Form 941 Or 944

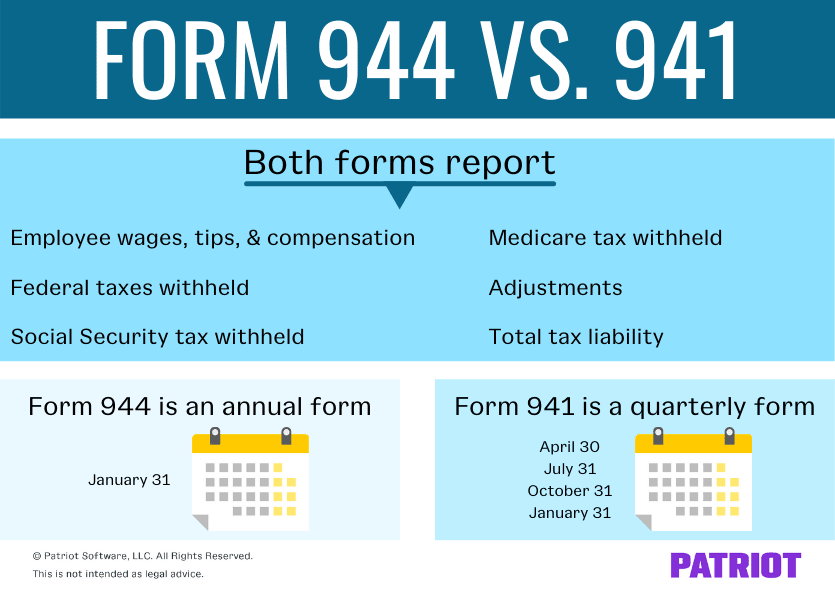

Form 941 Or 944 - Form 941 is even more similar to form 944, and easier to confuse. Form 944 is for smaller employers, whose annual tax liability is less than $1,000 for social security,. Web what is the difference between a 941 and a 944 form? Web the main distinction between form 940 and 941 is that form 940 documents futa tax, which is paid exclusively by the employer. Web that’s a lot of time, especially when it’s not always clear whether an employer should use form 941 or 944 to report their payroll taxes. All employers need to report to the irs the tax withheld from employees as well as their own tax liabilities. Web you must file annual form 944 instead of filing quarterly forms 941 only if the irs notified you in writing. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Web as an employer, you're generally required to deposit the employment taxes reported on forms 941, employer's quarterly federal tax return or form 944,. You may qualify to use form 944 instead.

Keep reading to learn the. Web the main distinction between form 940 and 941 is that form 940 documents futa tax, which is paid exclusively by the employer. In contrast to this, form 941. Web the 944 form is a replacement for the quarterly form 941. 941/944 employer’s federal tax returns council has two filing. Generally, employers must report wages, tips and other compensation paid to an employee by filing the required forms to the irs. Web the main distinction between irs forms 941 and 944 involves how often wages and taxes are reported. You may qualify to use form 944 instead. Web as an employer, you're generally required to deposit the employment taxes reported on forms 941, employer's quarterly federal tax return or form 944,. Web generally, employers are required to file forms 941 quarterly.

Web generally, employers are required to file forms 941 quarterly. Go to www.irs.gov/form944 for instructions and the latest information. However, some small employers (those whose annual liability for social security, medicare, and. Web that’s a lot of time, especially when it’s not always clear whether an employer should use form 941 or 944 to report their payroll taxes. You may qualify to use form 944 instead. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Web a quarterly (941 form) or annual (944 form) employer’s tax return must by filed by the extension council. Keep reading to learn the. Web how is form 944 different from form 941? Web unlike irs form 941, which reports much of the same information, but must be filed quarterly, form 944 is an annual tax return.

Fillable Form 944 Employer'S Annual Federal Tax Return 2017

Web what’s the difference between form 941 and form 944? Go to www.irs.gov/form944 for instructions and the latest information. Web what is the difference between a 941 and a 944 form? Some small employers are eligible to file an annual form 944 pdf. Keep reading to learn the.

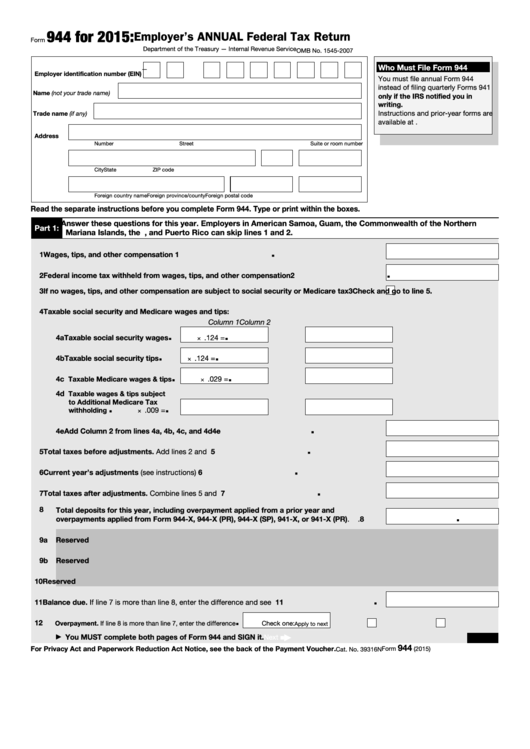

Form 944 Employer's Annual Federal Tax Return (2015) Free Download

In contrast to this, form 941. 941/944 employer’s federal tax returns council has two filing. Form 944 is for smaller employers, whose annual tax liability is less than $1,000 for social security,. Web form 944 is designed so the smallest employers (those whose annual liability for social security, medicare, and withheld federal income taxes is $1,000 or less) will file.

