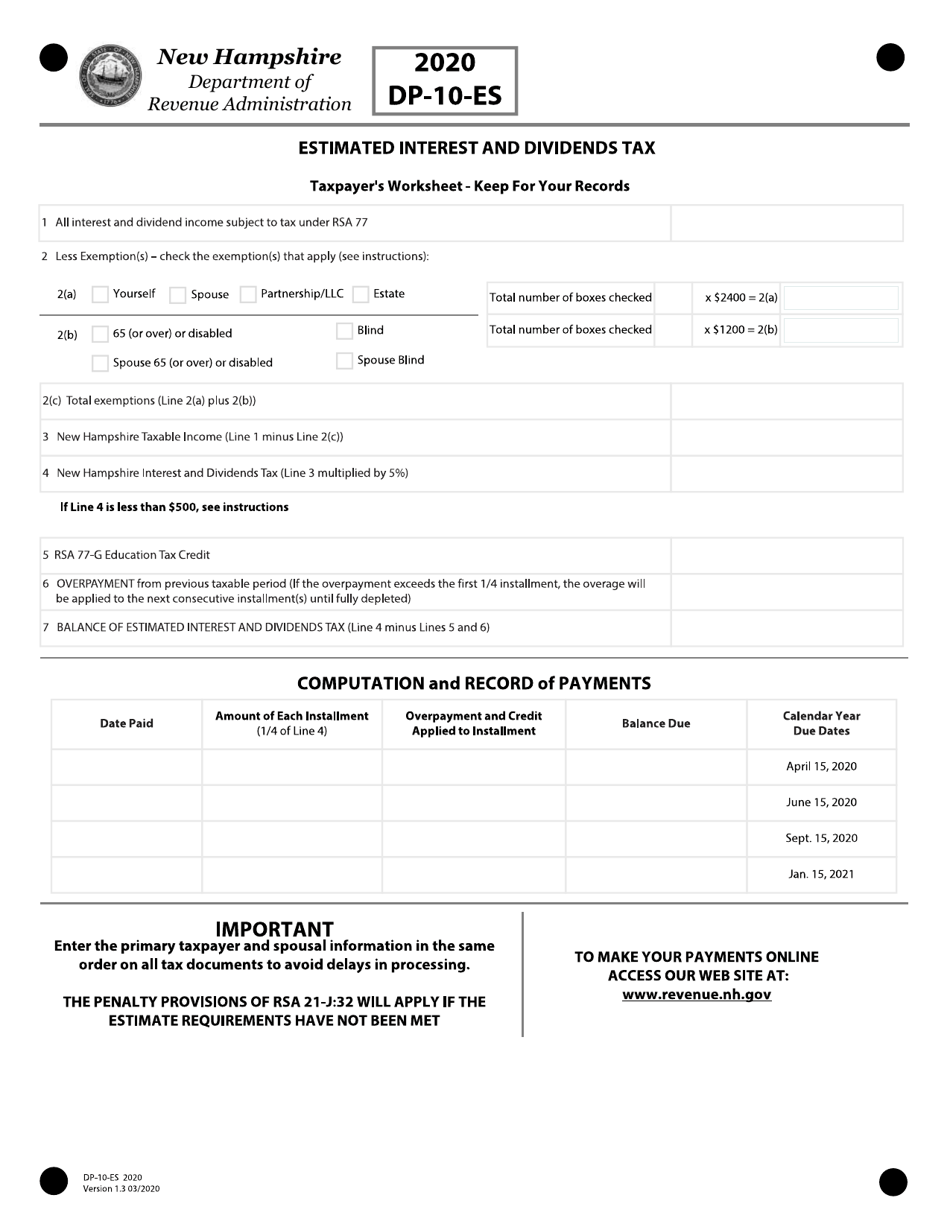

Form DP10ES Download Fillable PDF or Fill Online Estimated Interest

Enter the amount from line 2(a) of your federal return subtotal interest and dividends income. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. Fill out the personnel recovery debriefing statement online and print it out for free. New hampshire department of revenue administration interest and dividends tax instructions (continued) a. There is no.

