Form D 410

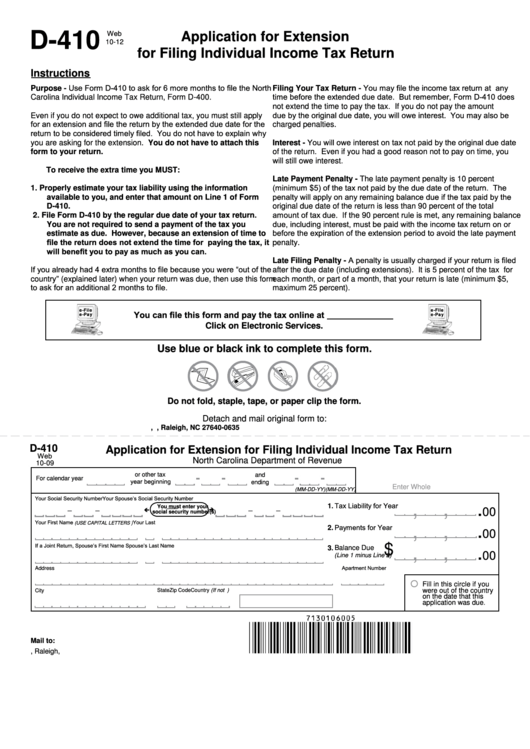

Form D 410 - Even if you do not expect to owe additional tax, you. Web complete d410 nc tax extension online with us legal forms. Web form d 410 ≡ fill out printable pdf forms online looking for form d 410? Save or instantly send your ready documents. Here, you can find this form and edit or fill it out with our pdf editor online. This form is for income earned in tax year 2022, with tax. Editable, printable, and free to use; Access form d 410 now for. Web application for extension for filing individual income tax return north carolina department of revenue for calendar year <rxu 6rfldo 6hfxulw\ 1xpehu or other tax Web if a taxpayer is not granted an automatic federal extension, the taxpayer may still request a state extension to file their north carolina individual income tax return by.

Here, you can find this form and edit or fill it out with our pdf editor online. Web if a taxpayer is not granted an automatic federal extension, the taxpayer may still request a state extension to file their north carolina individual income tax return by. Sign online button or tick the preview image of the form. If you were granted an automatic extension to file your. Save or instantly send your ready documents. Properly estimate your tax liability using the information available. If you were granted an automatic extension to file your. Sign it in a few clicks draw your. Editable, printable, and free to use; Edit your north carolina form d 410 online type text, add images, blackout confidential details, add comments, highlights and more.

To start the document, utilize the fill camp; Even if you do not expect to owe additional tax, you. If you were granted an automatic extension to file your. Web if a taxpayer is not granted an automatic federal extension, the taxpayer may still request a state extension to file their north carolina individual income tax return by. Save or instantly send your ready documents. Web form d 410 ≡ fill out printable pdf forms online looking for form d 410? If you were granted an automatic extension to file your. Web complete d410 nc tax extension online with us legal forms. Web to receive the extra time you must: If you were granted an automatic extension.

2014 Form NC DoR D400TC Fill Online, Printable, Fillable, Blank

Easily fill out pdf blank, edit, and sign them. Properly estimate your tax liability using the information available. The latest version available from the executive services directorate; Even if you do not expect to owe additional tax, you. Web application for extension for filing individual income tax return north carolina department of revenue for calendar year <rxu 6rfldo 6hfxulw\ 1xpehu.

Form MC410 Download Fillable PDF or Fill Online Notice of Release

The latest version available from the executive services directorate; Web the way to fill out the nc dept of revenue forms d410 online: Save or instantly send your ready documents. Editable, printable, and free to use; Easily fill out pdf blank, edit, and sign them.

