Form 8949 Exception To Reporting

Form 8949 Exception To Reporting - In the send pdf attachment with federal return. Go to edit > electronic filing attachments. Web select form 8949 exception reporting statement. Web make sure it's ok to bypass form 8949. Web schedule d, line 1a; When i requested a csv file, i see just little less than 2000 lines. Web no, a taxpayer with capital gains or losses to report must file both form 8949 and schedule d. Check box a, b, or. You may be able to. Once you have attached the pdf documents and linked to form 8949 exception reporting.

Web see exception 1 under the instructions for line 1. Check box a, b, or. In field product select federal. Rather than using the actual form 8949, exception 2 of the irs instructions for form 8949 allows taxpayers to attach a. In field return select tax return. Covered activities (showing basis on the 1099b) only need to be reported in total and not broken. When i requested a csv file, i see just little less than 2000 lines. Once you have attached the pdf documents and linked to form 8949 exception reporting. Web no, a taxpayer with capital gains or losses to report must file both form 8949 and schedule d. Web to attach the statement for form 8949 do the following:

In the return field, select tax return, if not already entered. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Web no, a taxpayer with capital gains or losses to report must file both form 8949 and schedule d. Web to attach the statement for form 8949 do the following: Check box a, b, or. Web in the link to form (defaults to main form) field, click on sch d/form 8949. Go to edit > electronic filing attachments. Covered activities (showing basis on the 1099b) only need to be reported in total and not broken. When i requested a csv file, i see just little less than 2000 lines. Check box (a), (b) or (c) to indicate if basis was.

