Form 940 Mailing Instructions

Form 940 Mailing Instructions - Web unlike your futa payments, which are due every calendar quarter, you must submit form 940 annually. Where you file depends on whether. Most forms and publications have a page on irs.gov: Here are the line by line instructions: If you file the return on paper, it must be sent to the address listed in the instructions on form 940. The form is required if you paid wages of $1,500 or more to. Connecticut, delaware, district of columbia, georgia, illinois, indiana,. Web “form 940” on the subject line. Web irs form 940 is relatively simple, but digging into the form 940 instructions can lead you down a complicated rabbit hole with many rules and calculations to manage. Employers must submit the form to the irs.

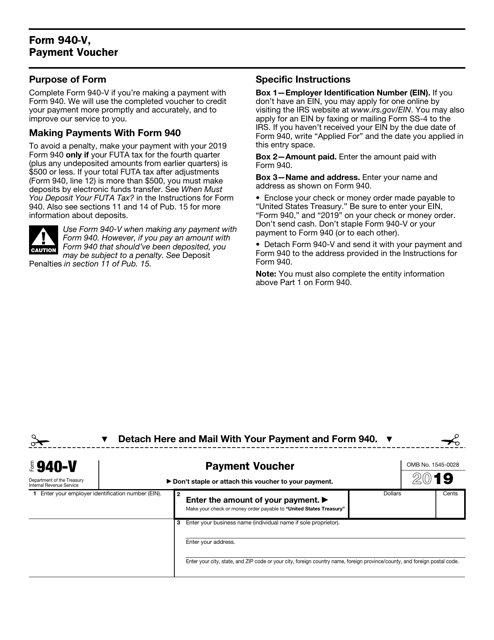

Web mailing addresses for forms 940. Web 940 mailing address. Web release of the form may show that less states are subject to credit reduction. Web “form 940” on the subject line. Connecticut, delaware, district of columbia, georgia,. Web if you’ll be mailing the complete form, the irs address you’ll use depends on where you’re located and whether you’re including a payment with your form along. Web up to $32 cash back instructions for completing form 940. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited. Web unlike your futa payments, which are due every calendar quarter, you must submit form 940 annually. Use form 940 to report your annual federal.

Web form 940 instructions. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited. Web unlike your futa payments, which are due every calendar quarter, you must submit form 940 annually. Web release of the form may show that less states are subject to credit reduction. Where you file depends on whether. Connecticut, delaware, district of columbia, georgia,. Web 22 rows addresses for forms beginning with the number 9. Web our platform proposes the utility to make the process of completing irs documents as simple as possible. Web mailing addresses for forms 941. Here are the line by line instructions:

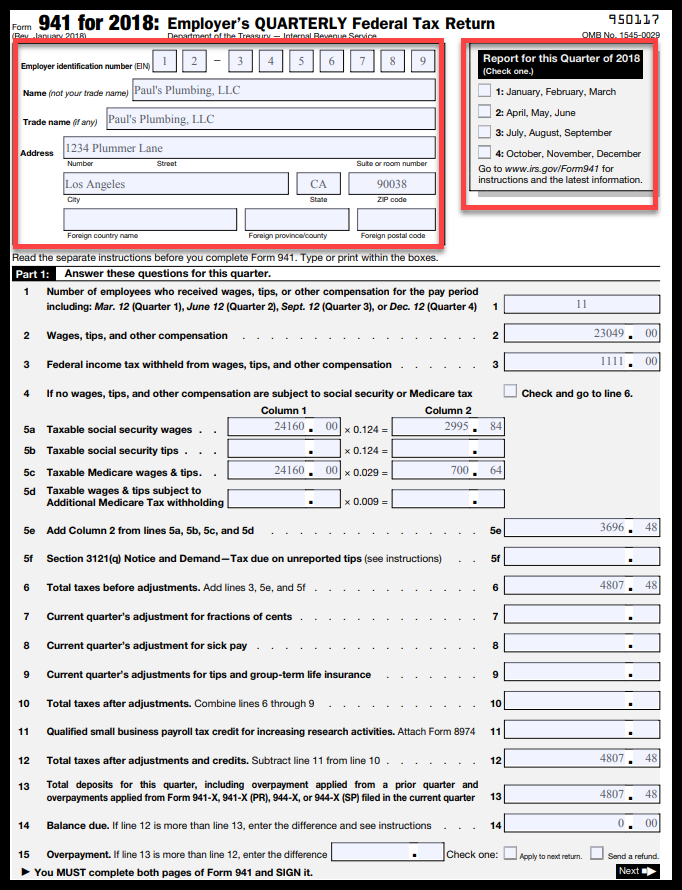

Example 13 Form Filled Out What I Wish Everyone Knew About Example 13

Most forms and publications have a page on irs.gov: Where to mail form 940 for 2022 & 2021 tax year? Irs form 940 reports your federal unemployment tax liabilities for all employees in one document. Here are the line by line instructions: Web line by line form 940 instructions for 2022 tax year.