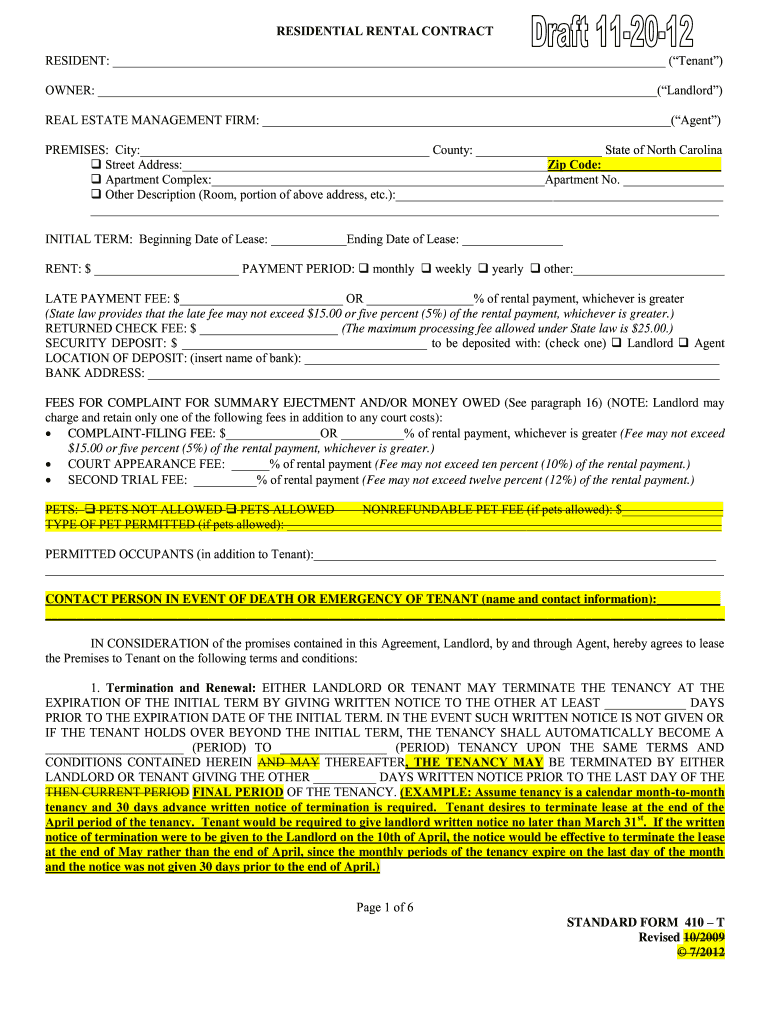

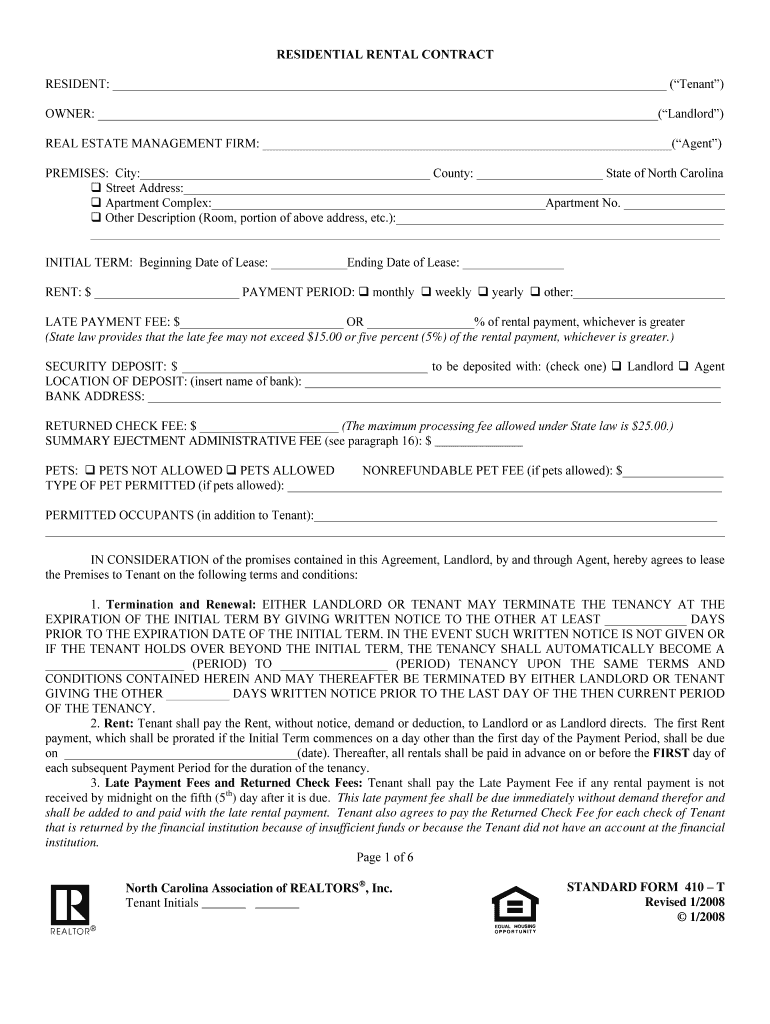

410 In Standard Form Fill Out and Sign Printable PDF Template signNow

Web the way to fill out the nc dept of revenue forms d410 online: Sign it in a few clicks draw your. Even if you do not expect to owe additional tax, you. Easily fill out pdf blank, edit, and sign them. Web complete d410 nc tax extension online with us legal forms.

