Form 8992 Schedule A

Form 8992 Schedule A - Web use form 8992 to compute the u.s. January 2020) department of the treasury internal revenue service. Web schedule b (form 8992) (rev. Shareholder is not a member of a u.s. Web schedule a (form 8992) (rev. Web notably, when computing form 8992, schedule a, if a cfc is owned by two or more members of the consolidated group, each ownership interest should be reported on separate lines. December 2022) department of the treasury internal revenue service. For instructions and the latest information. Web form 8992 and include in schedule a its tested income cfcs as well as any cfc from which it is allocated a portion of the consolidated tested loss, consolidated qbai, or consolidated specified interest expense. Consolidated group, use schedule a (form 8992), to determine the amounts to enter on form 8992, part l.

Form 8892 consists of parts i and ii. For instructions and the latest information. Web schedule a (form 8992) (rev. Web attach form 8992 and schedule a to your income tax return (including, if applicable, partnership or exempt organization return) and file both by the due date (including extensions) for that return. Name of person filing this return. Name of person filing this return. When and where to file attach form 8992 and schedule a to your income tax return (including, if applicable, Web use form 8992 to compute the u.s. Web schedule b (form 8992) (rev. Consolidated group who are u.s.

Consolidated group who are u.s. For instructions and the latest information. Complete form 8992 as follows. Web attach form 8992 and schedule a to your income tax return (including, if applicable, partnership or exempt organization return) and file both by the due date (including extensions) for that return. Web schedule b (form 8992) (rev. Web form 8992 and include in schedule a its tested income cfcs as well as any cfc from which it is allocated a portion of the consolidated tested loss, consolidated qbai, or consolidated specified interest expense. Web schedule a (form 8992) (rev. For instructions and the latest information. Form 8892 consists of parts i and ii. Shareholder is not a member of a u.s.

2011 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 8992 and include in schedule a its tested income cfcs as well as any cfc from which it is allocated a portion of the consolidated tested loss, consolidated qbai, or consolidated specified interest expense. December 2022) department of the treasury internal revenue service. Shareholder that owns, within the meaning of section 958 (a), stock in one or more.

Form 12 Pdf 12 Secrets About Form 12 Pdf That Has Never Been Revealed

January 2020) department of the treasury internal revenue service. Web attach form 8992 and schedule a to your income tax return (including, if applicable, partnership or exempt organization return) and file both by the due date (including extensions) for that return. Web schedule b (form 8992) (rev. Shareholder that owns, within the meaning of section 958 (a), stock in one.

Contact Us — Signature Builders Group Luxury New Home Builders in

Complete form 8992 as follows. December 2022) department of the treasury internal revenue service. When and where to file attach form 8992 and schedule a to your income tax return (including, if applicable, January 2020) department of the treasury internal revenue service. Web schedule a (form 8992) (rev.

Form 12 Schedule A Instructions Five Brilliant Ways To Advertise Form

Name of person filing this return. December 2022) department of the treasury internal revenue service. Web notably, when computing form 8992, schedule a, if a cfc is owned by two or more members of the consolidated group, each ownership interest should be reported on separate lines. Web schedule a (form 8992) (rev. When and where to file attach form 8992.

IRS Form 8992 San Francisco Tax Attorney SF Tax Counsel

Complete form 8992 as follows. Name of person filing this return. Web schedule a (form 8992) (rev. Consolidated group who are u.s. For instructions and the latest information.