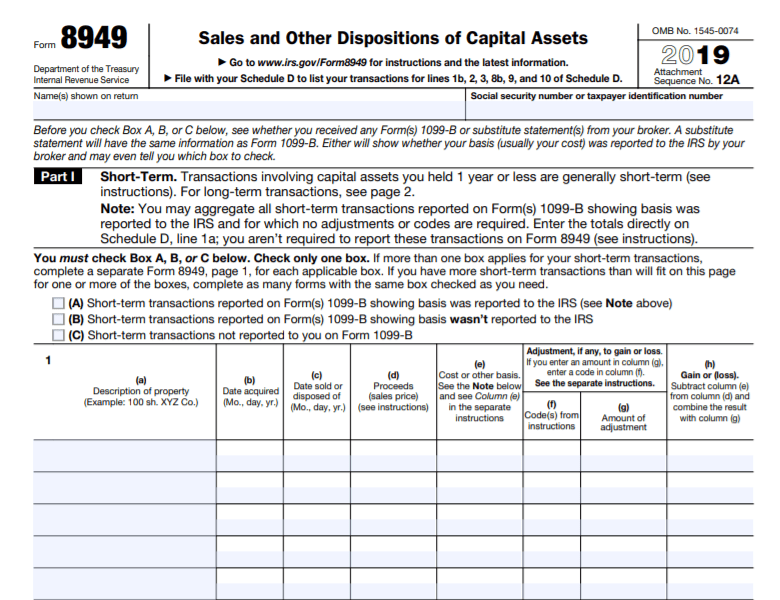

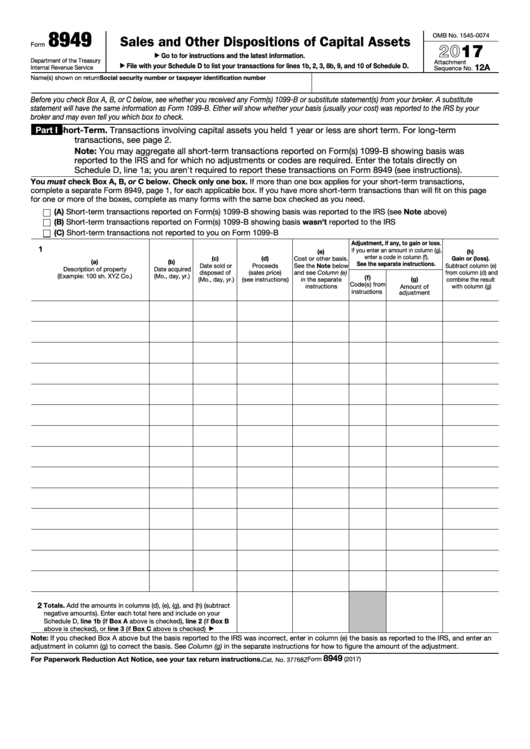

Online IRS Instructions 8949 2018 2019 Fillable and Editable PDF

Web form 8949 exception 1 below is an excerpt from the irs instructions (emphasis and bullets added). Form 8949 is not required for certain transactions. In field return select tax return. Form 8949 is a list of every transaction, including its cost basis,. Web to attach the statement for form 8949 do the following:

Form 8949 Instructions & Information on Capital Gains/Losses Form

Go to edit > electronic filing attachments. Check box (a), (b) or (c) to indicate if basis was. Web to attach the statement for form 8949 do the following: In field product select federal. The sale or exchange of a capital asset not reported on another form or schedule, gains from involuntary conversions (other than from.

2016 Form 8949 Fill Online, Printable, Fillable, Blank pdfFiller

Web no, a taxpayer with capital gains or losses to report must file both form 8949 and schedule d. You may be able to. Go to edit > electronic filing attachments. Web see exception 1 under the instructions for line 1. Form 8949 exception reporting statement.

