Form 8958 Instructions Example

Form 8958 Instructions Example - Web community discussions taxes deductions & credits skyecanyongator level 1 how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web show sources > form 8958 is a federal corporate income tax form. Web follow our simple steps to have your form 8958 examples prepared quickly: Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. Social security benefits, unemployment compensation, deductions,. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web common questions about entering form 8958 income for community property allocation in lacerte. Money earned while domiciled in a noncommunity property state is separate income; Web information about form 8958, allocation of tax amounts between certain individuals in community property states, including recent updates, related forms and. You will be required to claim half of the total.

Property that was owned separately before marriage is considered separate. Social security benefits, unemployment compensation, deductions,. Web forms and instructions about publication 555, community property about publication 555, community property publication 555 discusses community property. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web reduces form instructions from 15 pages to 8 pages; Select the document you want to sign and click upload. Make any adjustments in the split returns. You will be required to claim half of the total. Web follow our simple steps to have your form 8958 examples prepared quickly: Web complete income allocation open screen 8958 in each split return and indicate how the income is allocated.

States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar. Money earned while domiciled in a noncommunity property state is separate income; Enter all required information in the required fillable areas. Make any adjustments in the split returns. Select the document you want to sign and click upload. Web common questions about entering form 8958 income for community property allocation in lacerte. Web show sources > form 8958 is a federal corporate income tax form. Web reduces form instructions from 15 pages to 8 pages; Income allocation information is required when electronically filing a return with. Pick the web sample in the catalogue.

SelfEmployed Borrower Case Study Part I Completing the Form 91 wit…

Enter all required information in the required fillable areas. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar. Web complete income allocation open screen 8958 in each split return and indicate how the income is allocated. Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have.

SelfEmployed Borrower Case Study Part II Completing the Form 91 wi…

Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar. Web if your resident state is a community property state, and you file a federal tax return separately from your.

수질배출부과금징수유예 및 분납신청 샘플, 양식 다운로드

Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Property that was owned separately before marriage is considered separate. Web reduces form instructions from 15 pages to 8 pages; Web follow our simple steps to have your form.

Form 8958 Fill Out and Sign Printable PDF Template signNow

Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. Make any adjustments in the split returns. Social security benefits, unemployment compensation, deductions,. Web forms and instructions about publication 555, community property about publication 555, community property publication 555 discusses community property. Select the.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web for paperwork reduction act notice, see your tax return instructions. Enter all required information in the required fillable areas. Web reduces form instructions from 15 pages to 8 pages; Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Make any adjustments in the split returns.

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar. Web complete income allocation open screen 8958 in each split return and indicate how the income is allocated. Web reduces form instructions from 15 pages to 8 pages; Make any adjustments in the split returns. Pick the web sample in the catalogue.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web common questions about entering form 8958 income for community property allocation in lacerte. Make any adjustments in the split returns. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web follow our simple steps to have your form 8958 examples prepared quickly: Enter all required.

Alcoholics Anonymous 12 Step Worksheets Universal Network

Web community discussions taxes deductions & credits skyecanyongator level 1 how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Make any.

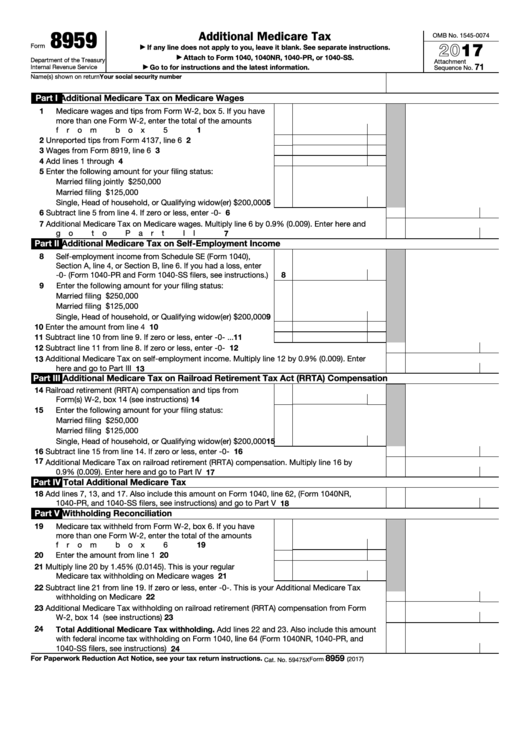

Top 9 Form 8959 Templates free to download in PDF format

Web for paperwork reduction act notice, see your tax return instructions. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Money earned while domiciled in a noncommunity property state is separate income; Social security benefits, unemployment compensation, deductions,. Web form 8958 allocation of tax amounts between.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. Enter all required information in the required fillable areas. Income allocation information is required when electronically filing a return with. Property that was owned separately before marriage is considered separate. You will be required.

Web Reduces Form Instructions From 15 Pages To 8 Pages;

Web common questions about entering form 8958 income for community property allocation in lacerte. Web complete income allocation open screen 8958 in each split return and indicate how the income is allocated. Enter all required information in the required fillable areas. Web for paperwork reduction act notice, see your tax return instructions.

Web Forms And Instructions About Publication 555, Community Property About Publication 555, Community Property Publication 555 Discusses Community Property.

Make any adjustments in the split returns. Income allocation information is required when electronically filing a return with. Pick the web sample in the catalogue. Select the document you want to sign and click upload.

Web Follow Our Simple Steps To Have Your Form 8958 Examples Prepared Quickly:

Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Property that was owned separately before marriage is considered separate. Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses will be. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar.

Social Security Benefits, Unemployment Compensation, Deductions,.

Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. You will be required to claim half of the total. Web community discussions taxes deductions & credits skyecanyongator level 1 how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web show sources > form 8958 is a federal corporate income tax form.