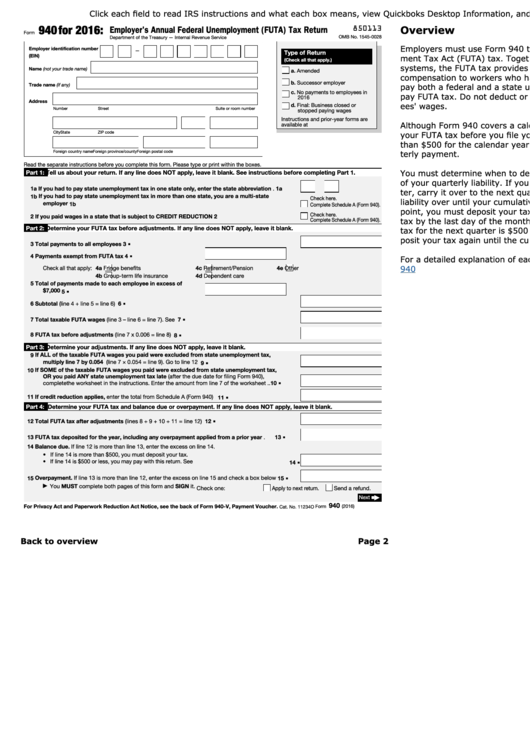

Fillable Form 940 Employer's Annual Federal Unemployment (futa) Tax

Most forms and publications have a page on irs.gov: If you file the return on paper, it must be sent to the address listed in the instructions on form 940. When filing paper copies, employers must mail form 940 to the irs. There are currently seven parts that need to be completed for a 940. Web “form 940” on the.

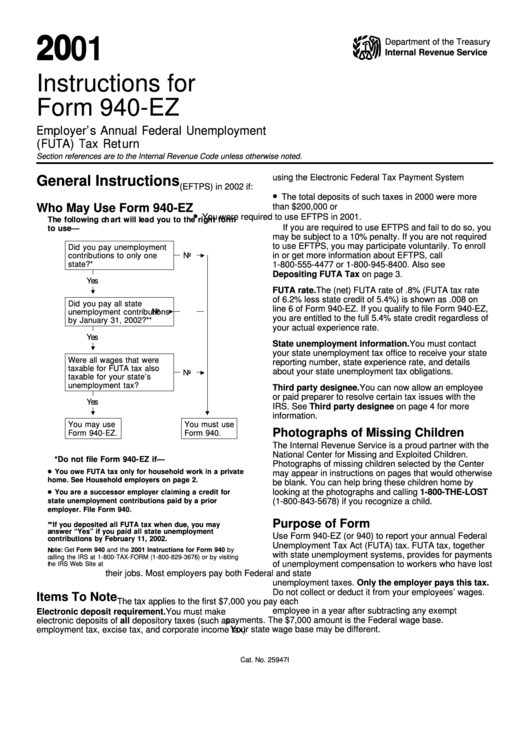

Instructions For Form 940Ez Employer'S Annual Federal Unemployment

Web our platform proposes the utility to make the process of completing irs documents as simple as possible. There are currently seven parts that need to be completed for a 940. Irs form 940 reports your federal unemployment tax liabilities for all employees in one document. Web release of the form may show that less states are subject to credit.

IRS Form 940V Download Fillable PDF or Fill Online Payment Voucher

( for a copy of a form, instruction, or publication) address to mail form to irs:. Web line by line form 940 instructions for 2022 tax year. Web irs form 940 reports an employer’s unemployment tax payments and calculations to the irs. Web irs form 940 is relatively simple, but digging into the form 940 instructions can lead you down.

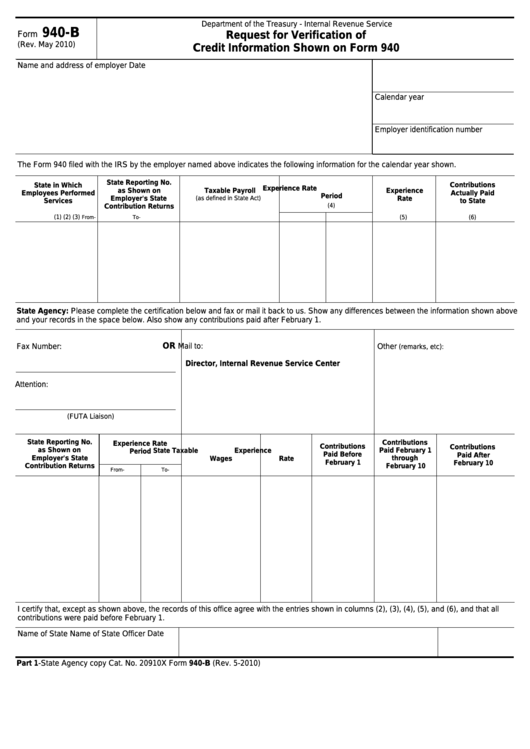

Fillable Form 940B Request For Verification Of Credit Information

Follow these guidelines to quickly and properly submit irs. Most forms and publications have a page on irs.gov: Web irs form 940 reports an employer’s unemployment tax payments and calculations to the irs. Connecticut, delaware, district of columbia, georgia,. Web up to $32 cash back instructions for completing form 940.