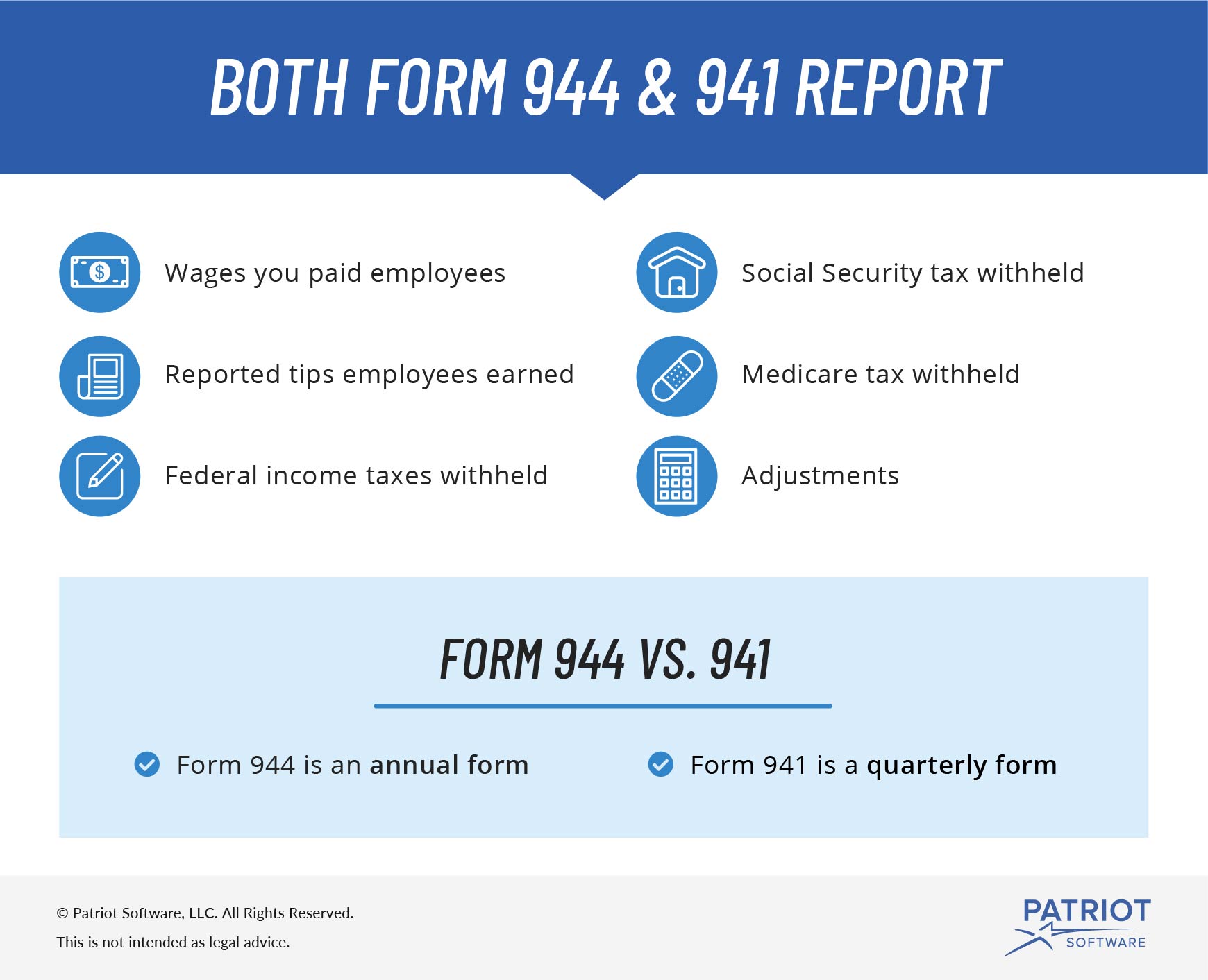

Form 944 vs. 941 Should You File the Annual or Quarterly Form?

In contrast to this, form 941. Web what is the difference between a 941 and a 944 form? Both of these forms are used to report fica and income tax. Web unlike irs form 941, which reports much of the same information, but must be filed quarterly, form 944 is an annual tax return. 941/944 employer’s federal tax returns council.

Form 944 Demonstration

However, some small employers (those whose annual liability for social security, medicare, and. Form 941 is even more similar to form 944, and easier to confuse. Web a quarterly (941 form) or annual (944 form) employer’s tax return must by filed by the extension council. Web the main distinction between irs forms 941 and 944 involves how often wages and.