Printable Nc Form D 410 Printable Word Searches

Even if you do not expect to owe additional tax, you. Properly estimate your tax liability using the information available. Save or instantly send your ready documents. Even if you do not expect to owe additional tax, you. Web application for extension for filing individual income tax return north carolina department of revenue for calendar year <rxu 6rfldo 6hfxulw\ 1xpehu.

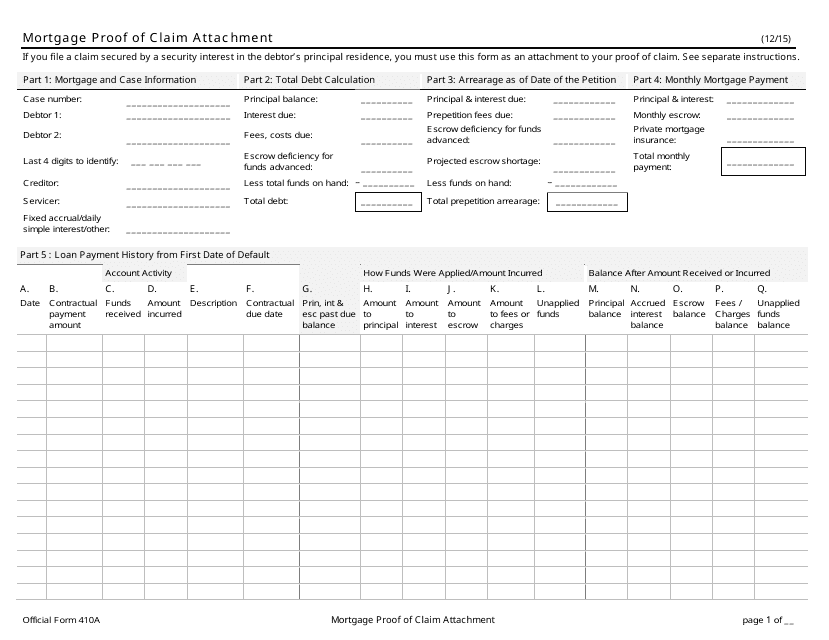

Official Form 410A Download Printable PDF or Fill Online Mortgage Proof

Even if you do not expect to owe additional tax, you. Sign it in a few clicks draw your. Web the way to fill out the nc dept of revenue forms d410 online: Properly estimate your tax liability using the information available. Easily fill out pdf blank, edit, and sign them.

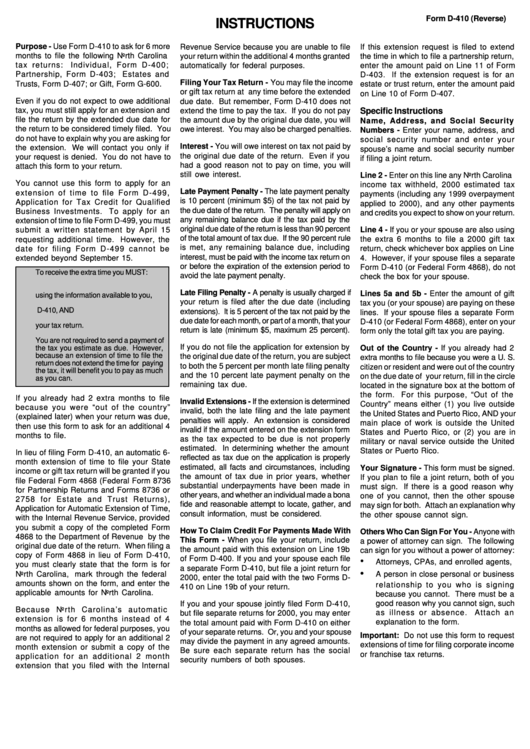

Instructions For Form D410 printable pdf download

This form is for income earned in tax year 2022, with tax. Access form d 410 now for. Save or instantly send your ready documents. Web form d 410 ≡ fill out printable pdf forms online looking for form d 410? Must file the extension by.