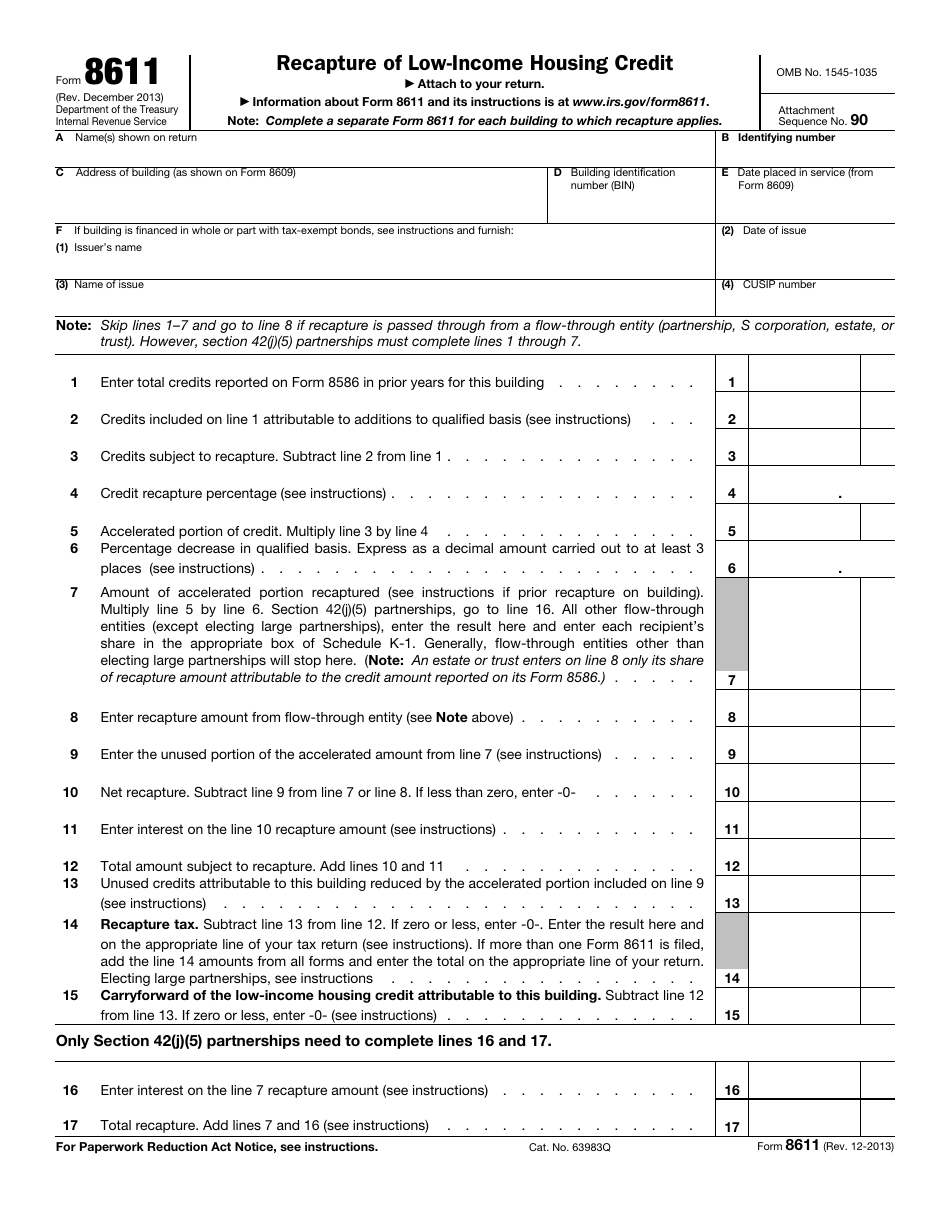

IRS Form 8611 Download Fillable PDF or Fill Online Recapture of Low

Shareholder is not a member of a u.s. Web attach form 8992 and schedule a to your income tax return (including, if applicable, partnership or exempt organization return) and file both by the due date (including extensions) for that return. Web schedule b (form 8992) (rev. Form 8892 consists of parts i and ii. Name of person filing this return.

Form 12 Schedule A Instructions Five Brilliant Ways To Advertise Form

Web use form 8992 to compute the u.s. Shareholder is not a member of a u.s. Web notably, when computing form 8992, schedule a, if a cfc is owned by two or more members of the consolidated group, each ownership interest should be reported on separate lines. Web schedule b (form 8992) (rev. When and where to file attach form.

Form 16 Tested 16 Doubts You Should Clarify About Form 16 Tested

For instructions and the latest information. Complete form 8992 as follows. For instructions and the latest information. Consolidated group, use schedule a (form 8992), to determine the amounts to enter on form 8992, part l. Name of person filing this return.

Form 8992 Fill Out and Sign Printable PDF Template signNow

December 2022) department of the treasury internal revenue service. Form 8892 consists of parts i and ii. For instructions and the latest information. Web form 8992 and include in schedule a its tested income cfcs as well as any cfc from which it is allocated a portion of the consolidated tested loss, consolidated qbai, or consolidated specified interest expense. When.

