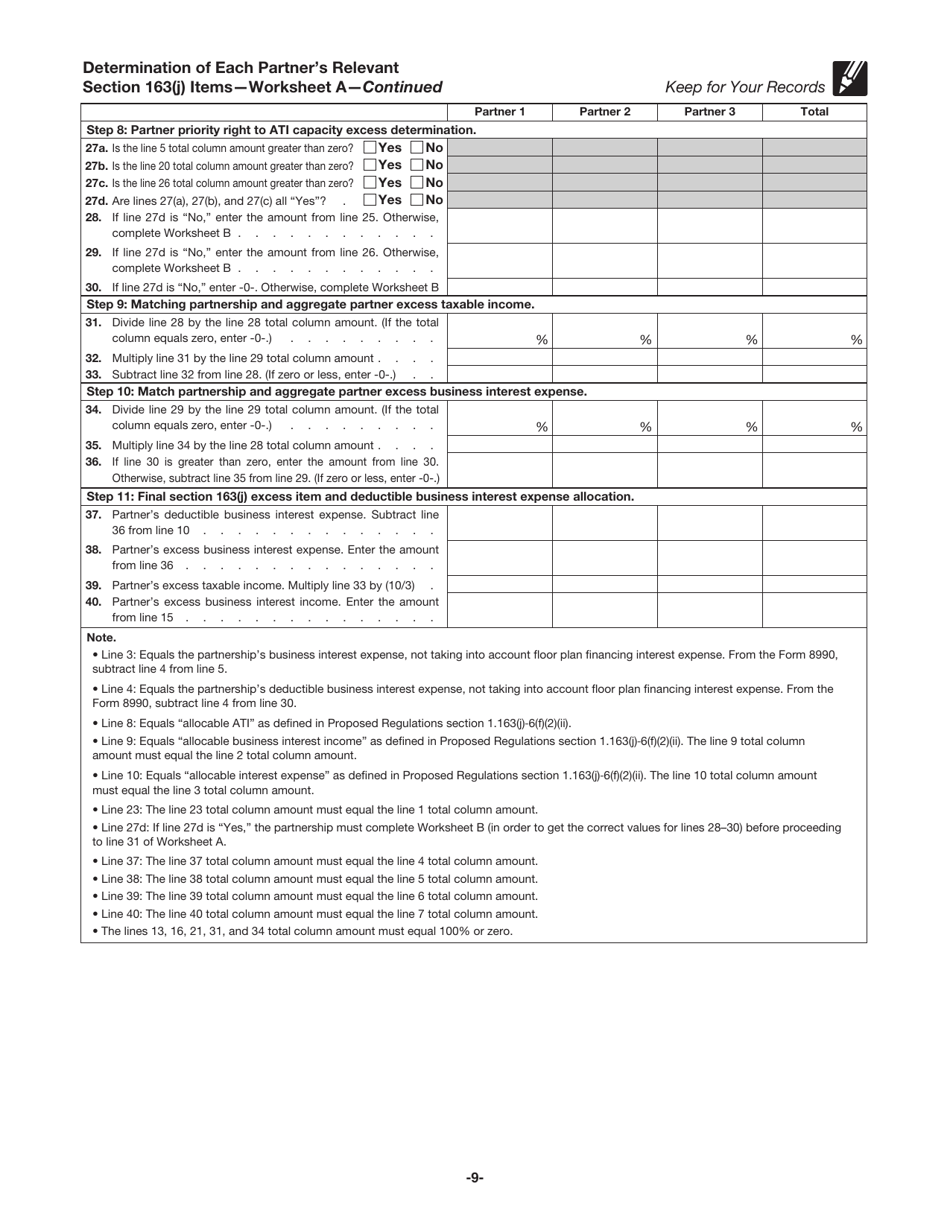

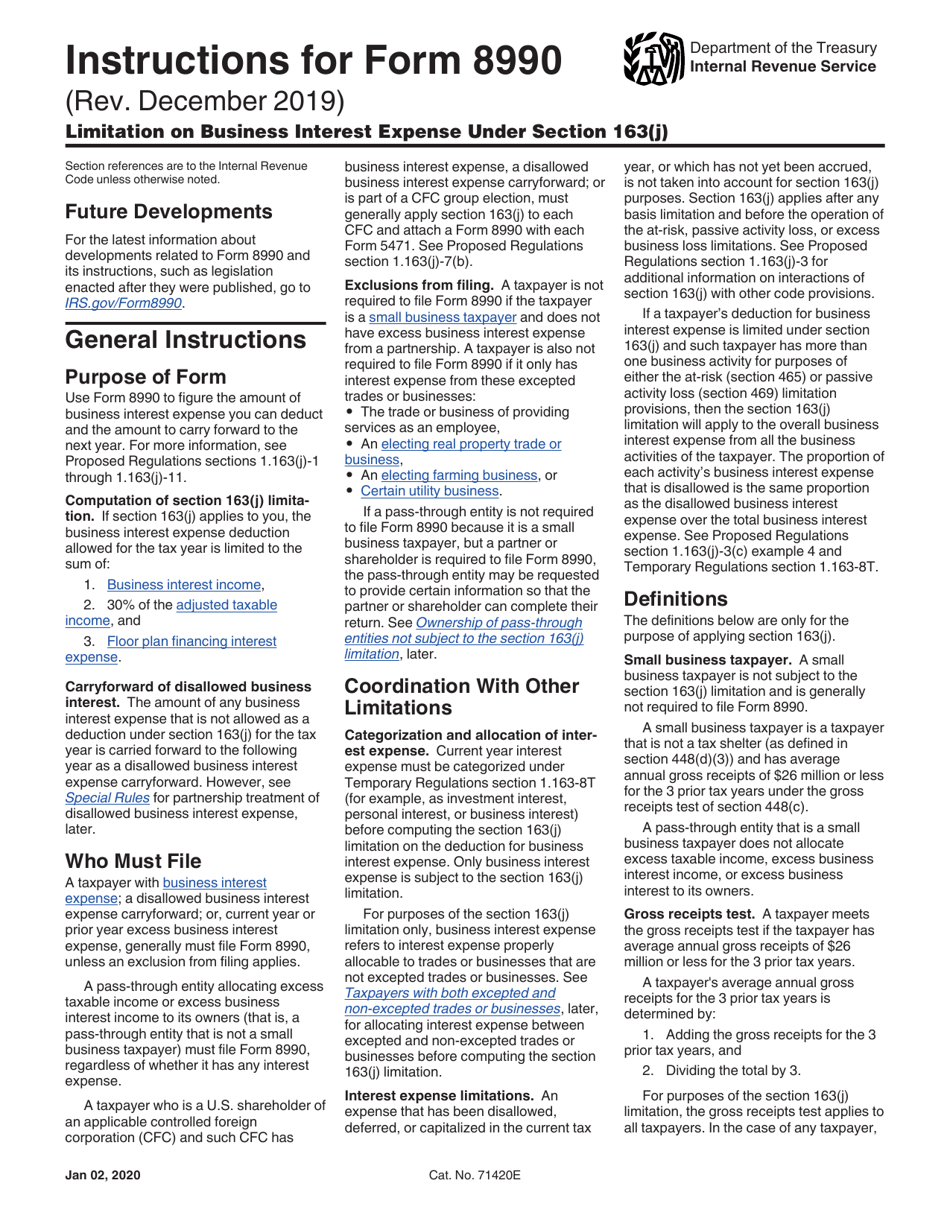

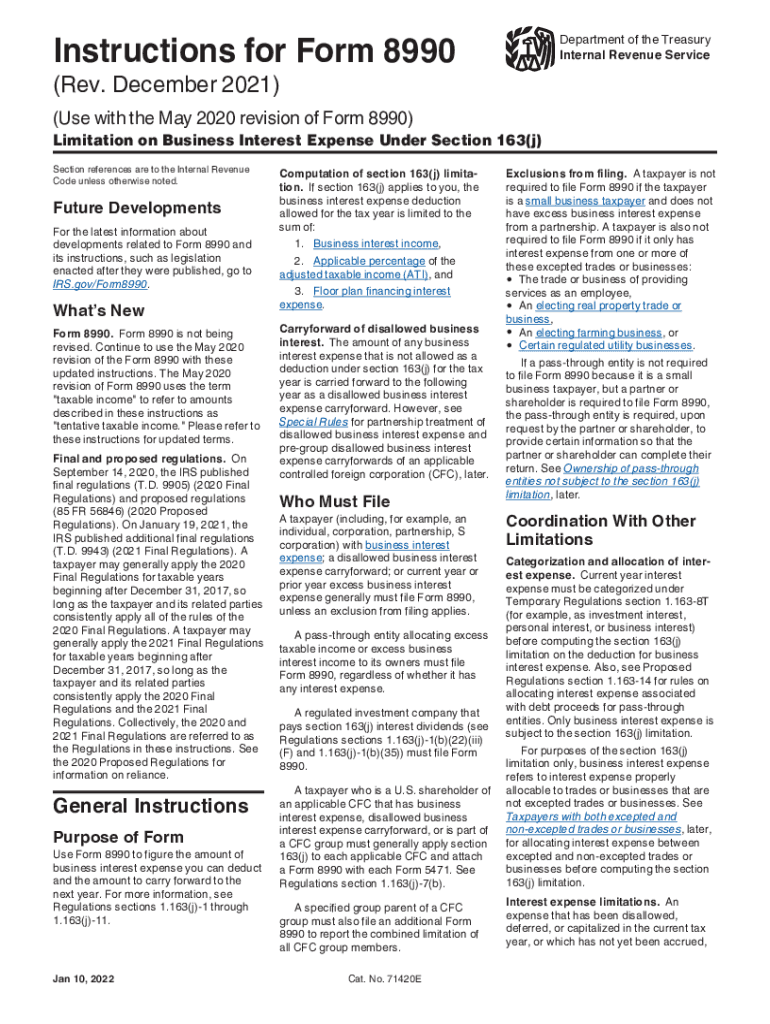

Form 8990 For 2022

Form 8990 For 2022 - Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest limitation requirements outlined in. Rental real estate income and expenses. Web learn & support community hosting for lacerte & proseries how to generate form 8990 this article will help you enter information for form 8990 limitation on. Web form 8990 for dummies community discussions taxes get your taxes done wstewart level 2 form 8990 for dummies looking for help from some of the more. Web form 8990 (draft rev. Web the business interest limitation returned with a vengeance in 2022: 163 (j) had rules in place intended to prevent multinational entities from using. Us shareholder calculation of global intangible low. Web note if 13k is zero you do not file form 8990. Web first, some background may be helpful.