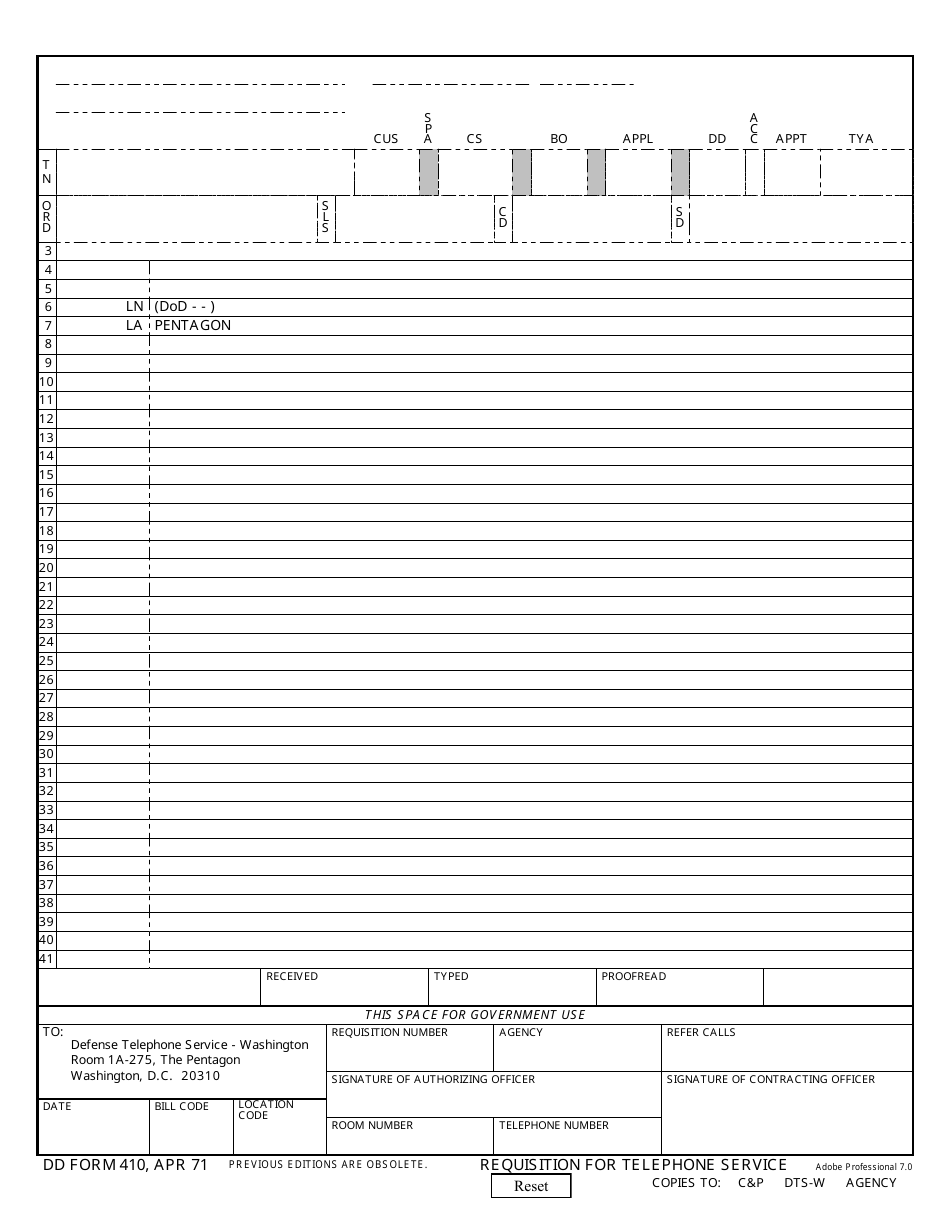

DD Form 410 Download Fillable PDF or Fill Online Requisition for

If you were granted an automatic extension to file your. Edit your north carolina form d 410 online type text, add images, blackout confidential details, add comments, highlights and more. This form is for income earned in tax year 2022, with tax. Sign it in a few clicks draw your. Web if a taxpayer is not granted an automatic federal.

