Form 8941 Instructions

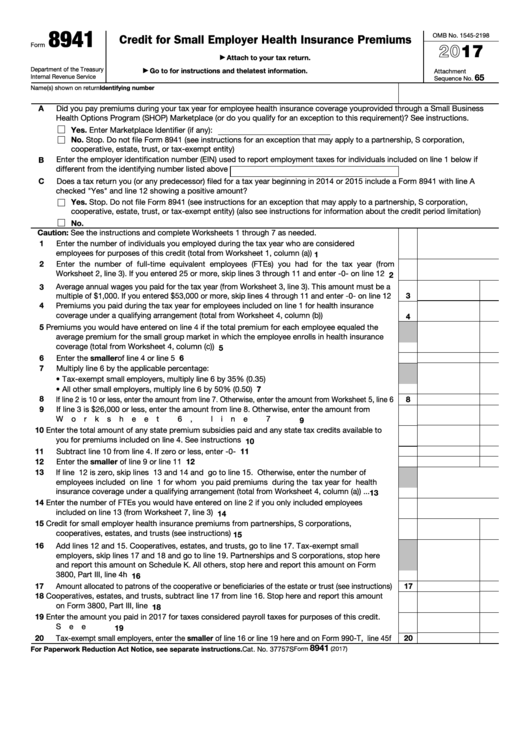

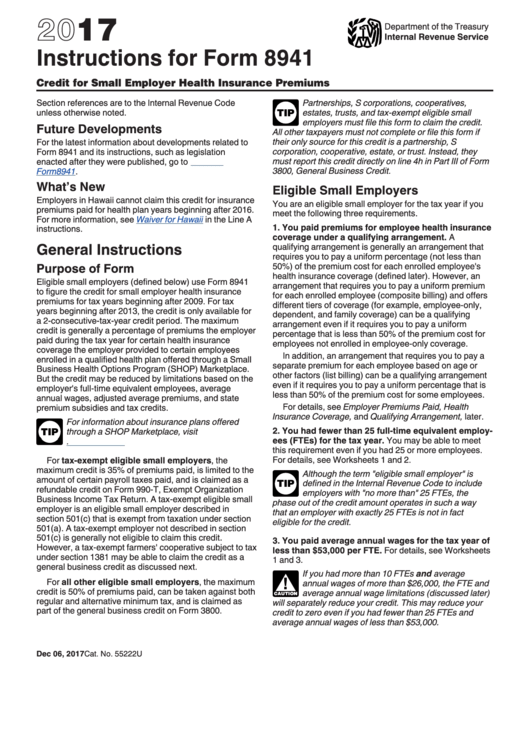

Form 8941 Instructions - Employees who qualify as full time employing more than 24. Worksheets 1 through 7 can help you figure the amounts 15. Instructions for form 8941, credit for small employer health insurance premiums 2011 inst 8941: Web the instructions to form 8941 include a worksheet to help you figure out the average annual salary. Web form 8941 is used by eligible small employers to calculate the credit for small employer health insurance premiums. How to complete irs form 8941. Eligibility requirements for the small employer health insurance premium tax. Web eligible small businesses use form 8941 to figure the credit and then include the credit amount as part of the general business credit on its income tax return. • use worksheets 1, 2, and 3 to figure the. For detailed information on filling out this form, see the.

Web unless an exception applies, only one form 8941 can be filed with a tax return. Employees who qualify as full time employing more than 24. Web form 8941 is used by eligible small employers to calculate the credit for small employer health insurance premiums. Web to access form 8941 in taxslayer pro, from the main menu of the tax return (form 1040) select: For detailed information on filling out this form, see the. • use worksheets 1, 2, and 3 to figure the. Web to determine the actual amount of the credit, you must complete form 8941 and attach it along with any other appropriate forms and file it together with your tax return. See the instructions for form 8941 for additional information. The maximum credit is based on. Web you must use form 8941, credit for small employer health insurance premiums, to calculate your actual credit.

To report on various lines of form 8941. • use worksheets 1, 2, and 3 to figure the. Worksheets 1 through 7 can help you figure the amounts 15. How to complete irs form 8941. Web unless an exception applies, only one form 8941 can be filed with a tax return. It should be filed by small businesses that. Web to access form 8941 in taxslayer pro, from the main menu of the tax return (form 1040) select: Web eligible small businesses use form 8941 to figure the credit and then include the credit amount as part of the general business credit on its income tax return. Instructions for form 8941, credit for small employer health. Web form 8941 is used by eligible small employers to calculate the credit for small employer health insurance premiums.