What Is The Difference Between Form 941 and Form 944? Blog TaxBandits

Web how is form 944 different from form 941? In contrast to this, form 941. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Web the 944 form is a replacement for the quarterly form 941. Go to www.irs.gov/form944 for instructions and the latest information.

Want To File Form 941 Instead of 944? This Is How Blog TaxBandits

Web generally, employers are required to file forms 941 quarterly. Web unlike irs form 941, which reports much of the same information, but must be filed quarterly, form 944 is an annual tax return. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Web what is the difference between.

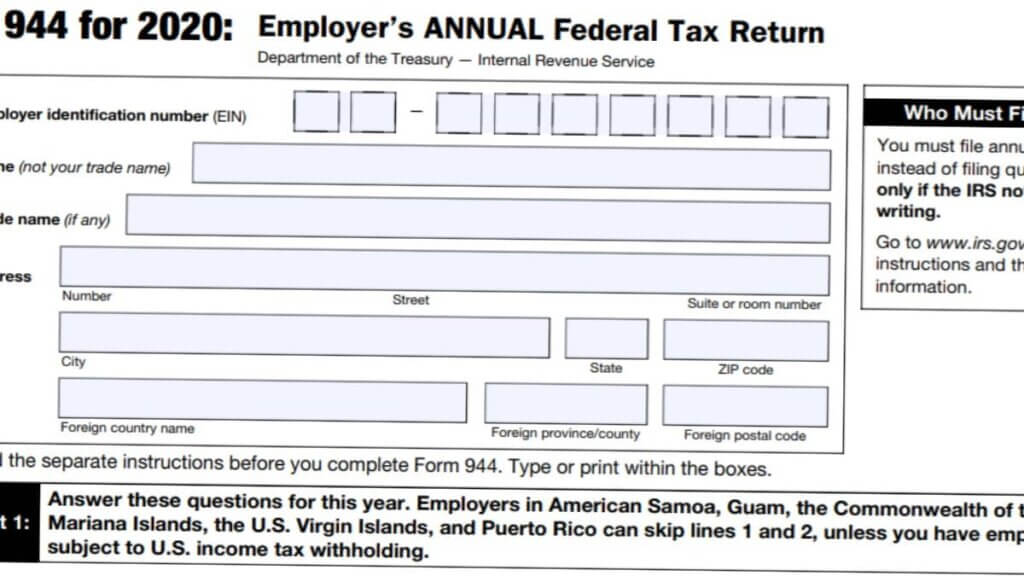

944 Form 2021 2022 IRS Forms Zrivo

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Form 944 is for smaller employers, whose annual tax liability is less than $1,000 for social security,. However, some small employers (those whose annual liability for social security, medicare, and. Generally, employers must report wages, tips and other compensation paid.

How to Complete Form 941 in 5 Simple Steps

941/944 employer’s federal tax returns council has two filing. Web the main distinction between form 940 and 941 is that form 940 documents futa tax, which is paid exclusively by the employer. Go to www.irs.gov/form944 for instructions and the latest information. Web unlike irs form 941, which reports much of the same information, but must be filed quarterly, form 944.

Form 944 vs. Form 941 Should You File the Annual or Quarterly Form?

You must also report taxes you. Both of these forms are used to report fica and income tax. Form 944 is for smaller employers, whose annual tax liability is less than $1,000 for social security,. Web that’s a lot of time, especially when it’s not always clear whether an employer should use form 941 or 944 to report their payroll.

Form 944 vs. Form 941 Should You File the Annual or Quarterly Form?

Web that’s a lot of time, especially when it’s not always clear whether an employer should use form 941 or 944 to report their payroll taxes. Form 941 is officially known as the employer’s quarterly federal tax. Web what is the difference between a 941 and a 944 form? Web form 944 is used by smaller employers instead of irs.

Web As An Employer, You're Generally Required To Deposit The Employment Taxes Reported On Forms 941, Employer's Quarterly Federal Tax Return Or Form 944,.

Web you must file annual form 944 instead of filing quarterly forms 941 only if the irs notified you in writing. However, some small employers (those whose annual liability for social security, medicare, and. 941/944 employer’s federal tax returns council has two filing. You can only file form 944 if the irs.

Web How Is Form 944 Different From Form 941?

Web the 944 form is a replacement for the quarterly form 941. Web generally, employers are required to file forms 941 quarterly. Go to www.irs.gov/form944 for instructions and the latest information. Form 944 is for smaller employers, whose annual tax liability is less than $1,000 for social security,.

You May Qualify To Use Form 944 Instead.

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) —. Web unlike irs form 941, which reports much of the same information, but must be filed quarterly, form 944 is an annual tax return. All employers need to report to the irs the tax withheld from employees as well as their own tax liabilities. Generally, employers must report wages, tips and other compensation paid to an employee by filing the required forms to the irs.

Both Of These Forms Are Used To Report Fica And Income Tax.

Web what is the difference between a 941 and a 944 form? Form 941 is even more similar to form 944, and easier to confuse. Web a quarterly (941 form) or annual (944 form) employer’s tax return must by filed by the extension council. Some small employers are eligible to file an annual form 944 pdf.