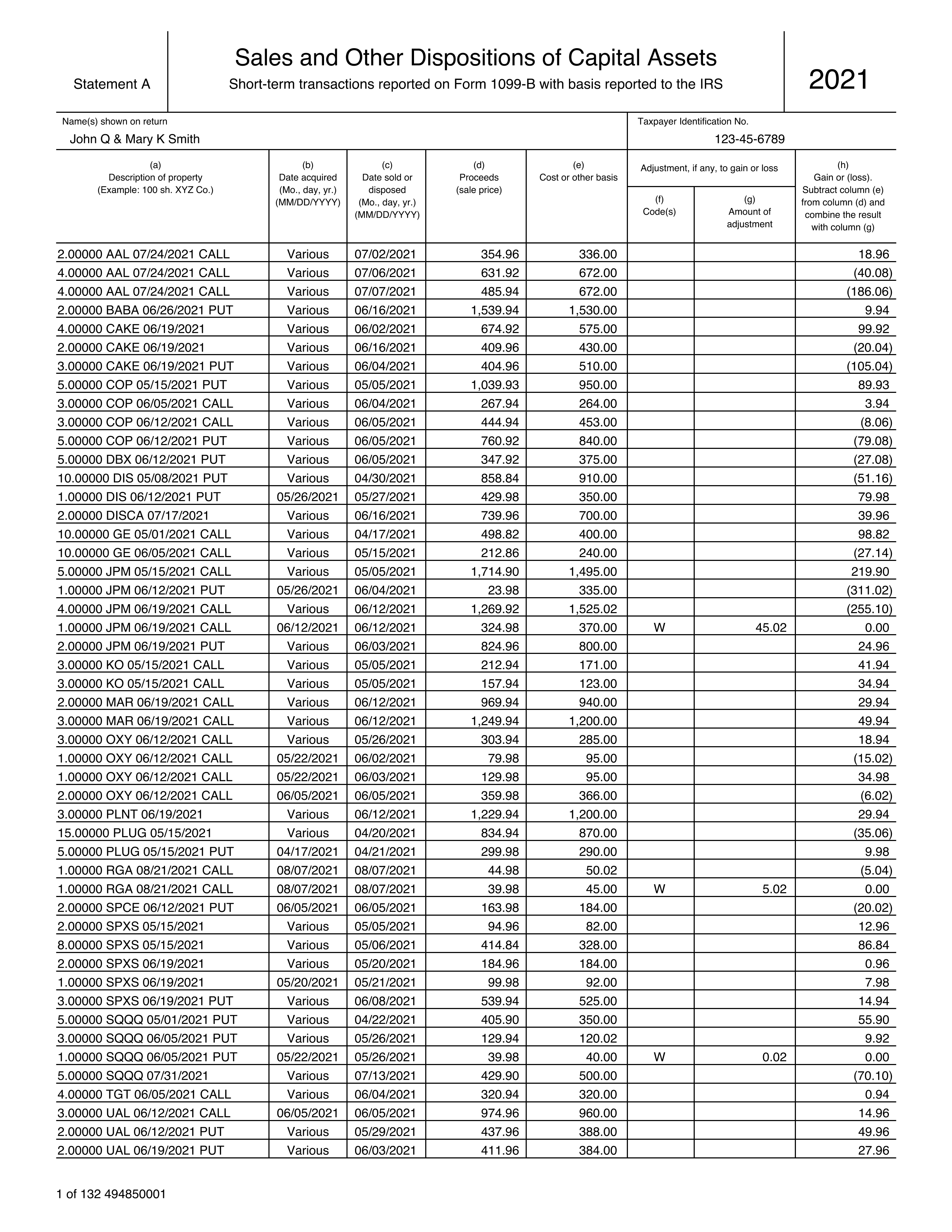

In the following Form 8949 example,the highlighted section below shows

In field product select federal. Form 8949 is not required for certain transactions. In field return select tax return. Rather than using the actual form 8949, exception 2 of the irs instructions for form 8949 allows taxpayers to attach a. Web see exception 1 under the instructions for line 1.

What is the IRS Form 8949 and Do You Need It? The Handy Tax Guy

Form 8949 is a list of every transaction, including its cost basis,. Web to attach the statement for form 8949 do the following: When i requested a csv file, i see just little less than 2000 lines. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h.

Form 8949 Sales and Other Dispositions of Capital Assets (2014) Free

Form 8949 exception reporting statement. Once you have attached the pdf documents and linked to form 8949 exception reporting. In the send pdf attachment with federal return. You aren’t required to report these transactions on form 8949 (see instructions). You may be able to.

File IRS Form 8949 to Report Your Capital Gains or Losses

Web to attach the statement for form 8949 do the following: Form 8949 isn't required for certain transactions. When i requested a csv file, i see just little less than 2000 lines. You aren’t required to report these transactions on form 8949 (see instructions). Web in the link to form (defaults to main form) field, click on sch d/form 8949.

Form 8949 and Sch. D diagrams How are capital gains taxed when I sell

Web see exception 1 under the instructions for line 1. Once you have attached the pdf documents and linked to form 8949 exception reporting. Web 2 i have been trading in 2017 on robinhood. Web per the irs, you'll use form 8949 to report the following: Web individuals use form 8949 to report:

Fillable Form 8949 Sales And Other Dispositions Of Capital Assets

Web per the irs, you'll use form 8949 to report the following: Web form 8949 exception 1 below is an excerpt from the irs instructions (emphasis and bullets added). Web see exception 1 under the instructions for line 1. Web click the add button. Go to edit > electronic filing attachments.

Form 8949 Exception 2 When Electronically Filing Form 1040

Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Web in the link to form (defaults to main form) field, click on sch d/form 8949. In the send pdf attachment with federal return. Web to attach the statement.

Web In The Link To Form (Defaults To Main Form) Field, Click On Sch D/Form 8949.

Web form 8949 exception 1 below is an excerpt from the irs instructions (emphasis and bullets added). The sale or exchange of a capital asset not reported on another form or schedule, gains from involuntary conversions (other than from. Check box (a), (b) or (c) to indicate if basis was. You may be able to.

Check Box A, B, Or.

Go to edit > electronic filing attachments. Covered activities (showing basis on the 1099b) only need to be reported in total and not broken. Web but before you can enter the net gain or loss on schedule d, you have to fill out the irs form 8949. In field return select tax return.

Web Make Sure It's Ok To Bypass Form 8949.

Web individuals use form 8949 to report: In the send pdf attachment with federal return. The transactions taxpayers must report on form 8949. Web select form 8949 exception reporting statement.

Web To Attach The Statement For Form 8949 Do The Following:

Web see exception 1 under the instructions for line 1. Web click the add button. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Form 8949 is not required for certain transactions.