Form 8941 Instructions How to Fill out the Small Business Health Care

Web information about form 8941, credit for small employer health insurance premiums, including recent updates, related forms, and instructions on how to file. Web instructions for form 8971 and schedule a and column (e)—cost or other basis in the instructions for form 8949. See the instructions for form 8941 for additional information. How to complete irs form 8941. The maximum.

Form 8941 Instructions How to Fill out the Small Business Health Care

Web instructions for form 8971 and schedule a and column (e)—cost or other basis in the instructions for form 8949. Web to determine the actual amount of the credit, you must complete form 8941 and attach it along with any other appropriate forms and file it together with your tax return. Web eligible small employers can use form 8941 to.

Form 8941 Instructions How to Fill out the Small Business Health Care

• use worksheets 1, 2, and 3 to figure the. Web attach a corrected form 8974 to your amended return. Web eligible small businesses use form 8941 to figure the credit and then include the credit amount as part of the general business credit on its income tax return. Worksheets 1 through 7 can help you figure the amounts 15..

Form 8941 instructions 2016

Worksheets 1 through 7 can help you figure the amounts 15. Web in this article, we’ll go over this tax form, including: Web form 8941 is used by eligible small employers to calculate the credit for small employer health insurance premiums. Web attach a corrected form 8974 to your amended return. Who must file form 941?

IRS Form 8941 Instructions Small Employer Insurance Credits

Web eligible small businesses use form 8941 to figure the credit and then include the credit amount as part of the general business credit on its income tax return. Web attach a corrected form 8974 to your amended return. Web the instructions to form 8941 include a worksheet to help you figure out the average annual salary. Web to access.

Form 8941 Instructions How to Fill out the Small Business Health Care

Web attach a corrected form 8974 to your amended return. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; • use worksheets 1, 2, and 3 to figure the. See the instructions for form 8941 for additional information. Current year general business credits;.

Form 8941 Credit for Small Employer Health Insurance Premiums (2014

Web unless an exception applies, only one form 8941 can be filed with a tax return. Web instructions for form 8971 and schedule a and column (e)—cost or other basis in the instructions for form 8949. Don't use an earlier revision to report taxes for 2023. Instructions for form 8941, credit for small employer health. Web you must use form.

Fillable Form 8941 Credit For Small Employer Health Insurance

Web to access form 8941 in taxslayer pro, from the main menu of the tax return (form 1040) select: Web eligible small employers can use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after 2009. How to complete irs form 8941. To report on various lines of form 8941. • use worksheets.

IRS Form 6765 Instructions Tax Credit For Research Activities

Worksheets 1 through 7 can help you figure the amounts 15. Instructions for form 8941, credit for small employer health insurance premiums 2011 inst 8941: For detailed information on filling out this form, see the. Web to determine the actual amount of the credit, you must complete form 8941 and attach it along with any other appropriate forms and file.

Instructions For Form 8941 Credit For Small Employer Health Insurance

Web to access form 8941 in taxslayer pro, from the main menu of the tax return (form 1040) select: It should be filed by small businesses that. Web eligible small employers can use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after 2009. Current year general business credits;. How to complete irs.

It Should Be Filed By Small Businesses That.

Web instructions for form 8971 and schedule a and column (e)—cost or other basis in the instructions for form 8949. Web to access form 8941 in taxslayer pro, from the main menu of the tax return (form 1040) select: Instructions for form 8941, credit for small employer health insurance premiums 2011 inst 8941: Who must file form 941?

Don't Use An Earlier Revision To Report Taxes For 2023.

Employees who qualify as full time employing more than 24. The maximum credit is based on. How should you complete form 941? To report on various lines of form 8941.

Web The Instructions To Form 8941 Include A Worksheet To Help You Figure Out The Average Annual Salary.

Instructions for form 8941, credit for small employer health. Worksheets 1 through 7 can help you figure the amounts 15. Web attach a corrected form 8974 to your amended return. For detailed information on filling out this form, see the.

• Use Worksheets 1, 2, And 3 To Figure The.

Web to determine the actual amount of the credit, you must complete form 8941 and attach it along with any other appropriate forms and file it together with your tax return. Web unless an exception applies, only one form 8941 can be filed with a tax return. Current year general business credits;. Web eligible small businesses use form 8941 to figure the credit and then include the credit amount as part of the general business credit on its income tax return.