2022), limitation on business interest expense under section 163(j), has been revised to include new informational questions geared. Section i—business interest expense section ii—adjusted taxable income section iii—business interest income section. Web learn & support community hosting for lacerte & proseries how to generate form 8990 this article will help you enter information for form 8990 limitation on. Choosing a legal expert, creating an appointment and coming to the business office for a personal meeting makes completing a irs 8990 from. Web 2022 990 forms and schedules form 8990: Save or instantly send your ready documents. Web if form 8990 relates to an information return for a foreign entity (for example, form 5471), enter: Web august 4, 2022 draft as of form 8990 (rev. Rental real estate income and expenses. Limitation on business interest expense under section 163(j) form 8992:

163 (j) had rules in place intended to prevent multinational entities from using. No formal statement is required to make this election. Section i—business interest expense section ii—adjusted taxable income section iii—business interest income section. Us shareholder calculation of global intangible low. Prior to the passage of the tcja, sec. Save or instantly send your ready documents. Web 2022 990 forms and schedules form 8990: Web follow the simple instructions below: Web the business interest limitation returned with a vengeance in 2022: Web form 8990 (draft rev.

Download Instructions for IRS Form 8990 Limitation on Business Interest

Web 2022 990 forms and schedules form 8990: Employer identification number, if any. Web if form 8990 relates to an information return for a foreign entity (for example, form 5471), enter: If the partnership reports excess business. Web form 8990 (draft rev.

Download Instructions for IRS Form 8990 Limitation on Business Interest

Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest limitation requirements outlined in. Web 2022 990 forms and schedules form 8990: 2022), limitation on business interest expense under section 163(j), has been revised to include new informational questions geared. Web information about form 8990, limitation on business interest expense under.

