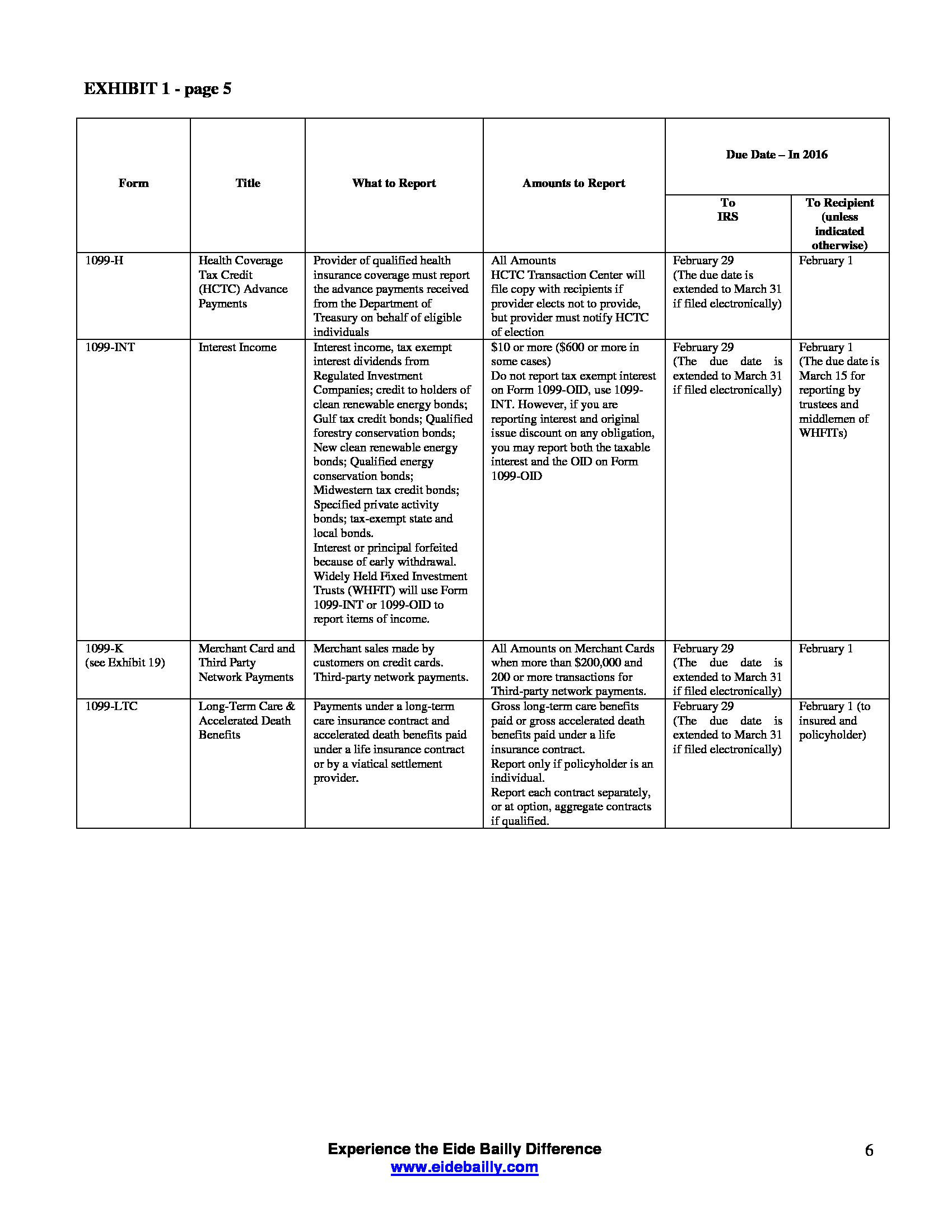

Form 982 Insolvency Worksheet

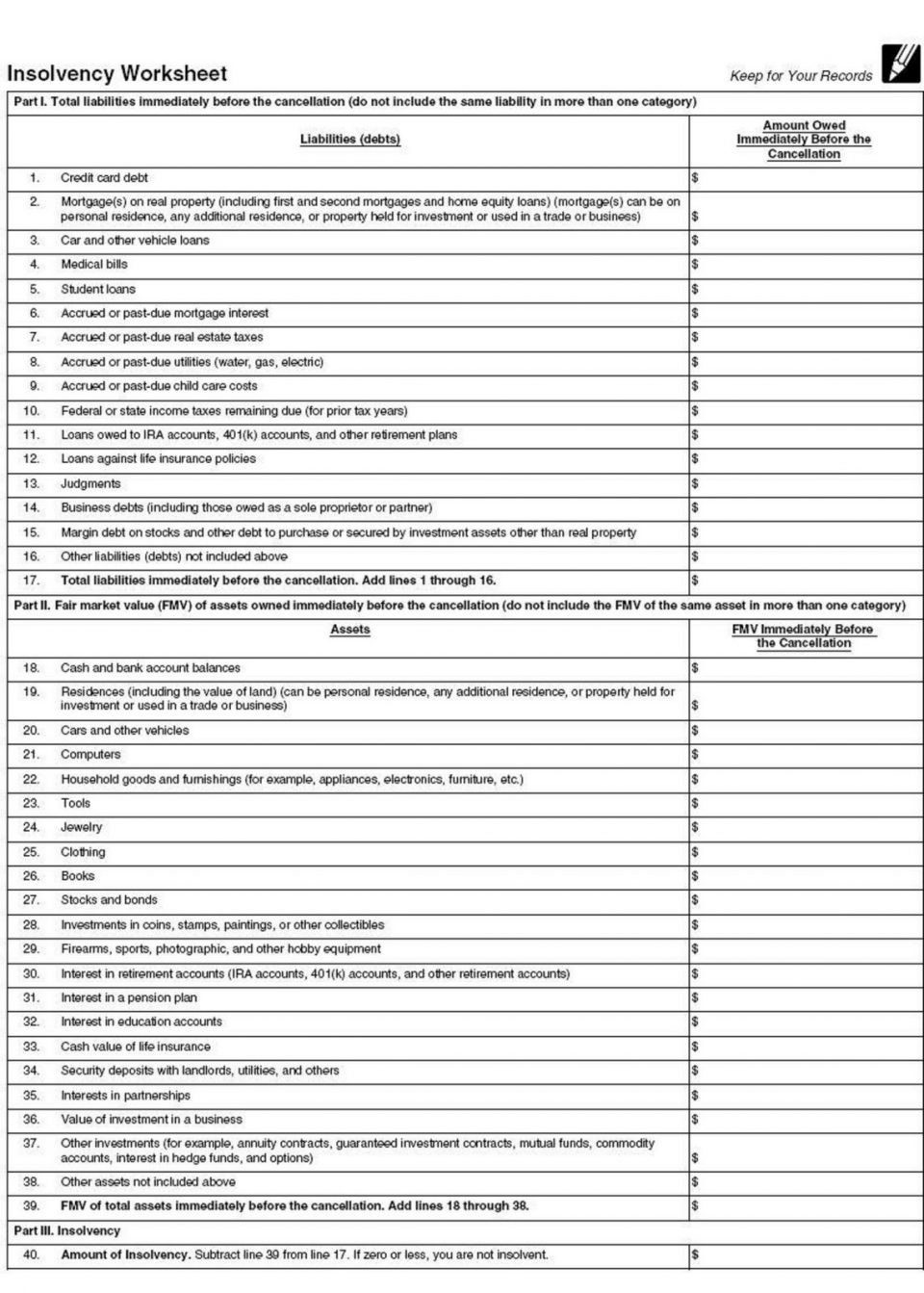

Form 982 Insolvency Worksheet - Now, you have to prove to the irs that you were insolvent. Irs publication 4681 (link opens pdf) includes an insolvency worksheet on page 8, which lists the. Web fill insolvency canceled debts, edit online. December 2021) department of the treasury internal revenue service reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) (for use with form 982 (rev. March 2018)) section references are to the internal revenue code unless otherwise noted. Create professional documents with signnow. Web first, make a list of the total assets you owned immediately before the debt was canceled. Web insolvency means that you are unable to pay your debts. Common situations covered in this publication You may need to file a form 982 to reduce your tax basis, or cost, in the underlying property if the debt relates to your insolvency or bankruptcy.

Web insolvency is a condition in which the fmv of all assets is less than one’s liabilities. This sample worksheet is for reference only. Web video instructions and help with filling out and completing sample of completed form 982 for insolvency. This reduction in basis can increase the. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Form 982 insolvency calculator quantity. Qualified real property business indebtedness If you need more help, click below: Vehicle loans bank accounts personal signature loans iras,. Web you must complete and file form 982 with your tax return to do so.

Vehicle loans bank accounts personal signature loans iras,. Open (continue) your return, if it's not already open. Web first, make a list of the total assets you owned immediately before the debt was canceled. For instructions and the latest information. Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). Get accurate templates in the easiest way online. Web the zipdebt irs form 982 insolvency calculator. This reduction in basis can increase the. Check the box that says “discharge of indebtedness to the extent insolvent,” which appears at line 1b. Create professional documents with signnow.