Fillable Form D410 Application For Extension For Filing Individual

This form is for income earned in tax year 2022, with tax. Easily fill out pdf blank, edit, and sign them. Even if you do not expect to owe additional tax, you. Access form d 410 now for. Must file the extension by.

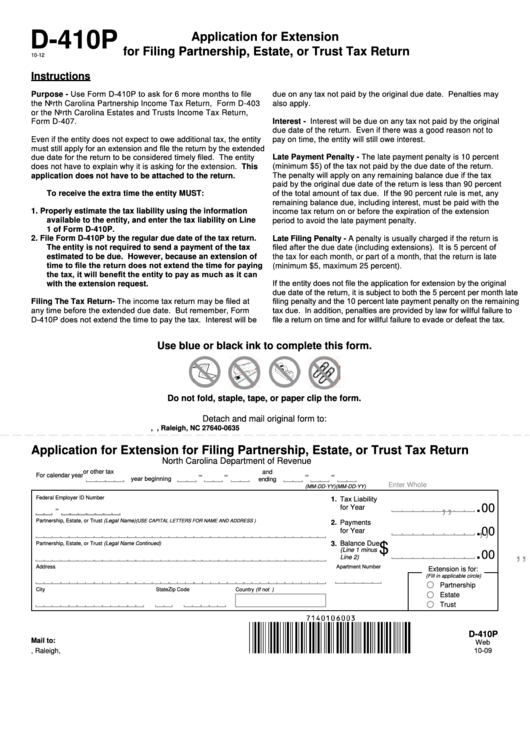

Form D410p Application For Extension For Filing Partnership, Estate

Here, you can find this form and edit or fill it out with our pdf editor online. If you were granted an automatic extension. Properly estimate your tax liability using the information available. Even if you do not expect to owe additional tax, you. If you were granted an automatic extension to file your.

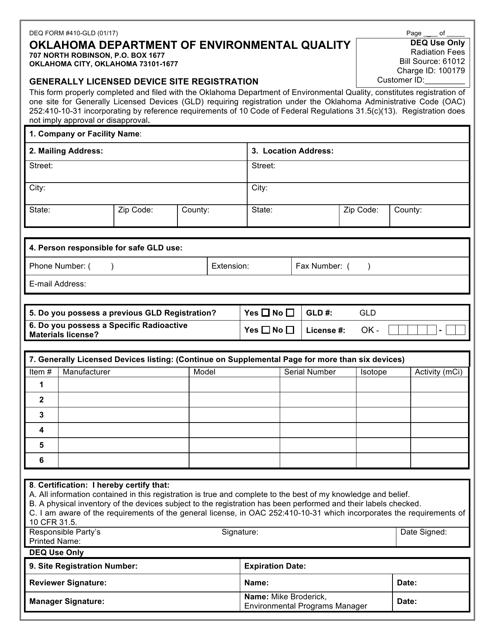

DEQ Form 410GLD Download Fillable PDF or Fill Online Generally

If you were granted an automatic extension to file your. Edit your north carolina form d 410 online type text, add images, blackout confidential details, add comments, highlights and more. Web complete d410 nc tax extension online with us legal forms. The latest version available from the executive services directorate; Even if you do not expect to owe additional tax,.

If You Were Granted An Automatic Extension To File Your.

If you were granted an automatic extension. Must file the extension by. Access form d 410 now for. If you were granted an automatic extension to file your.

To Start The Document, Utilize The Fill Camp;

Web form d 410 ≡ fill out printable pdf forms online looking for form d 410? Web if a taxpayer is not granted an automatic federal extension, the taxpayer may still request a state extension to file their north carolina individual income tax return by. This form is for income earned in tax year 2022, with tax. The latest version available from the executive services directorate;

Even If You Do Not Expect To Owe Additional Tax, You.

Editable, printable, and free to use; Save or instantly send your ready documents. Edit your north carolina form d 410 online type text, add images, blackout confidential details, add comments, highlights and more. Sign online button or tick the preview image of the form.

Properly Estimate Your Tax Liability Using The Information Available.

Web to receive the extra time you must: Sign it in a few clicks draw your. Easily fill out pdf blank, edit, and sign them. Web complete d410 nc tax extension online with us legal forms.