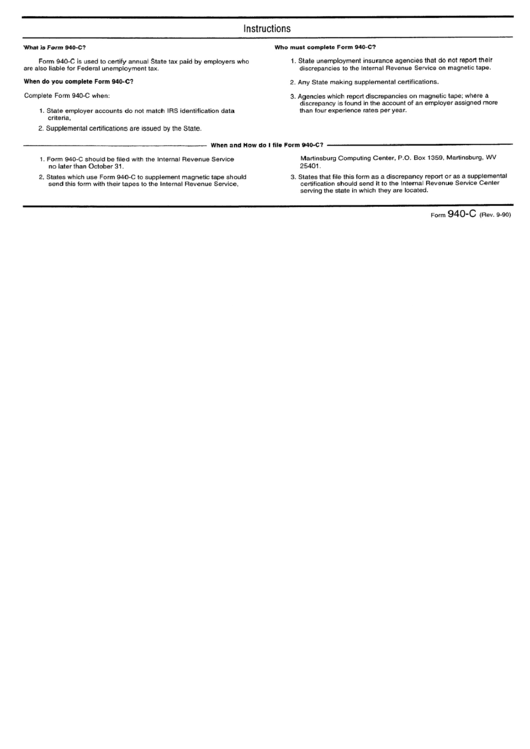

Top Form 940c Templates free to download in PDF format

The form is required if you paid wages of $1,500 or more to. Follow these guidelines to quickly and properly submit irs. Web our platform proposes the utility to make the process of completing irs documents as simple as possible. Web up to $32 cash back instructions for completing form 940. Employers must submit the form to the irs.

Payroll Tax Forms and Reports in ezPaycheck Software

My qb desktop instructions page for filing the 940 return says the address for mailing the form is department of the treasury, internal. Where to mail form 940 for 2022 & 2021 tax year? Web line by line form 940 instructions for 2022 tax year. Web irs form 940 is relatively simple, but digging into the form 940 instructions can.

2012 Form 940 Instructions Updated Releases New

Web our platform proposes the utility to make the process of completing irs documents as simple as possible. My qb desktop instructions page for filing the 940 return says the address for mailing the form is department of the treasury, internal. Web irs form 940 reports an employer’s unemployment tax payments and calculations to the irs. Connecticut, delaware, district of.

2018 Form IRS 940 Fill Online, Printable, Fillable, Blank PDFfiller

Connecticut, delaware, district of columbia, georgia,. Here are the line by line instructions: Web “form 940” on the subject line. Web irs form 940 is relatively simple, but digging into the form 940 instructions can lead you down a complicated rabbit hole with many rules and calculations to manage. Web making payments with form 940 to avoid a penalty, make.

Barbara Johnson Blog Form 940 Instructions How to Fill It Out and Who

Web form 940 is filed with the irs. Use form 940 to report your annual federal. Where to mail form 940 for 2022 & 2021 tax year? Connecticut, delaware, district of columbia, georgia,. Web line by line form 940 instructions for 2022 tax year.

Connecticut, Delaware, District Of Columbia, Georgia,.

Web if you’ll be mailing the complete form, the irs address you’ll use depends on where you’re located and whether you’re including a payment with your form along. Where to mail form 940 for 2022 & 2021 tax year? When filing paper copies, employers must mail form 940 to the irs. My qb desktop instructions page for filing the 940 return says the address for mailing the form is department of the treasury, internal.

Form 940Is An Irs Tax Form That Is Used To.

Here are the line by line instructions: Web up to $32 cash back instructions for completing form 940. The address is based on the location. Irs form 940 reports your federal unemployment tax liabilities for all employees in one document.

There Are Currently Seven Parts That Need To Be Completed For A 940.

Employers must submit the form to the irs. Web mailing addresses for forms 941. Web mailing addresses for forms 940. Follow these guidelines to quickly and properly submit irs.

Web Line By Line Form 940 Instructions For 2022 Tax Year.

Web 22 rows addresses for forms beginning with the number 9. If you file the return on paper, it must be sent to the address listed in the instructions on form 940. Web “form 940” on the subject line. The form is required if you paid wages of $1,500 or more to.