Form 990 Vs 990 Ez

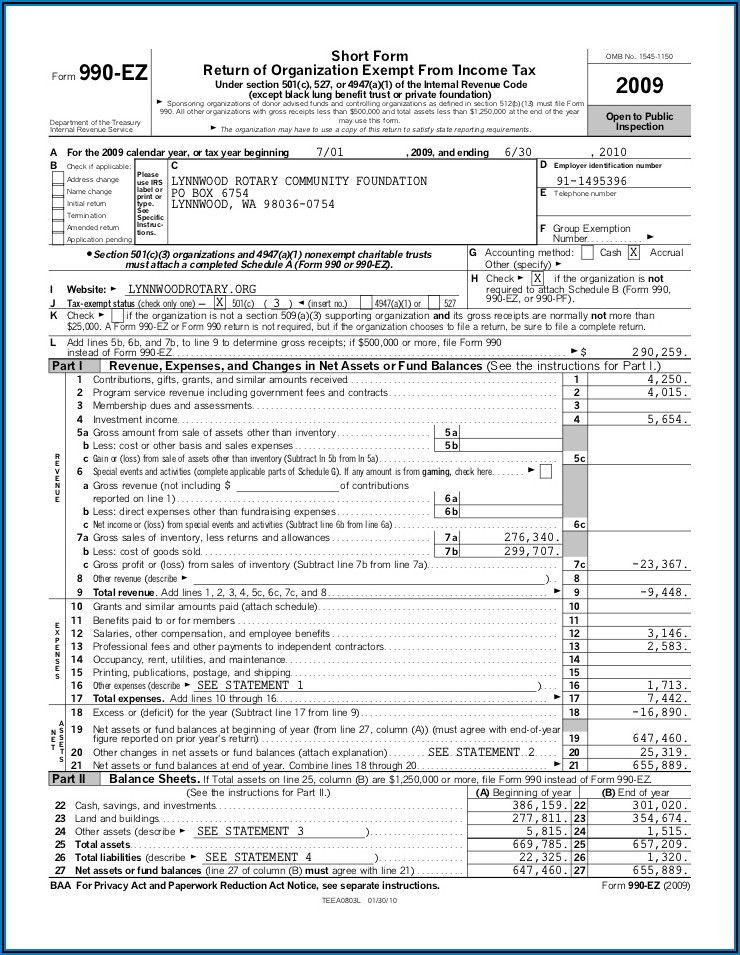

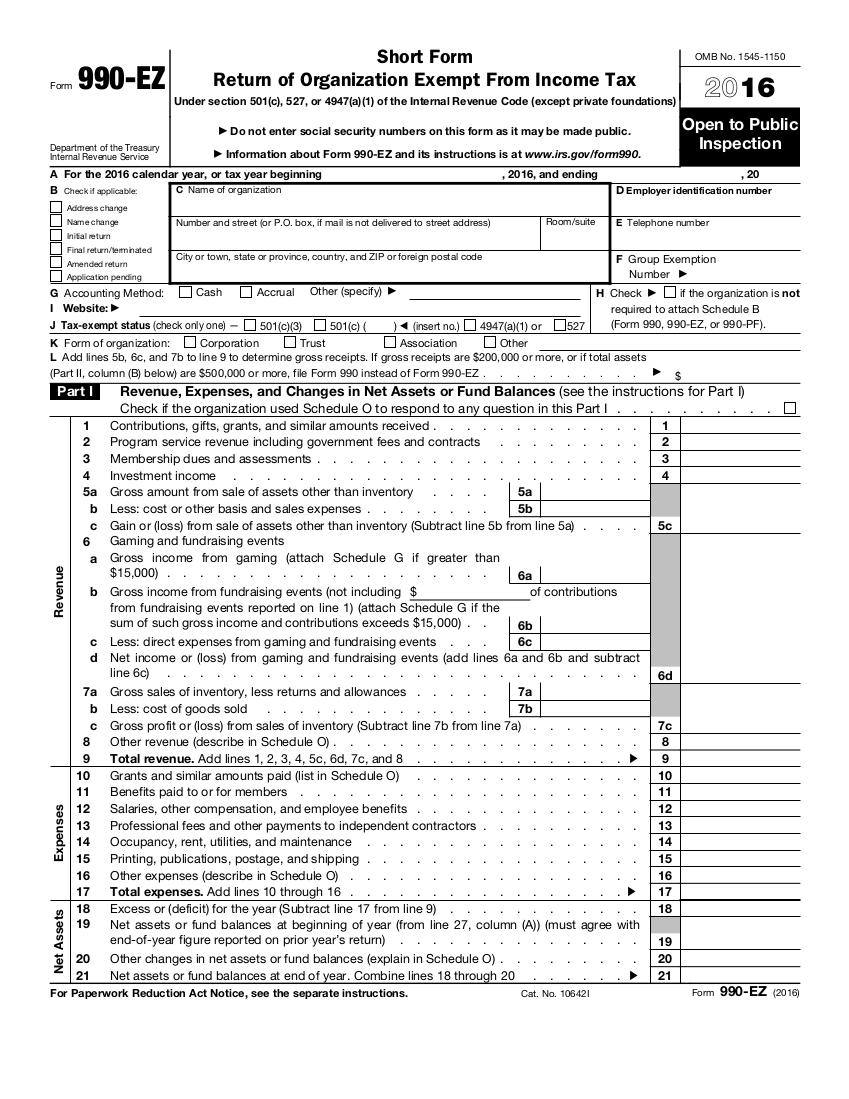

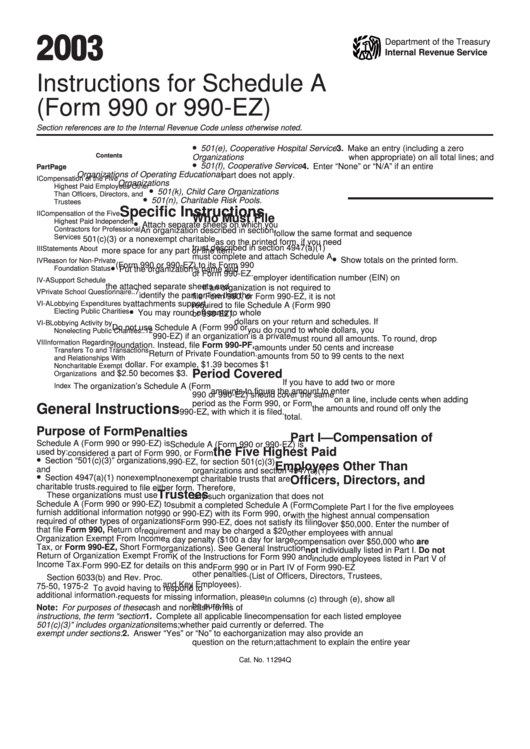

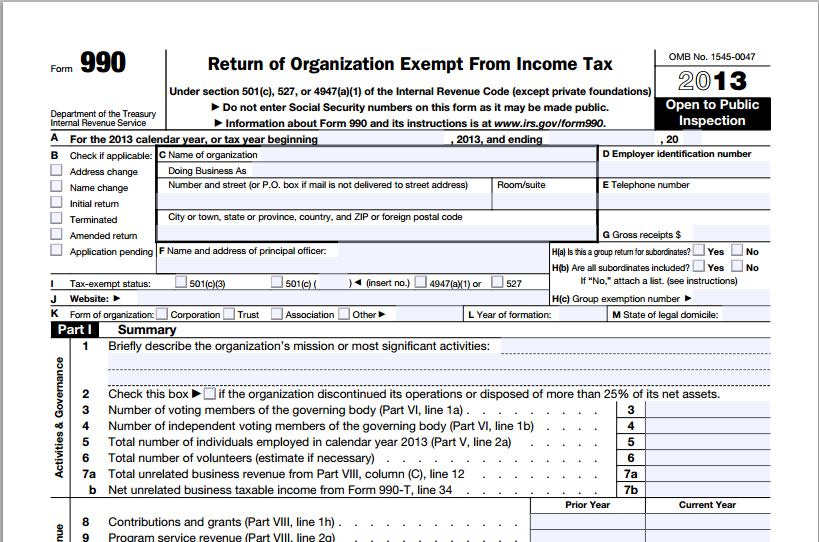

Form 990 Vs 990 Ez - The application does not provide unique input screens for. The information provided will enable you to file a more complete return and reduce the. Exempt organizations must file a tax return called a form 990 with the irs each year to comply. Web the form 990ez requires all of above information, as well as fiscal year financial activity for the organization to include: Web blog 990n vs. Was the organization controlled directly or indirectly at any time during the tax year by one or more disqualified. Simplify your 1099 reporting with the irs and the state by importing your 1099 data from xero into. Organizations exempt from income tax under section 501 (a). Opening asset and liability balances, income and expenses. Try it for free now!

990ez | a compact (yet complete!) guide as we wrap up. • the gross revenues of the organization for the past year are less than $200,000; A supporting organization described in section 509 (a) (3) is required to file form 990 (or. The information provided will enable you to file a more complete return and reduce the. 990ez | a compact (yet complete!) guide published on 15 mar 2022 by auctria 990n vs. Organizations exempt from income tax under section 501 (a). Web blog 990n vs. Upload, modify or create forms. How can i learn about using them? For tax years beginning on or after july 2, 2019, section 3101 of p.l.

