Form 8941-T

Form 8941-T - In particular, it provides a. Eligible employees in general, all employees who perform services for you. How do i clear this us. Once made, the election is irrevocable. Solved•by intuit•proconnect tax•4•updated july 14, 2022. Don’t complete for a simple trust or a pooled income fund. Ask questions and learn more about your taxes and finances. Generating form 8941 credit for small employer health insurance premiums. Income tax return for estates and. Web 2 schedule a charitable deduction.

Once made, the election is irrevocable. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: Web 2 schedule a charitable deduction. Form 8941 (credit for small employer health. Solved•by intuit•proconnect tax•4•updated july 14, 2022. Web form 8941, officially named the credit for small employer health insurance premiums, provides tax relief to eligible small businesses. How do i clear this us. Prior yr 8941 must be entered. Of the estate or trust. Web what does it mean by py 8941 no box while i do the review?

Once made, the election is irrevocable. In particular, it provides a. How do i clear this us. Solved•by intuit•proconnect tax•4•updated july 14, 2022. Web form 8941 department of the treasury internal revenue service credit for small employer health insurance premiums a attach to your tax return. Web because this tool can only provide an estimate, to determine the small business health care tax credit, you must complete form 8941 and attach it along with any other. Web form 8941 department of the treasury internal revenue service. Income tax return for estates and. Only “eligible small employers” can take advantage of the tax credit for small employer health insurance premiums. Web what does it mean by py 8941 no box while i do the review?

Grandma’s going goblin mode r/dankmemes

Web because this tool can only provide an estimate, to determine the small business health care tax credit, you must complete form 8941 and attach it along with any other. In particular, it provides a. Solved•by intuit•proconnect tax•4•updated july 14, 2022. Income tax return for estates and. Web what does it mean by py 8941 no box while i do.

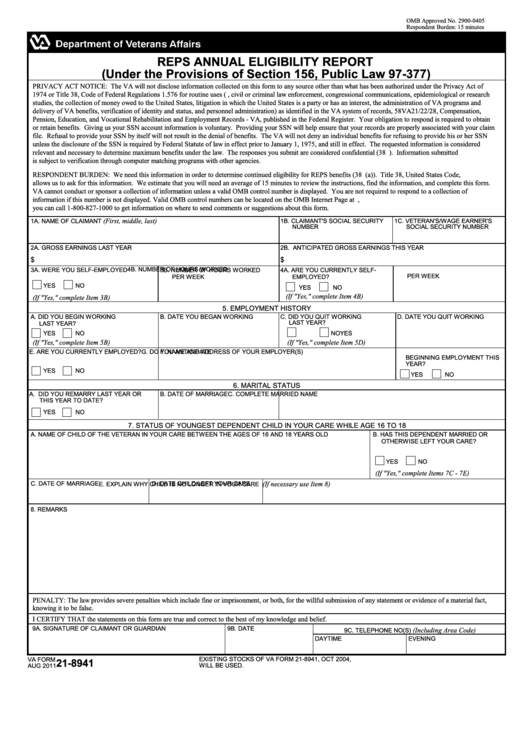

Fillable Va Form 218941 Reps Annual Eligibility Report printable pdf

Web form 8941 department of the treasury internal revenue service credit for small employer health insurance premiums a attach to your tax return. Web form 8941 department of the treasury internal revenue service. Form 8941 (credit for small employer health. Ask questions and learn more about your taxes and finances. Web determining eligibility as a small employer.

Form 8941 Credit for Small Employer Health Insurance Premiums (2014

Web determining eligibility as a small employer. Form 8941 (credit for small employer health. Generating form 8941 credit for small employer health insurance premiums. Don’t complete for a simple trust or a pooled income fund. Once made, the election is irrevocable.

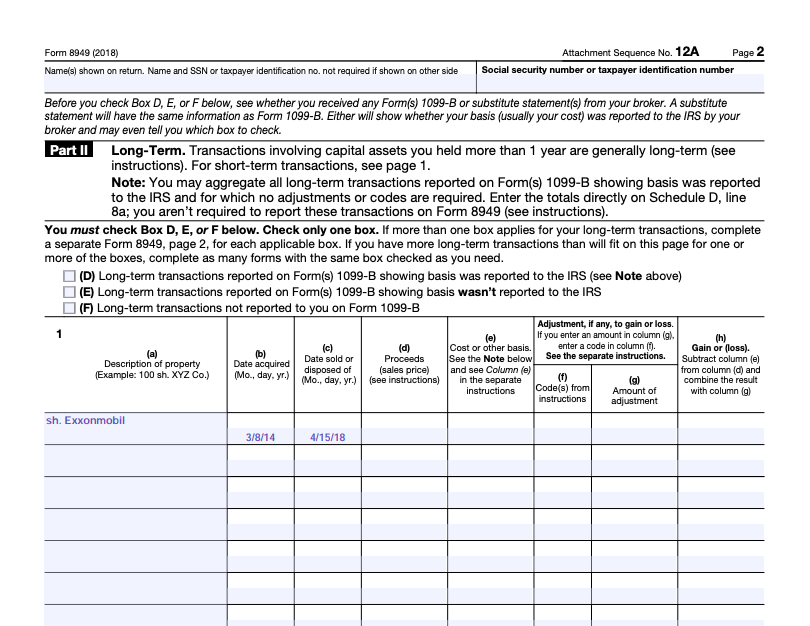

Can You Please Help Me Fill Out Form 8949? So I Kn...

