Form 941 Schedule R

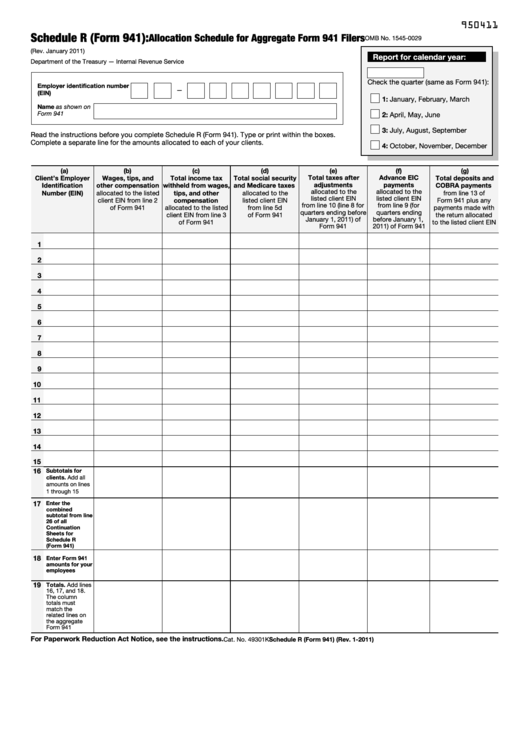

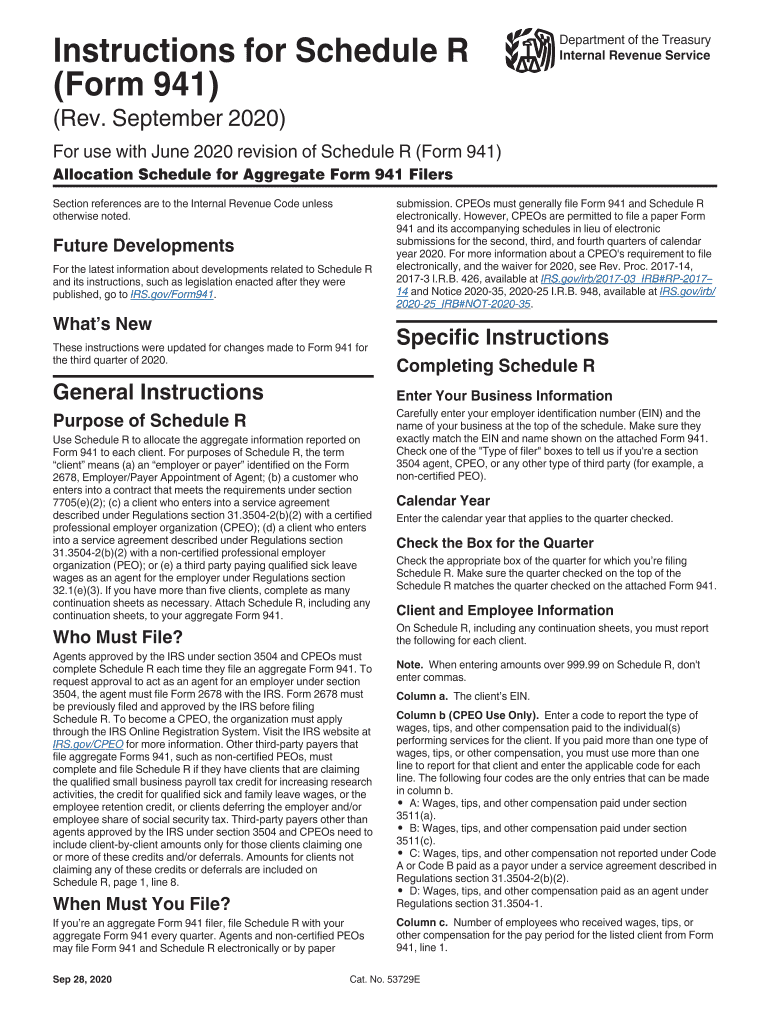

Form 941 Schedule R - Web if you’re an aggregate form 941 filer, file schedule r with your aggregate form 941 every quarter. Web address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code 950122 omb no. Web the irs form 941 is an employer's quarterly tax return. Agents approved by the irs under section 3504 and cpeos must complete. Web we last updated the allocation schedule for aggregate form 941 filers in december 2022, so this is the latest version of 941 (schedule r), fully updated for tax year 2022. Employers use tax form 941 to report federal income tax withheld, social security tax, and medicare tax. Web schedule r has been redesigned to allow the new lines from the april 2020 revision of form 941 to be reported on schedule r. Web form 941 for 2020: Web understanding the schedule r (form 940) the internal revenue service (irs) uses form 940 to determine the annual federal unemployment tax act (futa) tax owed by. Web revised draft instructions for form 941’s schedule r were released.

Form 941 schedule r for cpeos & 3504 reporting agents. Agents approved by the irs under section 3504 and cpeos must complete. Web attach schedule r, including any continuation sheets, to your aggregate form 941. June 2020) department of the treasury — internal revenue service omb no. Web overview of form 941 (schedule r) form 941 (schedule r) is the allocation schedule for aggregate form 941 filers and is required to be filed by cpeo’s. Save or instantly send your ready documents. General instructions purpose of schedule r. Web understanding the schedule r (form 940) the internal revenue service (irs) uses form 940 to determine the annual federal unemployment tax act (futa) tax owed by. Employers use tax form 941 to report federal income tax withheld, social security tax, and medicare tax. Web if you’re an aggregate form 941 filer, file schedule r with your aggregate form 941 every quarter.