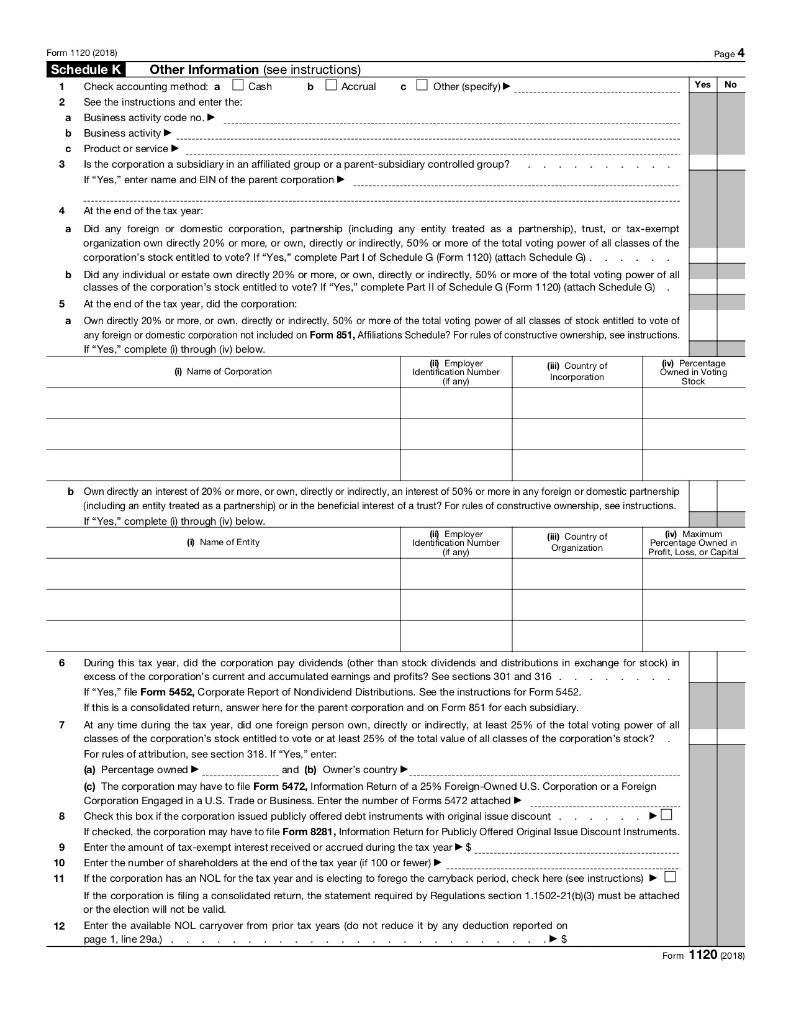

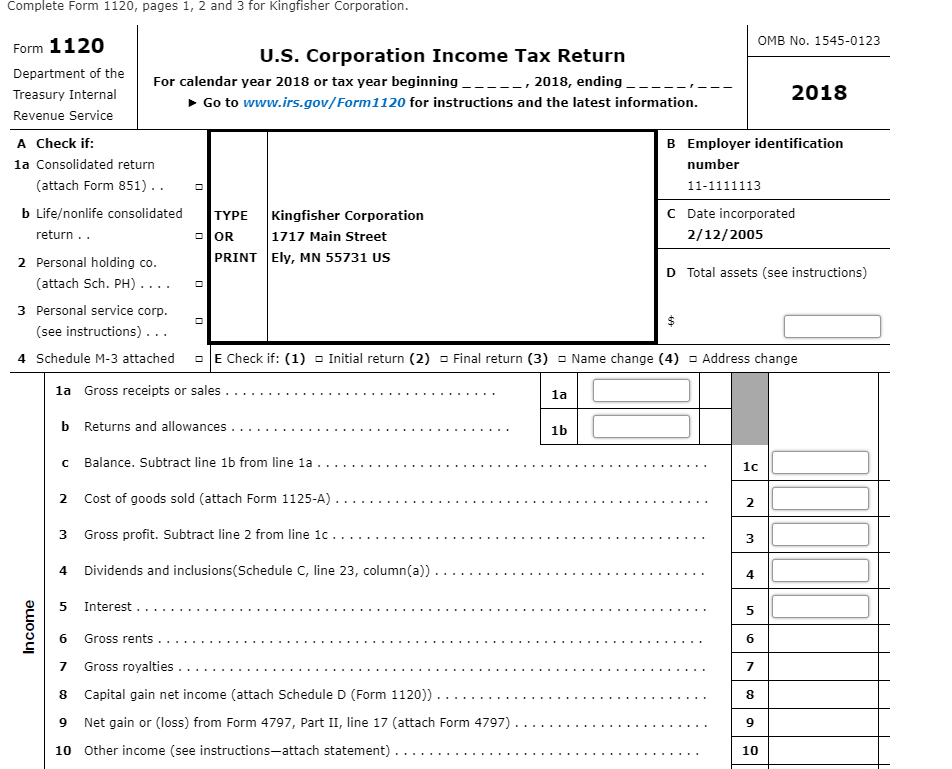

C16 Appendix C CORPORATE TAX RETURN PROBLEM 2

Shareholder is not a member of a u.s. For instructions and the latest information. January 2020) department of the treasury internal revenue service. Web schedule b (form 8992) (rev. When and where to file attach form 8992 and schedule a to your income tax return (including, if applicable,

Complete Form 8992 As Follows.

Name of person filing this return. December 2022) department of the treasury internal revenue service. For instructions and the latest information. Web form 8992 and include in schedule a its tested income cfcs as well as any cfc from which it is allocated a portion of the consolidated tested loss, consolidated qbai, or consolidated specified interest expense.

December 2022) Department Of The Treasury Internal Revenue Service.

Consolidated group, use schedule a (form 8992), to determine the amounts to enter on form 8992, part l. Consolidated group who are u.s. When and where to file attach form 8992 and schedule a to your income tax return (including, if applicable, Shareholder is not a member of a u.s.

January 2020) Department Of The Treasury Internal Revenue Service.

Web notably, when computing form 8992, schedule a, if a cfc is owned by two or more members of the consolidated group, each ownership interest should be reported on separate lines. Web schedule b (form 8992) (rev. Form 8892 consists of parts i and ii. For instructions and the latest information.

Web Use Form 8992 To Compute The U.s.

December 2022) department of the treasury internal revenue service. For instructions and the latest information. Name of person filing this return. Shareholder that owns, within the meaning of section 958 (a), stock in one or more cfcs must attach a form 8892 to a form 5471.