Of the estate or trust. Eligible employees in general, all employees who perform services for you. Web form 8941 department of the treasury internal revenue service. Form 8941 (credit for small employer health. Solved•by intuit•proconnect tax•4•updated july 14, 2022.

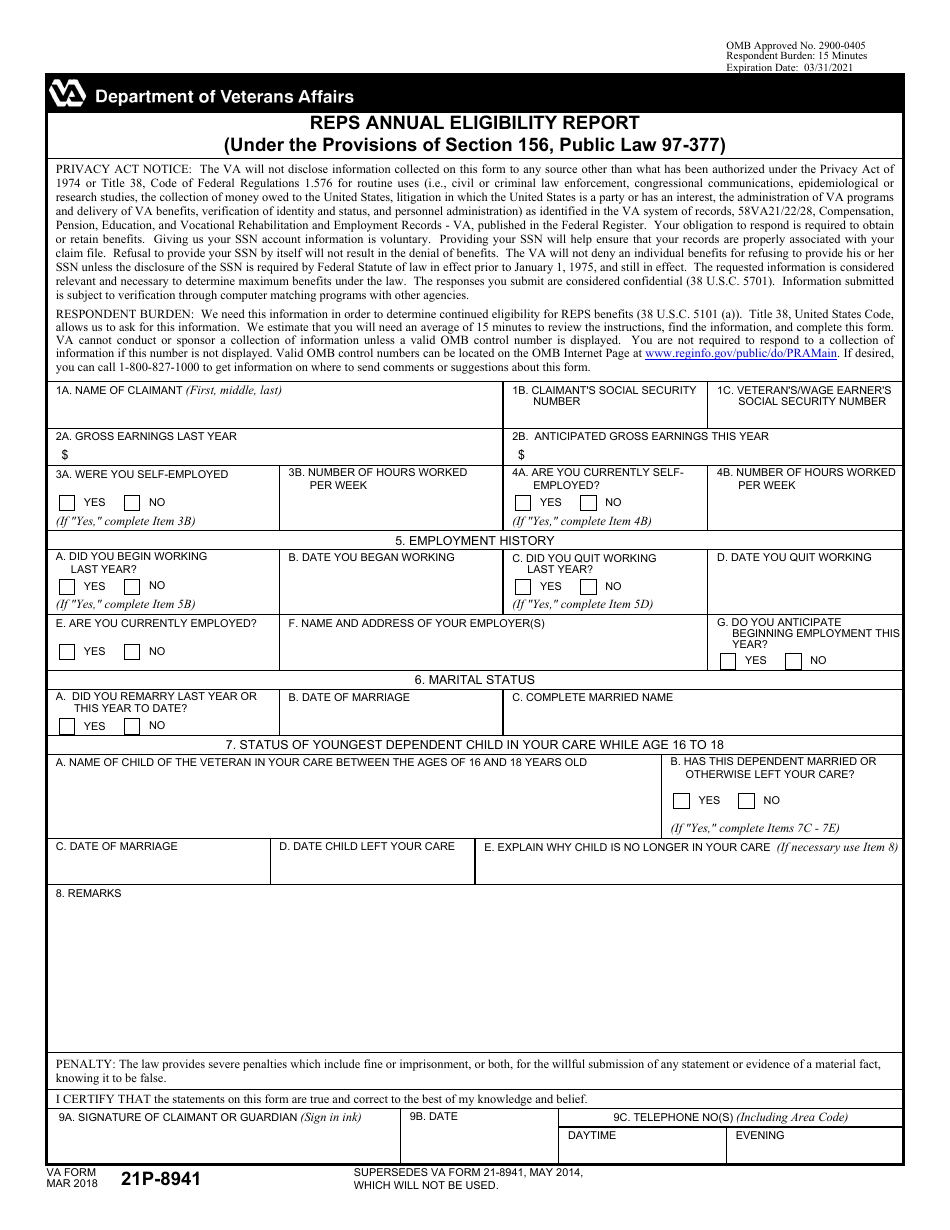

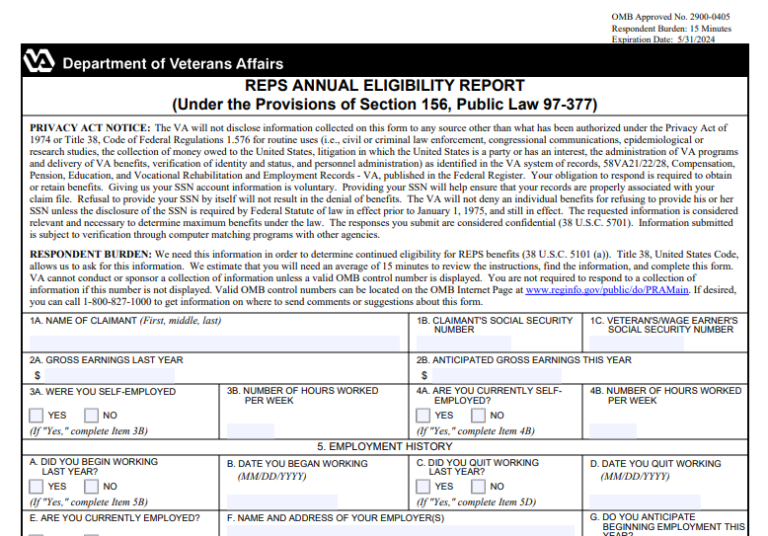

VA Form 21P8941 Download Fillable PDF or Fill Online Reps Annual

Prior yr 8941 must be entered. Don’t complete for a simple trust or a pooled income fund. Web get more help. Generating form 8941 credit for small employer health insurance premiums. Ask questions and learn more about your taxes and finances.

Va Form 21 8940 Printable VA Form

Form 8941 (credit for small employer health. Prior yr 8941 must be entered. Generating form 8941 credit for small employer health insurance premiums. Eligible employees in general, all employees who perform services for you. Web form 8941, officially named the credit for small employer health insurance premiums, provides tax relief to eligible small businesses.

Form 8941 Instructions How to Fill out the Small Business Health Care

Income tax return for estates and. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: The income, deductions, gains, losses, etc. Only “eligible small employers” can take advantage of the tax credit for small employer health insurance premiums. Credit for small employer health insurance premiums attach to your tax return.

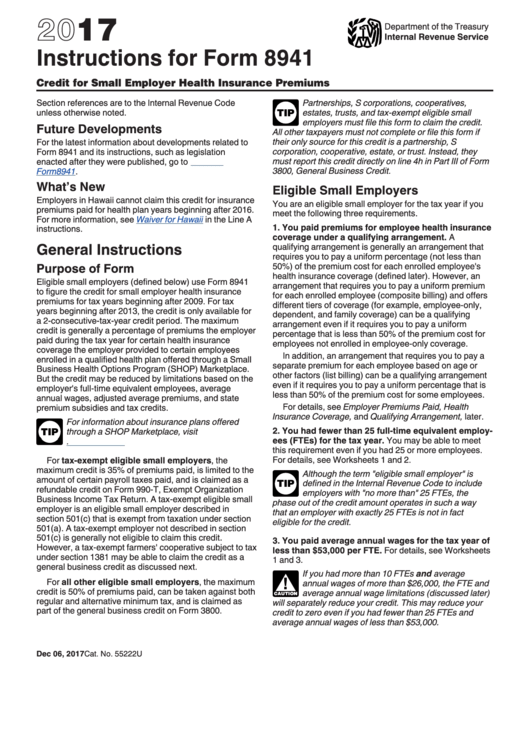

Instructions For Form 8941 Credit For Small Employer Health Insurance

Of the estate or trust. Web form 8941 department of the treasury internal revenue service. Credit for small employer health insurance premiums attach to your tax return. I am not a small business owner and don't have this form. In particular, it provides a.

IRS Releases 2017 Form 8941 for Claiming Small Business Health Care Tax