Employers use tax form 941 to report federal income tax withheld, social security tax, and medicare tax. Allocation schedule for aggregate form 941 filers (rev. Easily fill out pdf blank, edit, and sign them. Agents approved by the irs under section 3504 and cpeos must complete. Save or instantly send your ready documents. June 2020) department of the treasury — internal revenue service omb no. Web schedule r (form 941): Web staying compliant with form 941 to ensure compliance with form 941 and the related deposit schedules, it is crucial to keep accurate records of your employee’s. Web schedule r has been redesigned to allow the new lines from the april 2020 revision of form 941 to be reported on schedule r. Columns m, s, t, and v are now reserved for future use.

Fill Free fillable F941sr Accessible Schedule R (Form 941) (Rev

General instructions purpose of schedule r. Web the irs form 941 is an employer's quarterly tax return. Allocation schedule for aggregate form 941 filers (rev. March 2023) allocation schedule for aggregate form 941 filers department of the treasury — internal revenue service omb no. Web attach schedule r, including any continuation sheets, to your aggregate form 941.

Form 941 (Schedule R) Filing with TaxBandits Blog TaxBandits

March 2023) allocation schedule for aggregate form 941 filers department of the treasury — internal revenue service omb no. March 2023) allocation schedule for aggregate form 941 filers department of the treasury — internal revenue service omb no. Form 941 schedule r for cpeos & 3504 reporting agents. July 2020) employer’s quarterly federal tax return department of the treasury —.

Form 941 (Schedule R) Allocation Schedule for Aggregate Form 941

July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950120. General instructions purpose of schedule r. Web understanding the schedule r (form 940) the internal revenue service (irs) uses form 940 to determine the annual federal unemployment tax act (futa) tax owed by. The revised schedule may be used only for the first quarter.

Form 941 (Schedule R) Allocation Schedule for Aggregate Form 941

Form 941 schedule r for cpeos & 3504 reporting agents. Web understanding the schedule r (form 940) the internal revenue service (irs) uses form 940 to determine the annual federal unemployment tax act (futa) tax owed by. Web schedule r (form 941): Web form 941 schedule r has been updated to reflect the changes made to form 941 for q1..

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

Web form 941 schedule r has been updated to reflect the changes made to form 941 for q1. Form 941 for other tax professionals or payroll service provider. Web attach schedule r, including any continuation sheets, to your aggregate form 941. General instructions purpose of schedule r. Columns m, s, t, and v are now reserved for future use.

Instructions for Schedule R Form 941 Rev September Instructions for

Web form 941 schedule r has been updated to reflect the changes made to form 941 for q1. Easily fill out pdf blank, edit, and sign them. Web understanding the schedule r (form 940) the internal revenue service (irs) uses form 940 to determine the annual federal unemployment tax act (futa) tax owed by. Web we last updated the allocation.

EFile 2019 Form 941 Schedule R 941r Efiling solution for CPEO/RA

Form 941 schedule r for cpeos & 3504 reporting agents. Web staying compliant with form 941 to ensure compliance with form 941 and the related deposit schedules, it is crucial to keep accurate records of your employee’s. The revised schedule may be used only for the first quarter of 2022. Web overview of form 941 (schedule r) form 941 (schedule.

Fillable Schedule R (Form 941) Allocation Schedule For Aggregate Form

Columns m, s, t, and v are now reserved for future use. The revised schedule may be used only for the first quarter of 2022. Web schedule r (form 941): General instructions purpose of schedule r. Web understanding the schedule r (form 940) the internal revenue service (irs) uses form 940 to determine the annual federal unemployment tax act (futa).

What’s The Deal With Schedule R For The Second Quarter? Blog TaxBandits

Web if you’re an aggregate form 941 filer, file schedule r with your aggregate form 941 every quarter. July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950120. Web form 941 schedule r has been updated to reflect the changes made to form 941 for q1. Allocation schedule for aggregate form 941 filers (rev..

Form 941 (Schedule R) Allocation Schedule for Aggregate Form 941

Web the irs form 941 is an employer's quarterly tax return. Web form 941 for 2020: Allocation schedule for aggregate form 941 filers (rev. Web attach schedule r, including any continuation sheets, to your aggregate form 941. Agents approved by the irs under section 3504 and cpeos must complete.

Form 941 Schedule R For Cpeos & 3504 Reporting Agents.

Web understanding the schedule r (form 940) the internal revenue service (irs) uses form 940 to determine the annual federal unemployment tax act (futa) tax owed by. Columns m, s, t, and v are now reserved for future use. Allocation schedule for aggregate form 941 filers (rev. Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents.

Web Staying Compliant With Form 941 To Ensure Compliance With Form 941 And The Related Deposit Schedules, It Is Crucial To Keep Accurate Records Of Your Employee’s.

Save or instantly send your ready documents. Web schedule r has been redesigned to allow the new lines from the april 2020 revision of form 941 to be reported on schedule r. Web if you’re an aggregate form 941 filer, file schedule r with your aggregate form 941 every quarter. March 2023) allocation schedule for aggregate form 941 filers department of the treasury — internal revenue service omb no.

Web We Last Updated The Allocation Schedule For Aggregate Form 941 Filers In December 2022, So This Is The Latest Version Of 941 (Schedule R), Fully Updated For Tax Year 2022.

July 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950120. Easily fill out pdf blank, edit, and sign them. Web revised draft instructions for form 941’s schedule r were released. Web schedule r (form 941):

Web What Is Form 941 Schedule R?

Web schedule r (form 941): The revised schedule may be used only for the first quarter of 2022. Agents approved by the irs under section 3504 and cpeos must complete. March 2023) allocation schedule for aggregate form 941 filers department of the treasury — internal revenue service omb no.

-flow-diagram.png)