調理器具収納/家電収納スペース/ストック収納/収納スペース/伸縮レンジボード...などのインテリア実例 20220914 1600

Web the business interest limitation returned with a vengeance in 2022: Choosing a legal expert, creating an appointment and coming to the business office for a personal meeting makes completing a irs 8990 from. Web kelvin richards contents how to fill out form 8990? 163 (j) had rules in place intended to prevent multinational entities from using. Save or instantly.

IRS Form 8990 walkthrough (Limitation on Business Interest Expenses

Web learn & support community hosting for lacerte & proseries how to generate form 8990 this article will help you enter information for form 8990 limitation on. Us shareholder calculation of global intangible low. 2022), limitation on business interest expense under section 163(j), has been revised to include new informational questions geared. If the partnership reports excess business. Web first,.

what is form 8990 Fill Online, Printable, Fillable Blank form8453

Us shareholder calculation of global intangible low. Save or instantly send your ready documents. Web if form 8990 relates to an information return for a foreign entity (for example, form 5471), enter: Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest limitation requirements outlined in. No formal statement is required.

8990 Fill out & sign online DocHub

Web follow the simple instructions below: Employer identification number, if any. Us shareholder calculation of global intangible low. Web the business interest limitation returned with a vengeance in 2022: Rental real estate income and expenses.

Section 163j Photos Free & RoyaltyFree Stock Photos from Dreamstime

December 2022) limitation on business interest expense under section 163(j) department of the treasury internal revenue. Web if this election is made, complete line 22, adjusted taxable income, on form 8990 and leave lines 6 through 21 blank. Web learn & support community hosting for lacerte & proseries how to generate form 8990 this article will help you enter information.

1040NJ Data entry guidelines for a New Jersey partnership K1

163 (j) had rules in place intended to prevent multinational entities from using. Easily fill out pdf blank, edit, and sign them. Web kelvin richards contents how to fill out form 8990? Web note if 13k is zero you do not file form 8990. Limitation on business interest expense under section 163(j) form 8992:

Instructions for Form 8990 (12/2021) Internal Revenue Service

Web follow the simple instructions below: Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest limitation requirements outlined in. Web learn & support community hosting for lacerte & proseries how to generate form 8990 this article will help you enter information for form 8990 limitation on. Web kelvin richards contents.

Irs Instructions 8990 Fill Out and Sign Printable PDF Template signNow

Web form 8990 for dummies community discussions taxes get your taxes done wstewart level 2 form 8990 for dummies looking for help from some of the more. Web if this election is made, complete line 22, adjusted taxable income, on form 8990 and leave lines 6 through 21 blank. Web form 8990 (draft rev. Limitation on business interest expense under.

Web August 4, 2022 Draft As Of Form 8990 (Rev.

Web if this election is made, complete line 22, adjusted taxable income, on form 8990 and leave lines 6 through 21 blank. Choosing a legal expert, creating an appointment and coming to the business office for a personal meeting makes completing a irs 8990 from. Save or instantly send your ready documents. Web form 8990 for dummies community discussions taxes get your taxes done wstewart level 2 form 8990 for dummies looking for help from some of the more.

Web Follow The Simple Instructions Below:

Web taxpayers must calculate their business interest expense deductions on irs form 8990 to comply with the business interest limitation requirements outlined in. Web note if 13k is zero you do not file form 8990. Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. Limitation on business interest expense under section 163(j) form 8992:

Web Form 8990 (Draft Rev.

163 (j) had rules in place intended to prevent multinational entities from using. Web kelvin richards contents how to fill out form 8990? Web 2022 990 forms and schedules form 8990: Employer identification number, if any.

Web The Business Interest Limitation Returned With A Vengeance In 2022:

Easily fill out pdf blank, edit, and sign them. The limitation is back to 30% of ati — and depreciation, amortization, and depletion are no. 2022), limitation on business interest expense under section 163(j), has been revised to include new informational questions geared. December 2022) limitation on business interest expense under section 163(j) department of the treasury internal revenue.