Web determining eligibility as a small employer. Web get more help. Don’t complete for a simple trust or a pooled income fund. Web form 8941, officially named the credit for small employer health insurance premiums, provides tax relief to eligible small businesses. In particular, it provides a.

Form 8941 Credit for Small Employer Health Insurance Premiums (2014

How do i clear this us. Credit for small employer health insurance premiums attach to your tax return. Web form 8941 department of the treasury internal revenue service. Generating form 8941 credit for small employer health insurance premiums. Prior yr 8941 must be entered.

Generating Form 8941 Credit For Small Employer Health Insurance Premiums.

Credit for small employer health insurance premiums attach to your tax return. Eligible employees in general, all employees who perform services for you. Web 2 schedule a charitable deduction. In particular, it provides a.

Only “Eligible Small Employers” Can Take Advantage Of The Tax Credit For Small Employer Health Insurance Premiums.

Web because this tool can only provide an estimate, to determine the small business health care tax credit, you must complete form 8941 and attach it along with any other. Ask questions and learn more about your taxes and finances. Web what does it mean by py 8941 no box while i do the review? Form 8941 (credit for small employer health.

Web Form 8941 Department Of The Treasury Internal Revenue Service Credit For Small Employer Health Insurance Premiums A Attach To Your Tax Return.

Web get more help. Web form 8941 department of the treasury internal revenue service. Prior yr 8941 must be entered. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report:

Solved•By Intuit•Proconnect Tax•4•Updated July 14, 2022.

How do i clear this us. Web determining eligibility as a small employer. Income tax return for estates and. Web form 8941, officially named the credit for small employer health insurance premiums, provides tax relief to eligible small businesses.