Tax form 982 Insolvency Worksheet

Web irs form 982 insolvency worksheet. Calculators, cancelation of debt income, cancellation of debt, form 982,. Web attach form 982 to your federal income tax return for 2022 and check the box on line 1d. Web you must complete and file form 982 with your tax return to do so. About form 982, reduction of tax attributes due to discharge.

Tax Form 982 Insolvency Worksheet —

Qualified real property business indebtedness Calculators, cancelation of debt income, cancellation of debt, form 982,. Web in order to show that the insolvency exception applies and some or all of the canceled debt is not taxable due to insolvency, the debtor needs to complete form 982 and mark the box that says, “discharge of indebtedness to the extent insolvent.” typically,.

Tax Form 982 Insolvency Worksheet —

If you have had debt forgiven because you are unable to pay the debt, you'll check box 1b. Web first, make a list of the total assets you owned immediately before the debt was canceled. Web insolvency is a condition in which the fmv of all assets is less than one’s liabilities. Web you were insolvent if your liabilities (the.

Insolvency Worksheet Example Studying Worksheets

Attach this form to your income tax return. Web in order to show that the insolvency exception applies and some or all of the canceled debt is not taxable due to insolvency, the debtor needs to complete form 982 and mark the box that says, “discharge of indebtedness to the extent insolvent.” typically, no further explanation is necessary. Reduce document.

Worksheet Form 10 Insolvency Worksheet Worksheet Fun —

Web the zipdebt irs form 982 insolvency calculator. Web in order to show that the insolvency exception applies and some or all of the canceled debt is not taxable due to insolvency, the debtor needs to complete form 982 and mark the box that says, “discharge of indebtedness to the extent insolvent.” typically, no further explanation is necessary. Web video.

Tax Form 982 Insolvency Worksheet

Check the box that says “discharge of indebtedness to the extent insolvent,” which appears at line 1b. Form 982 insolvency calculator quantity. Web for details and a worksheet to help calculate insolvency, see pub. Get accurate templates in the easiest way online. The reduction must be made in the following order unless you check the box on line 1d for.

Insolvency Worksheet Example worksheet

Calculators, cancelation of debt income, cancellation of debt, form 982,. For more details on what it means to be insolvent, please reference irs. Web below are five scenarios where an exclusion from taxable income could be applicable by utilizing a properly reported form 982: Cents per dollar (as explained below). Fill out the insolvency worksheet (and keep it in your.

Form 982 Insolvency Worksheet

Attach this form to your income tax return. You don’t have to do anything else, but you might want to complete the insolvency worksheet, showing how you arrived at the number, to avoid the irs questioning your. Web form 982 is used to determine, under certain circumstances described in section 108, the amount of discharged indebtedness that can be excluded.

Debt Form 982 Form 982 Insolvency Worksheet —

Get accurate templates in the easiest way online. Create professional documents with signnow. Include the amount of canceled qualified real property business debt (but not more than the amount of the exclusion limit, explained earlier) on line 2 of form 982. Get your fillable template and complete it online using the instructions provided. Attach this form to your income tax.

Irs Insolvency Worksheet Form Printable Worksheets and Activities for

Reduce document preparation complexity by getting the most out of this helpful video guide. If you have had debt forgiven because you are unable to pay the debt, you'll check box 1b. This reduction in basis can increase the. Fill out the insolvency worksheet (and keep it in your important paperwork!). Web insolvency is a condition in which the fmv.

Now, You Have To Prove To The Irs That You Were Insolvent.

Web you must complete and file form 982 with your tax return to do so. You don’t have to do anything else, but you might want to complete the insolvency worksheet, showing how you arrived at the number, to avoid the irs questioning your. The amount or level of insolvency is expressed as a negative net worth. Reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment).

December 2021) Department Of The Treasury Internal Revenue Service Reduction Of Tax Attributes Due To Discharge Of Indebtedness (And Section 1082 Basis Adjustment) (For Use With Form 982 (Rev.

Common situations covered in this publication Web use part i of form 982 to indicate why any amount received from the discharge of indebtedness should be use part ii to report your reduction of tax attributes. How to complete the form. Web create the insolvency worksheet.

Web You Were Insolvent If Your Liabilities (The Total Amount Of All Debts) Were More Than The Fair Market Value (Fmv) Of All Of Your Assets Immediately Before The Discharge.

Web insolvency is a condition in which the fmv of all assets is less than one’s liabilities. This reduction in basis can increase the. If the discharged debt you are excluding is. Web the zipdebt irs form 982 insolvency calculator.

Cents Per Dollar (As Explained Below).

Web for details and a worksheet to help calculate insolvency, see pub. If you have had debt forgiven because you are unable to pay the debt, you'll check box 1b. The reduction must be made in the following order unless you check the box on line 1d for qualified real property business indebtedness or make the election on line 5 to reduce Attach this form to your income tax return.