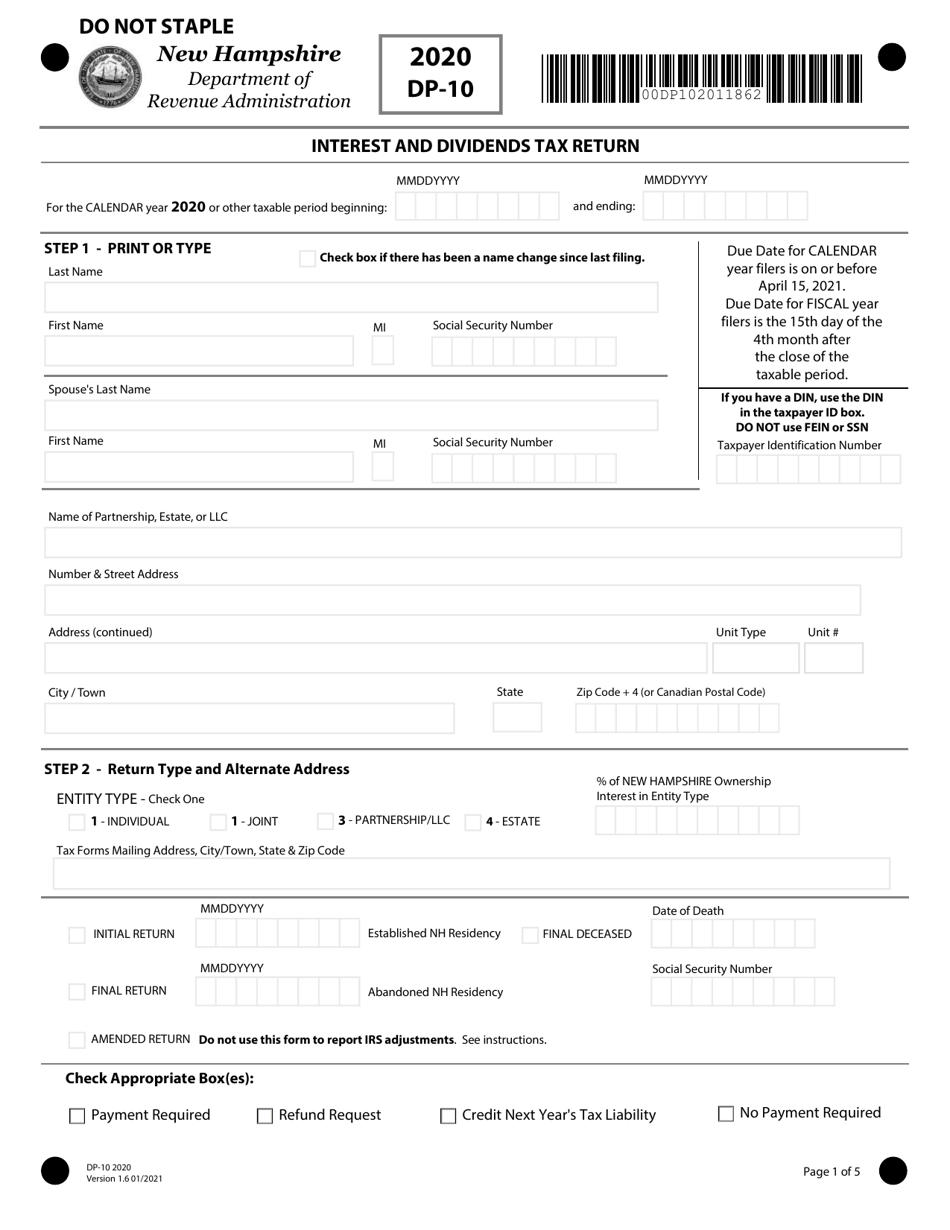

Form DP10 Download Fillable PDF or Fill Online Interest and Dividends

Fill out the personnel recovery debriefing statement online and print it out for free. Enter the amount from line 2(a) of your federal return subtotal interest and dividends income. See www.revenue.nh.gov for instructions, the. There is no requirement for nonresidents. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers.

DP 10 Hygienic Diaphragm Pump Diapump

Web dd form 1610, request and authorization for tdy travel of dod personnel, is a form used to request travel authorization for military personnel on active duty within. Web this research is devoted to numerical and experimental analysis on deformation of completely removed component induced by wire arc additive. Web drop forms this page provides a complete list of the.

DP 10 Hygienic Diaphragm Pump Diapump

(sum of lines 1(a), 1(b) and 1(c)) round to the. Web leave of absence pursuant to psb no. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. Web drop forms this page provides a complete list of the drop forms available to members. New hampshire department of revenue administration interest and dividends tax instructions.