The information provided will enable you to file a more complete return and reduce the. Web the form 990ez requires all of above information, as well as fiscal year financial activity for the organization to include: 990ez | a compact (yet complete!) guide as we wrap up. Organizations exempt from income tax under section 501 (a). • the gross revenues of the organization for the past year are less than $200,000; Mail your recipients paper copies of their forms. How can i learn about using them? The following are examples when form 990 must be utilized. • the assets of the organization are less than. Upload, modify or create forms.

Federal Tax Form 990 Ez Instructions Form Resume Examples 0g27lBAx9P

Upload, modify or create forms. Organizations exempt from income tax under section 501 (a). Web blog 990n vs. Simplify your 1099 reporting with the irs and the state by importing your 1099 data from xero into. How can i learn about using them?

Pdf 2020 990 N Fill Out Fillable and Editable PDF Template

Exempt organizations must file a tax return called a form 990 with the irs each year to comply. Try it for free now! The information provided will enable you to file a more complete return and reduce the. Upload, modify or create forms. Organizations exempt from income tax under section 501 (a).

Where Should I Mail My Form 990EZ?

Upload, modify or create forms. The application does not provide unique input screens for. Mail your recipients paper copies of their forms. For tax years beginning on or after july 2, 2019, section 3101 of p.l. Opening asset and liability balances, income and expenses.

Form 990 or 990EZ (Sch C) Political Campaign and Lobbying Activities

Ad download or email irs 990ez & more fillable forms, register and subscribe now! Web the form 990ez requires all of above information, as well as fiscal year financial activity for the organization to include: 990ez | a compact (yet complete!) guide as we wrap up. 990ez | a compact (yet complete!) guide published on 15 mar 2022 by auctria.

File Form 990 Online Efile 990 990 Filing Deadline 2021

Organizations exempt from income tax under section 501 (a). The following are examples when form 990 must be utilized. The application does not provide unique input screens for. Web the form 990ez requires all of above information, as well as fiscal year financial activity for the organization to include: A supporting organization described in section 509 (a) (3) is required.

990EZ (2016) Edit Forms Online PDFFormPro

A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Web the form 990ez requires all of above information, as well as fiscal year financial activity for the organization to include: Organizations exempt from income tax under section 501 (a). Web blog 990n vs. How can i learn about using them?

990N vs. 990EZ What is the difference?

The application does not provide unique input screens for. Simplify your 1099 reporting with the irs and the state by importing your 1099 data from xero into. A supporting organization described in section 509 (a) (3) is required to file form 990 (or. The following are examples when form 990 must be utilized. 990ez | a compact (yet complete!) guide.

Instructions For Schedule A (Form 990 Or 990Ez) 2003 printable pdf

Organizations exempt from income tax under section 501 (a). Was the organization controlled directly or indirectly at any time during the tax year by one or more disqualified. Exempt organizations must file a tax return called a form 990 with the irs each year to comply. Opening asset and liability balances, income and expenses. The information provided will enable you.

Form 990 Preparation Service 501(c)(3) Tax Services in Tampa

990ez | a compact (yet complete!) guide published on 15 mar 2022 by auctria 990n vs. Mail your recipients paper copies of their forms. Upload, modify or create forms. The following are examples when form 990 must be utilized. The application does not provide unique input screens for.

Form 990EZ for nonprofits updated Accounting Today

Web the form 990ez requires all of above information, as well as fiscal year financial activity for the organization to include: For tax years beginning on or after july 2, 2019, section 3101 of p.l. Try it for free now! The following are examples when form 990 must be utilized. The application does not provide unique input screens for.

• The Gross Revenues Of The Organization For The Past Year Are Less Than $200,000;

Opening asset and liability balances, income and expenses. Ad download or email irs 990ez & more fillable forms, register and subscribe now! • the assets of the organization are less than. For tax years beginning on or after july 2, 2019, section 3101 of p.l.

The Information Provided Will Enable You To File A More Complete Return And Reduce The.

Web blog 990n vs. How can i learn about using them? Web the form 990ez requires all of above information, as well as fiscal year financial activity for the organization to include: 990ez | a compact (yet complete!) guide as we wrap up.

Try It For Free Now!

A supporting organization described in section 509 (a) (3) is required to file form 990 (or. Simplify your 1099 reporting with the irs and the state by importing your 1099 data from xero into. The following are examples when form 990 must be utilized. 990ez | a compact (yet complete!) guide published on 15 mar 2022 by auctria 990n vs.

The Application Does Not Provide Unique Input Screens For.

Mail your recipients paper copies of their forms. Upload, modify or create forms. Exempt organizations must file a tax return called a form 990 with the irs each year to comply. Organizations exempt from income tax under section 501 (a).