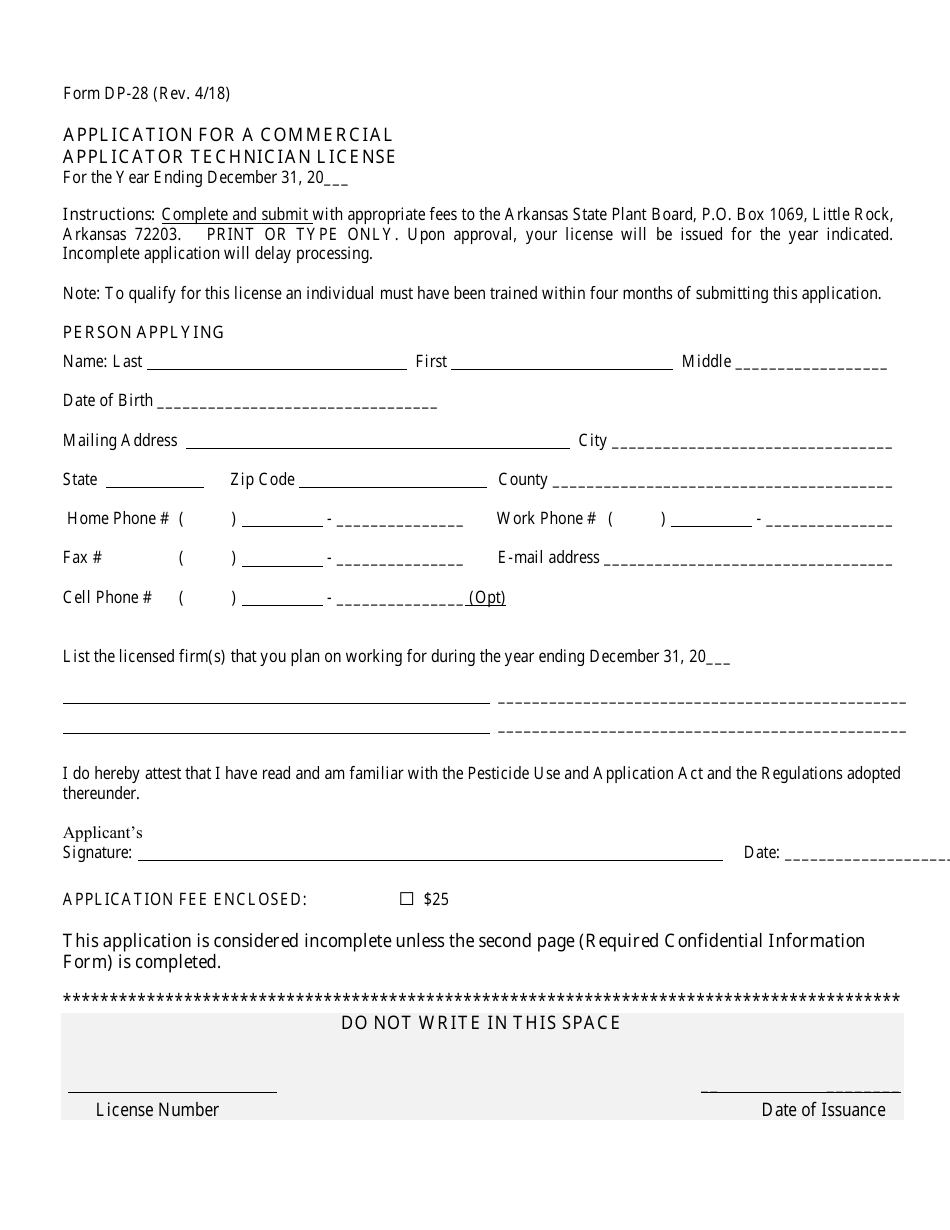

Form DP28 Download Printable PDF or Fill Online Application for a

Web leave of absence pursuant to psb no. Enter the amount from line 2(a) of your federal return subtotal interest and dividends income. To be eligible for a leave under this policy, the employee should submit the form no later than. Web dd form 1610, request and authorization for tdy travel of dod personnel, is a form used to request.

DP 10 Metallic Diaphragm Pump Diapump

Enter the amount from line 2(a) of your federal return subtotal interest and dividends income. The penalty provisions of rsa 21. There is no filing requirement for nonresidents. Web important enter the primary taxpayer and spousal information in the same order on all tax documents to avoid delays in processing. This form is for income earned in tax year 2022,.

Full form of DP YouTube

Web dd form 1610, request and authorization for tdy travel of dod personnel, is a form used to request travel authorization for military personnel on active duty within. Drop retirement forms packet () packet containing all the forms needed to apply for. (sum of lines 1(a), 1(b) and 1(c)) round to the. There is no filing requirement for nonresidents. Web.

You Do Not Need To File This Return.

There is no requirement for nonresidents. (sum of lines 1(a), 1(b) and 1(c)) round to the. Web this research is devoted to numerical and experimental analysis on deformation of completely removed component induced by wire arc additive. To be eligible for a leave under this policy, the employee should submit the form no later than.

Enter The Amount From Line 2(B) Of Your Federal Return (B) Dividend Income.

Enter the amount from line 2(a) of your federal return subtotal interest and dividends income. Web leave of absence pursuant to psb no. Drop retirement forms packet () packet containing all the forms needed to apply for. Web dd form 1610, request and authorization for tdy travel of dod personnel, is a form used to request travel authorization for military personnel on active duty within.

Web Drop Forms This Page Provides A Complete List Of The Drop Forms Available To Members.

Web important enter the primary taxpayer and spousal information in the same order on all tax documents to avoid delays in processing. Enter the amount from line 2(a) of your federal return subtotal interest and dividends income. The penalty provisions of rsa 21. New hampshire department of revenue administration interest and dividends tax instructions (continued) a.

This Form Is For Income Earned In Tax Year 2022,.

There is no filing requirement for nonresidents. See www.revenue.nh.gov for instructions, the. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. (sum of lines 1(a), 1(b) and 1(c)) round to the.